Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 20, 2020

Daily Global Market Summary - 20 November 2020

European equity markets closed modestly higher, while APAC and US markets were mixed. US and European benchmark government bonds closed higher, with the US dollar stronger on the day. European iTraxx credit indices were flat and CDX-NA closed wider across IG and high yield. Gold, silver, and oil all closed higher on the day.

Americas

- Most US equity market closed lower, except for Russell 2000 +0.1%; DJIA -0.8%, S&P 500 -0.7%, and Nasdaq -0.4%. The S&P 500 closed -0.8% week-over-week.

- 10yr US govt bonds closed -1bp/0.83% yield and 30yr govt bonds closed -3bps/1.52% yield.

- CDX-NAIG closed +3bps/56bps and CDX-NAHY +12bps/340bps, which

is +2bps and -2bps week-over-week, respectively.

- DXY US dollar index closed +0.1%/92.40.

- Gold closed +0.6%/$1,872 per ounce and silver +1.3%/$24.36 per ounce.

- Crude oil closed +1.2%/$42.42 per barrel.

- US banks that decide to stop lending to fossil fuel businesses could face penalties unless they can demonstrate they are doing so because of purely financial concerns, under a new rule proposed by the outgoing Trump administration. The Office of the Comptroller of the Currency said its rule would require banks to offer services equitably based on impartial risk analysis, rather than for political reasons. (FT)

- While fresh whole turkeys remained flat at $1.32 per pound this week, frozen hens and toms were shown at a significant discount when compared with recent weeks. There were 580,000 pounds of whole frozen hens reported at a weighted average $0.07 lower than the previous week. There was a suggestion that the market would carry strength from Thanksgiving through Christmas, but it appears there are some market participants finalizing destinations. Our suspicion is that this is largely occurring in the larger bird segments, where disappearance is lacking the same ferocity present for smaller hens. Fresh tom breast meat prices fell $0.06 this week. Slack in the system is expected to keep pressure on prices nearby. Our forecasts are reflecting a weaker tone for this segment nearby, as the industry continues to grapple with dampened disappearance in top channels. Alternatively, wings have been strengthening in recent weeks as a result of elevated demand in further processing channels. Drums have been echoing the support present in wing markets in recent weeks, and the support continued this week, as prices for both in frozen continued to work steadily higher from the previous week. Mechanically deboned turkey (MDT) prices remained steady in the mid-$0.30 per pound area as well. This segment continues to exceed expectations. Limited downside price movement is expected nearby despite the typical seasonal descent that occurs during the fourth quarter for MDT. (IHS Markit Agribusiness Intelligence Meat Price Outlook)

