Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 28, 2020

Daily Global Market Summary - 28 August 2020

US equity markets ended the day higher across the major indices, with the S&P 500 closing higher for a seventh consecutive day and achieving another all-time high close. European equity markets were mostly lower on the day and APAC was mixed. US government bonds recovered slightly from yesterday's major sell-off, while European government bonds were mixed. iTraxx and CDX indices were relatively flat across both IG and high yield, while Brent closed higher and WTI was lower.

Americas

- US equity markets closed higher, with the S&P 500 achieving yet another record close and the seventh consecutive up day; Russell 2000 +0.9%, S&P 500 +0.7%, and Nasdaq/DJIA +0.6%.

- 10yr US govt bonds closed -2bps/0.74% yield and 30yr bonds closed -1bp/1.51% yield.

- CDX-NAIG closed -1bp/67bps and CDX-NAHY -3bps/369bps, which is

-1bp and -20bps week-over-week, respectively.

- Crude oil closed -0.2%/$42.97 per barrel.

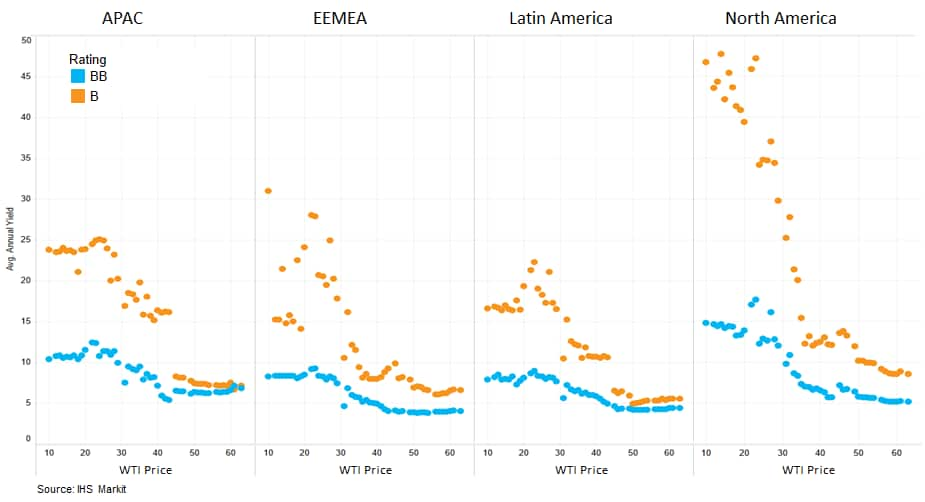

- The below chart shows BB and B rated oil & gas company

debt's yield sensitivity to WTI prices across emerging market

regions and the US during 2020 (as of 25 August). The data

indicates that Latin American company's debt appears to have been

the least sensitive to declines in oil prices, while North American

debt being the most sensitive.

- Coronavirus cases in the U.S. increased 0.9% as compared with the same time Thursday to 5.9 million, according to data collected by Johns Hopkins University and Bloomberg News. The increase was higher than the average daily gain of 0.7% over the past week. Deaths rose by 0.6% to 181,409. (Bloomberg)

- The University of Michigan US Consumer Sentiment Index rose 1.6

points (2.2%) to 74.1 in the final August reading. The index was

still in the neighborhood of its April low of 71.8, suggesting that

the recovery in consumer spending has not coincided with a

commensurate increase in consumer optimism. The reading is

consistent with our expectation for sharply slower growth of

consumer spending in the fourth quarter. (IHS Markit Economists

David Deull and James Bohnaker)

- The final August Consumer Sentiment reading was 1.3 points higher than the preliminary reading, suggesting that sentiment improved slightly over the course of the month.

- The August increase was driven by the expectations index, which rose 2.6 points to 68.5. The current conditions index edged up 0.1 point to 82.9.

- Consumer sentiment rose 4.6 points to 71.8 among households earning less than $75,000 a year but fell 0.5 point to 75.4 among households with earnings above that threshold.

