Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 25, 2020

Daily Global Market Summary - 25 August 2020

Global equity markets closed mixed, while benchmark government bonds ended the day lower across Europe and the US. iTraxx credit indices widened modestly, while CDX IG was flat and high yield was tighter on the day. Oil prices were higher on the day, as US Gulf Coast production and refining is being halted as two major storms begin to approach the region. All eyes will be on Fed Chairman Powell's speech tomorrow at the virtual Jackson Hole Economic Policy Symposium, as he is expected to outline changes to the Federal Reserve's monetary policy approach to confronting inflation risk.

Americas

- Most US equity markets closed modestly higher except for DJIA -0.2% and the S&P 500 closed at a new record high; Nasdaq +0.8%, S&P 500 +0.4%, and Russell 2000 +0.2%.

- 10yr US govt bonds closed +3bps/0.69% yield and 30yr bonds closed +4bps/1.40% yield.

- Fed Chairman Powell is expected to open the Kansas City Fed's annual economic policy conference (usually held in Jackson Hole, WY) tomorrow with an update on the U.S. central bank's plans to refit its monetary policy approach to a world where persistently low inflation and low interest rates numb the effects of the Fed's recession-fighting stimulus measures. (Reuters)

- CDX-NAIG closed flat/66bps and CDX-NAHY -6bps/377bps.

- Gold closed -0.8%/$1,923 per ounce and is now -6.6% from its all-time high close of $2,069 per ounce on 6 August.

- Crude oil closed +1.7%/$43.35 per barrel.

- Seadrill Limited reported a net loss attributable to shareholders of USD181 million and an operating loss of USD88 million for the second quarter of 2020, compared to a net loss of USD1,564 million and an operating loss of USD1,284 million for the first quarter of 2020 after making material asset impairments. Seadrill is continuing to evaluate capital structure proposals from its financial stakeholders. While no agreement has been reached at this point, the company expects that potential solutions will lead to significant equitization of debt which is likely to result in minimal or no recovery for Seadrill's current shareholders. Seadrill had previously announced plans to scrap up to 10 rigs within its fleet. The company has stated that it does not believe that the reactivation of cold-stacked assets in the current environment represents an appropriate use of cash nor return on investment. Seadrill currently has two drillships, four jackups, three tender rigs and 10 semisubmersibles cold stacked. (IHS Markit Upstream Costs and Technology's Matthew Donovan)

- A large chunk of oil and natural gas production in the Gulf of Mexico will be offline for several days as operators wait for Hurricane Laura to move inland. Offshore production shut-ins started over the weekend as Tropical Storm Marco, which has now fizzled out, moved through the region. According to the latest report from the Bureau of Safety and Environmental Enforcement, 84.3% of Gulf crude production—or 1.56 million b/d—has been taken offline. Operators have also shut in 1.65 Bcf/d of natural gas production, or 60.9% of all Gulf gas output. In addition, BSEE reports that personnel have been evacuated from a total of 299 production platforms, or 46.5% of the 643 manned platforms in the Gulf. All of the 16 dynamically positioned rigs operating in the Gulf have been moved out of the storms' project paths as a precaution. (IHS Markit Plays and Basins' Jeff Gosmano)

- The US Conference Board Consumer Confidence Index fell 6.9

points (7.5%) to 84.8 in August after a similar decline in July,

bringing the index to a new COVID-19-era low at a level last seen

in May 2014. The August reading is consistent with our continued

expectation for sharply slower growth of consumer spending in the

fourth quarter. (IHS Markit Economists David Deull and James

Bohnaker)

- The present situation index led the decline, falling 11.7 points to 84.2, while the expectations index fell 3.7 points to 85.2. The two measures have essentially converged, suggesting that even as economic activity has partly recovered after the business closures during the spring, consumers have lowered their expectations about the pace of recovery going forward.

- The labor index (the percentage of respondents viewing jobs as plentiful minus the percentage viewing jobs as hard to get) returned to negative territory in its first drop since April, falling 5.9 points to -3.7%. A net 7.2% of respondents expected employment conditions to improve six months hence, down from 24.0% in June.

