Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 21, 2020

Daily Global Market Summary – 21 April 2020

Yesterday's extreme sell-off in May 2020 WTI crude oil futures added momentum to a global sell-off in equities and other risk assets today. 10yr government bonds closed the day particularly strong, with the yield curve also continuing to flatten.

Americas

- US equity markets closer lower across the region; Nasdaq -3.5%, S&P 500 -3.1%, DJIA -2.7%, and Russell 2000 -2.3%.

- 10yr US govt bonds closed -4bps/0.57% yield and 30-year bonds -6bps/1.16% yield, with 10s reaching the lowest intraday yield since the day the all-time record low yield of 0.38% was recorded on 9 March.

- IHS Markit's CDX-NAIG closed +5bps/98bps and CDX-NAHY +36bps/680bps.

- June WTI Crude oil contracts closed -43%/$11.57 per barrel, which was well above its intraday low of $6.50 per barrel at 1:50pm ET.

- Negative prices and technical factors aside, the WTI May 2020 contract's 20 April meltdown marks the decisive inflection point in the physical market from storage fear to storage panic, lifting the speculative veil off the futures market and exposing the US oil market's unprecedented congestion. Conceptually, markets broadly understood that left unchecked, the US oil system would face tank tops over the course of the second quarter, but never has the physical market's signal of the urgency of the situation come across as clearly as it has over the past 24 hours. Simply, markets are faced with the question: if there is no room to deliver crude in Cushing in May, how could there possibly be room in June? (IHS Markit's Roger Diwan)

- The United States Oil Fund (USO), an ETF with over $4 billion in assets, said it would shift investments out of the June expiration West Texas Intermediate futures contract, in turn purchasing later-dated contracts and possibly even other kinds of energy derivatives. (FT)

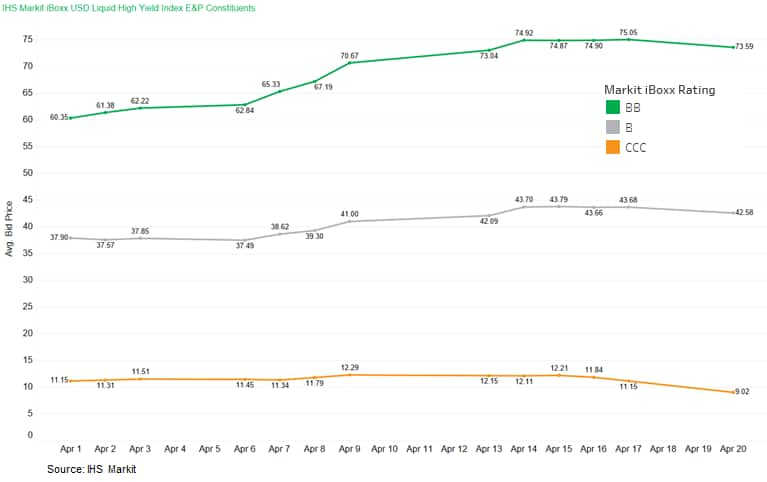

- Bond prices for Oil Exploration & Productions constituents

in IHS Markit's iBoxx USD Liquid High Yield index declined over 1

point on average across BB and B rating categories after

yesterday's sell-off in WTI, while CCC credits were down 2 points

or -19% on average.

- IHS Markit has released its April 2020 light-vehicle sales and production forecasts to clients via AutoInsight e-files, including a top-line expectation of a 21.7% drop in global sales and a 21.2% fall in global production - far worse than the 8% peak-to-trough decline of the 2008-09 recession. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Fiat Chrysler Automobiles (FCA), Ford, and General Motors (GM) are negotiating safety rules with the United Auto Workers (UAW) union for the reopening of their US plants, shut amid the coronavirus disease 2019 (COVID-19) pandemic, reports Reuters. According to the report, the automakers and UAW representatives are discussing the safety rules for when the plants restart production, with the union leaders asking that any workers who feel sick to be allowed to self-quarantine without losing pay. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Voyage has received a permit from the California Public Utilities Commission (CPUC) to conduct passenger rides in its fleet of autonomous vehicles (AVs) on the state's public roads, reports TechCrunch. Voyage was founded in 2017 and focuses on offering point-to-point transportation solutions using self-driving cars. To date, the company has raised USD52 million in funding. Voyage's autonomous G2 fleet has been tested in the Villages, a resident retirement city in Florida, and the retirement community in San Jose, California. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- US existing home sales dropped 8.5% in March from February to an annual rate of 5.27 million units. Single-family sales fell 8.1% while condo/co-op sales skidded 11.7%. Sales were down in all regions. Entering March, the market for existing homes was as strong as it had been in years. February sales were at a 13-year high and home prices were reaccelerating. By the end of the month, the market had collapsed. Sales plunged, cancellations shot up, homeowners took their homes off the market, credit availability dried up, real estate agents lost their jobs. March's numbers only partly reflect the abrupt drop in demand. Bottom line: The collapse in existing home sales will show up in next month's release. (IHS Markit Economist Patrick Newport)