- Despite impasse in Congress over a new economic relief package, the mean estimated odds of an increase in respondents' personal income in the next year rose 1.5 percentage points to 49.7%, the highest since April.

- Perceptions of buying conditions barely changed in August. The index of buying conditions for large household durable goods was unmoved at 106, while that for vehicles rose 1 point to 125. The index of buying conditions for homes was unchanged at 133, just shy of the 2019 average.

- The expected one-year inflation rate edged up 0.1 percentage point to 3.1%. It has been elevated since May, when it jumped 0.9 percentage point. Expected 5-year inflation ticked up 0.1 percentage point to 2.7%.

- The August reading of slight improvement in the University of Michigan Consumer Sentiment Index puts it out of step with the Conference Board's Consumer Confidence Index, which fell 6.9 points in August to a new COVID-19-era low.

- Personal income increased 0.4% in July and real disposable

personal income (DPI) edged down 0.1%. The increase in personal

income primarily reflected gains in employee compensation (up 1.3%)

and proprietors' income (up 1.4%) as parts of the economy continued

to reopen in July. (IHS Markit Economists James Bohnaker and David

Deull)

- Unemployment insurance transfer payments, inclusive of pandemic assistance programs, declined from a peak of $1.47 trillion (annual rate) in June to $1.36 trillion in July. Paycheck Protection Program (PPP) loans to businesses were estimated at $304.5 billion (annual rate), up from $301.2 billion in June. The PPP loans accounted for nearly 19% of total proprietors' income in July.

- Real personal consumption expenditures (PCE) advanced 1.6% in July to a level that was still 4.7% below the pre-pandemic peak in February. This was somewhat weaker than expected, and as a result we revised down our estimate of third-quarter real PCE growth by 0.6 percentage point to 37.4%.

- Within goods, the leading contributor to the increase was spending for new motor vehicles (up 8.6%). Within services, the leading contributors to the increase were spending for healthcare (up 2.4%) as well as food services and accommodations (up 5.2%).

- With outlays outpacing disposable personal income in July, the personal saving rate eased from 19.2% to 17.8%—still more than double its pre-pandemic rate.

- Uncertainty about additional fiscal support and ongoing caution about COVID-19 will contribute to a slower recovery over the next few months. High-frequency data show that consumer spending stalled in August.

- The US goods deficit widened in July by $8.3 billion to $79.3

billion, in contrast to our assumption of a narrowing and the

consensus expectation for a much smaller widening. Inventories rose

in July; we had expected a decline. (IHS Markit Economists Ben

Herzon and Lawrence Nelson)

- In response to the details in this report that inform our GDP tracking, we raised our forecast of third-quarter GDP growth 0.9 percentage point to a 27.7% annualized increase.

- Both exports and imports rose more than expected, with the latter outpacing our assumption by considerably more than the former. The result was a large markdown to our third-quarter forecast of real net exports, which we now expect to decline by $155 billion and subtract 1.8 percentage points from third-quarter GDP growth.

- Both exports and imports of goods have reversed large portions of their COVID-related declines (i.e., from February to May); exports have reversed about one-half and imports have reversed about 90% of their respective declines.

- The combined inventories of wholesalers and retailers rose 0.5% in July. This followed sharp declines over the prior three months and led us to raise our forecast of the change in inventory investment in the third quarter by about $107 billion.

- We expect inventories to decline in the third quarter by far less than they did over the second quarter, contributing 3.5 percentage points to third-quarter GDP growth.

- Today's report rounds out the data we need to calculate real goods GDP through July, which we estimate slowed sharply to a 0.6% increase in July (not annualized) following sharp increases (around 10% per month) over the prior two months. This supports our view that the recovery has slowed.