- Purchasing plans dipped in August. The share of respondents planning to buy autos in the next six months fell 2.8 percentage points to 9.7%, while the share planning to buy major appliances fell 3.4 points to 44.8%. The share planning to buy homes fell 1.8 percentage points to 5.9%.

- With consumer spending on durable goods in June and sales of new and existing homes in July well exceeding their pre-pandemic levels, the decline in purchasing plans is likely driven at least in part by consumers now having conducted the purchasing they had previously planned.

- The share of respondents planning a vacation in six months, at 35.6%, was slightly higher than in June, but the share planning such a trip specifically by airplane (12.4%) was the lowest since early 1975.

- Federal income support is flagging and the COVID-19 pandemic wears on. Although economic activity is greater than at its springtime depths, consumers are now reconciling themselves to a new, more socially distant normal.

- US carrier American Airlines has said it will cut 19,000 jobs at the beginning of October as a result of its reduced flight schedule during the coronavirus pandemic and the expiration of federal aid. American said on Tuesday the reductions include furloughs of 17,500 employees and 1,500 management job cuts. (FT)

- Over the past week, chicken wings were once again trading over $2. How could that be? Unemployment is over 10%. The traditional autumn start of wing season still is more than a month away. Most potentially, televised sporting events have been cancelled or postponed so as not to imperil fans or athletes with COVID-19 infection. Those sports bars keeping their doors open do so with severe seating capacity limits and their myriad TV screens tuned mostly to re-runs. Casual dining traffic flow is at a trickle. Even at fire sale price levels, domestic dark meat interest flounders, global broiler meat exports appear to be losing momentum, and the USDA national weighted average cutout has struggled below $0.75 per pound since March. However, wing prices imply defiance. (IHS Markit Food and Agricultural Commodities' Roger Bernard)

- US new home sales sizzled again in July, rising 13.9% (±20.0%)

to a seasonally adjusted annual rate of 901,000—the highest

since December 2006. The reading, like the previous one, was not

statistically significant, however (90% confidence intervals). (IHS

Markit Economist Patrick Newport)

- Sales in the South and Midwest skyrocketed to 13-year highs (the reading for the Midwest was statistically significant; that for the South was not).

- Sales for the prior three months were revised up a cumulative 19,000.

- The number of units for sale dropped 5,000 to 299,000; completed homes for sale came in at 61,000, down 5,000.

- The months' supply of unsold homes fell 0.6 months to 4.0 months.

- The median price in the second quarter fell to 330,600—7.2% above the year-earlier level; the average price was up 4.8% year on year at $391,300.

- Although most of the numbers in this report fail the statistical significance threshold, they are consistent with other housing data, including existing home sales numbers, in showing activity rising above pre-pandemic levels in July.

- The housing market is reaping the benefits of record-low interest rates and pent-up demand. But low inventory levels, which have led to bidding wars, are also fanning the flames.

- For the fourth month in a row, S&P CoreLogic Case-Shiller

composite data in June were limited to only 19 cities as opposed to

20 under normal circumstances. Data for Wayne County, Michigan,

were unavailable and as a result, there are no data for Detroit in

this release. (IHS Markit Economist Troy Walters)

- The 10-city index slipped 0.1% month over month (m/m) in June while the 20-city index was flat.

- Home prices were up month on month (m/m) in 12 of the 19 cities reported. Gains ranged from 0.7% in Charlotte to just 0.1% in Miami.

- On an annual basis, home price growth slowed slightly again in June. The 10-city index was up 2.8% year on year (y/y), slower than May's reading of 3.0%. The 20-city index was up 3.5% y/y compared with 3.6% in May.

- Despite decelerating, y/y price growth in June remained well into positive territory, with prices higher than one year ago in all 19 cities reporting. Increases ranged from 9.0% in Phoenix to just 0.6% in Chicago.

- Growth in the national index held steady at 4.3% y/y in June.

- The Federal Housing Finance Agency (FHFA) House Price Index

(HPI) increased 5.4% from a year earlier. This is slower than the

first quarter's 5.9% gain—but that comparison is misleading.