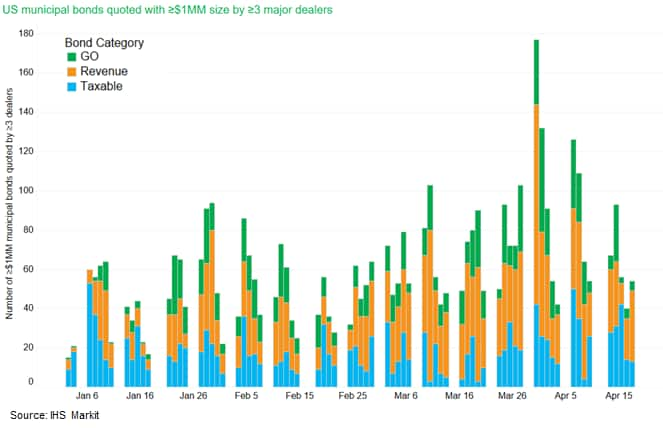

- The number of US municipal bonds being quoted by 3 or more

major dealers in size (≥$1 million) had reached its highest point

of the year on March 30 and has generally been trending lower

since, but remains in line with quote depth trends before the

COVID-19 pandemic impacted the municipal bond market.

- S&P Global Ratings (S&P) has downgraded Bolivia's rating from BB- to B+ (or from 50 to 55 on the IHS Markit scale), while the outlook has been changed from Negative to Stable. IHS Markit believes that a downgrade would be warranted if the government fails to follow through on austere fiscal policy, leading to an increase in fiscal deficits; a decline in monetary policy credibility could also spur a downgrade. An upgrade could be spurred if the government's fiscal policy strengthens external imbalances faster than currently expected. (IHS Markit Sovereign Risk's Ellie Vorhaben)

- Nicaraguan Textile and Clothing Industry Association (Asociación Nicaraguense de la Industria Textil y Confección: ANITEC) Executive Director Dean García has called for the government to pass free-zone manufacturing legislative support measures as the spread of the coronavirus disease 2019 (COVID-19) virus is causing contract cancellations and layoffs. ANITEC expects that up to 45% of all Nicaraguan textile production will be lost by June, with textiles in Nicaragua accounted for USD1.5 billion, or 28%, of all exported goods in 2017, according to figures from the Observatory of Economic Complexity (OEC). (IHS Markit Country Risk's Kari Pries and Cristina Arbelaez)

Europe/Middle East/ Africa

- The state-owned Land and Agricultural Development Bank of South Africa has announced that it has defaulted on its revolving credit facility and is currently in negotiations with lenders for a waiver and an extension of the repayment date in relation to the said default. The bank received a state guarantee amounting to ZAR5.7 billion in February, thus the default could potentially leave the government liable for ZAR5.7 billion. In IHS Markit's view, although the bank is not systemically important, being a smaller player within the banking industry, the bank is central to the provision of credit to the agricultural sector, and the troubles it has run into do raise questions regarding the supervision and control of banking regulators in South Africa and dampen investors' confidence. (IHS Markit Economist Ana Souto)

- Swiss Federal Customs Office data reveal that nominal, seasonally and working-day adjusted exports rebounded by 2.2% month on month (m/m) in March, following February's sharp drop of 5.0%, which unwound an increase by 4.9% in January. By contrast, imports posted -3.9% m/m in March, revealing a deteriorating tendency (January: 0.6%, February: -1.8%). The most conspicuous aspect of the export breakdown by region (only available in nominal terms) was the huge jump in deliveries to the US (46.0% m/m), whereas exports to China were weak at -2.9%. Exports to China had jumped in the previous month, but February's increase of 41.4% had only represented the usual correction related to the Chinese New Year holidays (January: -33.0%). Dampening effects of the COVID-19 virus outbreak only started to show in earnest in March, and unusually high demand for pharmaceuticals - probably also related to the pandemic - was an offsetting support for Switzerland's exports. (IHS Markit Economist Timo Klein)

- More automakers have announced their plans to resume vehicle production in Spain. Nissan plans to resume production at its Barcelona (Spain) facility on 4 May, reports Europa Press. Sources have told the news service that this will initially focus on Line 2, which manufactures pick-ups including the Nissan Navarra. However, the rate of production will be set at around 60 units per day rather than 102 units per day due to inventory levels. (IHS Markit AutoIntelligence's Ian Fletcher)

- Brent crude closed -24%/$19.33 per barrel.

