Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 20, 2020

Daily Global Market Summary - 20 April 2020

The US Crude oil futures market took center stage today as prices on a Crude Oil WTI contract entered negative territory for the first time in history. Global equity markets were generally lower on the day and both investment grade and high yield credit closed lower.

Americas

- US equity markets closed modestly lower; DJIA -2.4%, S&P 500 -1.8%, Russell 2000 -1.3%, and Nasdaq -1.0%.

- Since the beginning of March, IHS Markit's dividend forecasts for US companies has decreased approximately 33%, resulting in over 30 dividend suspensions and cuts for 600 firms. In the S&P 500, this changed the outlook for close to two-thirds of the index and resultingly, their dividend index point (DIP) forecasts. Our current forecasts project S&P 500 of 55.01pts in 2020 and 59.2pts in 2021, down 9% and 5% respectively, since the last week of March. DIPs have dropped precipitously since December. (IHS Markit Dividend Forecasting's Dominique DeRubeis)

- 10yr US govt bonds closed -4bps/0.61% yield.

- Prices on a Crude Oil WTI contract entered negative territory for the first time in history, with the May 2020 contracts expiring tomorrow trading as low as -$40.32 per barrel before "rallying" to end the day at -$13.10 per barrel. According to research published today by IHS Markit's Energy Advisory group, open interest in May 2020 WTI contracts has declined dramatically in recent weeks and stood just above 100,000 contracts on Friday, 20% of the size of the June 2020 open interest, reflecting that liquidity and vast majority of any speculative/paper positions had already broadly shifted further along the curve. The remaining contracts represent contracts that are set for physical delivery in May (becoming de facto cash positions). Unlike ICE Brent, the WTI contract is settled by physical delivery in Cushing, Oklahoma at a time of dwindling spare storage capacity, leaving sellers at the mercy of extremely congested market conditions on a fast-expiring time clock. "The May crude oil contract is going out not with a whimper, but a primal scream," said Daniel Yergin, a Pulitzer Prize-winning oil historian and vice chairman of IHS Markit Ltd according to Bloomberg News.

- The new front contract June 2020 Crude Oil WTI futures closed -15%/+$20.43 per barrel.

- An important decision point is being reached for many US LNG offtakers. Today is the deadline for foundation customers at Sabine Pass and Corpus Christi LNG to cancel or suspend cargoes for loading in June 2020. With more than 4.5 MMt of US LNG contracted to foundation customers in June and increasing to more than 5 MMt by the end of 2020, these decisions will play an important role in how the LNG market balances in the coming months. IHS Markit views US offtake commitments as call options, which offtakers may choose not to exercise during challenging market conditions while still paying the fixed-fee portions of their contract prices. With low spot prices placing US LNG firmly out of the money this summer, IHS Markit expects a significant turndown in US LNG production over the next several months to help balance the LNG market. (IHS Markit Energy Advisory's Roger Diwan)

- IHS Markit's Investment Grade iTraxx-Europe closed +3bps/85bps and CDX-NAIG +6bps/93bps. The High Yield indices iTraxx-Xover +20bps/505bps and CDX-NAHY +56bps/643bps.

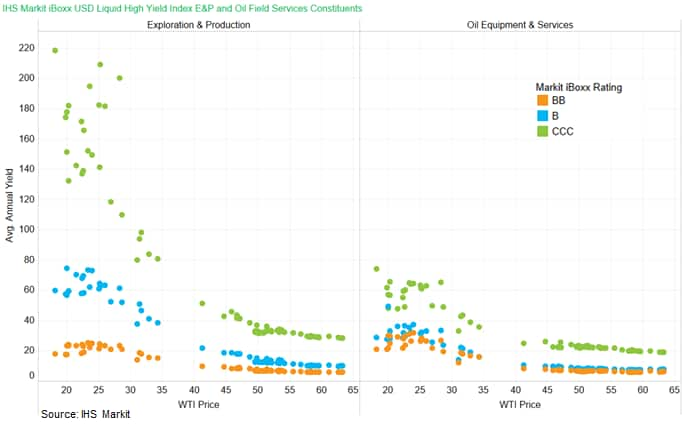

- The below is an updated comparison of IHS Markit USD Liquid

High Yield Index Exploration & Production and Oil Field Service

constituent's average bond yields year-to-date 2020 (as of April

17) versus the price of WTI oil. The colors indicate the bonds'

ratings, and the tiering in yields vs WTI across ratings is most

pronounced in the E&P company's debt:

