Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 14, 2020

Daily Global Market Summary - 14 October 2020

Most major European equity markets closed modestly higher, APAC was mixed, and the US was lower on the day. Most European government bonds were higher on the day, while US bonds were close to unchanged. The US dollar was slightly weaker on the day, while oil, gold, and silver closed higher. The number of COVID-19 cases continues to grow as winter approaches in the northern hemisphere, with new restrictions to slow the spread of the virus being announced by governments every day across Europe and the US.

Americas

- US equity markets closed lower again today; Russell 2000 -0.9%, Nasdaq -0.8%, S&P 500 -0.7%, and DJIA -0.6%.

- 10yr US govt bonds closed flat/0.73% yield and 30yr bonds flat/1.51% yield.

- CDX-NAIG closed +1bp/56bps and CDX-NAHY +3bps/368bps.

- DXY US dollar index closed -0.1%/93.40.

- Gold closed +0.7%/$1,907 per ounce and silver +1.1%/$24.40 per ounce.

- Crude oil closed +2.1%/$41.04 per barrel.

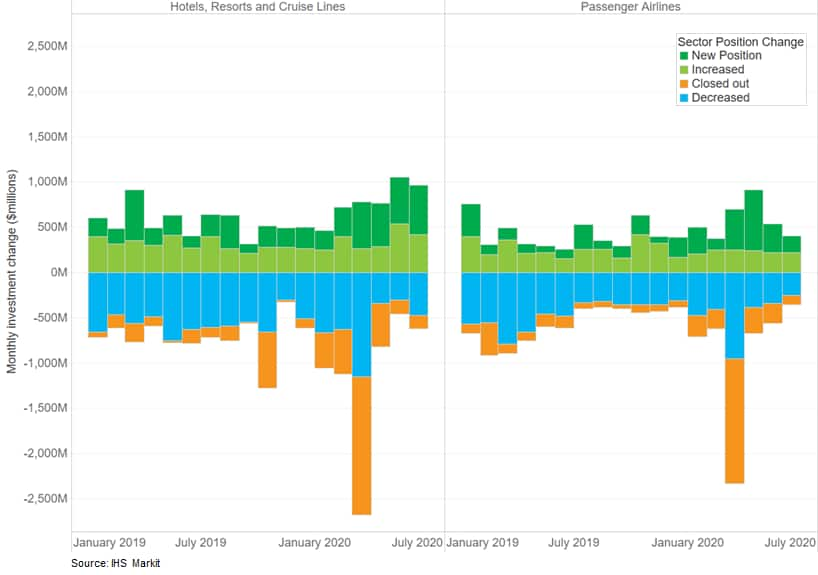

- The below chart shows the Jan 2019 - June 2020 monthly

estimated value of new positions, increases/decreases to existing

positions, and full close outs of equity held by a static pool of

US actively managed mutual funds that report their holdings monthly

in IHS Markit's fund holdings database (does not include funds that

report only quarterly). The data shows that the largest segment of

funds' equity sales out of the hotel, resort, and cruise lines and

passenger airline sectors in March 2020 was from funds completely

leaving those sectors (orange bars) that month, which totaled $1.5

billion and $1.4 billion in total sold assets, respectively.

- The total producer price index (PPI) for final demand rose 0.4%

in September, matching its change over the past 12 months as it

accumulated a 0.4% gain. (IHS Markit Economist Michael Montgomery)

- Total goods prices also rose 0.4 in a report awash in "0.4" data points. Core goods prices also rose 0.4% with food up 1.2%, but the larger energy category counterbalancing that rise with a 0.3% drop.

- Food prices in September featured a 5.5% rise in beef and veal and a 9.1% spike upwards in fresh and dried vegetables. The largest gains of 15-20% occurred in grains, fresh eggs, and oilseeds. Pork, chicken, fish, rice, and baked goods prices all eased, but were swamped by the larger gains in other products. Oil-based products drove the monthly dip in energy prices, but natural gas and electricity gains dampened the groups drop.

- Total services prices posted a 0.4% increase with its transportation and warehousing piece matching that gain. Margins for retailers and wholesalers firmed by only 0.2% and "other" services prices climbed 0.5%. Many pieces of the retail world saw reduced margins, but gasoline stations scored a gain. Recreational vehicles scored a second consecutive massive surge in margins (31.8% after an August 23.8% climb)—the pandemic may have created a bubble in demand for less-conventional recreation.

- Producer prices are now back into the black on a y/y basis, albeit only 0.4% for the total and 0.7% excluding food, energy, and trade margins. Two related items dominate the outlier, with energy still down by double-digit percentages (11.5%) and transportation down 4.5% because of airfares (weak demand plus lower fuel costs).

- Producer prices continue to slowly recover ground lost during the spring pandemic disruptions but that was augmented by the outliers like food. The net result was the chronic appearance of 0.4% gains in a raft of categories in monthly data. The y/y changes would be called mild save for the fact that they are the net result of a collapse and a rebound, but overall price pressures not related to slow recovery are lumped in a small number of special cases.

