Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 27, 2020

Daily Global Market Summary - August 27, 2020

US and European benchmark government bonds sold off in tandem today, with US 30yr bond yields almost increasing by double digits (basis points). US and APAC equity markets closed mixed, while European equity markets were lower across the region. Oil and gold both closed lower, while iTraxx and CDX credit indices were close to unchanged on the day. Fed Chair Powell shared details today on the Fed's upcoming major shift in how they will react to inflation and US initial claims for unemployment insurance failed to fall back below 1,000,000 new claims last week.

Americas

- US equity markets closed mixed; DJIA +0.6%, Russell 2000 +0.3%, S&P 500 +0.2%, and Nasdaq -0.3%.

- 10yr US govt bonds closed +6bps/0.76% yield and 30yr bonds closed +9bps/1.51% yield.

- CDX-NAIG closed +1bp/68bps and CDX-NAHY +1bp/372bps.

- Gold closed -1.0%/$1,952 per ounce.

- Crude oil closed -0.8%/$43.04 per barrel.

- Following a more than yearlong review, Powell said Thursday that the Fed will seek inflation that averages 2% over time, a step that implies allowing for price pressures to overshoot after periods of weakness. It also adjusted its view of full employment to permit labor-market gains to reach more workers. The new strategy, outlined by Powell in a speech delivered virtually for the central bank's annual policy symposium traditionally held in Jackson Hole, Wyoming, is being undertaken to tackle years of too-low inflation. It hands the central bank flexibility to let the job market run hotter and price pressures float higher before taking action as it may previously have done. (Bloomberg)

- US seasonally adjusted initial claims for unemployment

insurance, at 1,006,000 in the week ended 22 August, remained at

historically high levels, although well below the all-time high of

6,867,000 in the week ended 28 March. (IHS Markit Economist Akshat

Goel)

- The seasonally adjusted number of continuing claims (in regular state programs), which lags initial claims by a week, fell by 223,000 to 14,535,000 in the week ended 15 August. The insured unemployment rate in the week ended 15 August fell 0.2 percentage point to 9.9%.

- There were 607,806 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 22 August. In the week ended 8 August, continuing claims for PUA fell by 252,004 to 10,972,770.

- In the week ended 8 August, 1,407,802 individuals were receiving Pandemic Emergency Unemployment Compensation (PEUC) benefits.

- The Department of Labor provides the total number of people claiming benefits under all its programs with a two-week lag. In the week ended 8 August, the unadjusted total fell by 1,042,323 to 27,017,232.

- Beginning with the next release, the method of seasonal adjustment will be switched from multiplicative to additive. Over the last several months, and especially in March, multiplicative adjustment has resulted in differences between adjusted and unadjusted figures that are too large to be reasonably accounted for by seasonality. Switching to additive adjustment will fix this issue.

- The US Pending Home Sales Index (PHSI) climbed 5.9% to 122.1 in

July, its best reading since October 2005—and not too distant

from the 127.0 record high set in July 2005. Four months earlier,

at the end of April, the index recorded an all-time low of 69. (IHS

Markit Economist Patrick Newport)

- All four indexes have posted solid gains in the past three months. For the first time since April 2006, all four regional indexes are above the 100 threshold.

- The South, which accounted for 44% of existing home sales in July, soared to an all-time high, despite the raging pandemic.

- What's driving sales? Mostly, it's near-record-low mortgage rates, pent-up demand, and record-low inventories, which have led to bidding wars and a rush to buy.

- For those able to work from home living in cities, such as San Francisco, Boston, or New York, where real estate is pricey, it is a good time to cash out and move into a larger, less-expensive house where traffic is never a problem. It is unclear how much this new development—the ability to work from home—is also driving sales.

- Applications to buy homes remain strong, according to the Mortgage Bankers Association. Its Purchase Index for the week ending 26 August was 33% higher than a year earlier, according to a report released yesterday (26 August).

- The PHSI leads existing home sales by a month or two, according to the National Association of Realtors. Expect solid existing home sales, likely higher than July's 13-year high, in August or September or both.

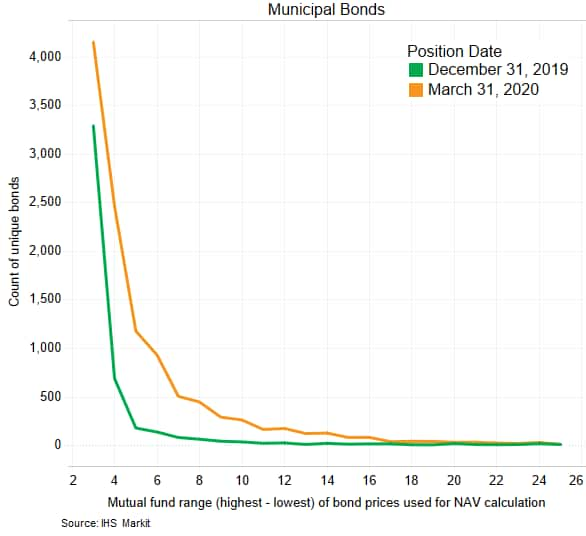

- The below chart uses IHS Markit's mutual fund holdings database

to quantify the degree of dispersion in the prices on individual

bonds used to calculate NAVs for US funds holding municipal bonds.