Prices accelerated in June, after dipping in May, and all signs

indicate that the housing market heated up in July. (IHS Markit

Economist Patrick Newport)

- Quarterly house prices rose in all 50 states, with Idaho (up 10.8%), Arizona (up 9.1%), Washington (up 8.6%), Utah (up 8.1%), and New Mexico (up 7.7%) leading the way; West Virginia and North Dakota, where prices increased 1.1%, were the two laggards.

- Prices also rose in 99 of the largest 100 metropolitan areas (San Francisco witnessed a 0.3% decline).

- The monthly index jumped 0.9% month on month (m/m) in June—the largest gain in seven years. In May, this index fell for the first time in over three years. The monthly index was up 5.7% from a year earlier.

- Eight of nine divisions posted solid monthly gains; the index for the South Atlantic Division fell 0.1% for the second straight month. All nine divisions registered solid year-on-year quarterly gains.

- Autonomous vehicle (AV) sensor manufacturer Luminar Technologies is planning to go public through a merger agreement with Gores Metropoulos, a special-purpose acquisition company (SPAC). This will bring Luminar's market value to USD3.4 billion, reports Reuters. The deal includes USD400 million of cash from Gores Metropoulos and USD170 million of financing from investors including Alec Gores, Van Tuyl Companies, Peter Thiel, Volvo Cars Tech Fund, Crescent Cove, Moore Strategic Ventures, GoPro founder Nick Woodman, and VectoIQ. As part of the agreement, the combined company will retain the name Luminar Technologies Inc and will be listed on the NASDAQ stock exchange under the ticker symbol LAZR. The deal is expected to be closed in the fourth quarter of this year. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Utah Department of Transportation (UDOT) has launched a five-year program to test vehicle-to-everything (V2X) communication technology in the US state. UDOT is working with Panasonic to deploy 80 roadside radio units that can receive and transmit data from cars that have 5.9-GHz radio transmitters. The radio units gather data from passing vehicles and process it using artificial intelligence technologies to send out important information, including warning drivers of unsafe conditions and road closures due to accidents or hazards in the road such as potholes or rocks. Blaine Leonard, UDOT engineer, said, "The real key is the long-term plan to improve safety on our roads. This is a technology that is unique in that while we're still waiting for coming autonomous vehicles, V2X is here now, usable now and ready to give us a benefit." V2X technology is designed to allow vehicles to communicate directly with other vehicles, pedestrians, devices, and roadside infrastructure, and assists the operation of advanced driver assistance systems (ADAS). Utah is among eight US states that have participated in an initiative to make available data on autonomous vehicle (AV) testing through an online and public-facing platform (see United States: 16 June 2020: US regulator launches initiative to make nationwide data available on autonomous vehicle testing). Last year, UDOT and the Utah Transit Authority (UTA) teamed up to launch a pilot project using French company EasyMile's autonomous shuttle. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Patrick Collignon has launched startup TrovaCV, based in the US state of Virginia. The new company will "focus on the engineering, design and production of fully electric commercial vehicles with the goal of achieving mass production cost-effectively," the company press statement says. Collignon is quoted as saying, "This is an exciting time as the electric commercial vehicle market is being reshaped. While technology and innovation have made it possible to convert fuel-powered commercial vehicles into electric vehicles, we haven't seen a production model capable of producing the required volume of fully electric commercial vehicles to meet the demand. We believe that our engineering approach will offer OEMs the opportunity to build a higher volume of electric vehicles at a lower cost. At the same time, we will utilize our chassis design experience to achieve a complete EV build design from the ground up." The new company's website opens with the tag "Get Your Fleet Moving: Your Partner into Alternative Drive-Line Vehicles." Trova aims to offer product cost reduction services, industrial and manufacturing engineering services, launch management, on-site full-service management and complete vehicle manufacturing, according to its web site. TrovaCV appears to be largely aimed at supplying expertise, knowledge and engineering support, compared to a company like Nikola, which is focused on vehicle production. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Brazil's crude steel production rose 21% in July to 2.59 mt from 2.14 mt in June, according to Brazilian Steel Institute data. July volume was also 3% higher than 2.51 mt produced in the same month last year, after operations restarted at three of 13 blast furnaces that have been idled. Brazil's big steel makers -- Usiminas, Companhia Siderúrgica Nacional (CSN) and ArcelorMittal -- are working at nearly 70% capacity. Some of those 13 units have been under maintenance since the end of last year and have not restarted, while others were idled during the peak of the pandemic. The timing for resumption of the remaining idled operations is uncertain. Crude steel production in January-July 2020 was 17.07 mt, down 14% year on year from 19.75 mt in January-July 2019, falling on reduced steel demand from the automotive industry and infrastructure. Brazil will see its real GDP decrease by 7.4% in 2020, according to IHS Markit data. Crude steel output during the first seven months of the year annualizes at 29.27 mt, which would be a drop of 9% of last year's total of 32.34 mt.