- The California Public Utilities Commission (CPUC) has allowed robotaxi operators to charge fares for driverless rides in the US state, reports TechCrunch. To achieve this, robotaxi companies need approval from the California Department of Motor Vehicles (DMV) before they begin the application process with the CPUC through a "Tier 3" advice letter. The Tier-3 advice-letter process is used to approve rates for energy utilities, water, and sewer operations and can take months to years. All CPUC permit holders are required to submit a safety plan and quarterly reports to the CPUC with aggregate data on the number of autonomous vehicles (AVs) used, fuel type used by the vehicles, total miles travelled, and passenger miles travelled. The move will place California among other states and cities that have begun operating small-scale commercial AV services such as Arizona, Las Vegas, Shanghai, and Singapore, among others. In California, the CPUC permit required to test AVs is different from the permits issued by the DMV. The CPUC has granted AV test permits to only seven companies: Aurora, AutoX, Cruise, Pony.ai, Voyage, Zoox, and Waymo. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- GM took the opportunity of an appearance at the Barclay's Global Automotive Conference to provide an update on its progress on EV development, as well as provide a comprehensive look at its plans to accelerate EV development and increase funding. GM has been increasing its communication about its development of EVs during 2020. The announcements on 19 November indicate the depth of GM's commitment to a transformation to EVs, as it includes not only increasing spending on EV development and manufacturing, but also a focus on creating the EV Team and combining its strengths in OnStar, connectivity, and history of customer experience to explore how to transform its relationship with customers. GM plans to execute this strategy based on its strengths and to fund increased investments prudently. GM says it will define its EV franchise as a successful one when it has the top share of the EV market in North America, has margins similar to or higher than margins on ICE vehicles, and exceeds its previous target of selling 1 million EVs globally by mid-decade. In stating those goals, GM has laid out a strategy that includes clear metrics to gauge success. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Velodyne Lidar and Local Motors have entered into a multi-year sales agreement. Local Motors will integrate Velodyne's Puck sensors, which allow 360-degree surround view, into its autonomous shuttle, the Olli. Local Motors will also deploy additional Velodyne sensors, including the Velarray H800, in the Olli to enable real-time localization and object detection functions. LiDAR sensors are necessary for autonomous vehicles (AVs) as they measure distance via pulses of laser light and generate 3D maps of the world around them. Vikrant Aggarwal, president of Local Motors, said, "Velodyne's technology leadership gives us confidence we will always have the latest lidar technology to help ensure safety in our vehicles. We look forward to co-evolving our product offerings to address more use cases in the autonomous mobility space." Velodyne Lidar went public this year through a reverse merger agreement with Graf Industrial, a special-purpose acquisition company (see United States: 3 July 2020: Velodyne confirms reverse merger agreement with Graf Industrial). The company is one of the pioneers of LiDAR solutions for Advanced Driver Assistance Systems (ADAS) and AV applications. The company's technology is used by automakers including Mercedes-Benz and Ford. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- US regulatory agency the National Highway Traffic Safety Administration (NHTSA) has issued an advance notice of proposed rulemaking, which is a preliminary step in ultimately defining and setting vehicle safety standards. During this initial phase, the NHTSA is requesting comments "on the development of a framework for Automated Driving System (ADS) safety". The NHTSA's statement says the framework will "objectively define, assess, and manage the safety of ADS performance while ensuring the needed flexibility to enable further innovation… NHTSA seeks specific feedback on key components that can meet the need for motor vehicle safety while enabling innovative design, in a manner consistent with agency authorities." The agency states that its efforts on this issue so far have involved determining which existing Federal Motor Vehicle Safety Standards (FMVSS) are relevant to ADS-equipped vehicles. The NHTSA states that, because the development of an FMVSS requires developing an objective metric (what aspect of performance to measure) and then establishing the standard (or specifying the minimum performance level), "premature establishment of an FMVSS without the appropriate knowledge base could result in unintended consequences". Rather than focusing on an FMVSS, which the NHTSA says it is too soon to develop, the agency is looking to create a government safety framework specifically tailored to ADS. The NHTSA says it is seeking to introduce a safety framework that would enable ADS developers to use performance-orientated approaches and metrics that would accommodate the design flexibility needed to ensure innovation and novel designs for new technologies. The NHTSA says that four primary functions of ADS should receive the agency's attention. First, how the ADS receives information about its environment (sensing); second, how the ADS detects and categorizes other road users, infrastructure, and conditions (perception); third, how the ADS analyses the situation, plans the route, and makes decisions about road users, infrastructure, and conditions (planning); and fourth, how the ADS executes the driving function (control). The NHTSA is looking for feedback including on process and engineering measures for the framework, as well as on how it should be administered. Unlike many other FMVSS rules, the NHTSA is exploring the introduction of "if equipped" rules, under which an FMVSS would not mandate the installation of ADS, but would define requirements if one was installed. The NHTSA rule-making process can take years to complete, and the agency's request for comments will have a deadline for comments to be received of six months from its publication in the Federal Register. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Volvo Cars has partnered with Waycare Technologies to offer its connected safety technology in the United States. The technology enables Volvo Cars to share real-time vehicle data via a cloud-based system that allows vehicles to communicate with each other and alert Volvo drivers of nearby hazards. The automaker says that it will begin sharing the live and anonymised data in cars featuring its Hazard Light Alert and Slippery Road Alert systems. Through the partnership with Waycare, Volvo Cars is able to share the safety data with transportation municipalities and navigation app Waze. Malin Ekholm, head of Volvo Cars Safety Centre, said, "Sharing real-time safety data between cars can help avoid accidents. Volvo owners directly contribute to making roads safer for other drivers that enable the feature, while they also benefit from early warnings to potentially dangerous conditions ahead." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Canada's largest province ordered a lockdown in Toronto and one of its suburbs, a declaration that forces shopping malls, restaurants and other businesses to close their doors to slow a second wave of coronavirus cases. (Bloomberg)

- Brazil's monthly index of economic activity (MIEA) increased by

1.3% month on month (m/m) during September, slightly below the

August rate, but still a robust number. The deceleration will

continue in the upcoming months. This is based on seasonally

adjusted data. (IHS Markit Economist Rafael Amiel)

- After sharp declines in March and April because of lockdowns and social-distancing measures, the Brazilian economy has posted five consecutive monthly increases. According to the MIEA, it is currently only 2.5% below its pre-pandemic levels.

- In September, industrial production was just above its February levels and 3.4% above its September 2019 levels. Credit growth is supporting demand for automobiles; the production of electronics and appliances is also increasing. Working from home is supporting higher demand for computers.

- Retail sales are being fueled by strong demand, supported by government transfers to households; in September, retail sales were 7.3% higher than the previous year.

- The manufacturing Purchasing Managers Index (PMI) remained at record highs in October, signaling that the expansion will continue during the last quarter of the year. The service PMI also expanded during October, albeit at lower levels than the manufacturing PMI.

- In the third quarter of 2020, Colombian GDP grew 8.7% quarter

on quarter (q/q) after declining 16.1% q/q in the second quarter.

In annual terms, third-quarter GDP remained 9.0% below the

third-quarter 2019 level, showing that although the economy has

begun to look up, the recovery has been only partial up to this

point. (IHS Markit Economist Lindsay Jagla)

- On the demand side, all GDP components improved in the third quarter compared with the second but stayed below 2019 levels, except for government consumption, which grew 2.0% year on year (y/y).

- Private consumption fell 8.9% compared with the third quarter of 2019, largely due to the persistence of some selective isolation measures and the continued risk-averse nature of consumers in the face of the coronavirus disease 2019 (COVID-19) virus pandemic. This also affected import demand, which fell 21.1% y/y.