- Taiwan will ease restrictions on imports of US pork and beef, announcing they will allow shipments of US pork containing the feed additive ractopamine and will allow imports of US beef from animals older than 30 months of age. Taiwan's leader, Tsai Ing-wen, said the decision is in line with their interests and their goals of "strategic development," adding it could boost ties between the US and Taiwan. "It will be an important start for Taiwan-US economic cooperation at all fronts," she commented. Council of Agriculture Minister Chen Chi-chung said the new rules will take effect January 1. (IHS Markit Food and Agricultural Policy's Roger Bernard)

- Commercial real estate deals in New York City have taken a major hit as the pandemic continues to roil the local economy. Investment sales totaled $10.5 billion in the first half of 2020, down 54% from a year earlier and a record low since the Real Estate Board of New York begin reporting the data in 2015. "We continue to see the devastating and long-lasting impacts the pandemic has had on the health and stability of the New York economy," James Whelan, the trade group's president, said in a statement. "Real estate is a fundamental driver of the city's economy." (Bloomberg)

- Rivian has hired a former Tesla executive to head its engineering division, reports Automotive News. Nick Kalayjian, who served for 11 years at Tesla and was most recently employed as senior vice-president at San Francisco-based Plenty Inc., will be serving as executive vice-president of engineering at Rivian. Nick Kalayjian replaces Mark Vinnels, who was serving as Rivian's executive director of engineering, and was previously executive director for product development at McLaren. The executive vice-president of engineering and product is appointed as Rivian prepares for production and market launches, although these have been pushed back somewhat because of the COVID-19 virus pandemic. In June 2020, Rivian hired several new senior executives, who according to the report were recruited from Tesla, Lucid, and other companies (see United States: 10 June 2020: Rivian hires new senior executives ‒ report). The new hires were in addition to the positions reportedly filled earlier this month. In April, Rivian stated that its plans for a production start had been delayed from late 2020 to 2021 on the impact of the COVID-19 pandemic, but the company's latest round of appointments reflects where it is in the development of its production, charging, sales, and service networks. (IHS Markit AutoIntelligence's Tarun Thakur)

- Canada's real GDP plunged 38.7% quarter on quarter annualized

(q/q a.r.) in the second quarter, and the first quarter's decline

of 8.2% q/q a.r. was surprisingly unchanged. (IHS Markit Economist

Arlene Kish)

- The massive loss to final domestic demand was a touch smaller, falling 37.4% q/q a.r. as huge pullbacks in household consumption and business investment closely matched expectations.

- Import trade volume losses far exceeded export volumes and Canada's terms of trade deteriorated to a 17-year low from the dramatic downturn in oil prices, which struck a harsh blow to national income.

- Given that the economy bottomed in April, the partial rebound in the third quarter will be large. However, do not be swayed by the big upturn as it will be off extremely low real GDP levels. The rate of recovery beyond the third quarter will be much milder.

- Canada's real GDP by industry output advanced at a record-high

6.5% month-over-month (m/m) pace in June. (IHS Markit Economist

Chul-Woo Hong)

- Output in the goods-producing industries jumped 7.5% m/m while services-producing industries increased 6.1% m/m.

- Industrial production climbed 7.5% m/m mainly because of the strong 14.6% leap in manufacturing output.

- Given Statistics Canada's estimated 3.0% m/m increase in July, real GDP output will continue to recover from the COVID-19 pandemic shock in the coming months.

- The increase was widespread as June output levels increased in all but one industry, mining and oil and gas extraction, where the 4.7% m/m decrease was mainly due to the 58.0% m/m plunge in support activities for mining and mining and oil and gas extraction.

- Output in accommodation and food services increased the largest in the month, surging 28.5% m/m, followed by retail trade (up 22.3% m/m).

- While the overall increase was led by the surge in

manufacturing output, specifically durable manufacturing (up 22.0%

m/m) with strong increases in motor vehicles and parts

manufacturing and machinery manufacturing, service output growth

was healthily accelerated in many industries including wholesales,

administrative, waste management and remediation services, and

arts, entertainment, and recreation.