Europe/Middle East/Africa

- European equity markets closed mixed; UK -1.1%, Italy -0.4%, and Germany/France/Spain flat.

- 10yr European govt bonds closed sharply lower across the region; Italy +9bps, France/Spain +7bps, Germany +6bps, and UK +5bps.

- iTraxx-Europe closed +1bp/55bps and iTraxx-Xover +3bps/329bps.

- Brent crude closed +1.6%/$45.86 per barrel.

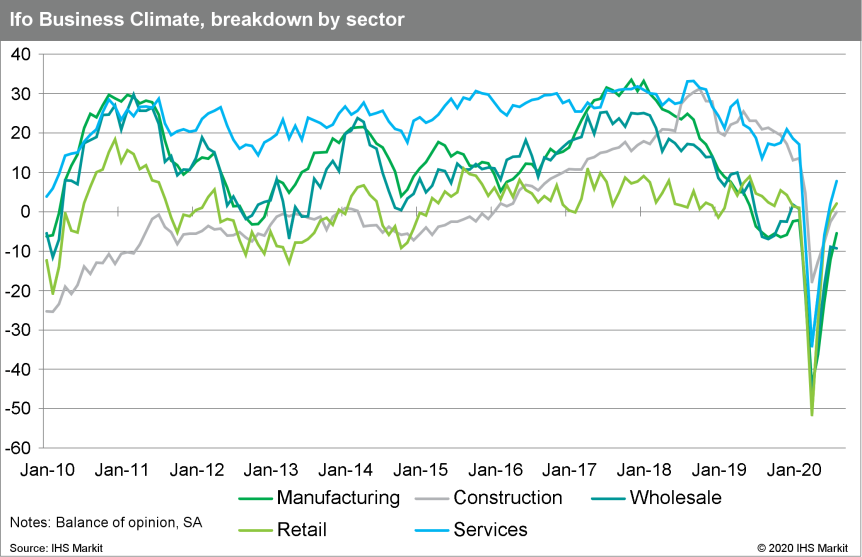

- Germany's headline Ifo index, which reflects business

confidence in industry, services, trade, and construction combined,

has posted an increase for the fourth consecutive month, rising

from 90.4 to 92.6 in August. (IHS Markit Economist Timo Klein)

- This level means that business confidence has not quite returned to February's pre-COVID-19 pandemic reading of 95.8. However, the March level of 86.1, which already reflected the beginning of the COVID-19 lockdown, has been surpassed for the past three months now.

- The long-term average of 97.2 is coming in sight, and the Ifo institute summarizes the results by saying that "the German economy is on the road to recovery".

- Expectations were no longer the driving component in August's survey, only edging up by 0.8 points from 96.7 to 97.5. However, this is the highest reading since November 2018. Expectations improved the most in the manufacturing and services sectors. The same applies to current conditions, the overall index for which has increased by a robust 3.4 points to 87.9.

- The breakdown by sector also reveals that, while the loosening

of lockdown restrictions during May and June initially benefited

the retail and service sectors the most, the previously somewhat

lagging manufacturing sector is now catching up.