- Globally, the continued spread of the COVID-19 virus has also limited the reopening of the economy, which has contributed to a slow recovery in investor sentiment and kept investment 18.3% below 2019 levels in the third quarter. External demand and still-low oil prices also resulted in a gradual quarterly recovery for exports, with a still steep 24.1% y/y contraction in the third quarter.

- On the supply side, all economic activities expanded compared with the second quarter, but only agriculture (1.5%), financial activities (1.5%), and real-estate activities (1.8%) grew in annual terms.

- The sectors continuing to put the greatest downward pressure on the Colombian economy in annual terms were mining and quarrying (-19.1%), wholesale and retail (-20.1%), and construction (-18.1%).

- Colombia's third-quarter data release is in line with IHS Markit's expectations that the economy would begin to recover during the quarter but that this rebound would be only partial, with most areas of the economy still operating below 2019 levels. This reflects the significant reopening of the country that occurred in the third quarter following strict shutdown measures earlier in the year in response to the COVID-19 virus outbreak.

- President Alberto Fernández promulgated a law on 18 November ratifying Argentina's membership of the China-based Asian Infrastructure Investment Bank (AIIB). Government officials had confirmed in October that Argentina would join the China-led Belt and Road Initiative (BRI), under which China seeks to develop worldwide infrastructure projects to facilitate trade. Under Fernández, Argentina is moving closer to China as a strategic partner, continuing efforts by his predecessors Mauricio Macri (2015-19) and current vice-president Cristina Fernández de Kirchner (2007-15). In April, China became Argentina's main trading partner, overtaking Brazil. Main Argentine exports to China include soybeans, beef, and animal and vegetable oils and fats, while imports primarily include machinery and chemicals. Strengthened bilateral ties are likely to bring further Chinese investment in key infrastructure projects, such as the upgrade of the San Martín railway, the road connecting Luján (Buenos Aires province) and Santa Rosa (La Pampa), and the Paraná-Paraguay waterway. China is also likely to invest in telecommunications and expand its involvement in the mining and energy sectors, mainly focusing on nuclear and renewable power, where it already has a significant presence. In October, Caucharí solar-power park in Jujuy province - the largest in Latin America, built and financed by Chinese companies - came online. (IHS Markit Country Risk's Carla Selman)

Europe/Middle East/Africa

- European equity markets closed modestly higher across the region; Italy +0.8%, Spain +0.6%, France/Germany +0.4%, and UK +0.3%.

- 10yr European govt bonds closed higher except for Spain being unchanged on the day; UK -2bps and Italy/France/Germany -1bp.

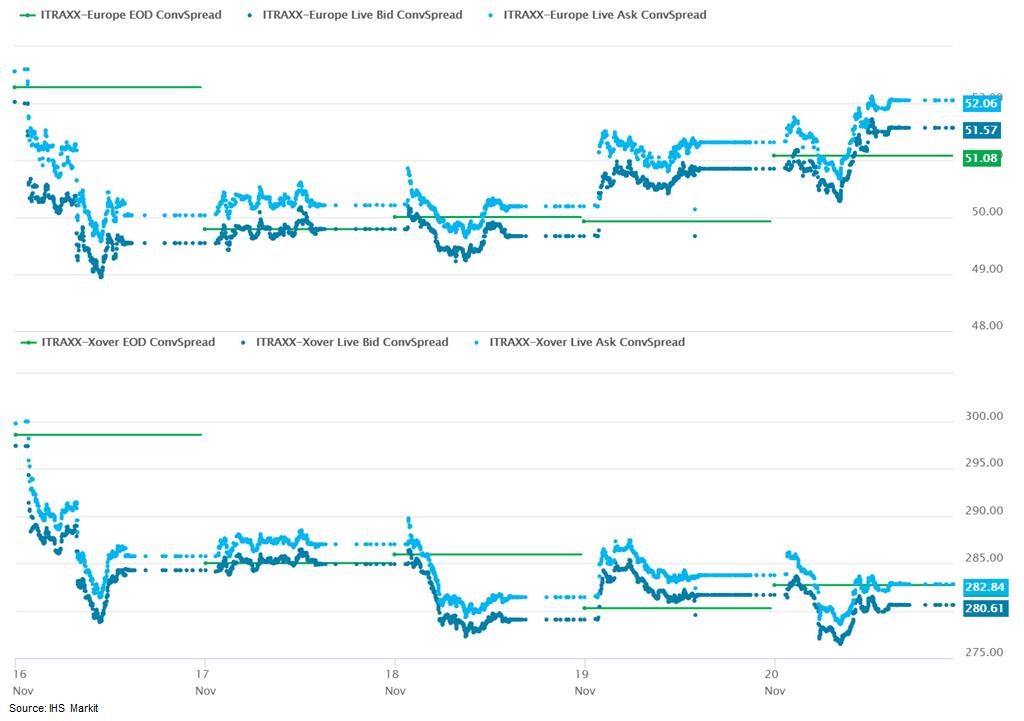

- iTraxx-Europe closed +1bps/52bps and iTraxx-Xover -1bp/282bps,

which is flat and -17bps week-over-week, respectively.

- Brent crude closed +1.7%/$44.96 per barrel.

