Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 28, 2020

Daily Global Market Summary - 28 April 2020

Volatility was relatively subdued again today, as the equity markets eagerly await tomorrow's post-FOMC meeting statement and continue to digest the flurry of Q1 earnings and March's economic releases. This week alone, over 150 S&P 500 companies will be reporting earnings, which will continue to shed some light on the initial impact of the COVID-19 pandemic on revenues and set the stage for what to expect in Q2. Government bonds closed the day modestly higher, while both IG and HY credit were close to unchanged on the day.

Americas

- Most US equity markets closed modestly lower today with the exception of the Russell 2000 at +1.3%; Nasdaq -1.4%, S&P 500 -0.5%, and DJIA -0.1%.

- 10yr US govt bonds closed -4bps/0.62% yield and 30yr bonds -5bps/1.21% yield.

- Crude oil closed +3.4%/$12.34 per barrel, but was as low as $10.07 at 4:30am ET

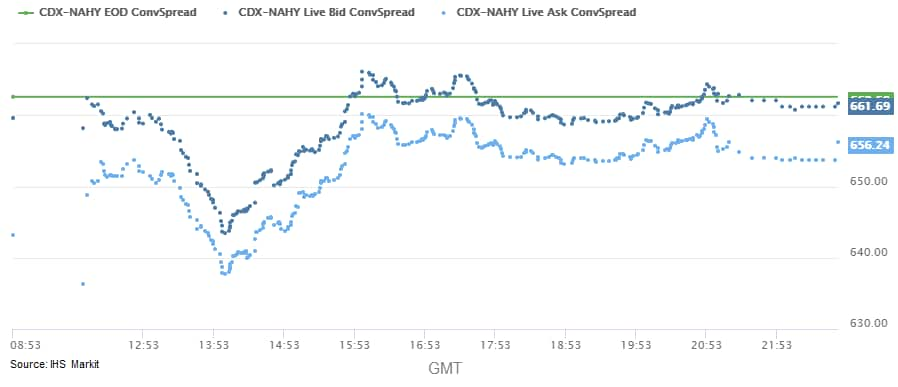

- IHS Markit's CDX North America Investment Grade index -1bp/92bps. CDX North America High Yield was 22bps tighter at 9:00am ET, but sold off through 1:00pm ET and leveled off to close -4bps/659bps:

- This week's FOMC meeting (28-29 April) will be an opportunity for reflection, assessment, and perhaps adjustment of policy responses. Major new policy initiative are less likely. In many instances, the Fed's emergency programs are just beginning to gear up and it will be some time before their effects will be fully evident, so taking this opportunity to assess their impacts is appropriate. The statement released by the FOMC this Wednesday will be rewritten to reflect sharp contractions in economic activity, widespread employment losses, and concerns about the ability of the financial system to intermediate credit flows to businesses, households, and governments impacted by COVID-19. (IHS Markit Economists Ken Matheny and Chris Varvares)

- The US Conference Board Consumer Confidence Index dropped by 31.9 points (26.9%) to 86.9 in April after a 13.8-point decline in March. It was the largest single-month decline on record and consistent with our expectation for a collapse in real consumer spending in the second quarter. (IHS Markit Economists David Deull and James Bohnaker)

- The present situation index was responsible for the month's decline. It plummeted 90.3 points (54.2%) to 76.4 in April, the lowest since December 2013 and the largest monthly decline by a factor of more than three.

- The labor index (the percentage of respondents viewing jobs as plentiful minus the percentage viewing jobs as hard to get) inverted, falling 43.1 points from a still-elevated 29.5 in March to -13.6 in April, the lowest since July 2014.

- The share of respondents planning to buy autos in the next six months fell 3.9 points to 7.5%, the lowest since October 2010. The share planning to buy major appliances fell 2.6 points to 45.1%, the lowest since January 2015.

