Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 04, 2020

Daily Global Market Summary - 4 June 2020

Global equity markets closed mixed, with most of the day's changes under 1% in either direction. Credit indices closed close to unchanged, despite the announcement of a €600 billion increase in the ECB bond buying program. Benchmark government bonds continued to sell-off, with US Treasury bonds closing significantly lower and with further steepening in 30s10s. The market will now be focusing on tomorrow's 8:30am ET US non-farm payroll report after today's slightly weaker than expected US initial claims for unemployment insurance.

Americas

- US equity markets closed mixed; DJIA +0.1%, Russell 2000 flat, S&P 500 -0.3%, and Nasdaq -0.7%.

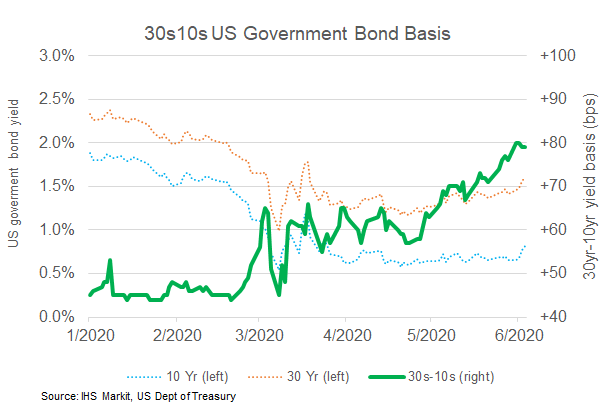

- 10yr US govt bonds closed lower on the day at +8bps/0.83%

yield. The sell-off in 30yr bonds was even more severe, closing at

+10bps/1.63% yield; 10s and 30s closed at the highest yields since

20 and 19 March, respectively. It is worth noting that 30s10s have

steepened 34bps since 9 March (chart below):

- CDX-NAIG closed almost flat/73bps and CDX-NAHY +3bps/464bps.

- Seasonally adjusted US initial claims for unemployment

insurance, at 1,877,000 in the week ended 30 May, remained at

historically high levels, although well below the all-time high of

6,867,000 in the week ended 28 March. This was the 11th straight

week with claims in seven figures and a total of 38.8 million

initial claims (non-seasonally adjusted) have been filed over this

period. This is 23.8% of the labor force as of February. (IHS

Markit Economist Akshat Goel)

- There were 623,073 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 30 May. A total of 6,025,388 initial claims for PUA have been filed so far.

- The seasonally adjusted number of continuing claims, which lag initial claims by a week, rose by 649,000 to 21,487,000 in the week ended 23 May. Although the level of continuing claims increased last week, it is still comfortably below the all-time high of 24,912,000 in the week ended 9 May.

- The Department of Labor provides the total number of people claiming benefits under all its programs with a two-week lag. The unadjusted total for the week ended 16 May was 29,965,415; 63% of this total is from the "Regular State" program and 36% from the PUA program.

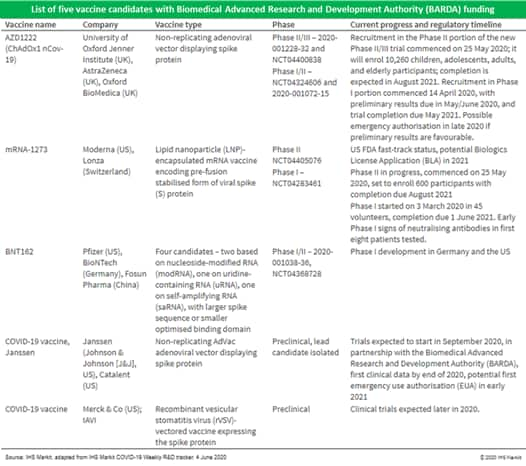

- The US administration has selected five pharmaceutical

companies - Moderna (US), Johnson & Johnson (J&J; US),

Pfizer (US), Merck & Co (US), and AstraZeneca (UK) - as the

most likely to provide a COVID-19 vaccine by the end of the year,

according to senior officials cited by The New York Times. The

finalists were selected from around a dozen companies, with the

hope that at least one or several can provide the United States

with sufficient quantities of COVID-19 vaccines to immunize the

entire population quickly. (IHS Markit Life Science's Margaret

Labban)