- Germany needs to build at least 400,000 more electric vehicle (EV) charging stations to fulfil demand from the growing electrification of the country's vehicle parc, according to a study published by the German Transport Ministry and reported by the DPA news agency. The German government's own data foresees there being 14.8 million electric and plug-in hybrid (PHEV) vehicles on the road by 2030. The study also said that it was possible that the number could be as high as 843,000 additional public charging stations needed, depending on how many private ones would be built and how often the existing ones would be used. Studies like this are important as they show the increasing disconnect between the kind of rhetoric and legislation that governments are coming out with regarding the desire to accelerate light-vehicle electrification and the lack of planning and pragmatism regarding the charging infrastructure that is required. (IHS Markit AutoIntelligence's Tim Urquhart)

- The recovery in UK retail sales continued to evolve in October,

climbing further above their pre-COVID-19 virus level, but IHS

Markit still assesses that the immediate outlook for retail

spending is challenging. (IHS Markit Economist Raj Badiani)

- UK retail spending continued to recover in October after the reopening of non-essential shops from mid-June.

- The Office for National Statistics (ONS) has reported that retail sales (including fuel sales) in volume terms increased for the sixth straight month, rising by 1.2% month on month (m/m) in October, standing 6.7% above their February pre-COVID-19 virus level.

- In annual terms, they were 5.8% higher than in September 2019.

- Some households are releasing savings accumulated during the lockdown to fund home improvements and goods to make their increased time at home more comfortable. Indeed, spending in household goods stores rose by 3.2% m/m.

- In addition, retail sales continued to benefit from households spending less on services and foreign travel.

- The ONS stated, "Feedback from shops suggested some consumers may have brought forward their Christmas shopping, ahead of potential further restrictions. Online stores also saw strong sales, boosted by widespread offers."

- Indeed, non-store retailing rose again in October after falling in the previous three months. It grew by 6.4% m/m in October, implying that it stood 44.9% higher than the February pre-COVID-19 virus levels and accounts for about one-third of all retail spending.

- Sales on the high street, or in physical shops, continued to rise above their pre-lockdown levels, with spending in non-food stores in October being 2.6% higher than February's level.

- Fuel sales volumes were unchanged between September and October and remained 8.6% below February's level because of reduced travel as many continued to work from home in October.

- Less encouragingly, textile, clothing, and footwear stores fell back in October, down by 1.2% m/m, after reviving steadily in the previous five months. In addition, their sales remained 13.8% below February's levels.

- Retail sales were stronger than expected in October after the introduction of the tougher tiered restrictions across the United Kingdom.

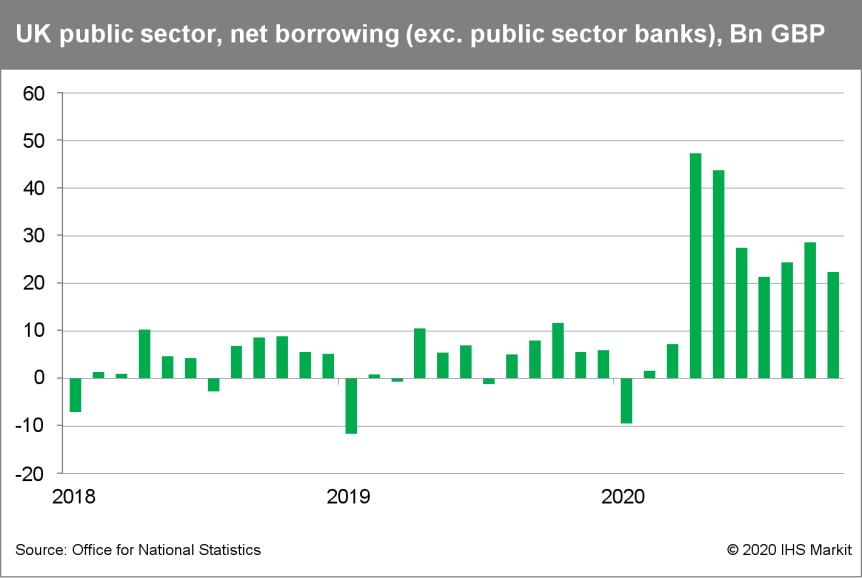

- The United Kingdom's fiscal landscape is far more perilous in

2020, with the COVID-19 virus pandemic having an unprecedented

impact on both tax receipts and expenditure. (IHS Markit Economist

Raj Badiani)

- UK public-sector net borrowing (excluding public-sector banks; PSNB ex) was GBP215 billion (USD284.5 billion) in the first seven months (April to October) of the current fiscal year (FY), up from GBP45.8 billion a year earlier. This was the highest borrowing in any April-October period since the records began in 1993.

- Central government net cash requirements were GBP260.8 billion in April to October, up from GBP33.2 billion in the equivalent period a year earlier.

- Central government finances are displaying considerable stress from the COVID-19 virus crisis. Substantial fiscal costs are resulting from the public health measures and policies deployed to support businesses and households. Indeed, Chancellor of the Exchequer (Finance Minister) Rishi Sunak has revealed that he has provided over GBP200 billion of support "to protect the economy, lives and livelihoods from the significant and far reaching impacts of coronavirus".

- The ONS reported that general government borrowing (public-sector net borrowing excluding public-sector banks; PSNB ex) stood at GBP22.3 billion in October, GBP10.8 billion higher than a year earlier (see chart below). This was the sixth highest borrowing in any month since the records began in 1993.