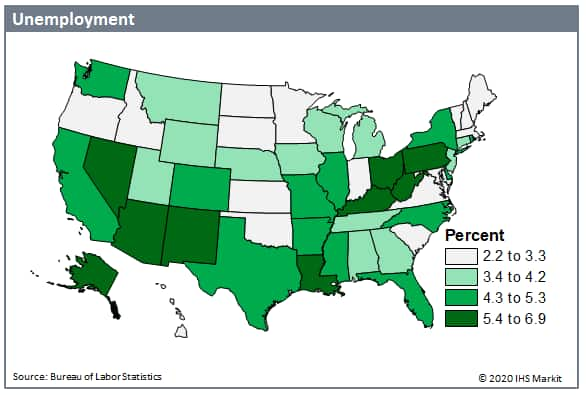

- Total nonfarm payroll employment decreased in 47 states in

March 2020, losing a net 707,400 jobs from the previous month,

according to the most recent report from the US Bureau of Labor

Statistics (BLS). The unemployment rate also increased considerably

in March 2020, climbing in 32 states as well as the District of

Columbia, while just 7 states saw a decrease and 11 remained the

same. Nevada, a state hit particularly hard because of the virus's

impact on the gaming industry, jumped 2.7 points to an unemployment

rate of 6.3%. Following Nevada was Louisiana, also struggling with

a decrease in casino and tourism-related employment. The state

jumped 1.7 points to a jobless rate of 6.9% in March, which now

stands as highest in the nation. (IHS Markit Economist Steven

Frable)

- New York state has asked the federal government for a $4 billion no-interest loan to cover unemployment payments for people put out of work by the coronavirus pandemic as it and other states burn through funds set aside for jobless claims. (WSJ)

- Total North American exports of polyethylene (PE) and polypropylene (PP) resins will decline this year for the first time since 2015 due to the COVID-19 pandemic but the downturn may not be as severe as first feared just weeks ago, according to Joel Morales, executive director/polyolefins Americas at IHS Markit speaking at a live session of the IHS Markit World Petrochemical Conference (WPC) 2020 Online on 17 April. Despite expecting reduced demand worldwide for plastics, there are "some positives" from the pandemic that are increasing consumption, he says. "We see a tremendous bump in food packaging all over the world. We've seen a rollback on bag bans and single-use items. Plastics were really considered bad before COVID, now they are making people feel more comfortable." Converters in North America that were expecting a downturn this year "now can't keep up with orders," he says.

- Chemical industry volumes in the US are expected to decline 3.3% in 2020 because of negative impacts from the COVID-19 pandemic, according to an interim forecast released today by the American Chemistry Council (ACC). There are some bright spots for the industry. "Partially offsetting weakness in US chemical production is strengthening demand for chemistry used in the response to COVID-19," ACC says. These products include ingredients in cleaners and disinfectants, materials for personal protective equipment (PPE), and plastics used in some medical devices.

- Brazil's President Jair Bolsonaro on 16 April suspended health minister Luiz Henrique Mandetta over disagreements on how to tackle the COVID-19-virus pandemic. From the beginning of the outbreak in Brazil, Mandetta called on the population to remain indoors and ordered the closure of businesses to contain the spread of the virus. However, President Bolsonaro publicly contradicted him, arguing that the lockdown was an overreaction to a virus that was like a "minor flu" and that it would cause thousands of job losses. Mandetta's suspension worsens relations between President Bolsonaro and Congress and the diminishing political support signals a likely collapse in the government's co-operation with Congress on all policy issues. (IHS Markit Country Risk's Carlos Caicedo)

- Argentina's finance minister Martín Guzmán presented on 17 April a restructuring offer to private creditors of over USD70 billion of international debt under foreign legislation. The proposal consists of a three-year grace period with a debt-service holiday, a 62% reduction in interest payments (worth USD37.9 billion, with initial interest payments of 0.5% after 2023, rising to 4.5%), and a 5.4% write-off on capital (USD3.6 billion), with variations depending on the types of bonds. Bondholders were offered 20 days to accept the proposal; 75% of bondholders need to approve it for it to be applied uniformly under Collective Action Clauses (CAC) designed to prevent holdout investors from blocking agreement. (IHS Markit Country Risk's Carla Selman)

- General Motors (GM) has delivered its first batch of ventilators to Chicago-area hospitals in the United States, reports the Detroit Bureau. For producing the medical equipment, GM partnered with Ventec Life Systems, a US-based medical equipment manufacturer, and the automaker took about one month from the date of the first discussions about producing ventilators to the delivery date. (IHS Markit AutoIntelligence's Tarun Thakur)