- Kansas State University has snared a $11.3 million grant to develop a new Center of Emerging and Zoonotic Infectious Diseases (CEZID). The grant was awarded to K-State by the National Institutes of Health under the Centers of Biomedical Research Excellence program and will be issued over a five-year period. K-State is already home to a prominent college of veterinary medicine. The center will run four primary research projects that aim to "bridge areas of excellence" in the university's collective infectious disease programs. According to K-State professor Jurgen Richt, the projects will examine virulence factors and host-pathogen interactions of a range of pathogens. He stated the studies will utilize both basic and translational approaches in in vitro systems and models. (IHS Markit Animal Pharm's Daniel Willis)

- Employers announced 397,061 planned layoffs in May, according to Challenger, Gray & Christmas—down 40.8% from April's record-shattering high. However, it is important to note that May's total places it second only to April in terms of layoffs (Challenger began tracking job-cut announcements in January 1993). It is better, but it is not great. May's number was up an 557.8% over the same period a year earlier. Year-to-date, 1,414,828 job cuts have been announced, 389.5% higher than the same period in 2019. Of that total, nearly 1 million were because of COVID-19, according to employers. (IHS Markit Economist Rebecca Mitchell)

- US productivity (output per hour in the nonfarm business

sector) declined at a 0.9% annual rate in the first quarter, less

of a decline than IHS Markit had expected and revised up 1.6

percentage points from the previously reported figure. (IHS Markit

Economists Ken Matheny and Lawrence Nelson)

- Hours, on the other hand, declined 5.6% in the first quarter, more of a decline than we had anticipated and revised down 1.8 percentage points from the previously report figure.

- Compensation per hour (comp/hour) rose at a 4.2% rate in the first quarter, an upward revision of 2.0 percentage points from the previously reported figure, which surpassed our expectation for a smaller upward revision. This largely reflected the decline in hours that was well below our assumptions, as unit labor costs were revised up only 0.3 percentage point to 5.1% in the first quarter, close to our expectation.

- The increase in unit labor costs was the largest quarterly increase since the first quarter of 2019. Four-quarter changes in comp/hour and unit labor costs as of the first quarter were 2.6% and 1.9%, respectively.

- The nominal US trade deficit widened in April by $7.1 billion to $49.4 billion, more of a widening than the Bloomberg consensus had expected but close to our assumption. Underlying the headline number, nominal exports declined 20.5% and nominal imports declined 13.7%. As first seen in the March data, exports and imports of transport and travel services declined sharply in April. With air travel all but shut down for much of March and April, these sectors were hit particularly hard by measures to contain the global spread of COVID-19. We expect trade in these sectors to drift up beginning in May, consistent with recent gradual improvement in the daily data on domestic air travel. (IHS Markit Economist Kathleen Navin)

- General Motors (GM) CEO Mary Barra has said the company will come out of the COVID-19 crisis with a permanently reduced cost structure, reports Reuters. According to the report, Barra was speaking at an investors' event and said, "We were quickly able to take out significant costs and we are being very conservative about what costs we turn back on. I believe we will come out of this with a lower cost structure that is permanent... We've found things that we don't need to do and things we can do more efficiently." While the details of the plan were not disclosed, Barra reportedly said that the permanent cost reductions could include fewer vehicle platforms and reduced complexity of platforms by focusing on the versions that consumers want most. The pandemic, she said, gave GM an opportunity to go through its expenses and eliminate redundant processes. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Nikola has announced the completion of a business-combination deal with VectoIQ Acquisition Corp. The new company begins trading on the NASDAQ on 4 June and Nikola says the deal has raised USD700 million. Much of the cash has been raised through a related private investment in public equity (PIPE) transaction, in which investors bought shares of the combined company at an undisclosed discounted price. As IHS Markit stated when the deal was first announced, it further cements Nikola's potential as a new competitor in the medium and heavy commercial vehicle (MHCV) sector, joining Freightliner and Tesla in the EV segment and the likes of Toyota in the FCEV segment. In late 2019 and 2020, Nikola announced a joint venture with CNH Industrial's Iveco to supply the Nikola Tre electric MHCV in Europe and plans for an electric pick-up. (IHS Markit AutoIntelligence's Stephanie Brinley)