- Central government receipts collected by HM Revenue & Customs fell for the eighth straight month but at a slower pace in October. They declined by 2.8% year on year (y/y) to GBP58.8 billion because of lower-than-normal economic activity, job losses, and companies deferring tax payments.

- Central government expenditure increased by 9.9% y/y to GBP71.3 billion in October. This partly reflected the cost of the Coronavirus Job Retention Scheme (CJRS) and Self-Employment Income Support Scheme (SEISS), higher grants to local authorities, increased funds for frontline public services, and emergency funding for Transport for London.

- The furlough schemes (the CJRS and SEISS) added GBP55.1 billion to borrowing in April-October. In October, the total cost of the CJRS and SEISS was GBP2.4 billion.

- The UK's net debt position increased by 19 percentage points over the year, standing at 100.8% of GDP in October (see chart below), the highest level since early 1960s. In monetary terms, it was at a record high of GBP2.077 trillion, GBP283.8 billion more than in October 2019.

- According to IHS Markit's November forecast, general government

borrowing requirements in the current FY (April 2020 to March 2021)

are likely to be in excess of GBP350 billion. Meanwhile, the fiscal

watchdog, the Office for Budget Responsibility, suggests that

borrowing in the FY could exceed GBP370 billion.

- Lotus Engineering has announced that it has launched a pilot for a containerized battery testing facility. According to the company, this is taking place under the project name BattCon, and involves individual walk-in laboratories the same size as a 40-foot shipping container. These will allow it to carry out various battery cell, module and pack characterization tests, performance evaluations, and component and lifetime testing under controlled conditions. These will be in operation at its Hethel (UK) headquarters as well as the new Lotus Advanced Technology Centre in Wellesbourne (UK). It also plans to offer the facilities to clients, once the pilot ends in early 2021. The project is also supported by The pilot project will conclude in early 2021 and is co-funded by the Automotive Transformation Fund (ATF), which is part of the Advanced Propulsion Centre (APC); Innovate UK, which is part of UK Research and Innovation; the UK Government's Department for Business, Energy and Industrial Strategy (BEIS) and the Department for International Trade (DIT). (IHS Markit AutoIntelligence's Ian Fletcher)

- On 20 November, the European Food Safety Authority(EFSA) announced that the highly pathogenic avian influenza (HPAI) is "spreading rapidly" across the continent and the likelihood of the transmission from wild birds to the poultry sector is high. EFSA said that within the past month, there have been over 300 cases reported in Belgium, Denmark, France, Germany, Ireland, the Netherlands, Sweden and the United Kingdom. The majority of these detections were in wild birds, but the EU agency said there was also a handful of outbreaks in poultry farms. Several of the bird flu outbreaks were reported this week. In Denmark, the government detected the virus in the west of the county and announced that 25,000 birds will be slaughtered. German authorities also ordered around 16,000 turkeys to be culled on 16 November, following a case in the eastern state of Mecklenburg-Vorpommern. On the same day, France announced that it detected avian flu in a garden center and has since ordered all birds to stay indoors. Meanwhile, the Netherlands has struggled with bird flu on duck and layer hen farms for several weeks, resulting in around 300,000 animals being culled. Nik Kriz, head of EFSA's animal health unit, said: "Preventing further escalation of these outbreaks will require close cooperation between animal, public, environmental and occupational health authorities." The EU agency has renewed its calls for national authorities to continue their surveillance of wild birds and poultry and to implement control measures to prevent human contact with infected or dead birds. Member states are also recommended to enforce EU rules (2018/1136) to mitigate risk of transmission and reinforced biosecurity measures. (IHS Markit Food and Agricultural Policy's Steve Gillman)

- Scania has released financial results which have shown that its

performance during the third quarter of 2020 remained weak. During

the three months ending 30 September, the truck- and bus-maker

reported net sales as declining by 16.9% year on year (y/y) to

SEK30,374 million. (IHS Markit AutoIntelligence's Ian Fletcher)

- Operating income fell by 45.2% y/y to SEK2,436 million, while its operating margin fell from 12.2% in the third quarter of 2019 to 8%. Net income also retreated by 50.8% y/y to SEK1,527 million.

- Net sales at its core Vehicle and Services unit slipped by dropped by 17% y/y to SEK29,290 million during the third quarter.

- Trucks made up SEK16,036 million, a fall of 29.3% y/y, as deliveries plummeted by 24.8% y/y to 15,788 units. Its

- Buses division's revenues also fell by 25.9% y/y to SEK2,735 million as its delivery volume increased by 31.2% y/y to 1,510 units.

- Its Service-related productions business has also recorded a fall in revenues of 8.5% y/y to SEK6,635 million. Operating profit at its Vehicle and Services units fell by 49.7% y/y to SEK2,049 million.

- Scania has also announced that it is making investments to support the electrification of its vehicle range. According to a statement, the company is planning to spend "well over SEK1 billion" on a battery assembly plant in Södertälje (Sweden) located adjacent to its chassis assembly facility. This will take place over "several years", with the initial phase being an 18,000-square-meter facility that will begin construction in early 2021 and be fully operational by 2023.