- The Hillsborough Area Regional Transit (HART) has partnered with Beep to launch a one-year autonomous shuttle trial program in Tampa (Florida, US). The program, called Smart Mobility Alongside Regional Transit (SMART) AV, is funded by the Florida Department of Transportation (FDOT). The program will use an autonomous shuttle to provide first- and last-mile connectivity to passengers between the TECO Line Streetcar and the Marion Transit Center. The shuttle operates without a steering wheel and deploys eight sensors on the outside of the vehicle providing a 360-degree view of the environment. An on-board shuttle attendant will be present to operate in case of emergency by steering the vehicle using an Xbox controller. Tampa Mayor Jane Castor said, "HART's new autonomous vehicle project is yet another feather in Tampa's cap as we invest in our multi-modal mobility future while providing clean-energy solutions for transit that will help transform Tampa's tomorrow". Beep is an autonomous mobility solution company that offers services to fleet operators in planned communities and low-speed environments. Last year, Beep selected Bestmile Fleet Orchestration Platform to plan, manage, and optimize its autonomous shuttle fleet. Florida is gaining attraction from various tech companies as the state government passed a bill last year to allow autonomous vehicles to operate on public roads without a human operator. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- US regulatory agency National Highway Traffic Safety Administration (NHTSA) has opened an investigation into complaints of fires with certain 2018 and 2019 model year Bolt EVs. NHTSA posted a document advising of the action on its web site. NHTSA's Office of Defects Investigation (ODI) received complaints alleging that two Bolt EVs caught fire under the rear seat while parked and unattended. The ODI's initial research, NHTSA says, uncovered a 2017 model year Bolt with similar burn patterns in the interior rear seat area. The ODI wrote, "In the three cases identified, fire damage appeared to be concentrated in the EV battery compartment area with penetration into the passenger compartment from under the rear seat. The root cause of these fires is unknown." The agency has opened a preliminary investigation to "assess the scope, frequency, circumstances and safety consequences of the alleged fires." NHTSA indicates that one of the three complaints noted an injury of smoke inhalation, though no fatalities or accidents related to these three complaints. At this point, there is no recall to issue or corrective action GM is expected to take. Whether a recall is eventually issued will depend on the results of this preliminary investigation. (IHS Markit AutoIntelligence's Stephanie Brinley)

- In a letter to customers dated 7 October, LyondellBasell says it was forced to significantly cut operating rates at its Bayport facility in Pasadena, Texas, after a leak in a PO refining column on 6 October. "We are currently evaluating the impact of this event on our production capability," says the letter. "Additional information will be provided once we have assessed our ability to supply." LyondellBasell operates a propylene oxide/tert-butyl alcohol (PO/TBA) plant totaling 600,000 metric tons/year of PO capacity at Pasadena, according to data from IHS Markit. The company also has two propylene oxide/styrene monomer (PO/SM) lines totaling 544,000 metric tons/year of PO capacity at Channelview, Texas. The PO output from both facilities is shared with Covestro, which owns a 36.72% share, and Bayer, which owns 2.68%. Products affected include PO, p-glycols, allyl alcohol, butanediol (BDO) and derivatives, p-series glycol ethers, and p-specialties glycol ethers. (IHS Markit Chemical Advisory's Clay Boswell)

- FDA on Tuesday (October 13) sent warning letters to five dietary supplement marketers selling supplements that contain cesium chloride - a new dietary supplement ingredient that is sometimes promoted as an alternative cancer treatment but that has been found to pose significant health risks. The move follows a public health alert that the agency issued in February, warning consumers and health professionals to avoid using supplements that contain cesium salts because of their negative health effects. It also comes in response to efforts by one advocacy group - Public Citizen - to push FDA to ban the use of cesium chloride in dietary supplements. Cesium chloride is a new dietary ingredient that has not previously been present in the food supply in a non-chemically altered form and therefore the makers of supplements that contain that ingredient are required to provide FDA with certain safety-related information about the substance. The five companies named in the new warning letters have not met that requirement, so their products cannot be legally marketed, FDA said on Tuesday. "FDA will continue to take action against dietary supplements that contain cesium chloride because of significant safety concerns — including heart toxicity and potential death —associated with this ingredient," said Steven Tave, director of Office of Dietary Supplement Programs at FDA's Center for Food Safety and Applied Nutrition (CFSAN). FDA stressed in the new warning letters that the agency has already looked into the evidence for the safety of cesium chloride and found "no history of use or other evidence of safety establishing that cesium chloride will reasonably be expected to be safe when used as a dietary ingredient." That means that even if companies had followed the agency's rules for a new dietary supplement ingredient, supplements containing cesium chloride would still be deemed adulterated, according to FDA. (IHS Markit Food and Agricultural Policy's Margarita Raycheva)