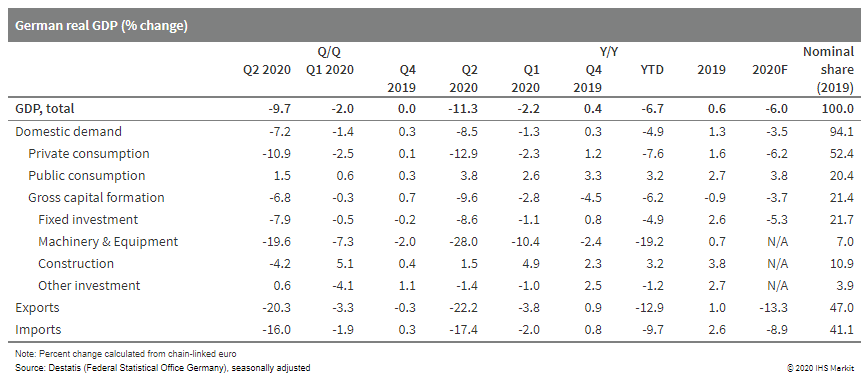

- German GDP declined by 9.7% quarter on quarter (q/q) in the

second quarter of the year, slightly less than the 10.1% released

with the flash data on 30 July. (IHS Markit Economist Timo Klein)

- The detailed breakdown now available for the first time reveals that the largest burden came from private consumption, followed by net exports and investment in equipment.

- Although exports dropped by one-fifth from first-quarter levels, imports were not far behind, limiting the external burden on GDP growth.

- Net exports subtracted 2.8% from quarterly GDP growth and final domestic demand (excluding inventories) about 7.2%. This was slightly offset by an increase in stocks that added 0.3% to overall growth.

- The stock increase in the second quarter should be seen as involuntary, reflecting the plunge in final demand due to the March-April lockdown.

- At -20.3% q/q, exports declined at almost twice the pace of the previous record during the global financial market crisis in early 2009. Indeed, even the cumulative export decline between mid-2008 and mid-2009 was smaller, at about -19%.

- As already in the first quarter, imports held up better than

exports, but at -16.0% q/q they also dropped in extreme fashion,

twice the previous low recorded in the first quarter of 1993.

- Switzerland's employment barometer for the second quarter,

published by the Federal Statistical Office, reveals the marked

deterioration that was expected in view of the COVID-19 virus

outbreak and the lockdown conditions it triggered during

March-April. (IHS Markit Economist Timo Klein)

- The so-called BESTA statistics - based on a comprehensive picture of the corporate landscape, using pension system statistics that also include many micro firms and employees with less than six weekly work hours - shows that seasonally adjusted employment declined by 1.1% quarter on quarter (q/q) in the second quarter, following a slight slippage already in the first quarter (-0.1%).

- This contrasts sharply with an average quarterly increase of 0.4% q/q during 2019. Having reached an all-time high of 5.15 million at the end of 2019, employment has now returned to its early-2019 level.

- In year-on-year (y/y) terms, employment growth has also become negative now, posting -0.6% y/y in the second quarter after 0.9% in the preceding quarter and 1.6% on average during 2019.

- A comparable annual decline last occurred in mid-2009 during the recession caused by the global financial market crisis.

- As already observed in the first quarter, the breakdown by economic sector for the seasonally adjusted data shows that employment growth deteriorated to a greater extent in the service sector (-1.1% q/q) than in industry (-0.5% q/q). This unusual occurrence is linked to specifics of the pandemic, as any services in the entertainment and recreation sectors - usually related to large public gatherings - are affected the most by the need for physical distancing.

- Within manufacturing, employment in the car industry was hurt the most in the second quarter (-6.7% q/q), while among services the temporary employment sector (-18.9%) and the hotel/restaurant industry (-7.8% q/q) were hit the hardest.

- Vacancies, which had already plummeted to -13.3% y/y in the first quarter, plunged to -26.9% y/y in the second quarter.

- The annual change of the indicator of employment prospects for the next quarter broadly stabilized, but at -3.4% y/y this remains very low.

- The indicator measuring the degree of perceived skill shortages deteriorated anew from -3.9% to -5.0% y/y. This meant that the share of firms (weighted by the size of their workforce) reporting difficulties in finding qualified personnel broadly remained at the first quarter's already low level (28.2%).