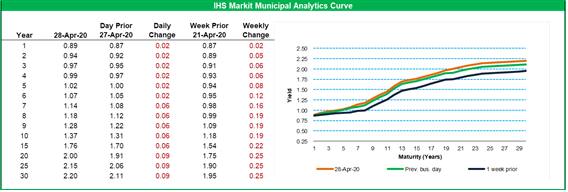

- IHS Markit's AAA Municipal Analytics Curve indicates significant steepening of the municipal bond yield curve over the past week, with the 20+ year maturity 9bps wider today and 25bps wider week-over-week:

- Approximately 50% of all U.S. workers could potentially earn more in unemployment benefits than they did at their jobs before the coronavirus pandemic shut down a large segment of the U.S. economy, and employers are indicating that the government relief is complicating plans to reopen businesses. The package of coronavirus stimulus laws Congress passed and President Trump signed in March included a $600 boost to weekly unemployment benefits through July 31, which will bring the average weekly unemployment payment to a laid-off worker from $378 to about $978. Labor Department data indicates that half of full-time workers earned $957 or less per week in Q1 2020. (WSJ)

- The US homeowner vacancy rate, the proportion of residential inventory vacant and for sale, dropped three ticks in the first quarter from a year earlier, to 1.1%—this was the lowest first-quarter reading since 1979. The rental vacancy rate, the proportion of rental inventory vacant and for rent, dropped to 6.6%, from 7.0% a year earlier. This was the lowest reading since 1985. The homeownership rate increased to 65.3%, from 64.2%. (IHS Markit Economist Patrick Newport)

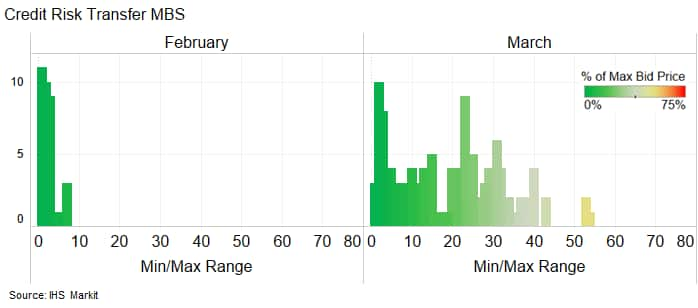

- The below chart compares the highest and lowest Credit Risk Transfer (CRT) mortgage backed security (MBS) bond trades (size ≥$1 million) on individual bonds during the months of February and March. The x-axis indicates the number of individual bonds that had a given max-min bid price range and the color indicates the range's average percentage of the highest bid. The data illustrates the unusually high degree of price dispersion that occurred in the municipal bond market last month.

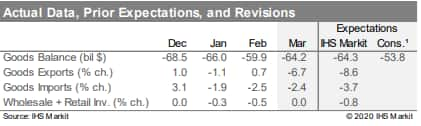

- The US goods deficit widened by $4.3 billion in March to $64.2 billion, which was very close to IHS Markit's projection compared to the consensus estimate for a much greater narrowing to $53.8 billion. The combined inventories of wholesalers and retailers, though, were flat; we had assumed a sharp decline. In response to these and other developments, IHS Markit has raised its estimate of first-quarter GDP growth by 0.5 percentage point to a 4.7% annualized rate of decline, and we lowered our forecast of second-quarter GDP growth by 0.4 percentage point to a 37.0% annualized rate of decline. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- The United States Mexico Canada Agreement (USMCA), which replaces the North American Free Trade Agreement (NAFTA), is set to go into force on 1 July 2020, according to a statement from the US Trade Representative. The statement says, "U.S. Trade Representative Robert Lighthizer today notified Congress that Canada and Mexico have taken measures necessary to comply with their commitments under the United States-Mexico-Canada Agreement (USMCA), and that the Agreement will enter into force on July 1, 2020." (IHS Markit AutoIntelligence's Stephanie Brinley)

- US President Trump plans to use the Defense Production Act to force meatpacking and meat-processing plants to stay open and could issue an order as early as today, according to a senior official. (FT)