- A group of six Indian generic drug manufacturers have signed an agreement with the Mexican state of Hidalgo to set up a production and logistics "pharmaceutical cluster", TheEconomic Times has reported. The companies involved in the initiative are Dr Reddy's Laboratories, Zydus Cadila, Glenmark Pharmaceuticals, Torrent Pharmaceuticals, Hetero Drugs, and Ackerman Pharma. According to the source, the deal is designed to help the companies make inroads into Latin American markets, and was facilitated by India's Ministry of Commerce and Industry. Further details of the plan have not been disclosed at this stage. According to data from India's Pharmaceutical Export Promotion Council (Pharmexcil), quoted by the newspaper, Indian exports of pharmaceuticals to Mexico increased by 67.6% between April and August 2020, highlighting the significant revenue potential for Indian drug makers seeking to trade with Latin America's second-largest pharmaceutical market. This is further compounded by the Mexican government's ongoing efforts to seek cheaper drugs for the public health system, including the recent controversial initiative to outsource the co-ordination of the consolidated medicines to UNOPS and open it to international bidders. (IHS Markit Life Sciences' Ewa Oliveira da Silva)

- Troller announced a partnership with the Federal Institute of Education, Science and Technology of Ceará (Brazil) (IFCE) for the development of embedded systems that are based on artificial intelligence (AI) for application in off-road driving assistance, reports Automotive Business. The project will be carried out by the IFCE innovation pole, acting as a Scientific and Technological Research Institution (Instituição de Pesquisa Científica e Tecnológica: ICT) to receive funds from Brazilian Company for Industrial Research and Innovation (Empresa Brasileira de Pesquisa e Inovação Industrial: EMBRAPII). Afrânio Costa, chassis and powertrain supervisor at Troller, said, "The objective is to develop new systems with computer vision and artificial intelligence that will improve the direction of our off-road vehicles, with the support of Embrapii and Rota 2030." He added that, "It is a win-win, generating new research and innovations with projects linked to the industry." As a part of the Rota 2030 program, Embrapii, with the aim of nationalizing technologies that are usually imported, can distribute funds to accredited ICTs (which are usually linked to universities) for research and development programs. Embrapii is accredited to receive resources that were used to pay reduced import tax (ex-tariff of 2%) for components that did not have an equivalent production in Brazil. In February 2020, Ford launched the automatic variant of the Troller TX4 sport utility vehicle (SUV) in Brazil. According to IHS Markit's light-vehicle production data, the Horizonte plant in Brazil produced 1,340 units of the Troller T4 in 2019, and is forecast to manufacture 819 units in 2020. The T4, which is the only SUV in the Troller brand's line-up, is based on the TR40 platform. The Troller brand was purchased by Ford in 2007. The T4 variant comes with a 6-speed manual transmission and a 3.2-litre turbodiesel engine that produces 200 hp and 470 Nm of torque. (IHS Markit AutoIntelligence's Tarun Thakur)

- SQM aims for cuts in emissions, water use, brine extraction in sustainability plan. The company is aiming for a 40% reduction in continental water use by 2030; carbon neutrality in lithium, potassium chloride, and iodine products by 2030; and a 50% cut in brine extraction at Salar de Atacama, Chile, also by 2030. It is also aiming to reduce waste, monitor ecosystems near operating facilities, and engage with local communities on development and environmental protection, although specific targets related to these goals were not disclosed. SQM's sustainable development plan "is primarily based on the sustainable development goals of the United Nations and includes a series of company-wide initiatives," says CEO Ricardo Ramos. Many of the goals entail escalating targets for a period of 10 or 20 years. The target for continental water use reduction calls for a 65% cut in such usage by 2040 though "initiatives to improve some production processes," which will enable the company to use continental water more efficiently and incorporate sea water into the production of nitrates and iodine, SQM says. This initiative will entail a total investment of around $95 million by 2040. The emissions reduction target also includes a 2040 goal, with SQM aiming for carbon neutrality in all products by that year. This target is expected to entail an investment of around $100 million. SQM will reduce brine extraction by 20% starting in November 2020, with further reductions continuing over the next decade until the 50% reduction target is reached in 2030. "We do not believe this brine extraction reduction will have an impact on our near- or long-term lithium production," SQM says. The company currently produces about 75,000 metric tons/year of lithium, and plans to expand production to nearly 200,000 metric tons/year "irrespective of the significant reduction of brine extraction." The move to reduce brine extraction also will not have an impact on production of potassium salts used to feed SQM's potassium nitrate production operations. However, third-party sales of potassium salts will be gradually ramped down as a result of lower brine extraction.

Europe/Middle East/Africa

- European equity markets closed mixed; Spain +0.6%, Italy +0.3%, Germany +0.1%, France -0.1%, and UK -0.6%.

- Most 10yr European govt bonds closed higher, except for Italy flat; Germany -3bps, UK -2bps, and France/Spain -1bp.

- iTraxx-Europe closed +2bps/54bps and iTraxx-Xover +13bps/330bps.

- Brent crude closed +2.0%/$43.32 per barrel.