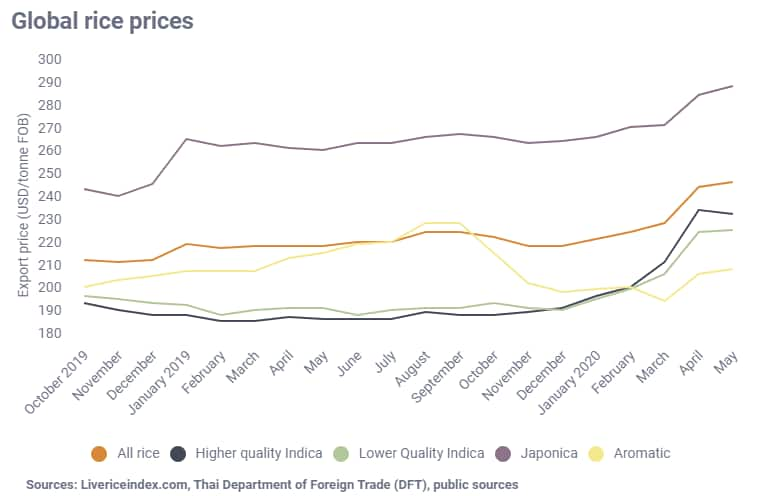

- The Food and Agriculture Organization of the United Nations'

(FAO) rice prices index surges for a fifth successive month in May

as coronavirus triggers stockpiling and limits supply. May 2020

marked the fifth consecutive monthly rise of the FAO All Rice Price

Index (2002-2004=100) up 2.1 points (0.9%) to 249.8 points.

According to the Index, international rice prices in the first five

months of 2020 were significantly higher (+6.6%) compared to the

same period last year, highlighting gains in all the major market

segments, apart from the Aromatic category. Lower availability and

soaring demand from the US retail sector resulted in Japonica

quotations rising by 1.9% month-on-month while monthly gains for

lower quality Indica and Aromatic rice were between 0.8-1.0%. As

for higher quality Indica, quotations declined by 0.8%. (IHS Markit

Agribusiness' Louisa Sabin)

Europe/Middle East/ Africa

- European equity markets closed modestly lower across the region; Switzerland -1.1%, Spain -0.8%, UK -0.6%, Germany -0.5%, France -0.2%, and Italy flat.

- 10yr European govt bonds closed mixed; Italy -14bps, Spain -7bps, France -2bps, UK +3bps, and Germany +4bps.

- iTraxx-Europe closed -1bp/64bps and iTraxx-Xover +1bp/372bps.

- Brent Crude closed +0.5%/$39.99 per barrel (there hasn't been a close of $40 or more per barrel since the 6 March close at $45.27).

- The European Central Bank aggressively scaled up its bond-buying program to €1.35 trillion ($1.52 trillion), a bold move that eases pressure on the region's embattled governments and puts the ECB's stimulus effort in line with that of the Federal Reserve. (WSJ)

- The euro closed higher today at €1.133/USD today and has rallied steadily versus USD since 25 May. Today's level is approaching the one year high of €1.149/USD set on 9 March.

- France's Finance Minister Bruno Le Maire agreed on 2 June to

provide a state guarantee for a EUR5-billion loan to car

manufacturer Renault to support the firm in mitigating the impact

of the COVID-19 virus outbreak. (IHS Markit Country Risk's Blanka

Kolenikova, Petya Barzilska, and Bibianna Norek)

- The French government set the safeguarding of operations at the Maubeuge plant as a condition for Renault's EUR5-billion state aid aimed at mitigating labour strikes and protests at car manufacturing plants across France.