- The Central Bank of the Argentine Republic (Banco Central de la

República Argentina: BCRA) on 26 August released its latest monthly

banking bulletin. The report provides banking-sector data covering

June 2020. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

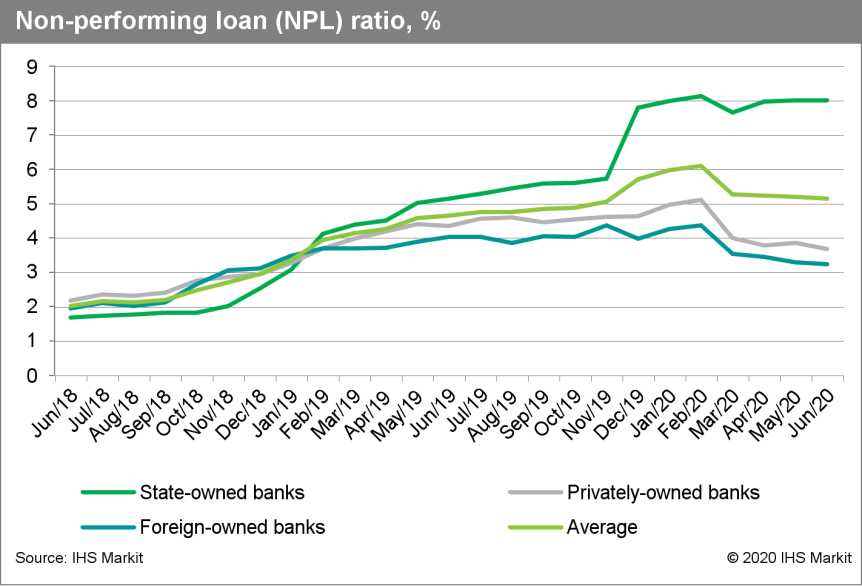

- The non-performing-loan (NPL) ratio of 5.1% has remained practically unchanged since March and is heavily influenced by the 8.0% reported impairment for state-owned banks.

- The sector and state-owned banks had a coverage ratio of 108% and 79%, respectively.

- Capital strength indicators remained high: the capital adequacy ratio (CAR) stood at 22.3%, the tier-1 capital ratio at 20.4%, and the shareholders' equity-to-assets ratio at 14.7%. Regarding profitability, the return-on-assets (ROA) ratio stood at 2.8%, significantly below the 4-5% figures observed between April 2018 and in January 2020.

- The reduction of the ROA from the trend observed since mid-2018 is explained mainly by the decrease in rates of the liquidity notes (Letras de Liquidez: Leliqs) from 62% in June 2019 to 38% since March 2020.

- Despite the decrease in funding costs, particularly in deposits, the financial margins have been reduced over the last year by 2.3 percentage points.

- Despite the reduction of the interest rate on Leliqs, banks have increased their holdings by 49% in the year up to June 2020. In contrast, credit grew by 30.6% over the same period.

- Margins from loans stood at 9.1%, while margins stemming from government securities stood at 8.3%. These figures suggest that banks are aiming to secure returns from Leliqs, despite the returns being lower than those of loans, in light of expectations of credit reducing its profitability over the following quarters.

- Contrary to other banking sectors in countries such as Brazil,

Mexico, and Chile, Argentine banks have not increased their

provisioning over the last quarters. his is relevant considering a

likely surge in NPLs as time progresses and forbearance measures

start to be retracted. Consequently, Argentinian banks' low

coverage ratios are likely to induce a reduction in the sector's

capitalization over the following quarters.