The analysis includes 58,851 bonds for the December 31, 2019 (green

line) reporting date and 68,163 for March 31, 2020 (orange line).

The graph shows the number of bonds that fall into each price range

(maximum-minimum price for each CUSIP). It is important to note

that approximately 54,000 bonds on December 31, 2019 and 57,000

bonds on March 31, 2020 had a max/min price range of only 0-2

dollars (not shown in graph due to scale). The graph highlights the

sharp increase in price disparity in March due to the extreme

volatility across all sectors that month, with the data indicating

over 11,000 bonds on the March 31, 2020 reporting date had a price

difference of three dollars or more.

- According to the Financial Times (FT), one-fifth of S&P 500

companies were trading on 21 August at more than 50% below their

peak values. (IHS Markit Economist Brian Lawson)

- The same source cited Cornerstone Macro data suggesting that the average member of the index was 28.4% below its peak.

- Technology shares were up 27% in 2020, and those in consumer discretionary activities by 23%.

- Conversely, from a base of 19 February valuations, energy stocks were the worst performing in the index, down by 34.2%, followed by financials with a 21.6% loss.

- Industrials, real estate and utilities were down by 9.3%, 13.3% and 15.5% respectively.

- Even in outperforming sectors performance divergence is very strong. Within the consumer area, as an example cited by the FT, Amazon (which has a 43% weighting in the sector's index presence) had appreciated 78% in 2020, while Carnival (cruise line) and Ralph Lauren have fallen by over 40%.

- The S&P 500 equally weighted index (not market cap weighted) is currently 6% below it's all time high set on 12 Feb of this year.

- Most chemical producers along the US Gulf Coast have been spared any substantial impact from Hurricane Laura, which has been moving north through Louisiana since making landfall 30 miles east of the Texas border at 1 a.m. CDT. The storm, which hit the coast with sustained winds of 150 miles/hr, at the high end of category 4 status, seems to have focused its attention on Lake Charles, Louisiana. Photos from the area show skyscrapers with half their windows blown out, and though the storm is rapidly losing strength, the National Hurricane Center (NHC) warns that damaging winds will continue over portions of northern Louisiana and Arkansas into this evening. Laura has been rapidly weakening as it heads inland, says NHC. The storm surge will result in dangerously elevated water levels into early afternoon for the Gulf Coast from Sabine Pass, Texas, to Port Fourchon, Louisiana, says NHC, and in some areas where surge penetrated far inland, floodwaters will not fully recede for several days. Producers located in Houston, Port Arthur, and Beaumont were largely spared, and market sources expect the steam crackers and polyolefins units in the area to be back online today and tomorrow. However, the steam crackers around Lake Charles could be offline for weeks, affecting about 12% of US ethylene capacity, while polyolefins units in the area could be down for a week. Operations around Geismar, Louisiana, were also unaffected, and the Port of New Orleans had already reopened before noon. The Port of Houston was slated to resume container exports on Friday. The most visible damage in the Lake Charles area this morning occurred at BioLab, a small producer of trichloroisocyanuric acid and disodium isocyanurate, biocides, and disinfectants. A fire onsite was producing a billowing plume of dark smoke as of mid-morning.

- US ag exports are forecast to reach $140.5 billion in Fiscal Year (FY) 2021, with exports to China expected to rise to $18.5 billion, up $4.5 billion from the level expected in FY 2020, according to USDA's latest Outlook for US Agricultural Exports. For FY 2021, USDA also forecasts imports of $136 billion, which would be a new record high, leaving a trade surplus of $4.5 billion. The growth in ag exports expected for FY 2021 "is primarily driven by higher exports of soybeans and corn," USDA said. "Soybean exports are forecast up $4.2 billion from FY 2020 to $20.4 billion, largely due to expected strong demand from China and reduced competition from Brazil," the report detailed. Meanwhile, "Corn exports are projected up $700 million to $9.0 billion on expectations of higher export volume." Other FY 2021 increases include horticultural product exports, which are expected to rise $500 million to $35.0 billion, "with increasing sales of tree nuts and miscellaneous products," USDA said. Livestock, poultry, and dairy exports are also forecast higher in FY 2021, up $500 million to $32.3 billion, "led by higher beef and veal, variety meat, dairy and poultry exports." Bucking the trend is cotton, with USDA forecasting FY 2021 exports down $400 million to $5.0 billion, due to "smaller volume and unit values." The rise in ag imports USDA expects in FY 2021 is attributed "largely to a $3.9 billion increase in horticultural products, and a $700 million increase in grain and feed imports," USDA said. (IHS Markit Food and Agricultural Policy's Richard Morrison)