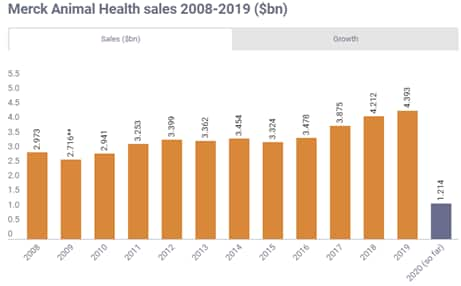

- Merck expects its animal health business to record $400 million less sales this year, owing to the effect of COVID-19. This reduction is the equivalent of around 9% of the animal health division's annual sales, according to 2019 figures. The wider Merck group has forecast an unfavorable impact on turnover of around $2.1 billion in 2020. This is equivalent to about 4.5% of its annual sales. Of this total, the firm's human pharmaceutical business is expected to witness a $1.7bn downturn due to COVID-19 (about 4% of 2019 revenues). (IHS Markit Animal Pharm's Joseph Harvey)

- General Motors (GM) has announced it has been extended USD3.6 billion under its three-year revolving credit facilities, and has suspended its dividend payment and share repurchase programs. GM also says it remains committed to its capital allocation framework strategy, which includes reinvesting in the business at pretax returns equal to or greater than 20%, maintaining a strong investment-grade balance sheet, and returning capital to shareholders after those objectives are met. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Honda is increasing its electrification options in the United States with the 2020 model-year CR-V Hybrid, moving closer to the company's target of seeing two-thirds of its global sales involving vehicles with electrified powertrains by 2030. According to IHS Markit's 2018 registration data, hybrids accounted for 1.9% of compact CUV registrations in the US. This figure grew to 2.8% in 2019, essentially on the success of the latest RAV4 hybrid, and over the first two months of 2020, this percentage grew to 3.9%. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/ Africa

- The European Central Bank's (ECB) quarterly bank lending survey (BLS) for the first quarter of 2020 was compiled between 19 March and 3 April, therefore partly capturing the devastating impact of the COVID-19 virus-related containment measures on economic activity in the eurozone. The survey polled 144 banks across the member states. (IHS Markit Economist Ken Wattret)

- A standout features of the first quarter's survey is the unprecedented divergence of demand for loans from enterprises and households. The former surged due to firms' emergency liquidity needs following the lockdown of large parts of the economy: the net percentage of banks reporting an increase in loan demand jumped to +26% in the first quarter of 2020, from -7% in the fourth quarter of 2019.

- Notably, demand was much higher for short-term loans (net percentage +29%) than long-term loans (+5%). Financing needs for inventories and working capital rocketed, whereas financing needs for fixed investment declined, a negative sign for future growth prospects.

- In contrast to enterprises, net household demand for housing loans moderated in the first quarter (net percentage +12%, versus +25% in the fourth quarter of 2019), while the net percentage for consumer credit and other lending turned negative (-4%, versus +10%).

- In contrast, deeply negative net balances for loan demand are expected both for housing (-67%) and consumer credit (-30%) in the second quarter of 2020. For housing loans, this would be similar to the trough during the GFC in the second half of 2008.

- A new emergency action plan to address critical issues pertaining to farm labor in Italy is currently in the works, announced the country's ministry of agriculture, food and forestry policy, or MIPAAF. According to a statement by Italy's agriculture minister Teresa Bellanova, the country's agriculture sector employs "more than 346,000 foreigners from 155 different countries", who jointly contribute 30 million working days or some 26.2% of the labor hours that are required in the Italian countryside. Italy's farmers' group Coldiretti highlighted the fact that the country witnessed a 10% drop in overall farm workdays in March at a time when the country experienced the second warmest winter since 1800, which brought forward the ripening of early fruits. (IHS Markit Agribusiness' Vladimir Pekic)

- BP reported first quarter 2020 underlying replacement cost (RC) profit of $791 million, down 66% from $2,358 million in the same period in 2019. The result reflected lower prices, demand destruction in the downstream, particularly in March, a lower estimated result from Rosneft and a lower contribution from oil trading. BP's loss was $4,365 million, compared with a profit of $2,934 million a year ago. Operating cash flow excluding Gulf of Mexico oil spill payments was $1.2 billion, down from $5.9 billion a year ago. Total reported production, including the Rosneft contribution, was 3,715,000 boe/d, down 2.8% from a year ago. BP announced a revised organic capital investment of $12 billion, down 25% from its previous organic capital investment of $15 - 17 billion, announced in February 2020. (IHS Markit Upstream Companies and Transaction's Karan Bhagani)