Europe/Middle East/ Africa

- The United Kingdom's Financial Conduct Authority (FCA) has proposed measures to support holders of finance on vehicles who have become financially distressed as a result of the impact of the COVID-19 virus outbreak, reports Reuters. The FCA said in a statement released on Friday (17 April) that "if customers are experiencing temporary financial difficulties due to coronavirus, firms should not take steps to end the agreement or repossess the vehicle". The FCA said that the measures should include a three-month payment freeze. (IHS Markit AutoIntelligence's Ian Fletcher)

- The Volkswagen (VW) Group has published its delivery figures

for March and the first quarter, which were significantly affected

by the COVID-19 virus pandemic, with global deliveries down by

23.0% year on year (y/y) to 2,006,000 units, according to a company

statement. (IHS Markit AutoIntelligence's Tim Urquhart)

- The company's biggest market, China, dropped 35.1% y/y during the first quarter to 613,900 units, which almost equaled the overall rate of decline for the first quarter of 35.5% y/y to 209,600 units.

- The first-quarter decline in Western Europe was 20.2% y/y to 770,300 units, and March was down by 44.6% y/y to 228,800 units.

- Deliveries in Central and Eastern Europe fell 12.2% y/y to 164,400 units in the first quarter, which accelerated to a fall of 23.1% y/y in March to 53,700 units.

- In North America deliveries fell by 12.9% in the first quarter to 188,600 units, and 42.0% y/y to 50,400 units in March.

- In South America sales fell by just 3.4% y/y to 127,000 units in the first quarter, with a 23.8% y/y fall to 34,700 units in March.

- The Danish government has announced that it will extend the duration of some of the measures to support incomes and employment, first agreed on 19 March. The total cost of the new package, including loans and guarantees, is estimated by the government to be DKK100 billion (4.3% of GDP) with a direct cost of around DKK30 billion (1.3% of GDP). There are no official leading indicators of the drop in private consumption, investment or exports yet. Based on the April forecast round, IHS Markit expects the Danish economy to contract by over 4% in 2020 with risks tilted to the downside, particularly in the first half of the year. (IHS Markit Economist Daniel Kral)

- Fitch Ratings on 17 April changed Romania's sovereign risk outlook to Negative from Stable and affirmed the long-term foreign-currency issuer default rating at BBB-, in line with IHS Markit and consensus. Public finances are expected to worsen because of the spread of the coronavirus disease 2019 (COVID-19) virus. The economy is expected to contract by 5.9% in 2020, which together with increased public expenses is expected to increase the budget deficit from the already-high 4.6% last year to 7.9% and the public debt from 35% of GDP to 45% of GDP in 2020. Public debt would still remain below the BBB-rated median of 50%, according to Moody's. (IHS Markit Sovereign Risk's Vaiva Seckute)

- Brent crude closed -6.9%/$25.57 per barrel.

- 10yr European govt bonds closed lower across the region; Italy +16bps, Spain +8bps, France +6bps, UK +3bps, and Germany +2bps.

- European equity markets closed higher across the region except for Spain -0.6%; Switzerland +1.8%, France +0.7%, Germany/UK +0.5%, and Italy +0.1%.

Asia-Pacific

- While simultaneously shifting the outlook for Australia's sovereign to Negative from Stable, the international ratings agency S&P Global Ratings (S&P) affirmed the sovereign's rating at AAA (0 on the IHS Markit numerical scale). In its decision to shift the outlook for Australia's long-term rating to Negative, S&P indicated that it believes that the worsening of the country's fiscal balances will be temporary, but the significant amount of stimulus measures announced (11% of GDP over the current fiscal year and next) will boost the country's net government debt and interest expenditures over the next few years. The agency projects the fiscal deficit for the general government will average 7.5% of GDP between fiscal years (FY) 2020-21 and 2021-22. (IHS Markit Economist Bree Neff)

- On 17 April, the Reserve Bank of India (RBI) made several

announcements regarding the banking sector (IHS Markit Banking

Risk's Angus Lam):

- The suspension of dividend pay-outs by commercial banks to shareholders, including from state-owned banks to the RBI.

- The RBI expanded the targeted long-term repo operation (TLTRO) by INR500 billion (USD6.5 billion) to specifically target small and medium-sized non-bank finance companies (NBFCs) and micro finance institutions. Banks are required to distribute 50% of the new TLTRO to these companies. This is in addition to the first TLTRO of INR1 trillion introduced on 27 March.

- Announced a reduction in banks' liquidity coverage ratio (LCR) from 100% to 80%.