- Nissan has delayed the restart of vehicle production at its Barcelona (Spain) facility and at two other locations in the city after supplier Acciona cancelled its contract with the company, reports El Economista. Although the automaker had plans to resume yesterday (24 August), the automaker said in a statement published on 21 August that this was down to "external reasons beyond its control". However, workers not able to work from home were expected to go to the facilities to undergo training under new protection protocols. The company now expects production of the e-NV200 to resume on Line 1 at the site on 31 August, while manufacture of the Nissan Navarra and Mercedes X-Class will follow on 7 September. (IHS Markit AutoIntelligence's Ian Fletcher)

- Czechia's automotive industry association Sdružení automobilového průmyslu (AutoSAP) has said that it expects vehicle production in the country to fall by 20% in 2020. This coincided with the trade group revealing that passenger car registrations in the country are now down by 29.7% y/y during the first seven months of the year to 586,333 units, with a decline in July of 5.2% y/y to 82,718 units. At the same time, bus production in the country has fallen by 8.3% y/y during to the year to date (YTD) to 2,728 units, with a 11.7% y/y improvement recorded in July to 497 units. (IHS Markit AutoIntelligence's Ian Fletcher)

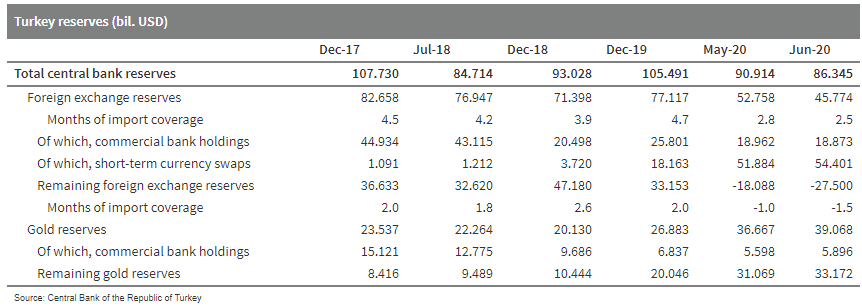

- On 21 August, Fitch Ratings downgraded the outlook on its

long-term issuer default ratings for Turkey from Stable to

Negative. The new outlook suggests that the current rating of BB-

could be revised downward within the next 12 months. (IHS Markit

Economist Andrew Birch)

- The deterioration of the country's external financing position was the primary reason cited by Fitch in its press release alongside the move. Specifically, the evaporation of foreign currency reserves, poor monetary policy, negative real interest rates, and a large (and growing) current-account deficit are all fueling increased risks.

- On the other hand, Fitch points at several points of resiliency to the country's sovereign risk position - including manageable government and private debt, the ability of banks and corporates to roll over existing debts and ongoing foreign currency deleveraging.

- With the move, Fitch's rating remains stronger than IHS Markit

or the other major rating agencies. S&P Global Ratings

(S&P) rates Turkey at B+ and Moody's rates the sovereign risks

at B1 - both one notch worse than does Fitch. IHS Markit is one

notch lower than those, at 60.

- The UAE's gross domestic product declined by 0.3% in

year-on-year (y/y) terms in the first quarter of 2020, the Federal

Competitiveness and Statistics Authority (FCSA) announced. This was

the first annual decline since 2017, reflecting the impact of the

COVID-19 pandemic to a limited extent. (IHS Markit Economist Ralf

Wiegert)

- Gross value added in the non-oil, non-financial sector declined by 3.1% at the same time. The sector includes all of manufacturing, construction, and services (except for banks and insurance) as well as agriculture and fishing. Since the UAE had implemented lockdown measures at the beginning of March, the effect on tourism revenues, the hospitality sector, and aviation has already been partly reflected in the released data.

- Mining (mainly oil production), by contrast, surged ahead by 3.3% as oil output was boosted following the inconclusive OPEC meeting in early March, which led the Arabian Gulf producers, led by Saudi Arabia, to open taps and glut global markets.