- British Airways is preparing to cut almost 30 per cent of its 42,000 workforce as the coronavirus crisis wreaks more damage on the battered aviation sector (FT)

- German automotive parts manufacturer Continental has released slightly better preliminary first-quarter financial results than expected, with an EBIT margin of 4.4%, according to a company statement. This was far higher than the company's own anticipated target range of between 2 and 3%. Continental also posted consolidated sales at the upper end of its projection of EUR9.4-9.8 billion, with the figure coming in at EUR9.8 billion. Sales in the Automotive Technologies group sector were EUR4.1 billion (prior year: EUR4.7 billion) and the adjusted EBIT margin was 1.8% which compared to 6% in the first quarter of 2019. This meant an 11.5% drop in sales in the segment. The Rubber Technologies group sector achieved sales of nearly EUR4 billion (prior year: EUR4.4 billion) and an adjusted EBIT margin of 9.8% with a 10.8% decline in sales. (IHS Markit AutoIntelligence's Tim Urquhart)

- Swedish automotive safety supplier Autoliv announced its net sales had retreated by 15.1% year on year (y/y) to USD1,846 million for the three months ending 31 March. This decline was driven by combination of an 11.4% y/y decline in its Seatbelt Products business to USD643.6 million and its Airbag Products and Other falling by 17% y/y to USD1,202.2 million. The supplier said in its statement that during this time, the virus has particularly hit sales in China where the outbreak originated, and where its customer plants were closed for several weeks in February and working at lower levels during March. This is underlined by its sales revenues for this market falling by 40.2% y/y in the quarter. (IHS Markit AutoIntelligence's Ian Fletcher)

- The Swedish central bank (Riksbank) has voted to keep the repo rate (policy rate) on hold at 0.0% in its April meeting. The last change was a rise of 25 basis points in December 2019. Plans to purchase SEK300-billion (USD30.1-billion) worth of assets this year were left unchanged, as was the scope of the SEK500-billion liquidity program. The Riskbank has also established a SEK600-billion swap line with the Federal Reserve to provide USD liquidity to the domestic banking sector. The Riksbank's two GDP scenarios imply a contraction of 6.9% in 2020 (scenario A) to 9.7% (scenario B). IHS Markit will revise down its current forecast of a recession from 4.1% to over 6% in the May forecast round. (IHS Markit Economist Daniel Kral)

- French automotive supplier Valeo has announced that its sales fell during the first quarter of 2020. For the three months ending 31 March, the company said that its revenues have declined by 7.3% year on year (y/y) to EUR4,488 million. Declines have come from all of its business areas. Its Visibility Systems business retreated by 7.5% y/y to EUR1,390 million, while Powertrain Systems slipped by 6.4 y/y to EUR1,185 million. Despite the coronavirus disease 2019 (COVID-19) virus pandemic that emerged this quarter, Valeo's sales have not declined as steeply as some businesses. (IHS Markit AutoIntelligence's Ian Fletcher)

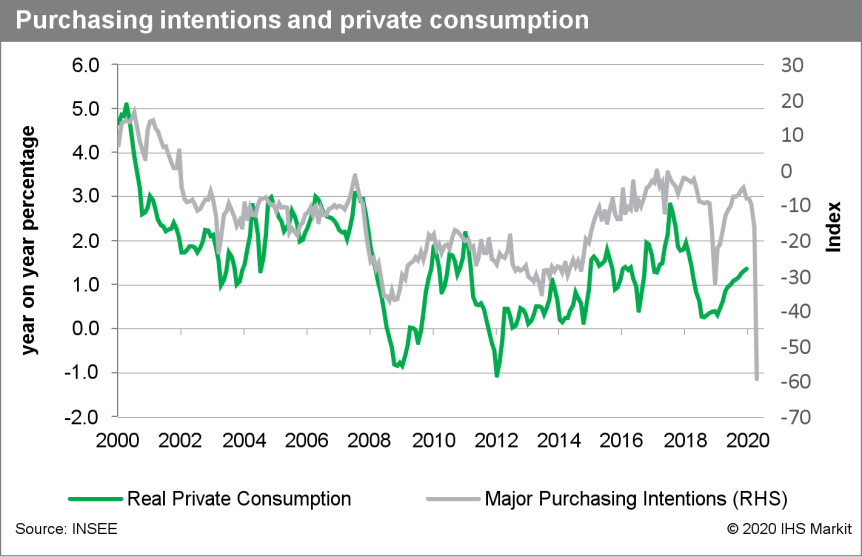

- France's consumer-confidence index collapsed from 103 in March to 95 in April, its lowest level since February 2019, according to seasonally adjusted figures released by the National Institute of Statistics and Economic Studies (Institut national de la statistique et des études économiques: INSEE)