- Ford is working with Bosch and real-estate company Bedrock on an automated valet-parking demonstration project in Detroit, Michigan, United States. The project began in August and runs until the end of September, with the three partners planning to demonstrate the system to consumers, the media, and technical stakeholders. The demonstration system is located at Bedrock's residential redevelopment project in the Corktown neighborhood of Detroit and is near Ford's new mobility innovation district center in the city. The automated valet parking (AVP) system was developed by Bosch and leverages infrastructure to communicate automated vehicle parking directions, rather than using self-driving software onboard the vehicle. In this demonstration project, infrastructure-based sensors are located in Bedrock's Assembly Garage, a new parking garage in the city. Vehicles using the Bosch AVP can drive themselves through the garage and automatically park themselves. The Ford vehicles are equipped with vehicle-to-infrastructure (V2I) technology and communicate with Bosch's intelligent parking infrastructure. The infrastructure's sensors recognize and localize the vehicle and potential hazards and guide the parking maneuver, rather than relying on a self-driving system in the vehicle; however, there is hardware in the vehicle that enables the communication and access to the vehicle systems. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Lucid Motors has shared more details of its upcoming Air electric sedan as the reveal date approaches (see United States: 18 June 2020: Lucid plans to reveal Air sedan on 9 September). On 26 August, Lucid announced that its "Space Concept" architecture will maximize the model's interior space with a miniaturized electric drivetrain and battery pack. The dual-motor version will have a 113-kWh extended battery pack and deliver up to 1,000 horsepower. Lucid says that the Air sedan will offer more interior space than competing luxury vehicle and EV offerings, including having the largest EV front trunk to date, with 280 liters of space and 739 liters of luggage space in total. In a statement, Lucid said the concept "capitalizes upon the miniaturization of Lucid's in-house developed EV drivetrain and battery pack to optimize interior cabin space within Lucid Air's relatively compact exterior footprint". The statement also refers to Lucid's full-canopy glass roof. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Voyage has shared the details of its first production-ready robotaxi, the G3, designed to operate without a driver behind the wheel. The G3 is a modified Chrysler Pacifica Hybrid minivan equipped with "driverless-ready vehicle platform" with updated software, sensors and computing power developed in partnership with Nvidia and Blackberry. Voyage said G3 robotaxi deploys three distinct features that are crucial for driverless vehicle operations. The first feature Voyage calls it a "commander", which acts as the brain of the G3 as it enables autonomous point-to-point driving. The second feature is "shield" that acts as an advanced driver assist system with collision avoidance to bring the vehicle to a safe stop if necessary. The third feature is called "Teleassist" that allows an operator to remotely monitor the G3 over a cellular connection to handle any unexpected situations on the road. Voyage has also partnered with GHSP, a global supplier of automotive systems, to deploy ultraviolet-C (UV-C) light in the G3 to reduce the risk of COVID-19 exposure. The rays are used to sterilize ambulances and hospital rooms to destroy viruses, fungus and bacteria. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Canada's current-account deficit narrowed by $4.6 billion to

$8.6 billion. The goods account deficit decreased by $1.0 billion

to $7.7 billion, mainly owing to the small surplus in motor

vehicles and parts. (IHS Markit Economist Chul-Woo Hong)

- The services account deficit improved by $4.3 billion to $0.2 billion as the travel balance turned into a $2.0-billion surplus, which was the first surplus since the third quarter of 1986.

- The primary income surplus fell by $0.9 billion to $0.2 billion while the secondary income deficit slightly narrowed to $1.0 billion.

- Total goods exports and imports plunged 23.7% quarter on quarter (q/q) and 23.0% q/q, respectively, in the second quarter because of the negative impact from the COVID-19.

- On balance, the biggest decline was the energy products surplus, which was down by $5.6 billion to $8.2 billion.

- It was followed by metals ores and non-metallic mineral products (down by $1.8 billion) and metals ores and non-metallic minerals (down by $1.1 billion).

- On the other hand, the balance of motor vehicles and parts increased to a $0.3-billion surplus, which was the first surplus since the second quarter of 2006 as imports (down 66.9% q/q) plummeted more than that of exports (down 56.2% q/q).

- Moody's Investors Service has downgraded Chile's medium-term

sovereign rating outlook to Negative from Stable. The rating

remains unchanged at A1, equivalent to 15/100 on IHS Markit's

scale. (IHS Markit Economist Ellie Vorhaben)

- Moody's has left Chile's medium-term rating unchanged at A1, but says the Negative outlook is warranted because of the fiscal impact that the COVID-19 pandemic will have on the country's fiscal deficits and debt levels.

- Without fiscal consolidation measures put in place, debt will continue rising amid heightened fiscal deficits. This will weaken the fiscal buffers, which have historically been a strong supporter of Chile's investment grade rating.

- The main reason Moody's is less optimistic about future of fiscal reform is that several political and social events over the short term will make it difficult politically to implement fiscal consolidation (austerity) measures.

- These include elections in 2021, constitutional reform set to begin in fall (autumn) 2020, and growing demand for policies that equalize economic opportunity. Furthermore, the deep recession forecast for 2020 will leave little appetite for revenue-raising or cost-saving measures.

- If the Chilean government were able to prove its commitment to fiscal reform, this could warrant an upgrade back to a Stable outlook. In the past, Chile's adherence to fiscal prudence and its solid governance and policy effectiveness indicators garnered it an investment grade rating; ensuring these indicators remain strong will be key to maintaining this rating.

Europe/Middle East/Africa

- European equity markets closed lower across the region; Italy -1.4%, UK -0.8%, Germany -0.7%, and Spain -0.5%.

- 10yr European govt bonds closed lower across the region; UK +4bps, Spain +2bps, and Italy/Germany +1bp.

- iTraxx-Europe closed flat and iTraxx-Xover -2bps/321bps.

- Brent crude closed -1.3%/$45.55 per barrel.