- Mexican Mining Chamber CAMIMEX's president Fernando Alanís demanded on 26 August that resources from the country's Mining Fund be invested directly back into mining communities following new regulations published on 28 July over the distribution of resources. The Fund, comprising the 7.5% mining royalty (generating around USD200 million annually), was established in 2014 to finance infrastructure and basic services in mining communities and was previously distributed directly to state and municipal governments. After original approval of the modifications in October 2019, the federal government has now assumed direct control of the Fund and 2020 resources will instead be allocated to the Education Ministry for school infrastructure (85%), the federal government (10%) and the Economy Ministry (5%). By contrast, in 2018, local governments received 77.5%. President Andrés Manuel López Obrador (AMLO) has said that the modifications were necessary to avoid state and municipal governments misusing resources. However, the changes are opposed by members of the opposition Institutional Revolutionary Party (Partido Revolucionario Institucional: PRI) and National Action Party (Partido Acción Nacional: PAN), state governors and CAMIMEX who argue that mining communities should benefit directly. The loss of resources for state and municipal governments will be felt during 2021, when the funds currently still being allocated from the previous 2019 royalties collection run out, and allocation under the new system begins. Local governments are likely to seek new means to extract resources from mining companies: a direct state-level tax is unlikely, but new regulatory barriers, permits or fees are more probable. (IHS Markit Country Risk's Johanna Marris)

- S&P upgraded Belize's sovereign rating to CCC+, which

reflects the completion of the debt restructuring process. On 18

August, the deal went into effect with 82% of bondholders accepting

the amendments that postpone debt service and capitalize the debt

service between August 2020 and February 2021 for the

US-dollar-denominated public sector bonds maturing in 2034. (IHS

Markit Sovereign Risk's Lindsay Jagla)

- The upgrade reflects the short-term relief and reduced financing risk provided by the deal. The previous SD rating reflected S&P's rating methodology, which categorized the announcement of the restructuring as a distressed debt exchange, with the expectation that the rating would change following the deal's conclusion.

- S&P has noted that the current rating reflects a moderate post-COVID-19 virus economic recovery, but also accounts for the institutional weaknesses of Belize, namely its growing government debt (which S&P expects to reach 112% of GDP this year), weak liquidity, and history of default.

- S&P also highlights that clear risks remain as a longer-than-expected COVID-19 shock would further exacerbate Belize's fiscal weakness, potentially forcing it to renege on debt payment obligations and cutting the country off further from lenders.

- S&P already expects GDP to contract 17.2%, a major hit to an economy still reeling from the devastating effects of drought and declines in tourism at the end of 2019. Belize's vulnerability to external shocks and the continued impact of COVID-19 will pose significant challenges to its debt sustainability.

- IHS Markit's medium-term sovereign rating for Belize remains constant (65 points, equivalent to CCC on the generic rating scale) and reflects a similar risk level compared with those assigned by Moody's and S&P. Belize's medium-term sovereign credit score falls in the category of extremely high payment risk despite the previous year improvement in debt sustainability.

Europe/Middle East/Africa

- Most European equity markets closed lower except for Spain +0.6%; UK -0.6%, Germany -0.5%, France -0.3%, and Italy flat.

- 10yr European govt bonds closed mixed; Italy +2bps, France +1bp, German -1bp, and UK/Spain -2bps.

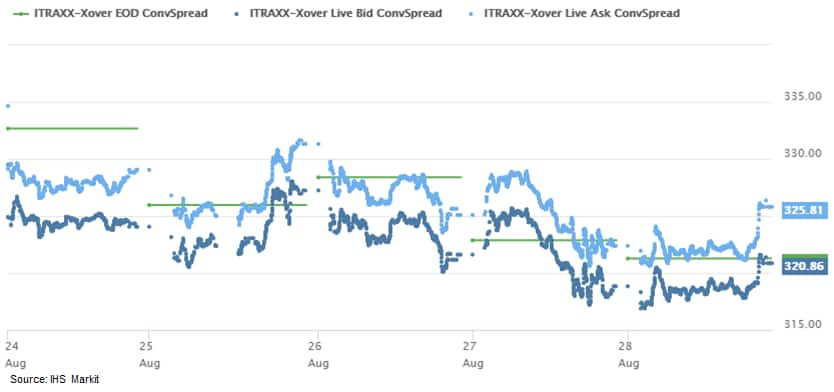

- iTraxx-Europe closed flat/54bps and iTraxx-Xover +2bps/323bps,

which is -1bp and -10bps week-over-week, respectively.