- French automotive companies are likely to focus on research and development (R&D) for sustainable vehicles at French plants.

- European countries that have already established vehicle production plants are unlikely to be immediately affected by Macron's 'relocation' proposal.

- The European Union is likely to continue to develop policies to assist the automotive sector in transitioning to green and sustainable production. Battery production is likely to remain a priority for the EU in the context of its climate and environmentally focused agenda, while the European Commission has emphasized the need for technological sovereignty for the EU's automotive sector.

- Both Western and Eastern EU member states are likely to benefit from EU policies to accelerate production of electric cars and car batteries.

- If French carmakers respond to President Macron's call to relocate production to France, this would increase the risk of contract cancellations affecting investments in Eastern European countries, particularly Romania.

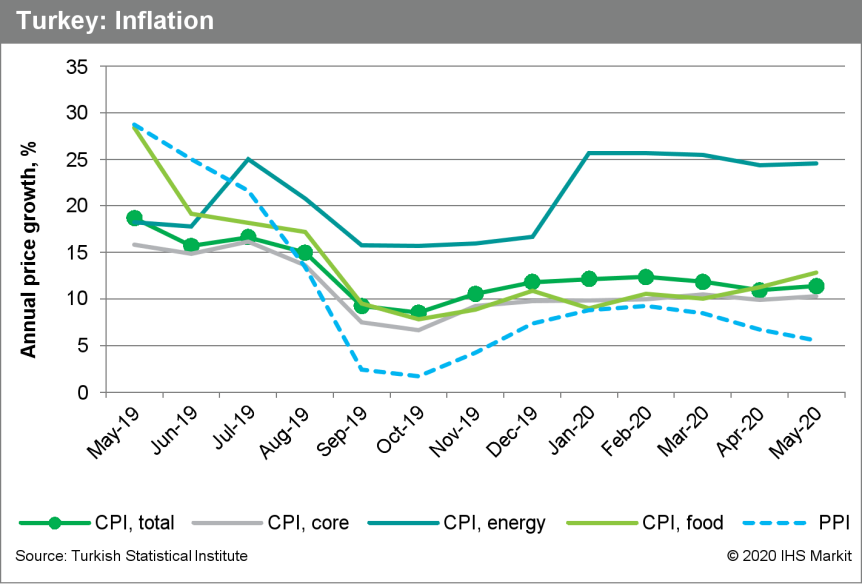

- Turkish inflation accelerated to 11.4% in May, in part fueled

by sharp lira losses in March and April. Inflation deviated from

central bank expectations, potentially causing the current rate

reduction cycle to be reconsidered. Should the lira remain

relatively steady, however, IHS Markit continues to expect another

rate cut in late June. (IHS Markit Economist Andrew Birch)

- Following two months of deceleration, Turkish annual consumer price inflation re-accelerated in May, rising to 11.4% according to the Turkish Statistical Institute, deviating from official forecasts. The inflation rate was right on point with IHS Markit's expectations for May.

- Sharp lira losses in March and April contributed to a surge in prices over the course of May. In particular, clothing and footwear prices soared by nearly 6.9% month on month (m/m), contributing heavily to headline consumer price growth. Transport prices also jumped, by 3.3% m/m, similarly fanning inflation.

- With the re-acceleration of inflation in May, the main policy rate of the Central Bank of the Republic of Turkey (Türkiye Cumhuriyet Merkez Bankası: TCMB), the repo rate, is now at 8.25%, 315 basis points below the prevailing rate of annual inflation. With the main policy rate now deeply negative in "real" terms, the vulnerability of the lira remains high.

- Although the lira is indeed extremely vulnerable to another

sharp slide because of the negative real interest rates, the

currency has stabilized in recent weeks, presumably in large part

due to huge foreign currency support from the TCMB.