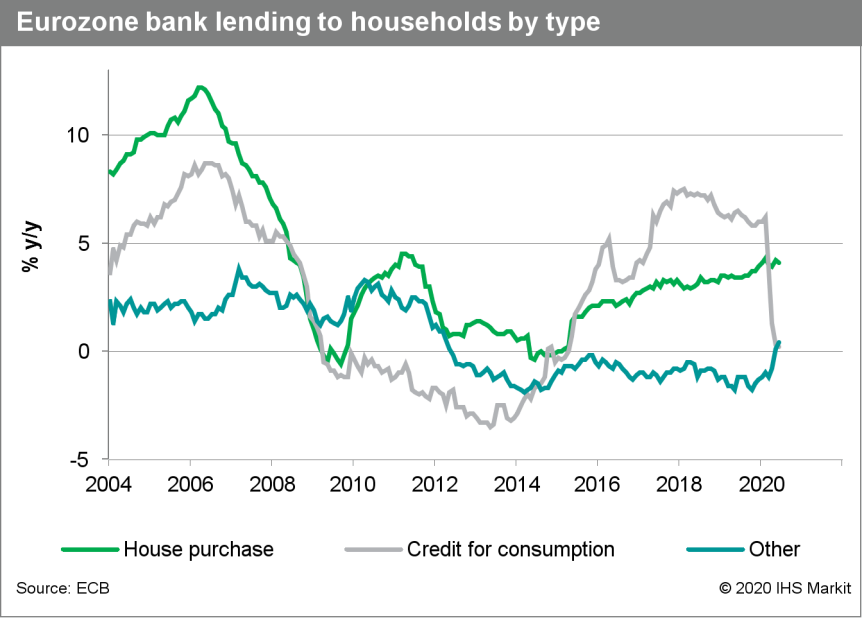

- Distressed corporate borrowing has eased but the data on

Eurozone households' loan demand and credit conditions augur poorly

for consumer spending prospects beyond the short-term bounce. (IHS

Markit Economist Ken Wattret)

- July's "hard" lending data from the European Central Bank (ECB; which are adjusted for loan sales and securitization effects) showed the second successive moderation in the year-on-year (y/y) growth rate for loans to non-financial corporations (NFCs).

- The y/y rate of increase remained relatively elevated, at 7.0%, double its trend prior to the COVID-19 virus shock (see first chart below). However, the monthly flow of loans to NFCs has shown a clear moderation, following a record pace of increase at the height of the disruption to the economy in March and April.

- With businesses in extreme distress during that period, demand for loans surged. This was also captured in the ECB's bank lending survey (BLS) for the second quarter, with the net percentage of banks reporting an increase in loan demand from enterprises soaring to +62, a record high

- The BLS reported much higher demand for short-term loans (net percentage +60) than long-term loans (+11), with financing needs for inventories and working capital rocketing, while financing needs for fixed investment declined.

- This is echoed in the breakdown of July's "hard" lending data, with growth in loans to NFCs with a maturity of over 5 years (6.4% y/y) not increasing anywhere near as quickly as loans with a maturity of 1 to 5 years (16.5% y/y).

- In contrast to the data for NFCs, loan growth to the eurozone's household sector has been comparatively low and stable, remaining unchanged at 3.0% y/y in July for the third straight month.

- However, the headline rate of change masks continued divergence

between relatively elevated loan growth for house purchases (4.2%

y/y in July) and the collapse in consumer credit (just 0.2% y/y in

July, down from over 6% in February

- Passenger car production in the United Kingdom continued to fall in July compared with the corresponding month last year. According to the latest data published by the Society of Motor Manufacturers and Traders (SMMT), passenger car output last month dropped by 20.8% year on year (y/y) to 85,696 units. Of this total, 72,262 units were designated for export, a decline of 16.8% y/y, and 13,434 units were for domestic sale, down 37.1% y/y. This means that year-to-date (YTD) volumes are now down by 39.7% y/y at 467,053 units due to the stoppages caused by the coronavirus disease 2019 (COVID-19) virus earlier in the year. However, the SMMT has also announced that commercial vehicle production witnessed a stronger month in July with a gain of 3.6% y/y to 5,234 units. Of this total, the number of vehicles built for export increased by 4.8% y/y to 2,905 units, while those for domestic sale rose 2.1% y/y to 2,329 units. However, output of vehicles in this category remains down 21.2% y/y in the YTD at 31,655 units. (IHS Markit AutoIntelligence's Ian Fletcher)

- According to France's National Institute of Statistics and

Economic Studies (Institut national de la statistique et des études

économiques: INSEE), French business confidence index stood at 91

in August, thus continuing a gradual climb back from the all-time

low of 53 in April. The employment climate has also improved to 88,

from an all-time low of 49 in April. (IHS Markit Economist Daniel

Kral)

- Confidence across all the main sectors continued to improve in August. Business climate in services and retail trade was up by 5 points to 94 and 93, respectively. Business climate in manufacturing was up by 10.5 points to 93.

- Compared with February, prior to the COVID-19 virus outbreak, confidence in manufacturing experienced the shallowest decline and staged the largest recovery. This is consistent with the crisis having the largest impact on the services sector, such as hospitality, travel, and entertainment.

- Despite the gradual improvement, all the business confidence indices remained well below the long-term average of 100.