- Although relatively stable recent oil revenues, in combination with the cautious recovery of the oil price, provide some re-assurance for the UAE, it leaves still quite a few open questions for the pace and the timing of the recovery of the economy, including the non-oil services part, which is mainly centered in Dubai.

- Hitherto unreported, in May 2020 Hexicon AB announced that it and Genesis Eco-Energy Developments had established a joint venture (GenesisHexicon (Pty) Ltd) to explore South Africa's offshore wind potential. GenesisHexicon (Pty) Ltd aims to develop large scale floating wind projects, contribute to the Oceans Economy and clean energy targets for South Africa, and transfer the Hexicon intellectual property for deep water deployment to the South African market. Hexicon has formed at least two other joint ventures: in South Korea Hexicon's joint venture CoensHexicon is together with Shell developing a floating wind farm with the ambition to make it the world's first large scale floating wind farm. WunderHexicon is Hexicon's joint venture with WunderSight, with the aim of developing, installing and operating a demonstrator semi-submersible floating platfom situated off the coast of Gran Canaria with a similar project in Portugal. There are currently no offshore windfarms in South Africa however, the potential for offshore floating wind farms is significant. Henrik Baltscheffsky, CEO of Hexicon mentioned that South Africa is one of the top ten long term markets for deep water deployment. (IHS Markit Plays and Basins' Justin Cochrane)

Asia-Pacific

- APAC equity markets closed mixed; South Korea +1.6%, Japan +1.4%, Australia +0.5%, India +0.1%, Hong Kong -0.3%, and Mainland China -0.4%.

- On 24 August, Wuhan City, the capital city of Hubei Province,

introduced eight measures to support business recovery in local

culture and tourism sector. (IHS Markit Economist Lei Yi)

- Four measures focus on alleviating financial burden of tourism enterprises in the near term. Interest discounts up to CNY500,000 will be provided to major tourism and hospitality enterprises, applying to their new loans starting from 2019 and lasting into 2020. To help cover pandemic-incurred losses, cash subsidies will be offered to travel agencies that experienced cancelation surges, hotels that have been transferred to designated quarantine facilities, tour guides that are still employed, and non-state-owned museums that have reopened, etc. Local government will also organize free vocational training programs for tourism professionals.

- Three measures aim to push for long-term upgrade of the local tourism industry. Local government plans to use various incentives for tourism enterprises to work on brand building and to further integrate with other industries like high-end manufacturing and digital content.

- To boost tourism activities from the demand side, shopping vouchers worth of CNY80 million will be distributed. This comes on top of the province-wide free-entry policy for all A-level tourist sites, which was introduced in early-August and will last until the year end.

- The municipal government of Shanghai published an action plan

on 20 August to guide the development of Lingang New Area in the

next three years, the same day that marks the first anniversary of

this newly expanded area of Shanghai free-trade zone. (IHS Markit

Economist Lei Yi)

- Specific growth targets for 2020-22 were set in the action plan, including gross regional value-added to expand on average at 25% year on year, three-year cumulative industrial output to reach CNY600 billion, and total value of imports and exports to top CNY115 billion by 2022.

- Local government will lower corporate income tax rate to 15% (compared with 25% nationwide) in the first five years of setup to attract enterprises and form business clusters for key cutting-edge industries, including integrated circuit, artificial intelligence, biomedicine, and civil aviation. Over 1,500 high-tech companies and innovative institutions should be set up in the area, with over 20 regional headquarters and 200 financial firms by the end of 2022.

- Efforts will also be made to improve funding conditions, as the local government required that funds used for supporting the real economy should top CNY150 billion by 2022, and enterprises' cross-border financing should expand at above 50% year on year.

- Additionally, local government will increase the coverage of 5G network to 100%, public transport network density by 20%, and total residential construction area by 9 million square meters for urban function enhancement.

- The unveiled plan aims to make better use of existing preferential policies to develop the Lingang New Area into a new growth engine for Shanghai. Despite the pandemic impact, Lingang's total industrial output is estimated to have expanded at 26% year on year through the end of July, with industrial investment up by 69.8% year on year.