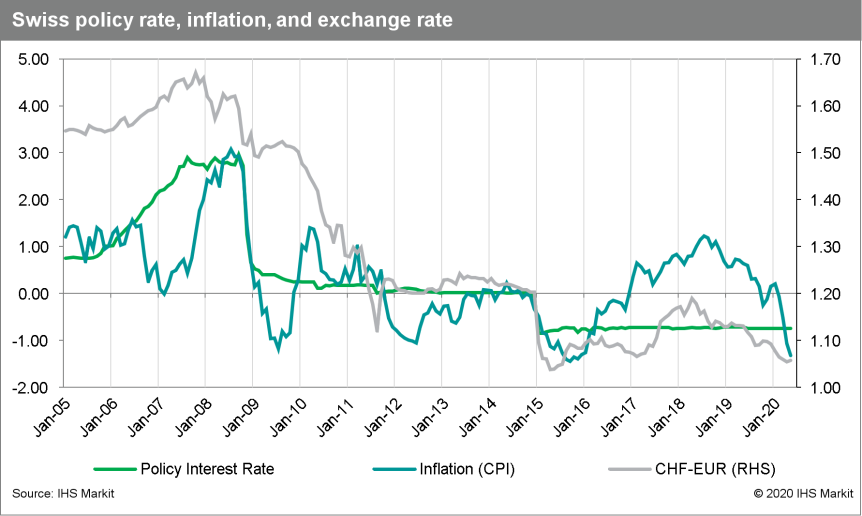

- Swiss inflation reached a fresh four-year low of -1.3% in May,

as oil price and currency developments suggest rebound looms.

According to the Swiss Federal Statistical Office (SFSO), Swiss

consumer prices remained flat month on month (m/m) in May, which

are roughly 0.2 percentage point lower than seasonal variations

would suggest. At least half of this can be attributed to yet

softer oil prices - the sizeable increase from USD30/barrel to

nearly USD40/barrel only began around mid-May. The annual rate

declined once more from -1.1% year on year (y/y) to a four-year low

of -1.3% y/y, caused by base effects in the telecommunications and

'miscellaneous goods and services' categories. At -1.3%, Swiss

inflation is likely to have reached its cyclical low point. In

recent weeks, oil prices have rebounded quite significantly, the

Swiss franc has depreciated against the euro, and economic activity

has started to rebound as authorities have lifted many of the

restrictions that begin in mid-March. (IHS Markit Economist Timo

Klein)

- Volvo Cars' global sales fell by a further 25.5% year on year

(y/y) during May. According to data released by the company, its

sales dropped from 60,196 units in May 2019 to 44,830 units in May

2020. (IHS Markit AutoIntelligence's Ian Fletcher)

- The steepest decline took place in Europe, where it recorded a fall of 49.6% y/y to 14,965 units.

- At the same time, sales in its "Other" market dropped by 37.4% y/y to 5,214 units.

- However, there was a more modest fall in the United States last month, with sales there dipping 2.5% y/y to 9,519 units.

- The automaker also posted a strong recovery in China, where its retail sales jumped 21.8% y/y to 15,132 units. The huge swings in demand that have been seen since the beginning of the year as a result of the COVID-19 virus pandemic have left the automaker's global year-to-date sales down 25% y/y at 208,479 units.

- Swedish-based startup Einride has announced that it is launching a freight mobility platform, reports New Mobility. The platform is designed for businesses that aim to make their shipments sustainable by providing live insights on emissions, energy usage, and location data and generates recommendations. Robert Falck, CEO and founder of Einride, said, "The benefits are clear: electric road freight solutions account for over 90% fewer CO2 [carbon dioxide] emissions and other harmful airborne pollutants, while autonomous transport is safer, more efficient, and more cost-effective. However, Autonomous Electric Transport (AET) will not reach its full potential without intelligent planning and optimised vehicle networks. Our platform sets the foundation upon which the freight solutions of the future are built." Einride was founded in 2016; it focuses on designing and building technologies for transportation systems and aims to have 200 electric trucks in logistics operations by 2020. (IHS Markit Automotive Mobility's Tarun Thakur)

- Swedish passenger car registrations declined by a steeper 50.2%

year on year (y/y) in May, according to data published by trade

association BIL Sweden. Sales retreated from 31,919 units in May

2019 to 15,881 units. (IHS Markit AutoIntelligence's Ian Fletcher)

- During the month, Volvo was the biggest-selling brand with registrations of 2,536 units, although this was a decline of 59.3% y/y.