- France's President Emmanuel Macron will impose a strict 9pm-6am curfew for Paris and eight other big French cities from Saturday in the latest move by a western leader to try to contain a "second wave" coronavirus outbreak that has spread across Europe and the US. (FT)

- Eurozone industrial production rose by 0.7% m/m in August,

broadly matching the market consensus expectation (of 0.8% m/m

according to Reuters' survey) and the indications from member

states' data already released. (IHS Markit Economist Ken Wattret)

- However, manufacturing production rose by a weaker 0.2% m/m, with the overall output increase inflated by a strong m/m rise in energy production (of 2.3%).

- Moreover, August's 0.7% m/m rise in industrial production compares with an average gain of 9% m/m from May to July, and despite the strong cumulative rebound output was still 7% below its February level (see chart below).

- Production of consumer durable goods outperformed during the rebound, with August's level of production over 3% above February's pre-coronavirus disease 2019 (COVID-19) virus peak. Production of capital goods (-8% versus February's level) and intermediate goods (-6%) fared less well.

- The vigor of the industrial output rebound since May creates a very positive "carry over" for third-quarter-2020 production and GDP.

- Assuming that the level of industrial output were to remain unchanged in September, the quarter-on-quarter (q/q) increase for the third quarter overall would exceed 16%, a record high by a huge margin. On the same basis, production of consumer durable goods would rise by almost 50% q/q.

- Daimler and BMW are exploring a sale of their joint venture (JV) Park Now, reports Automotive News. According to the report, the companies have appointed advisory firm Rothschild & Co. for their potential sale. Park Now allows drivers to pay for parking using mobile app and is currently available in more than 1,000 cities. Park Now is part of the Your Now group created through the mobility JV between BMW and Daimler in 2019 (see Germany: 25 February 2019: BMW and Daimler invest more than USD1 billion. in joint mobility services). The JV includes other services such as Share Now (car-sharing solutions), Free Now (ride-hailing app), and Charge Now (electric charging infrastructure). (IHS Markit Automotive Mobility's Surabhi Rajpal)

- BASF is eyeing the restart of its TDI plant at Ludwigshafen, Germany. The company declared force majeure on 31 August after experiencing technical problems, it stated at the time. BASF has tried to restart the plant since then, but its efforts were unsuccessful. "They will make another restart attempt in two to three days," says a market source. The company had planned three months of maintenance at the TDI plant this year, but postponed it to March 2021, citing the impact of COVID-19 as the main reason, the sources say. "The force majeure at our TDI plant in Ludwigshafen is still in place," a BASF spokeswoman tells OPIS. The force majeure at Ludwigshafen has exacerbated tightness in the global TDI market, according to James Elliott, principal analyst/polyurethane feedstocks at IHS Markit. This has not only been driven by supply-side issues but also demand has been particularly strong during the third quarter. Early indications for the fourth quarter are that offtake continues to strengthen, says Elliott. BASF started operations at the Ludwigshafen TDI plant in November 2015 after investing more than €1 billion ($1.17 billion) to build it. Since then, it has not consistently operated at optimal rates at the site, encountering different production and technical issues that have caused delays and shutdowns, according to Elliott. The company stopped producing TDI at its 80,000-metric tons/year Schwarzheide facility, based in southern Germany, in April this year. The COVID-19 pandemic and associated lockdowns led to a collapse in TDI demand during the second quarter as consumer spending on flexible polyurethane foam goods dropped, with total European demand plunging as much as 80% in April. Flexible polyurethane foam is mainly used in mattresses and furniture in western Europe.

- A recently published study carried out by German healthcare market consulting firm MundiCare, commissioned by the German generics' manufacturers association Pro Generika, shows how there has been a decisive switch from Europe to Asia in terms of the sourcing of active pharmaceutical ingredients (APIs) used in medicines consumed in Germany in the past two decades. The study is intended as a catalyst for a more active role of government in promoting the relocation of API production to Europe, in the context of the COVID-19 pandemic, which led to significant shortages of medicines during its early phase, as a result of disruption in production and global supply chains. The study found that around two-thirds of current Certificates of Suitability of Monographs of the European Pharmacopoeia (CEPs) - which are the certifications of compliance with the requirements established in the relevant monograph of the European pharmacopoeia, and are required for an API to be used in a product approved in the European Union - are held by manufacturers in Asian countries. There has been a dramatic shift since 2000, when Asian producers held 589 CEPs, compared with 2,369 today. In 2000, Asian manufacturers accounted for 31% of CEPs, while in 2020, they account for 63% of CEPs. European manufacturers held 59% of CEPs in 2000, but they hold just 33% in 2020. (IHS Markit Life Sciences' Brendan Melck)