- As opposed to March's survey, April's data were collected after the French government implemented strict containment measures to limit the spread of the coronavirus disease 2019 (COVID-19) virus on 17 March. Despite the headline index experiencing its largest monthly decline since the survey started to be collected in 1972, April's reading was well above consensus (80).

- The index related to households' financial situation during 2019 rose by five points to its highest level since 2001. On the other hand, the index measuring households' expected financial situation over the next 12 months plummeted by 15 points (its largest-ever fall) to a level not seen since May 2014.

- Households' views on the past general economic outlook were more upbeat than in March (up by 2 points), while the index measuring their views on the general economic outlook plunged by 34 points, reaching its all-time low (-71). The number of households that considered making a major purchase over the next 12 months also collapsed to a record low in April (down from -16 to -59 in the chart below).

- Brent crude closed -1.4%/$22.74 per barrel.

- Russia's March print data, released by RosStat on 27 April, showed the country's industrial sector barely escaping contraction, growing only by 0.3% year on year (y/y). This contrasts with y/y gains of 2.3% in February and 1.1% in January. Industrial production marked its weakest performance since May 2019. It is noteworthy that the deceleration is not linked to the lockdowns, which were imposed only on 30 March. (IHS Markit Economist Lilit Gevorgyan)

- The breakdown of the March data suggests that the overall weakness in the industrial production was driven by a 1.7% y/y decline in the extractive sector, although in quarter-on-quarter (q/q) comparison, the mining sector's growth accelerated to 5.6% in March. Specifically, oil, gas and coal extraction nearly halved in March, but the hydrocarbon extraction services expanded by double digits, thereby offsetting bigger losses in the mining sector.

- Manufacturing growth eased to 2.6% y/y from annual increases of 5.0% in February and 3.9% in January. Growth impulse came from food production, which expanded by around 9.0% y/y in March.

- Retail sales continued their strong expansion, up by 5.6% y/y in March, from 4.7% y/y growth in February, clearly marking the impact of COVID-19-related panic buying.

- Russia's largest carmaker AvtoVAZ has said that it plans to halt production from 29 April until 17 May as a result of an almost complete lack of demand in the market following the implementation of measures to halt the COVID-19 virus, while President Putin is looking at stimulus measures for the market. AvtoVAZ initially restarted production at Izhevsk on 13 April although the giant plant at Togliatti has only been operating with a skeleton staff. However, an almost complete lack of demand has led AvtoVAZ to halt production at all its plants from 29 April to 17 May. With around 95% of AvtoVAZ's sales taking place in Russia, the company's Lada brand is almost entirely dependent on the domestic market. With the domestic market facing an unprecedented slump as a result of the COVID-19 virus outbreak, it stands to reason that AvtoVAZ is facing severe turbulence. (IHS Markit AutoIntelligence's Tim Urquhart)

- Lebanese banks set exchange rate 50% higher than official rate for withdrawals from US-dollar accounts. Lebanese banks have set an exchange rate of LBP3,000 per USD1 for withdrawals from dollar-denominated accounts for the week of 27 April, Reuters reports. The Central Bank of Lebanon (Banque du Liban: BDL) has announced that exchange houses will use the rate of LBP3,200 per USD1, while funds being wired abroad will be exchanged at the rate of LBP3,800 per USD1. BDL Governor Riad Salamé told local media that USD5.7 billion had been withdrawn from the banking sector in the first two months of 2020, but central bank data show that deposit outflows since the end of 2019 have reached USD7.3 billion. (IHS Markit Banking Risk's Gabrielle Ventura)

- IHS Markit's iTraxx-Europe investment grade CDS index closed flat/81bps and iTraxx-Xover high yield index -1bp/494bps.