- Volkswagen (VW) was in second place as its registrations contracted by 51.1% y/y to 1,738 units, while Kia was third with 1,577 units, down 31.7% y/y.

- The passenger car market has now fallen by 25.8% y/y to 100,938 units in the year to date (YTD).

- In the commercial vehicle categories, registrations of light commercial vehicles (LCV) with a gross vehicle weight (GVW) of less than 3.5 tons fell by 51.3% y/y to 2,103 units, while in the YTD they are now down 44.4% y/y at 10,239 units.

- Sales of heavy commercial vehicles (HCVs) with a GVW of more than 16 tons fell by 47.1% y/y to 380 units last month, while in the YTD they are down 24.3% y/y at 2,177 units.

- Subsea 7 has been awarded an EPIC contract worth over USD 750 million by SSE Renewables for the Seagreen Offshore wind farm off the east coast of Scotland. The contractor will be responsible for the engineering, procurement, construction and installation of the foundations and inter array cables at the wind farm which will have 114 wind turbines and a total capacity of 1,075 MW. Management of the project will commence immediately from the Seaway 7 office in Aberdeen, Scotland. Phase 1 of the development comprises the Seagreen Alpha and Bravo offshore wind farms. (IHS Markit Upstream Costs and Technology's Mark Rae)

Asia-Pacific

- APAC equity markets closed mixed; Australia +0.8%, Japan +0.4%, Hong Kong/South Korea +0.2%, China -0.1%, and India -0.4%.

- Australia's real GDP contracted 0.3% quarter on quarter (q/q)

in the first quarter, as two major natural disasters, bushfires and

the COVID-19 pandemic, wiped out already-weak domestic demand in

the January-March quarter. (IHS Markit Economist Bree Neff)

- According to the data released by the Australian Bureau of Statistics (ABS), the last time the Australian economy shrank in q/q terms was in the wake of the dramatic floods during the first quarter of 2011. In year-on-year (y/y) terms, the expansion of 1.4% y/y was the weakest since the global financial crisis.

- Private consumption took a significant hit during the first quarter, despite panic buying pushing consumer purchases of food up to a record-high expansion of 5.7% q/q in real, seasonally adjusted terms.

- Households also boosted their spending on household furnishings and communications services to be able to work from home during the quarter, but that was completely offset by sharp declines in consumption of clothing and footwear (down 8.9% q/q), transport services (down 12.0% q/q), and hotel, café and restaurant services (down 9.2% q/q).

- Goods exports fell only 0.7% q/q with the largest export category- non-rural goods- expanding a paltry 0.2% q/q. A 3.4% q/q surge in exports of other mineral fuels (primarily liquefied natural gas) and non-gold metals (up 9.6% q/q), offset a 1.8% q/q fall in crucial metal ore exports.

- The first-quarter result on Australia's real GDP was stronger than IHS Markit had expected; however, the result does not change our view that Australia is heading for its first technical recession since 1991, because, unlike in 2008-09, exports and mining investment are not going to save the day.