- Brent crude closed +0.5%/$45.81 per barrel.

- The Turkish lira closed ₺7.33/USD, which is a slight improvement compared to its all-time low close of ₺7.38/USD recorded on 25 August.

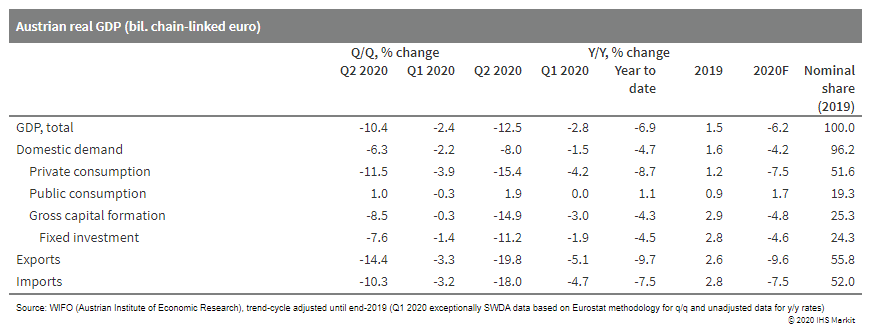

- Although Austria's second-quarter GDP decline has been revised

up from -10.7% to -10.4% quarter on quarter (q/q), this plunge

remains the largest on record by a wide margin. Indeed, the upward

revision is largely the result of import growth now shown to be

even more negative than before, so that net exports alone depressed

quarterly GDP growth by around 4%. Domestically, private

consumption and investment in equipment were the key recession

forces. IHS Markit continues to expect GDP contraction of more than

6% in 2020, followed by a rebound of around 4.3% in 2021. (IHS

Markit Economist Timo Klein)

- According to a second estimate published by the Austrian Institute of Economic Research (Österreichisches Institut für Wirtschaftsforschung: WIFO), Austrian GDP (exceptionally based on Eurostat SWDA series rather than the traditional trend-cycle calculation) declined by 10.4% quarter on quarter (q/q) during the second quarter of 2020, a slightly smaller drop than the -10.7% published as a 'flash' estimate a month ago. Nevertheless, this plunge is the largest on record by far.

- The year-on-year (y/y) rate, based on data unadjusted for seasonal or calendar variations, similarly has plummeted from -2.8% in the first quarter to -12.5% in the second quarter. The strict lockdown imposed by authorities for public health reasons between mid-March and late April, which included the closure of almost the entire non-food retail sector and large parts of the service sector, has caused this double-digit decline despite the emerging rebound from May onwards.

- WIFO has suspended for the time being the publication of its usual trend-cycle-component data that adjust for statistical 'irregularities'. The smoothing property of this methodology is not appropriate in the current environment as the huge volatility caused by the pandemic is not an artificial statistical outlier but actually reflects fundamental data edge developments. The q/q data now being published therefore use the harmonized Eurostat methodology, adjusted for seasonal and calendar variations.

- The final data for the second-quarter component breakdown (see also table below) show no or only small revisions compared with the 'flash' estimates with respect to domestic demand components, but relatively significant downward adjustments for both exports and imports. The only reason that the size of the drop in total GDP has been curtailed modestly is that imports experienced a larger downward revision than exports, which narrowed the net exports gap.

- That said, exports at -14.4% q/q still posted a much steeper

drop than imports at -10.3%, resulting in a depressing effect of

net exports on quarterly GDP growth of -4.1%. By comparison, this

export decline in a single quarter is almost as large as the entire

cumulative drop during the global financial crisis (GFC), observed

across four quarters between mid-2008 and mid-2009 (-15.1%).