- 10yr European govt bonds closed higher across the region; Spain -6bps, Germany/Italy/France -2bps, and UK -1bp.

- European equity markets closed higher across the region; UK +1.9%, Italy +1.7%, Spain +1.6%, France +1.4%, and Germany +1.3%.

Asia-Pacific

- Japan's unemployment rate notched up to 2.5% in March. The rise reflected a decline in the number of employees, mainly self-employed workers, and a decrease in female labor participation from the previous month. The ratio of active job openings to active job applications also declined rapidly to 1.39 in March 2020, which is the lowest level since September 2016, largely reflecting an accelerated decrease in the number of active job openings (down 5.9% month on month). (IHS Markit Economist Harumi Taguchi)

- Honda has decided to extend temporary suspension of production at its plants in Indonesia until 8 May, reports Kompas.com. It previously announced a temporary suspension from 13 to 24 April. Honda's announcement comes after the Indonesian government extended the large-scale social restrictions imposed in several areas of the country until 22 May to curb the spread of the COVID-19 virus. (IHS Markit AutoIntelligence's Jamal Amir)

- Takeda (Japan) has signed an agreement to divest approximately 110 non-core over-the-counter (OTC) and prescription pharmaceutical treatments marketed in Europe, as well as two manufacturing sites in Denmark and Poland, to Orifarm Group (Denmark) for up to approximately USD670 million, Takeda said in a statement. The divestment agreement will enable Takeda to continue to reduce its debt, which resulted from its USD62-billion acquisition of Shire (UK) in 2019. Takeda has set itself a target debt level of 2x net debt/adjusted EBITDA (earnings before interest depreciation and amortisation) within the March 2022-March 2024 period. (IHS Markit Life Science's Sophie Cairns)

- Hyundai plans to temporarily suspend production at its plant in Ulsan (South Korea), where it produces the Elantra, from 6 to 8 May, reports Reuters. Hyundai's other plants in the country will operate normally during this period. Separately, Renault Samsung plans to temporarily idle its sole Busan plant in South Korea from 30 April to 8 May, according to report by the Yonhap News Agency. By suspending operations at their plants, Hyundai and Renault Samsung aim to manage inventories amid the growing impact of the COVID-19 virus pandemic on the automotive industry. (IHS Markit AutoIntelligence's Jamal Amir)

- South Korea will invest around KRW1.1 trillion (USD896 million) in developing technologies for autonomous vehicles (AVs) by 2027, reports Yonhap News Agency. The country will focus on developing Level 4 autonomous cars that require no human intervention, but their applications will be limited to specific conditions. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese autonomous truck startup Inceptio Technology has raised USD100 million in a Series A funding round from investors such as GLP, and G7, among others. The company is developing software and an in-car computing system for autonomous trucks that will be deployed in a freight network. Inceptio Technology was founded in April 2018 and focuses on developing Level 3 and 4 autonomous truck technologies. The company has partnerships with truckmakers such as Dongfeng Automobile, Sinotruk Hong Kong, and Foton, which are responsible for developing engineering vehicles platforms. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Zotye Auto has released its financial results for 2019, revealing revenue of CNY3.20 billion (USD452 million), down 78.3%. Zotye recorded a net loss of CNY9.30 billion during 2019, compared with a net loss of CNY1.24 billion in 2018. The combined sales of the Zotye and Traum brands fell by 37.4% during 2019 to 152,846 units. Zotye pointed out in its 2019 annual report that the company faced several challenges brought about by changing market conditions, such as the need to invest in new technologies to meet the China 6 emission standards and increasingly fierce competition in the entry-level vehicle segment. (IHS Markit AutoIntelligence's Abby Chun Tu)

- APAC equity markets closed mixed; Hong Kong +1.2%, India +1.2%, South Korea +0.6%, Japan -0.1%, and Australia/China -0.2%.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-april-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-april-2020.html&text=Daily+Global+Market+Summary+-+28+April+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-april-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 28 April 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-april-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+28+April+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-april-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}