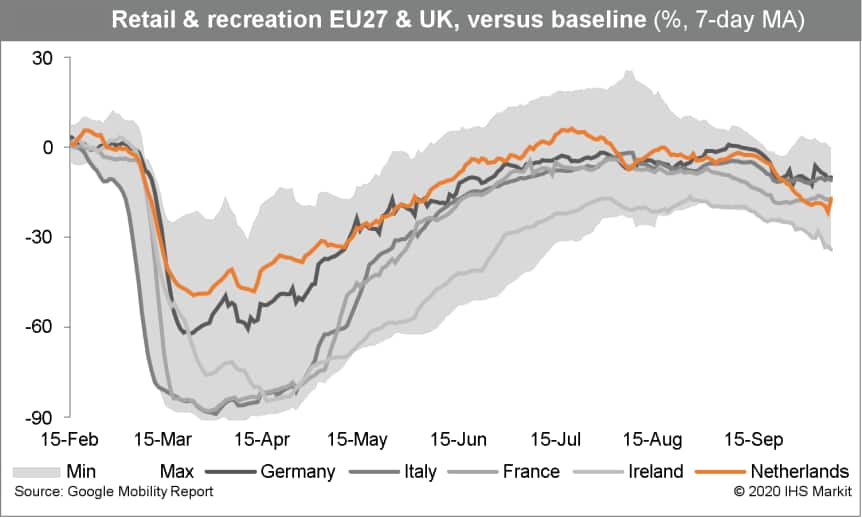

- On 13 October, Dutch Prime Minister Mark Rutte announced a

country-wide partial lockdown to combat the worsening COVID-19

virus pandemic, as the Netherlands has records among the highest

number of new cases in Europe since the start of October. The

measures will take effect from 10pm on 14 October and last for four

weeks, with a review after two weeks. (IHS Markit Economist Daniel

Kral)

- The purpose of the new measures is to limit mobility and close places with the highest risk of virus transmission. Schools and higher education institutions remain open.

- Only four people from different households are allowed to meet inside and outside. Indoor seated venues can have a maximum of 30 people.

- Everyone over the age of 13 should wear a face mask in public spaces and on public transport. Until now, the Dutch government had been an outlier in Europe in its reluctance to mandate widespread use of face masks.

- All establishments that serve food and drink must close, with only take-away allowed. Retail stores must close by 8pm, while no alcohol or soft drugs can be served between 8pm and 7am. Grocery stores may stay open later.

- With a few exceptions, public events are banned. Any establishments that do not respect new social distancing and other requirements may be closed. With a few exceptions, all team sports, including matches and competitions, are banned.

- The latest restrictions will have the most impact on the

hospitality, entertainment, and travel industries. Real-time

activity indicators point to a deterioration in mobility from

mid-September, when targeted restrictions were imposed.

- Portugal's consumer price index (based on the EU-harmonised

definition) fell by 0.7% year on year (y/y) in September. It had

declined by 0.2% y/y in August and 0.1% y/y in July. (IHS Markit

Economist Diego Iscaro)

- The accelerating pace of deflation was triggered by falling prices of clothing and footwear (-2.4% y/y, following a rise of 0.3% y/y in August) and restaurant and hotel services (-0.7% y/y, following a rise of 1.7% y/y). Transport prices continued to be a major drag on the headline inflation rate, falling by 3.2% y/y (which is unchanged from July).

- Core inflation was also in negative territory in September. It declined by 0.2% y/y, slightly below a fall of 0.1% in July. Underlying inflation had been below 1.0% y/y since early 2018, and negative in four out of the last six months.

- September's inflation rate was slightly weaker than expected. Going forward, deteriorating labor market conditions, as well as a gradual and fragile recovery from the collapse in activity during the first half of 2020, are expected to keep underlying inflation muted.

- Electric vehicle (EV) start-up Electromobility Poland has shown two electric prototypes, a sport utility vehicle (SUV) and a hatchback under a sub-brand called Izera, according to a Polish News Bulletin report. Both are well designed and contemporary models that would not look out of place if they were debuted by a major, established OEM. The interiors are well executed and look contemporary, with the use of floating screen displays that are fashionable in other brands' premium interior designs. The concepts feature wireless phone charging and other premium features and the company says that the cars will have the latest safety and advanced driver assistance systems such as ESC, Forward Collision Warning, Blind Spot Monitoring and Road Sign Recognition. ElectroMobility Poland is a Polish startup started in October 2016 by four publicly traded Polish energy companies. (IHS Markit AutoIntelligence's Tim Urquhart)