- UK-based startup Oxbotica has received an automated vehicle (AV) permit recommendation from an independent inspection body, TÜV SÜD, to begin live trials on public roads in Germany. This German AV permit shows, having completed trials on the left-hand side of the road in the UK, that the company's automated vehicle software can follow the rules of driving on the right in real-world conditions. To achieve this, the company started trials last month in Friedrichshafen to meet a rigorous assessment framework. Ozgur Tohumcu, CEO at Oxbotica, said, "The landmark TÜV SÜD AV permit recommendation in Germany allows us to test in one of the world's leading automotive markets, helping accelerate future deployments both in the region and globally. Our ability to understand and adapt to the rules of the road for driving both on the left and right-hand side of the road provides a fast route to market for our autonomous vehicle software. It also paves the way to take our autonomous driving software internationally through the ongoing commercial engagements with our partners." Oxbotica was founded in 2014 as an autonomous vehicle (AV) software company, headquartered in Oxfordshire. The company specializes in building AI software for controlling autonomous cars and cloud-based software that optimizes the route of the vehicle on the road. Last year, Oxbotica has partnered with Navtech Radar to develop advanced radar solutions for off-road AVs (see United Kingdom: 10 July 2019: Oxbotica teams up with Navtech to develop radar solutions for AVs). UK-based private hire company Addison Lee has selected Oxbotica to support its plans to launch robotaxis in London by 2021. The government has funded Oxbotica to support a GBP13-million project, that will program fleets of AVs that will run between London and Oxford. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Asia-Pacific

- APAC equity markets closed mixed; Japan -1.4%, Australia -0.9%, South Korea +0.4%, Hong Kong +0.6%, India +0.9%, and Mainland China +1.6%.

- Toyota Group has announced its global production figures for

July 2020. It reported a 13.8% year-on-year (y/y) decrease in

overall output to 793,291 units. The figure includes output at its

subsidiaries Daihatsu and Hino. (IHS Markit AutoIntelligence's

Nitin Budhiraja)

- According to data released by the automaker on its website on 28 August, worldwide output of the Toyota brand was down by 10.2% y/y to 691,091 units last month, Daihatsu's output was down by 29.9% y/y to 93,241 units, and Hino's production declined by 49.0% y/y to 8,959 units.

- By region, Toyota Group's production fell by 18.3% y/y in the domestic market to 347,855 units and by 10.0% y/y in overseas markets to 445,436 units during July. Japanese output of the Toyota brand was down by 22.0% y/y to 253,857 units.

- Volumes for Daihatsu were down by 0.1% y/y to 85,928 units, while those for Hino were down by 43.1% y/y to 8,070 units during July.

- In overseas markets, production volume of the Toyota brand during July was down by 1.7% y/y to 437,234 units, and Daihatsu posted a 84.4% y/y decline to 7,313 units while Hino's output declined by 73.8% y/y to 889 units.

- In the year to date (YTD; January-July), Toyota Group's global production declined by 26.1% y/y to 4.719 million units.

- The Toyota brand's output was down by 26.0% y/y to 4.004 million units.

- Production for Daihatsu was down by 25.0% y/y to 639,305 units and for Hino by 37.9% y/y to 76,042 units.

- By region, total YTD production in Japan declined by 23.3% y/y to 2.117 million units, while production outside Japan declined by 28.2% y/y to 2.602 million units.

- Japanese insurance company Sompo Holdings will invest JPY9.8 billion (USD92 million) for an 18% stake in autonomous vehicle (AV) startup Tier IV, reports Nikkei Asian Review. This deal is expected to bring new avenues for shrinking domestic insurance market by expanding into AV services. Tier IV will use the capital to accelerate the development of its AV technology. In addition, Tier IV can leverage Sampo's proprietary accident data to make autonomous vehicle operation safer. Tier IV was founded in 2015 and is based in Japan. The company has developed Autoware, an all-in-one software stack for autonomous vehicle operation. It claims its open-source solution is used by more than 200 companies globally, including automakers, government institutions, and other AV startups. Tier IV is currently testing its technology in AVs in more than 60 regions. This year, Yamaha Motor has partnered with Tier IV to form a joint venture (JV), named eve autonomy, which will develop an autonomous transportation service to address the growing shortage of labour at Yamaha Motor's manufacturing plants. In 2019, the company partnered with JapanTaxi, Sompo Japan Nipponkoa, KDDI, and Aisan Technology to launch an autonomous taxi trial in Tokyo. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Dongfeng Motor Group has reported a 68.8% year-on-year (y/y)