- Chinese automaker GAC Motor Corporation (GAC) has started deliveries of the Aion V electric sport utility vehicle (SUV) in the Chinese market. Consumers in Shanghai are among the first ones to take their Aion V home. Deliveries to customers in Chongqing, Beijing and Guangzhou are expected to begin on 29 August. The Aion V is the third model in GAC's Aion electric vehicle (EV) line-up. The model provides four variants with different battery sizes. The long-range version with a 80-kWh battery pack can deliver a NEDC range of 600km. The standard-range version, with a 70-kWh battery pack, provides a NEDC range of 500km. The Aion V starts from CNY159,600(USD23,097) after subsidies. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Zero sugar is the health theme in China, incorporated in all sorts of beverages. Wahaha reported that its fizzy water sales rose by 41% in H1 compared with the same period of last year. Its zero-sugar water with was first introduced in 2010. By end of July 2020, it had sold two billion bottles. In 2019, Wahaha launched its pH 9.0 alkaline water within the carbonated water line, following two years of research and development. It contains no sugar or carbon dioxide. The sales of its alkaline water increased 235% in H1 2020. Wahaha is planning to launch new products, including bubble tea, to attract younger consumers. Wahaha has over 7,000 distributors in China and has recently attracted analysts' attention by its expansion into e-commerce and the rumor that it will seek a public listing in the next couple of years. At JD.com, Wahaha pH 9.0 lightly alkaline water, lemon flavor, zero sugar, sells CNY58 (USD8.38) for 500ml*15 bottles. Coca-Cola's Schweppes, carbonated water, zero sugar, lemon flavor, 330ml*8 bottles at CNY48.8. According to a Frost & Sullivan report, China's soft drinks retail sales amounted to USD142 billion in 2019, with a CAGR of 5.9% from 2014 to 2019. The market is expected to reach USD190 billion by 2024. The soft drinks industry in the east and the south is slowing down. There is still a window of opportunity to develop health and wellness beverages. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- South Korean vehicle registrations stood at 24.02 million units at the end of June, up 1.4% from 23.68 million units at the end of 2019, according to data released by the South Korean Ministry of Land, Infrastructure, and Transport (MOLIT) and reported by the Maeil Business Newspaper. The numbers translate into one vehicle for every 2.16 people living in the country. "The number of car registrations is likely to continue to grow for the time being, though not rapidly, due to growing demand for hydrogen fuel-cell electric and other less emitting models," said an unnamed MOLIT official. Meanwhile, of the total at the end of June, locally produced vehicles accounted for 89.4%, while imports made up for the rest. Furthermore, the report also highlights that alternative-powertrain vehicles accounted for 2.9% at a tally of 689,495 with 111,307 electric vehicles (EVs; up 52.9%), 570,506 hybrids (up 25.3%) and 7,682 fuel-cell electric vehicles (up 226.5%). Alternative-powertrain vehicles' share has been on a rise from 0.5% in 2013, 0.7% in 2014, 0.9% in 2015, 1.1% in 2016, 1.5% in 2017, 1.9% in 2018, and 2.5% in 2019, highlights the report. (IHS Markit AutoIntelligence's Jamal Amir)

- Thai vehicle production - including passenger vehicles and light, medium, and heavy commercial vehicles - plunged by 47.7% year on year (y/y) to 89,336 units in July, according to data released by the Thailand Automotive Institute (TAI). Exports of completely built-up (CBU) units fell by 39.7% y/y to 49,564 units during the month. In the year to date (YTD), vehicle production in the country is down 43.8% y/y at 695,468 units, while exports of CBU units have declined by 37.7% y/y to 400,114 units. During July, most OEMs present in Thailand have returned to normal two-shift operation with higher outputs in the wake of revived domestic and export demand following the relaxation of the COVID-19 virus pandemic-related lockdown restrictions as well as improved consumer confidence. Furthermore, OEMs received around 18,381 units of new orders during the Bangkok International Motor Show 2020 that ran from 15 to 26 July, showing a glimpse of auto market recovery from the third quarter. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-25-august-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-25-august-2020.html&text=Daily+Global+Market+Summary+-+25+August+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-25-august-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 25 August 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-25-august-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+25+August+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-25-august-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}