- South Korea's Ministry of Land, Infrastructure, and Transport has announced that it aims to commercialize urban air mobility (UAM) services in the domestic market in 2025, reports Yonhap News agency. According to the ministry, South Korea is trying to handle its worsening traffic congestion in major cities. It initially plans to offer UAM services in one or two routes in the Seoul metropolitan area in 2025, and then gradually increase the number of terminals and routes to 10 by 2030. According to an unnamed ministry official, "The ministry will join hands with Hyundai Motor Group and other local companies to push forward the UAM commercialization project." The ministry expects the UAM market to reach KRW13 trillion (USD10.6 billion) in 2040 and that the UAM services will aid in faster transportation of passengers compared with buses and subways. (IHS Markit Automotive Mobility's Tarun Thakur)

- Hyundai has opened South Korea's first charging station for hydrogen-powered commercial vehicles in the country, reports Yonhap News Agency. The automaker established the hydrogen-charging station at its Jeonju plant, 240 km south of Seoul. It is the automaker's ninth hydrogen-charging station. An unnamed Hyundai spokesperson said, "Hydrogen buses and trucks, as well as hydrogen passenger cars, can charge themselves in the hydrogen commercial charging station as it is located near the roads." This latest development is in line with the South Korean government's wider aims to reduce greenhouse gas emissions, generate new growth momentum for its automotive industry, and reduce its heavy reliance on imported oil. (IHS Markit AutoIntelligence's Jamal Amir)

- South Korea on 2 June announced plans to reopen its complaint filed with the World Trade Organization (WTO) over Japan's imposition of restrictions on exports to South Korea. Since 4 July 2019, Japan has required export licenses for sales of fluorinated polyimide, hydrogen fluoride, and photoresists - all key materials used in manufacturing semiconductors. South Korea originally filed the complaint in September 2019, but withdrew it in November 2019 to continue bilateral negotiations. According to South Korea's Ministry of Trade, the decision was made after Japan allegedly failed to provide a satisfactory response to South Korean demands for it to lift trade restrictions by 31 May 2020. (IHS Markit Country Risk's Hannah Cotillon)

- Imported vehicle sales in Japan declined 45% year on year (y/y)

to 14,809 units during May, compared with 26,939 units in the

corresponding month of last year, according to the Japan Automobile

Importers Association (JAIA). (IHS Markit AutoIntelligence's Isha

Sharma)

- Of this total, sales of foreign-brand imported vehicles declined by 46.4% y/y to 12,522 units, while sale of Japanese-branded imported vehicles fell 36.4% y/y to 2,287 units.

- By brand, Mercedes-Benz continued to lead the imported market with an 18.19% share, its sales declining 40.7% y/y to 2,694 units. Volkswagen (VW) followed with a market share of 10.84% and sales of 1,605 units, down 57.4% y/y. BMW took third place with sales of 1,706 units (down 53.9% y/y) and a market share of 11.5%.

- Among the Japanese brands, Toyota sold 1,126 imported units last month (down 22.2% y/y), followed by Honda with 536 units (down 31.7% y/y), compared with 785 units in May 2019. In the year to date, sales of imported vehicles in Japan have declined 20% y/y to 112,472 units. Of this total, sales of foreign-branded imports are down 20.9% y/y at 93,128 units, while Japanese brands' imported vehicle sales have declined 14.6% y/y to 19,344 units.

- Imported vehicle sales in Japan declined in May for an eighth consecutive month. The decline was also the biggest year-on-year (y/y) fall for a second straight month ever recorded by the JAIA, after a 32.7% y/y plunge in April.

- BMW signed an agreement with State Grid Electric Vehicle Service (State Grid EV) on 3 June to engage in research and development (R&D) for electric-vehicle-charging technologies and expand China's EV charging network to serve BMW customers. According to gasgoo.com, the companies will make joint efforts to expand the charging network, formulate technical charging standards, and construct integrated energy stations. BMW aims to build over 270,000 charging piles by the end of 2020, of which 80,000 are fast-charging piles, and have its charging network cover more than 50,000 km of expressways nationwide. The two companies also plan to jointly build energy stations that integrate functions of EV charging, photovoltaic power generation, and energy storage. (IHS Markit AutoIntelligence's Abby Chun Tu)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-june-2020.html&text=Daily+Global+Market+Summary+-+4+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-june-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 4 June 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+4+June+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-4-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}