- Bulgaria has reported a modest rebound in the third quarter,

likely constrained by the weak tourism season. Renewed COVID-19

virus restrictions through the fourth quarter are likely to weigh

down on short-term growth, exacerbated by ongoing political

tensions. (IHS Markit Economist Dragana Ignjatovic)

- According to a 'flash' estimate released by the Bulgarian National Statistical Institute (NSI), the country's real GDP growth fell by 5.2% year on year (y/y) in the third quarter. This is the second consecutive quarter of economic contraction in annual terms. In quarter-on-quarter (q/q) terms, real GDP increased by 4.3%. A detailed breakdown of third-quarter growth will be released on 4 December.

- The main drivers of the ongoing downturn are the collapse of external demand and investment. Investment declined by nearly 6% y/y in the third quarter as political unrest combined with COVID virus-related uncertainties delay household and business investment decisions.

- At the same time, weak external demand for Bulgarian goods led to a 22% y/y fall in exports in the third quarter. However, the pace of import decline eased to just 3.4% y/y, implying a revival in domestic demand. This is also reflected in consumption data, with final consumption rising by 9% y/y in the third quarter, likely driven in part by the government's ongoing financial support to households and businesses.

- The 'flash' estimate, while stronger than expected, is in line with our expectation of a q/q return to growth in the third quarter. The easing of the most severe restrictions and lockdowns in May has resulted in a rebound from the historic fall in economic activity registered in the second quarter.

- The Turkish central bank raised its one-week repo rate to 15%,

unifying its funding of the marketplace back to the main policy

rate. The move was the second rate rise within the past three

policy meetings in an attempt to provide support for the lira,

which has faltered badly since end-July. The rate increase confirms

hopes that the new central bank governor would pursue tighter

monetary policy. (IHS Markit Economist Andrew Birch)

- At the first meeting of the Monetary Policy Committee under new governor, Naci Agbal, the Central Bank of the Republic of Turkey (TCMB) raised its main policy rate - the one-week repo rate - by 475 basis points, to 15%. Previously, the TCMB had raised the repo rate by 200 basis points at the September meeting, but declined to make any move at the October meeting.

- Also at the 19 November meeting, the TCMB has returned all market funding back to the one-week repo auction. This will discontinue the variable market funding through which the Bank funded the markets through varying methods including the one-week repo auction, the late liquidity window, and overnight borrowing.

- In its press release alongside the move, the TCMB pointed to the increased lira volatility since July and the strong inflationary impact those currency losses were exerting. The Bank is expecting a further acceleration of inflation in November, forcing them to a sharp tightening to counter these rising inflationary expectations.

- Expectations of a rate rise had been building before the meeting, as President Recep Tayyip Erdoğan, in public comments, acquiesced to the need for the TCMB to become more forceful to stabilize the lira. New Governor Agbal himself had pledged upon his appointment in early November to use all of the tools available to the Bank, implying that a rate rise would be coming.

- Previously, Erdoğan had been staunchly opposed to high interest rates, stating that he believed that higher interest rates caused high inflation. The president had ousted previous TCMB governors for implementing and/or maintaining high policy rates against his wishes.

- The new policy rate was expected. In the days prior to the meeting, the average rate of funding the market had risen to 14.8%, reflecting the likely new policy rate. Thus, the rise in the main policy rate does not, alone, significantly tighten monetary policy. The move, however, is important overall for providing evidence that the TCMB was tightening monetary policy.

- The Turkish lira has rallied 10% from its all-time low close versus the US dollar of ₺8.52/USD recorded on 6 November.

- President Vladimir Putin instructed the Russian government on

16 November to sign a bilateral agreement with Sudan on

establishing a Russian naval facility in Port Sudan, to accommodate

300 military service personnel and four naval vessels, including

nuclear-powered submarines, for a 25-year period. Sudan is to

provide land for the Russian naval facility in Port Sudan free of

charge, while Russia will install air-defense and electronic

warfare systems to protect the facility plus the wider area around

Sudan's vital Port Sudan. This will be the first official Russian

base in Africa since the break-up of the Soviet Union in 1991. (IHS

Markit Country Risk's Jihane Boudiaf, Emre Caliskan, Jack Kennedy,

and Alex Kokcharov)

- Russia's decision to establish the naval base in Sudan is part of a wider strategy to re-assert Russian influence in the Middle East and North Africa region. This base would likely support Russia's geostrategic influence in the eastern Mediterranean in Syria and Libya, as well as the Red Sea and Indian Ocean, rather than be primarily for military and conflict purposes.

- Russia is probably calculating that the base has become a viable option under the current internationally recognized Sudanese leadership, as opposed to under former president Omar al-Bashir.

- It is highly likely that Sudan will backtrack on its decision to grant permission for the base should the United States threaten to maintain Sudan on its State Sponsors of Terrorism (SST) list. US President Donald Trump initiated the process of rescission of Sudan's SST listing, a decision that may be challenged by the US Congress until 9 December 2020.

- If the agreement goes ahead, it is highly likely to be supported tacitly by Saudi Arabia, the United Arab Emirates (UAE), and Egypt - Arab states with key interests in the Red Sea. Sudan benefits from political and financial backing from Saudi Arabia and the UAE, so it is highly likely that the decision to grant Russia a naval base in Port Sudan was taken after consulting its Gulf allies and, to a lesser extent, Egypt, which also has strategic economic interests in ensuring the uninterrupted flow of marine cargo through the Red Sea and the Suez Canal.