- In a separate quarterly survey, INSEE reports that business managers in the manufacturing industry in July further lowered their nominal investment forecast for 2020 compared with April. They now expect a contraction of 11%, compared with 7% in April.

- The 2020 investment forecast has been downgraded in every sub-sector, most notably in the electrical, electronic, and machinery and equipment sector (growth rate updated from +1% to −5%) and in the transport equipment sector (updated from −16% to −20%). The agrifood industry has registered the slightest revision (from −3% to −5%).

- German generics and over-the-counter (OTC) medicines major Stada has announced that its sales grew on a reported basis by 16% year on year (y/y) in the first half of 2020 to EUR1.465 billion (USD1.731 billion). Organic sales growth - which does not include the new product lines acquired during the reporting period - amounted to 9% y/y. Sales of generics during the period increased by 12% y/y to EUR833.4 million, while sales of "branded products" (OTCs) were up 22% y/y at EUR631.9 million. The company has reported that the first quarter of 2020 showed particularly strong growth resulting from stockpiling by wholesalers, pharmacists, and patients, while the second quarter was characterized by considerable purchasing restraint, which particularly affected Stada's large markets in which the self-payor model dominates (including Russia and Serbia). (IHS Markit Life Sciences' Brendan Melck)

- Mercedes-Benz is set to open its new Industry 4.0 'Factory 56' digital production facility on 2 September, according to a company statement. The new facility is near Mercedes-Benz's existing facility at Sindelfingen and will use the latest Industry 4.0 manufacturing technology to create the most modern and flexible plant in Mercedes-Benz's current production network. The traditional production line will be replaced at Factory 56 by driverless transport systems in selected production areas - which are referred to as "TecLines" - for example at the beginning of the trim line. This moves from the traditional assembly operation to cycle operation, whereby the vehicle remains in position and is not continuously moved along the line. This makes automated activities such as installing sun roofs easier and means individual assembly units can be expanded and altered without interfering in the building's physical structure. In addition the plant's systems and equipment and fully linked and networked and can communicate with each other using a high-performance wireless network and mobile network form the basis for this with 5G-mobile phone technology having been tested in trial production. (IHS Markit AutoIntelligence's Tim Urquhart)

- Pony.ai has collaborated with Bosch's Automotive Aftermarket division in North America for maintenance of its autonomous vehicles (AVs). This partnership will enable Pony.ai to use Bosch's Car Service network in more than 20,000 locations across the world, of which more than 1,000 are in North America. The new maintenance solutions will enable efficient and scalable operation of commercial autonomous fleets. Pony.ai said it began piloting a maintenance program with Bosch in the San Francisco Bay Area in early July. Matthias Tan, director of product and partnerships at Pony.ai, said, "Autonomous vehicles are incredibly complex and continuously evolving systems which need to be maintained to the highest standards possible. We needed a partner who was capable of delivering high quality fleet maintenance services, and wanted to seize the opportunity for joint innovation in fleet management solutions for autonomous vehicles." (IHS Markit Automotive Mobility Surabhi Rajpal)

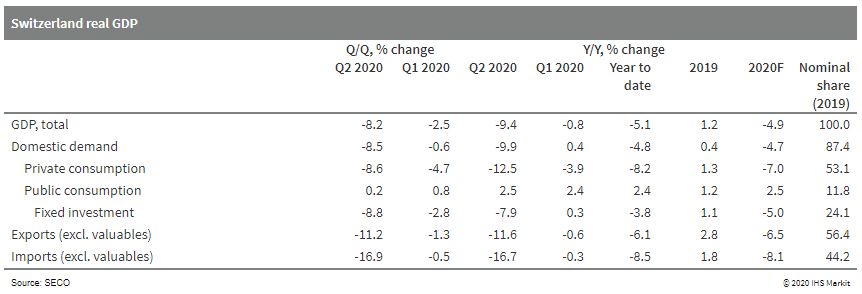

- According to the first estimate by the State Secretariat for

Economic Affairs (Secrétariat d'État à l'économie: SECO) of the

Swiss Federal Department of Economic Affairs, the country's real,

seasonally, and calendar-adjusted GDP declined by 8.2% quarter on

quarter (q/q) in the second quarter, sharply extending the

first-quarter drop of 2.5% q/q. (IHS Markit Economist Timo Klein)

- This follows average quarter-on-quarter growth of 0.6% during 2019 and full-year growth of 1.2% in 2019 (revised up from 1.0%).

- The year-on-year (y/y) rate - based on the same seasonally and calendar-adjusted series - had strengthened during 2019 to an interim peak of 2.2% in the final quarter, but deteriorated to -0.8% in the first quarter and -9.4% in the second quarter. This is the largest drop by far in the history of the current series that goes back to 1980.

- The second-quarter breakdown of expenditure components reveals an above-average decline in domestic demand (including a depressing impact from destocking) and a somewhat surprising offsetting boost from net exports.

- Noting that we regularly track external trade numbers that exclude valuables (most importantly non-monetary gold) to remove their distorting effect from the analysis of cyclical developments, exports did not fall quite as steeply as we had anticipated and imports concurrently posted an even larger decline than projected.