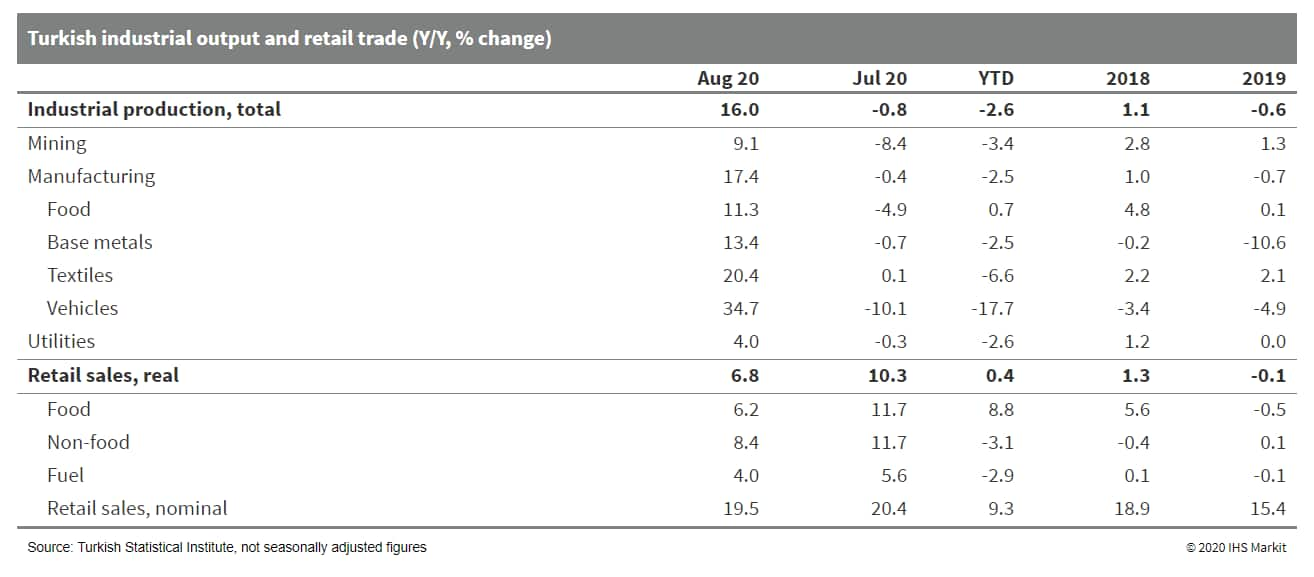

- After surging in May-July, Turkey's month-on-month (m/m)

recovery in both industrial production and retail trade moderated

significantly in August. (IHS Markit Economist Andrew Birch)

- After contracting by 22.8% in February-April - in seasonally and calendar adjusted data - total monthly industrial production recovered strongly in May and June, growing by approximately 18% m/m in those two months. In the third quarter, the pace of recovery has slackened greatly, to 8.5% m/m in July and 3.4% m/m in August.

- As of August, monthly production has returned to pre-pandemic levels, although total cumulative output through the first eight months remains 2.8% below what it had been in the same period of 2019.

- Retail trade activity, meanwhile, has had a similar arc of recovery, though less substantial. Total monthly retail trade activity in August - according to seasonal and calendar adjusted data - remained 0.6% below the February, pre-pandemic level.

- Officially reported labor data is likely to be well under-reporting joblessness, according to a prominent local labor union. Prohibitions of employers from laying off workers during the pandemic is likely leading to the fall of official unemployment rates, even though the number of those without jobs could be double what are officially reported.

- Annual industrial production growth in August was the strongest

it has been since early 2018. However, the m/m slowdown, combined

with the known tightening of monetary policy that has been underway

since early September suggests that the recovery will continue to

moderate in the final months of 2020.

- In August 2020, Turkey's balance of payments position further

edged the country closer to an external financing crisis. The

current-account deficit surged ahead to more than USD4.6 billion,

pushing the cumulative, 12-month current-account deficit above

USD20 billion for the first time since October 2018. (IHS Markit

Economist Andrew Birch)

- Along with the continued fall of merchandise exports, the negative impact of lost service exports has become particularly important in the third quarter. In July-August 2020, total service exports were nearly USD10 billion lower than they had been in the same period of 2019, totaling only USD5.4 billion. Lost tourism dollars are contributing to the already rapid rewidening of the current-account imbalance.

- Meanwhile, the net outflow of portfolio investment intensified greatly in August, totaling nearly USD2 billion. Through the first eight months of 2020, total net portfolio outflows topped USD14 billion. Negative real interest rates and high institutional risk have severely undermined gross investment inflows.

- Deepening balance-of-payments problems are undermining the stability of the lira, contributing to the currency's steep losses against the US dollar and the euro since late July. To try to stabilize the lira, the Central Bank of the Republic of Turkey (TCMB) has spent down its foreign currency reserves by tens of billions of US dollars since the beginning of the year.

- To combat the growing current-account deficit, the net outflow of portfolio investment, and the depreciation of the lira, the TCMB began to tighten monetary policy at the end of September, most notably with a 200-basis-point policy interest rate hike. While the move provided a temporary salve, much more aggressive actions are needed to offset growing foreign financing risks.

- While credit growth has retreated from the peaks it reached as the government fostered an environment in which new lending was encouraged to help the recovery from the pandemic-induced economic interruption, it remains extremely elevated. High credit growth continues to fuel the rapid deterioration of the current-account deficit given that export prospects for both merchandise goods and services remain poor.