- The Russian base is likely to undermine attempts by Turkey to establish a naval base at the nearby Sudanese port of Suakin, traditionally used as a transit point for Hajj pilgrims. This would be seen by Saudi Arabia as a challenge to its perceived Sunni leadership role.

Asia-Pacific

- APAC equity markets closed mixed; India +0.7%, Mainland China +0.4%, Hong Kong +0.4%, South Korea +0.2%, Australia -0.1%, and Japan -0.4%.

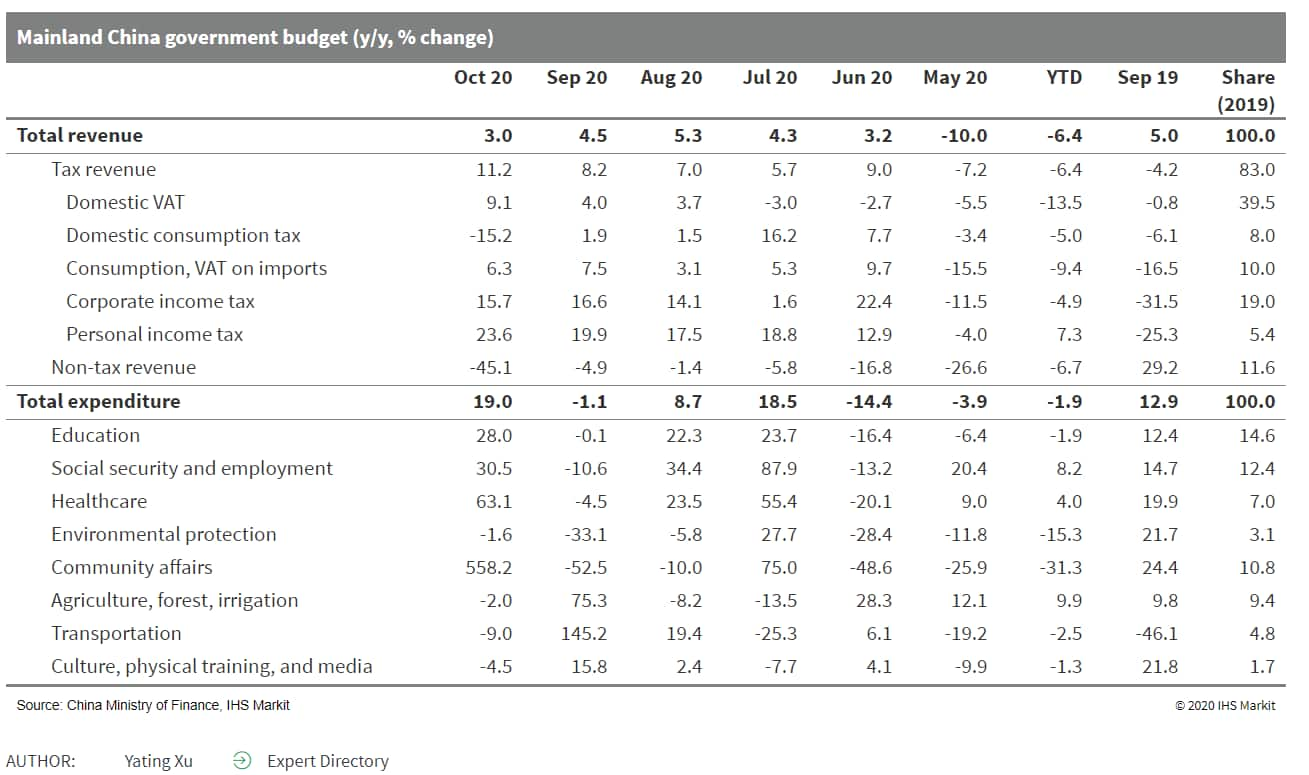

- Mainland China's fiscal spending growth momentum is expected to

be maintained through the end of 2020; this is likely to support

infrastructure investment. Revenue growth will stabilize as growth

recovery moderates. (IHS Markit Economist Yating Xu)

- Mainland China's public fiscal revenue growth edged down by 1.5 percentage points to 3.0% year on year (y/y) in October, according to the 18 October release from the Ministry of Finance (MOF).

- The headline moderation was entirely driven by the deeper contraction in non-tax revenue, which dropped by 45.1% y/y versus a 4.9% y/y decline in September. Meanwhile, tax revenue growth accelerated to 11.2% y/y despite the high base data, driving up the headline tax growth by 5.9 percentage points.

- Domestic value-added tax (VAT), corporate income tax, and individual income tax all accelerated. Foreign trade-related tax was on an upward trend with the acceleration in exports, as tariffs improved to expansion and as export tax rebates grew faster. Land and property-related tax revenues also broadly increased.

- Public fiscal spending rebounded sharply from a 1.1% y/y contraction in September to a 19% y/y expansion in October, reflecting local governments' efforts to accelerate spending towards the end of the year. Driven largely by the increase in spending on urban and rural area facilities, infrastructure-related spending growth rose to 31.3% y/y from a double-digit contraction in the September.

- Spending on healthcare, technology, education, and social security all registered double-digit growths. However, debt interest payment growth declined significantly.