- The resulting positive contribution of net exports to q/q GDP growth is 1.1%. However, these data often experience large revisions: the initial first-quarter result for net exports had been a positive contribution of 1.2% and has now been revised to -0.6%.

- A closer look at the external sector reveals that exports of

goods and services (excluding valuables) declined by 11.2% q/q in

the second quarter, extending the previous quarter's -1.3%. This

was driven less by goods (-9.4% q/q) than by services (-15.9%).

This applies similarly to imports of goods and services (excluding

valuables), with their overall decline of -16.9% q/q being divided

into -14.3% for goods and -22.2% for services. Goods trade,

especially with respect to exports, was supported by the resilience

of Switzerland's largest sector, chemicals and pharmaceuticals. In

contrast, services suffered from the restrictions imposed on all

activities involving public gatherings. This includes tourism, but

the SECO points out that Switzerland's dependence on tourism is

smaller than in most of its neighboring countries (this alludes to

Austria and Italy in particular).

- The trend of European farmers rarely going online to buy feed additives could be declining, according to McKinsey. While farmers in Europe are early adopters in the areas of yield improvement, sustainability and animal welfare, McKinsey suggested their general view of online purchasing has previously been skeptical. The company surveyed over 1,000 farmers across Belgium, Denmark, France, Germany, the Netherlands, Poland and Spain in 2019. The firm found only 13% of respondents had made online purchase of seeds, fertilizer, crop protection, animal feed/feed additives, farm equipment or software/agritech in the previous 12 months. Only 3% had bought animal feed additives in the last year. However, a follow-up survey in May 2020 found a much higher percentage of respondents now prefer to purchase agricultural products online. McKinsey noted: "There is an opportunity for companies in the agriculture industry to accelerate their online presence, work out omnichannel strategies and maybe even change their business models entirely to meet farmers' needs better." While many farmers do not purchase much online, more than half of dairy and livestock farmers use animal health optimization software - a clear sign of their willingness to take on new technologies. McKinsey estimated the European online agriculture market is currently worth only €150 million to €200 million ($177 million to $236 million). "The slow development of the online agriculture retail market in Europe is, in many ways, a self-inflicted wound," the firm explained. "It just isn't easy enough for farmers to go digital. Indeed, at a number of points along the customer decision journey, it is almost painful. (IHS Markit Animal Health's Joseph Harvey)

- Türkiye Petrolleri A.O. (TPAO) has made the largest gas discovery ever in the Black Sea, according to Turkish President Recep Tayyip Erdoğan. TPAO, the Turkish state-run oil and gas firm, said that the Tuna-1 exploration well in the western Black Sea had discovered a gas deposit with the potential to yield more than 320 Bcm using its Fatih drillship. Erdoğan himself announced the discovery on live television on 21 August, reflecting the potential importance of the discovery for Turkey, which relies on imports for more than 95% of its gas demand. Erdoğan said that the deepwater find in the Sakarya Block license would be fast-tracked for development, with a target production start date in 2023. The Tuna-1 exploration well, drilled to a depth of 4,525 m, is a significant gas discovery, with a reported 100-meter gas-bearing reservoir, although developing the find presents a number of operational challenges for TPAO. The deposit is located in 2,115 m of water in the Sakarya Block license, which lies 160 km north of Turkey's Zonguldak province, close to the Bulgaria-Romania border. Moreover, the target 2023 start date for first production as laid out by President Erdoğan - geared to correspond with the 100th anniversary of the founding of the Republic of Turkey - represents an extremely ambitious timetable, particularly given TPAO's relative lack of deepwater experience. The state company, which holds 100% of the license, may need to bring in external partners for financial and technical assistance in order to convert the gas find into production. (IHS Markit E&P Terms and Above-Ground Risk's Andrew Neff)

- The Belarusian and Chinese agreement is part of a project of the Caofeidian collaborative development demonstration area (Caofeidian District) within the framework of the Belt & Road initiative, according to the Belarus' Ministry of Agriculture. The agreement envisions the development of mutually beneficial cooperation between the two countries, the completion of contracts for the mutual supply of products, along with investment cooperation and participation in joint projects in both Belarus and China. During the ceremony, Deputy Minister Igor Brylo noted a positive trend in the development of cooperation in the agro-industrial complex between the two countries. In the first half of 2020, the exports of Belarusian foodstuffs to China were pinned at USD110.9 million, 2.7 times higher than in the same period last year. More than half of exports (52.5%) are supplies to the Chinese meat market products with over 18,0000 tons shipped in the past 6 months. Meanwhile, more than 85,000 tons of dairy products were exported to China this year valued at USD32.5 million, it indicated. To date, 56 milk processing organizations, 17 meat processing plants, 9 poultry factories, 7 fish processing organizations and 4 beet pulp production plants have been accredited for the right to supply products to China, it added. (IHS Markit Food and Agricultural Policy's Louisa Sabin)

- The National Bank of Tajikistan (BMT) reported that the

country's GDP grew by 3.5% year on year (y/y) in January-June 2020.

The negative impact of the spread of the COVID-19 virus slowed

growth sharply from reported 7.0% y/y expansion in the first

quarter. (IHS Markit Economist Andrew Birch)

- The report pointed to lost remittance inflows from migrant workers and lost investment from China because of closed borders as the reason for the deceleration of growth. Additionally, COVID-19 restrictions within Tajikistan would also have undermined domestic economic activity.