decrease in net profit to CNY2.755 billion (USD401 million) during

the first six months of 2020, according to an interim company

report filed with the Hong Kong Stock Exchange. (IHS Markit

AutoIntelligence's Nitin Budhiraja)

- Dongfeng's revenues for the period stood at CNY50.576 billion, up 4.4% y/y.

- The Group recorded impairment expenses of non-financial assets at CNY1.614 billion during the period compared to nothing during the same period last year.

- The impairment losses on financial assets of the Group increase from CNY 536 million last year to CNY 967 million.

- The finance expenses of the Group for the first half of 2020 amounted to approximately CNY599 million, up 260% y/y. The steep decline in net profit during the year can be attributed to the COVID-19 virus pandemic, which severely affected the company's production and sales activities.

- The group sold around 1.14 million vehicles in the first half of the year, falling 16.7% y/y.

- Despite the impact of the COVID-19 virus outbreak, Dongfeng's commercial vehicle (CV) operations still experienced strong growth in the first six months of 2020. Total sales of its CVs increased 9.0% y/y to around 262,000 units.

- The group's total passenger vehicle sales contracted 22.2% y/y to 882,277 units in the first half.

- The Times of India reported yesterday (27 August) that Reserve

Bank of India (RBI) governor Shaktikanta Das has asked banks to be

less risk averse, arguing that they should focus on "risk

management [and] building up resilience". The governor said

"proactive building of buffers and raising capital will [ensure]

credit flow". In a similar theme, Philstar reported on the same day

that Bangko Sentral Ng Pilipinas (BSP) governor Benjamin Diokno

said banks should mobilize the excessive liquidity at lending

rather than for other purposes. (IHS Markit Banking Risk's Angus

Lam)

- Most emerging Asian economies have experienced fast deposit growth in the first half of 2020, with relatively slow credit growth. This is no different for the Philippines, which has experienced deposit growth of 12.7% year on year (y/y) in the second quarter of 2020 compared with credit growth of only 6.4%, which is half the rate of the first quarter of 2020. This is likely to be similar for India, although the whole sector has not yet reported recent figures.

- State Bank of India, which has around 20% of total sector assets, reported credit growth of 5.3% y/y and deposit growth of 11.3% y/y in the first quarter of 2020.

- As a result, the loan-to-deposit ratio has fallen to 70.7% in the second quarter of 2020 for the Philippines, suggesting a looser liquidity position for banks. From a banking risk perspective, this is unsurprising as banks aim to reduce the potential losses they will take on, but this is likely to indicate that the last 100-basis-point (bp) cut in the reserve requirement ratio in the Philippines is likely to happen soon, as part of the 400-bp cut earmarked since the start of the year.

- For India, the slowdown in credit growth is not surprising as this has happened in the past when banks were risk averse, comparable to the period after the asset quality review in 2016, and that impact continued into 2019. Despite the fact that the state-sanctioned one-off loan restructuring will reduce banks' capital needs, it is likely that the government will inject capital into state-owned banks in the next several months to kick-start lending. Although the government aims to privatize four smaller state-owned banks this year, the remaining state-owned banks will still account for around two-thirds of total banking sector assets; the capital injection by the government is likely to jump-start lending.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-august-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-august-2020.html&text=Daily+Global+Market+Summary+-+28+August+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-august-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 28 August 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-august-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+28+August+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-august-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}