- In Italy's most populous and economically important region Lombardy, where Milan is the capital, the number of new infections remains stubbornly high, raising doubts about whether Italy is ready to start unwinding its lockdown as scheduled from May 4. (WSJ)

- A lead manager update has reported that Italy attracted around EUR110 billion in demand for the sale of a new five year (July 2025) bond and reopening of its 2.45% September 2050 deal. It opened books with guidance at 27 basis points area over its February 2025 BTP, before pricing at a 21 basis point margin: the long-dated tap was at 9 basis points over Italy's September 2049 outstanding issue. (IHS Markit Economist Brian Lawson)

- 10yr Italian govt bonds closed +22bps/2.16% yield today and are within 12bps of last month's weakest 2020 close of a 2.28% yield.

- 10yr European govt bonds closed mixed; Spain +10bps, France flat, Germany -3bps, and UK -4bps.

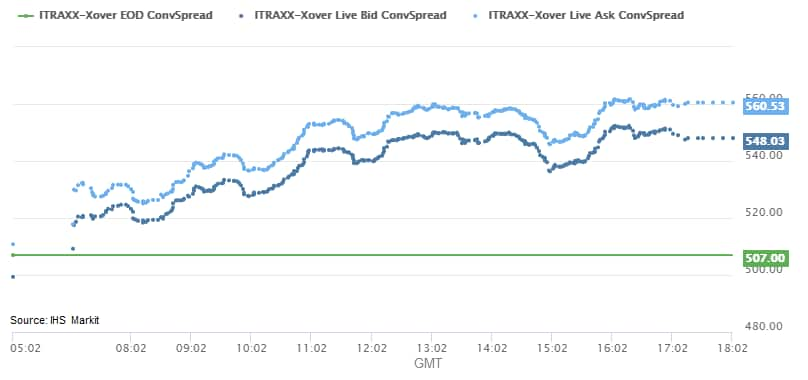

- IHS Markit's iTraxx-Xover European high yield index closed

+47bps/554bps, which is its widest level since April 7:

- European equity markets closed lower across the region; Germany -4.0%, France -3.8%, Italy -3.6%, UK -3.0%, and Spain -2.9%.

Asia-Pacific

- China's public fiscal revenue dropped by 26.1% year on year (y/y) in March 2020, the largest contraction since 1970, according to a release by the Ministry of Finance (MOF) on 20 April. The March drop significantly widened from a 9.9% y/y decline in the first two months with broadly-across deterioration. Tax revenue fell 32.2% y/y as income and sales dropped because of lockdowns during the COVID-19 pandemic. Corporate income tax contracted by 42% y/y, leading the headline decline. Individual income tax, which gained a 14.8% y/y expansion in the first two months, contracted by 25% y/y even with a low base data in the same period last year. (IHS Markit Economist Yating Xu)

- People's Bank of China (PBOC) cut the one-year loan prime rate (LPR), the bench market lending rate, by 20 basis points (bps) to 3.85% on 20 April. The five-year LPR, which is related to mortgage rate, was reduced by 10 bps to 4.65%. This reduction came as no surprise following the 20 bps cut of medium-term lending facility (MLF) rate and open market operation (OMO) rate earlier this month. It is the second reduction on LPR this year and the 20 bps cut on one-year rate was the largest ever since August 2019 when the central bank set it as the bench market rate. (IHS Markit Economist Yating Xu)

- In India, where measures to ease lockdown were already set in place, the country has reported its highest daily increase in COVID-19 infections, with an additional 1,553 cases in the past 24 hours. In addition, the situation in Africa has given particular cause for concern, with World Health Organization (WHO) Director General Tedros Adhanom Ghebreyesus stating that there had been a 51% increase in reported cases and a 60% increase in reported deaths in the continent. (IHS Markit Life Science's Sacha Baggili and Janet Beal)

- Nissan plans to temporarily shut down some of its non-production facilities in Japan due to the COVID-19 virus, according to a company statement. Nissan's global headquarters in Yokohama, its main research and development (R&D) base in Kanagawa Prefecture, and other facilities in Atsugi, Oppama, and Tochigi areas will remain closed between 25 April and 10 May. The measure is expected to affect around 15,000 employees. (IHS Markit AutoIntelligence's Tarik Arora)

- APAC equity markets closed lower on the day; India -3.2%, Australia -2.5%, Hong Kong -2.2%, Japan -2.0%, South Korea -1.0%, and China -0.9%.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--21-april-2020-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--21-april-2020-.html&text=Daily+Global+Market+Summary+%e2%80%93+21+April+2020++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--21-april-2020-.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary – 21 April 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--21-april-2020-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+%e2%80%93+21+April+2020++%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--21-april-2020-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}