- In a separate announcement, the BMT reported that labor migrant remittances were down by USD174 million from a year earlier, a fall of about 14.8% y/y.

- The Russian central bank, meanwhile, reported remittance flows to Tajikistan had dropped by 23.3% y/y. While Tajik workers are also prevalent in Kazakhstan and elsewhere, the bulk of Tajik workers are in Russia.

- On 26 August, Fitch downgraded the long-term issuer default

rating of HSBC Oman (BB), Ahli Bank (B+), and Bank Muscat (BB). The

downgrades stem from a sovereign-level downgrade and credit risks

resulting from the COVID-19-virus pandemic. The agency also revised

the outlook for Sohar International Bank from Stable to Negative,

owing to the bank's reliance on less stable funding sources. The

ratings of BB and B+ are equivalent to ratings of about 50 and 55,

respectively, on IHS Markit's 0-100 rating scale. (IHS Markit

Banking Risk's Gabrielle Ventura)

- These rating changes follow a similar move by Moody's in March.

- As noted previously, amid the global shock of the spread of the COVID-19 virus and the oil-price war between Saudi Arabia and Russia, the rating downgrades will make funding costs for Omani banks higher relative to regional peers, weighing on profitability.

- IHS Markit agrees with Fitch's assessment of increasing credit risk and the potential withdrawal of government deposits from local lenders during the COVID-19-virus pandemic. However, given the size and state ownership of Bank Muscat, which accounts for about 34% of the total banking sector assets, the Sultanate will provide liquidity and capital support for the bank if necessary.

- HSBC Oman and Ahli Bank each account for around 7% of the total banking sector assets. Given their smaller size and foreign ownership, it is less likely that the Sultanate will provide support for these lenders. However, the banks are likely to receive funding from their foreign parent banks if necessary.

Asia-Pacific

- APAC equity markets closed mixed; South Korea -1.1%, Hong Kong -0.8%, Japan -0.4%, India +0.1%, Australia +0.2%, and Mainland China +0.6%.

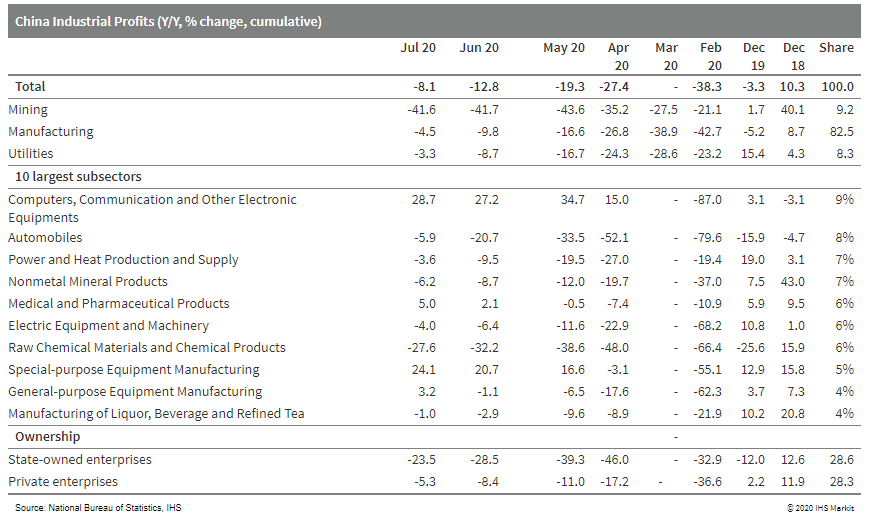

- Chinese industrial profit rose 19.6% year on year in July, the

third consecutive expansion since May and the fastest growth in two

years, according to the release by the National Bureau of

Statistics (NBS). (IHS Markit Economist Yating Xu)

- The continuity of the recovery growth came from narrowing industrial deflation, declining unit operating cost and fees as well as sharp increase in investment revenue. However, revenue growth moderated in July.

- The year-to-date industrial profit remained in 8.1% year-on-year contraction, narrowing by 4.7 percentage points from the previous month.

- By sector, 32 among the 41 surveyed sectors reported year-on-year profit increase in July, up from only 23 in June. Profit performance varied across sub-sectors with equipment manufacturing leading the growth while upstream mining and raw materials deteriorated.

- With the strength of infrastructure investment, home appliance exports as well as the environment protection standard upgrade, equipment manufacturing profits expanded 44.3% in July, up from 14.3% year-on-year growth in June, driving up headline industrial profits by 13.8 percentage points.

- Particularly, profits in auto and special-purpose equipment rose 12.5% year on year and 44.3% year on year respectively. Meanwhile, daily necessities, such as tobacco and agricultural foods registered profit growth of 14.9% year on year and 53.9% year on year respectively.

- Inventory pressure continued to ease as the increase in inventory of finished goods slowed for the fourth consecutive month to 7.4% year on year at the end of July, but it remained at high level since 2015.

- Industrial profits improved across ownership, with state-owned

sector leading the recovery. The average liability-to-asset ratio

at 56.7% was 0.1 percentage points down from the end of June.