- Saudi Arabia-headquartered Almarai, the Middle East's largest food and beverage manufacturer and distributor of dairy products, posted a 6.9% growth in net profit for the three months ended September 30, as revenues continue to rise. The company's top line grew in nearly all categories while food and long-life dairy segments recorded double digit growth. Net profit attributable to the company's shareholders in the third quarter rose to SAR621.5 million (USD165.6 million), compared to SAR581.2 million in the same quarter last year. Third quarter revenue climbed 8.1% SAR3.86 billion (USD1.03 billion). "Notwithstanding the VAT increase from 5% to 15% on 1st July 2020, top line grew in nearly all categories, led by Foods & Long-Life Dairy by recording double digit growth. The only exception was Bakery category due to drop in singe serve range," said Almarai. The company said in July that it anticipated 'significant' challenges for the second half of 2020 due to the threefold increase in value-added tax (VAT), additional customs duties and expected general decline in population as expatriates leave the country as the pandemic impacts jobs. The smaller market size is also attributable to the suspension of umrah since the end of February, and the hajj being significantly limited to only 1,000 resident pilgrims. Almarai's growth was fueled by retail, which secured double-digit growth, and the performance of its foodservice category bounced back during the period from the previous quarter after Saudi Arabia eased movement restrictions to curb the Covid-19 virus, but was flat year-on-year. (IHS Markit Food and Agricultural Commodities' Jana Sutenko)

Asia-Pacific

- APAC equity markets closed mixed; South Korea -0.9%, Mainland China -0.6%, Australia -0.3%, Hong Kong +0.1%, Japan +0.1%, and India +0.4%.

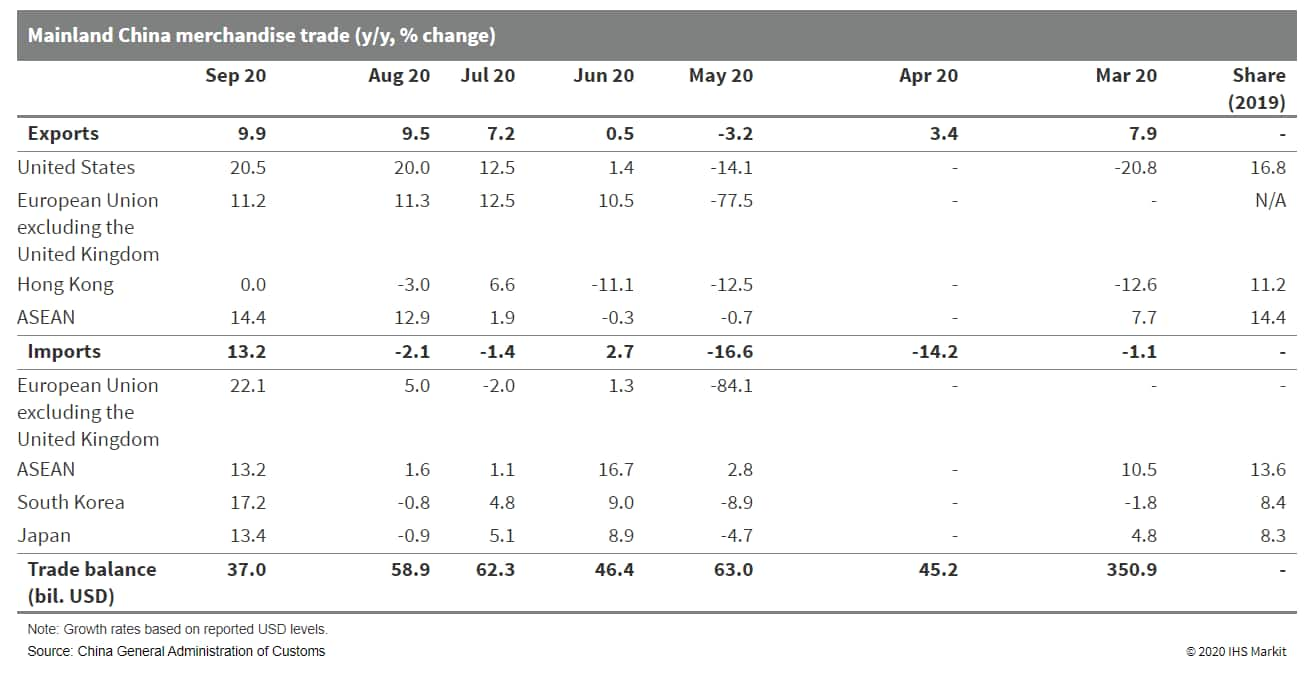

- Chinese merchandise exports rose 9.9% year on year (y/y) in

September in US dollar terms, accelerating from 9.5% y/y in August,

according to the General Administration of Customs (GAC). However,

the exports recovery momentum has been moderating. Merchandise

imports rebounded to 13.2% year on year expansion from a 2.1% y/y

contraction in the previous month, far exceeding market

expectation. In the first three quarters of 2020, Chinese exports

declined 0.8% y/y and imports declined 3.1% y/y, compared with

contractions of 6.2% y/y and 6.4% y/y, respectively, in the first

half of 2020. (IHS Markit Economist Yating Xu)

- The continuous recovery of global demand and mainland China's earlier reopening of industrial production remains the two major contributors to mainland China's strong exports growth. Exports of machinery increased 11.9% y/y, contributing 8.8 percentage points to the headline growth, while high-tech products exports growth continued to slow to 4.4% y/y. Meanwhile, overseas demand for lifestyle products such as clothes and home appliances remained the fastest-growing. Growth in exports of virus infection-prevention supplies remained strong, but the momentum has slowed.