- Government fund revenue growth slowed by 8.3 percentage points to 5.6% in October, in line with the moderation in land sales revenue.

- Over the first 10 months of 2020, fiscal revenue declined by 5.5 % y/y with declines registered across all sub-tax categories except individual income tax and stamp tax. Fiscal spending declined by 0.6% y/y through October on declines in all sub-spending categories besides agriculture, social security, and healthcare.

- Year on year, fiscal revenue grew 1 percentage point faster in

the first 10 months of the year. The government should be able to

achieve its revenue goal of CNY18 trillion (USD2.73 trillion) for

full-year 2020 despite continuous downward pressure on non-tax

revenue and slowing economic recovery.

- China's Haikou City (Hainan Province) published seven

consumption stimulus measures on 18 November, aiming to further

develop local consumption potential in the remainder of the year.

(IHS Markit Economist Lei Yi)

- To better satisfy the rise in duty-free shopping demand since July (see China: 14 July 2020: Duty-free sales surge in Hainan after shopping quota increase, supporting local consumption rebound), Haikou plans to expand the two existing duty-free shopping zones, and add another two by the end of 2020. A wider range of luxury brand options will also be introduced to these shopping zones at the same time.

- To boost auto consumption, the local government in Haikou will provide a purchase subsidy worth of CNY3,000 (USD455) per vehicle from 5 November to 31 December. Additionally, local auto enterprises with top 10 sales revenues will receive a subsidy of CNY200,000 for their promotion efforts.

- Recent demand surge in duty-free shopping results from both the favorable policy of shopping quota raise, and the pandemic-induced restrictions on outbound tourism. According to the General Administration of Customs, duty-free sales in Hainan have expanded by 214.1% year on year (y/y) in the first four months (July-October) after the favorable policy came into effect, with a number of shoppers reporting an increase of 58.8% y/y.

- Rivian CEO RJ Scaringe has said that the company is considering introducing smaller models, aimed specifically at the Chinese market, to follow its full-size pick-up and sport utility vehicle (SUV), according to media reports. Scaringe reportedly said that Rivian plans to launch the SUV in Europe in 2022 and in China soon after, adding, "What will really drive volume in those markets is the follow-on products." He said those products will be smaller and tailored for overseas customers. Scaringe went on to say that the smaller products "fit some of those other markets really well, in particular China… To really scale in those markets as we bring on follow-on products, having a production footprint outside the US is going to be important. That's a ways off… We wouldn't be serious about building a car company if we weren't thinking about China and Europe as important markets in the long term." (IHS Markit AutoIntelligence's Stephanie Brinley)

- Japan's Consumer Price Index (CPI) declined in October,

reflecting the effects of the government's "GO-TO-Travel" subsidies

on top of the drop-out of high base effects. Weak economic activity

is likely to weigh on near-term prices. (IHS Markit Economist

Harumi Taguchi)

- Japan's CPI fell by 0.4% month on month (m/m) on a seasonally adjusted basis in October, and the year-on-year (y/y) change also dropped by 0.4%. The CPI, excluding fresh food (core CPI), also fell by 0.4% m/m, and the y/y contraction widened to 0.7%. The CPI, excluding fresh food and energy (core-core CPI), held at the September level but fell by 0.2% y/y.

- In addition to the drop-out of the effects of the consumption tax increase in October 2019, the major factor behind the decline in the CPI was the extended application of the government's travel subsidies to travel to and from Tokyo in October 2020. Accommodation fees declined by 37.1% y/y, which lowered the CPI by 0.45 percentage point. The first deflation since September 2016 also reflected a larger decline in energy prices and a softer increase in fresh food prices.

- Japan's CPI is likely to decline over the coming months. The government's introduction of subsidy plans will lower restaurant charges and event fees to some extent. The global resurgence of COVID-19 could increase deflationary pressure as containment measures could slow the resumption of economic activity and suppress energy prices for an extended period.

- Autonomous a2z has raised USD1.9 million in a seed funding round from angel investors. The company will use the capital towards the development of autonomous mobility solutions and to maintain its leading position in relevant markets. Autonomous a2z CEO Han Ji-hyung said, "Thanks to seed investment, we have created a stable environment for commercializing our technologies. Through the support of our investors, who have agreed to partner with us based on their faith in our technologies and our independently-developed autonomous mobility solutions, we can dedicate even more energy to commercializing a solution for SPVs [special-purpose vehicles] such as cleaning and patrol vehicles." Autonomous a2z is based in Gyeongsan (South Korea) and focuses on a proving platform for autonomous robo-taxis and shuttles. The platform has enabled the company to log more than 20,000 kilometers for its autonomous vehicles (AVs) on South Korea's roads and highways. The company's technology offers a quick localization algorithm by combining "lighter high definition (HD) maps" and "recognition results from simultaneous signal processing from multiple LiDAR". The company has developed a LiDAR software development kit (SDK), software that develops LiDAR algorithms and which is compatible with Velodyne's LiDAR VLP16.Earlier this year, Autonomous a2z partnered with LG Uplus to launch a 5G-based AV validation business. (IHS Markit Automotive Mobility's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-november-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-november-2020.html&text=Daily+Global+Market+Summary+-+20+November+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-november-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 20 November 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-november-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+20+November+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-november-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}