- Dongfeng and its partners plan to build China's largest autonomous vehicle (AV) fleet in Wuhan, reports China Daily. Dongfeng said it will operate a fleet of at least 200 AVs by 2022 in the city. This initiative is part an investment deal between Dongfeng and local authorities in Wuhan. The automaker plans to scale production of high-level AV technology and explore business models using its mobility platform for commercial AV operations. Dongfeng Motor is accelerating its efforts on developing intelligent connected vehicles. Recently, Dongfeng has announced that its 5G-based driverless vehicle, named Dongfeng Sharing-VAN 1.0 plus, has entered mass production. This year, port terminal operator COSCO Shipping Ports partnered with China Mobile and Dongfeng Commercial Vehicle to demonstrate driverless trucks loading and delivering containers around the terminal. The automaker has also collaborated with Chinese technology company Tencent to jointly build a new ecosystem of "automobile industry Internet". Last year, Dongfeng Motor led a USD100-million Series A funding round for autonomous car startup AutoX. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Hyundai Mobis plans to build a new plant for manufacturing components for electrified vehicles in South Korea with an investment of KRW35.5 billion (USD29.9 million), reports Korea JoongAng Daily. The plant will be located on 16,726 square metres of land in Pyeongtaek. Construction of the plant is scheduled to start in September, and Hyundai Mobis aims to begin mass production in the second half of 2021. It plans to use the new plant to produce core electric vehicle (EV) components, including motors, inverters and power electronics modules. Referred to as PE modules, they are a combination of components that power EVs in place of an engine. The report highlights that the Pyeongtaek plant will mainly supply Kia, as it is relatively close to Kia's Hwaseong plant in Gyeonggi, only 13 km away. This will be Hyundai Mobis' third plant in South Korea for electrified vehicles. The first plant is in Chungju, where it produces components for fuel-cell electric vehicles and EVs. The second plant, in Ulsan, is currently under construction, will produce components for electrified vehicles from the first half of 2021, but for Hyundai (see South Korea: 28 August 2019: Hyundai Mobis begins construction of new EV parts plant in South Korea). The South Korean component maker is witnessing strong demand for electrification parts amid growing demand for EVs. During the second quarter of 2020 (April-June), Hyundai Mobis recorded a robust 40.9% y/y increase in sales in the electrification business to KRW990 billion. To meet this rapidly increasing demand, Hyundai Mobis plans to secure production capacity of 150,000 units next year and gradually expand facilities to reach a maximum of 300,000 units by 2026. (IHS Markit AutoIntelligence's Jamal Amir)

- The Volkswagen (VW) Group plans to test its first fleet of autonomous cars in China's eastern city of Hefei, reports Automotive News. VW will roll out 10 units of Audi's e-tron electric sport utility vehicle (SUV) in the city's Haiheng district from September. The cars will be open to the public from next year and residents can hail the ride using the VW app. Weiming Soh, executive vice-president of VW China, said, "This is our first-ever pilot project in China. We are very close with the Hefei government. They have the desire to do this and we jumped in. Imagine if you want to build cars, you're going to need a lot of suppliers, and that creates employment and so on. If we pick it as our base, we're starting to do that." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Mahindra & Mahindra (M&M) signed a non-binding memorandum of understanding (MoU) with Israeli e-mobility company REE Automotive on 26 August to explore development and manufacturing of electric commercial vehicles (CVs) for global markets, according to a filing to the Bombay Stock Exchange (BSE). M&M and REE plan to hold discussions over the next few months to finalize technical, commercial, and other terms of the collaboration. The strategic collaboration, when finalized, will use M&M's design, engineering, sourcing capability and manufacturing assets and REE's electric vehicle (EV) corner module and platform technology of integrating powertrain, suspension and steering components in the arch of a vehicle wheel. The companies added that production could be scaled further to support additional volume in the global and Indian market. The partnership is expected to support REE's global customer need for 200,000-250,000 electric CV units over a few years, including potential M&M's domestic and international volumes. (IHS Markit AutoIntelligence's Isha Sharma)

- Honda plans to launch its first electric vehicle (EV), the 'Honda e', in Japan on 30 October, according to a company press release. The Honda e will be available in two output versions, a 100 kW and a 113 kW, both with maximum torque of 315 Nm. The 100-kW version has a driving range of 283 km on a single charge on the Worldwide-harmonized Light vehicle Test Cycle (WLTC) and is priced at JPY4.51 million (USD42,450). Meanwhile, the 113-kW version has a driving range of 259 km on a single charge and is priced at JPY4.95 million. The Honda e is equipped with various advanced safety and technological features. The automaker aims to sell 1,000 units of the vehicle per year in Japan. The Honda e is an important part of the Japanese automaker's strategy, as it seeks to accelerate its vehicle electrification plan. The e is based on Honda's first standalone EV platform, which has its battery positioned centrally at a low level, giving both 50:50 weight distribution and a low center of gravity. The model will be sold only in Europe (where it was launched earlier this month) and Japan, and Honda has no plans to market the vehicle in other regions, including North America and China. IHS Markit expects that the e's sales will be about 3,800 units in Europe in 2020 and about 1,000 units in Japan. (IHS Markit AutoIntelligence's Nitin Budhiraja)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-august-27-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-august-27-2020.html&text=Daily+Global+Market+Summary+-+August+27%2c+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-august-27-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - August 27, 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-august-27-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+August+27%2c+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-august-27-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}