- New vehicles sold on a wholesale basis in China fell by 43.3% year on year (y/y) to 1.43 million units during March, while production decreased by 44.5% y/y to 1.42 million units, according to updated CAAM data. In the first quarter, China's new vehicle sales fell 42.4% y/y to 3.67 million units, while production volumes fell by 45.2% y/y to 3.47 million units. IHS Markit now anticipates light-vehicle production in mainland China to fall by 15.8% to 20.6 million units in 2020, followed by a rebound of 10.4% to 22.7 million units in 2021. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Jaguar Land Rover (JLR) has announced that its global sales fell by 30.9% year on year (y/y) during the first quarter of 2020, mainly as a result of the COVID-19 virus pandemic. According to data released by its parent company Tata Motors, during the three-month period, sales volumes retreated from 158,916 units to 109,869 units. (IHS Markit AutoIntelligence's Ian Fletcher)

- Japan's trade balance surplus narrowed to JPY5 billion (USD46 million) on a non-seasonally adjusted basis in March following a JPY1.1-trillion surplus in February. On a seasonally adjusted basis, the trade balance turned to a deficit of JPY190 billion from the first surplus since June 2018 recorded in February 2020. The contraction of exports widened to 11.7% year on year (y/y) as declines accelerated for exports to the US (down 16.5% y/y) and the European Union (down 11.1% y/y), while exports to Asia shifted to a decrease of 11.9% y/y. Declines in autos (particularly for exports to the European Union and the US) and auto parts (to Asia) were major contributors to sluggish overall exports. A softer decline in imports (down 5.0% y/y) largely reflected a narrower contraction of imports from mainland China (down 4.5% y/y) after a 47.1% drop in February. (IHS Markit Economist Harumi Taguchi)

- The Philippines' Department of Energy has awarded Triconti Windkraft Group with a contract providing exclusive rights to study and develop the first offshore wind projects in the country. Triconti Windkraft Group, a Filipino-Swiss-German partnership, has plans to develop two wind farms, totaling 1.2 GW, off the coast of the Philippines. They are the 600 MW Guimaras Strait project and the 500-600 MW Aparri Bay project. Pre-development of the Aparri Bay site has commenced. (IHS Markit's Upstream Costs and Technology's Chloe Lee)

- Vestas has been contracted for the supply of wind turbines for the 29 MW Ben Tre V1-3 intertidal wind farm in Vietnam. This is the fourth intertidal turbine supply contract awarded to Vestas in Vietnam. The contract includes the supply and supervision of the installation of seven V150-4.2 MW wind turbines that will be installed in shallow waters close to shore. Each turbine will be equipped with a full-scale converter. (IHS Markit's Upstream Costs and Technology's Chloe Lee)

- S&P Global Ratings has affirmed Indonesia's long-term sovereign rating at BBB (35 on the IHS Markit numerical scale), but the agency has shifted the outlook on the rating to Negative following its latest review. S&P Global Ratings (S&P) indicates that the Indonesian government's decision to temporarily remove the fiscal deficit cap of 3% of GDP is warranted, considering the economic and public health issues triggered by the COVID-19 pandemic, but it will result in a fiscal deficit on the order of 4.7% of GDP for 2020 and deficits just at or above 3.0% of GDP for the following two years. According to S&P, the rating may be downgraded if Indonesia's gross external financing needs significantly exceed current account receipts and reserves or if general government interest payments rise beyond 10% of government revenues. IHS Markit rates Indonesia less favorably than S&P and other ratings agencies, at 40 on our numerical scale (BBB- on the Generic scale), albeit with a Positive outlook. The impediment to the final step to upgrade Indonesia has been the rupiah's sensitivity to investor risk aversion stemming in part from moves by the US Federal Reserve Bank to unwind monetary stimulus, as well as Indonesia's twin deficits and its heavy dependence on foreign capital. (IHS Markit Economist Bree Neff)

- Most APAC equity markets closed lower except for China +0.5% and India +0.2%; Australia -2.5%, Japan -1.2%, South Korea -0.8%, and Hong Kong -0.2%.

In light of current events, IHS Markit is offering complimentary access for qualified market participants to o

Access to our Global Data via Price Viewer

We are currently offering access to our historical cross asset global fixed income pricing and liquidity data, as well as OTC Derivatives data via the Price Viewer web-based data portal. To request complimentary access, please contact data.delivery@ihsmarkit.com and reference this post.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-april-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-april-2020.html&text=Daily+Global+Market+Summary+-+20+April+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-april-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 20 April 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-april-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+20+April+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-april-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}