- By country, business recovery in the United States led to Chinese exports to the country rising by 20.5% y/y, the fastest growth rate since February 2018; exports to ASEAN countries and Africa improved significantly, growing 14.4% y/y and 13.8% y/y, respectively. Exports to the European Union continued to post double-digit growth.

- Increasing imports from the United States and economic recovery were the major drivers of the September imports growth. As per mainland China's commitments under the US-China phase-one agreement, agricultural product imports rose 23.2% y/y in September, with soybean imports rising 19.4% y/y, up 18.1 percentage points from August. Additionally, imports of mechanical and electrical products, auto parts, and semiconductors accelerated. Meanwhile, imports of commodities continued to improve with increases in volume and prices. Iron ore and crude oil imports rose 9.2% and 17.6%, respectively, copper imports growth stayed above 60% y/y, and integrated circuits imports growth remained above 20% y/y.

- The significant increase in imports led mainland China's trade surplus to decline to USD37 billion in September, from USD58.9 billion in August and USD39.1 billion a year ago. The United States remained the largest contributor to mainland China's trade surplus, accounting for 83.2% of the headline figure.

- Chinese exports are expected to remain strong in the fourth

quarter. The second wave of COVID-19 infections in the United

States and European Union may continue to support Chinese exports

in the short term. According to the World Trade Organization (WTO),

mainland China's share in global trade rose by 1.1 percentage

points through July. As production gradually recovers in emerging

countries, the effect of global supply shortage will fade, but

China's major trade partners may start to build up inventory with

the global economic recovery, thus driving up Chinese exports over

the near term.

- The Chinese new vehicle market continued to rally in September,

posting its sixth consecutive monthly gains in new vehicle sales

and production volumes. New vehicle sales on a wholesale basis

increased by 12.8% year on year (y/y) to 2.57 million units in

China during the month, while production rose by 14.1% y/y to 2.52

million units, according to preliminary CAAM data. (IHS Markit

AutoIntelligence's Abby Chun Tu)

- Thanks to a rebound in new vehicle demand that began in April, vehicle sales and production volumes in the year to date (YTD) are narrowing the gap each month with the equivalent period of last year. In the YTD for September, China's new vehicle sales had fallen by 6.9% y/y at 17.12 million units, while production volumes contracted by 6.7% y/y to 16.96 million units.

- Passenger vehicle (PV) sales increased by 8.0% y/y to 2.09 million units in September, while PV production grew by 9.5% y/y to 2.05 million units. The CAAM definition of passenger vehicles includes sedans, sport utility vehicles (SUVs), multi-purpose vehicles (MPVs), and minivans.

- In the YTD, sales of PVs were down 12.4% y/y at 13.38 million units, while production of PVs fell by 12.4% y/y to 13.22 million units.

- Sales of new energy vehicles (NEVs), which include battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel-cell vehicles (FCVs), increased by 67.7% y/y to 138,000 units in September, while NEV production rose by 48.0% y/y to 136,000 units.

- Commercial vehicle sales (including medium and heavy vehicles) remained strong in September. Sales volumes of commercial vehicles surged by 40.3% y/y to 477,000 units during September, contributing to the strong rebound in new vehicle sales.

- Driven by surging market demand, commercial vehicle production increased by 39.0% y/y to 479,000 units in September.

- In the YTD, sales of commercial vehicles have risen by 19.8% y/y at 3.74 million units, while production of commercial vehicles increased by 21.5% y/y to 3.74 million units.

- Ride-hailing company Dida Chuxing has filed for an initial public offering (IPO) on the Hong Kong Stock Exchange, reports Nikkei Asian Review. Dida, which runs an app allowing car owners to offer vacant seats to passengers with similar travel routes, is expected to raise funding of USD300-500 million in the IPO. The prospectus submitted by Dida revealed that its net profit stood at CNY172.4 million (USD26 million) in 2019 and CNY150.8 million in the first half of this year, with a net profit margin of 29.7% and 48.6% for the two periods. The company has hired Haitong International and Nomura as joint sponsors for the offering. Dida claims to be the largest carpooling company in China, and facilitated 178.5 million rides in 2019. Dida offers carpooling services in 366 Chinese cities and its dominance in the carpooling market came at a time when Didi Chuxing (DiDi) had suspended its similar services, called Didi Hitch, following the death of a passenger in 2018. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Audi and its Chinese joint-venture (JV) partner FAW Group (FAW) have signed a memorandum of understanding (MOU) that redefined the framework for electric vehicle (EV) production under the partnership in China. According to a statement from Audi released on 13 October, the German automaker will introduce the Premium Platform Electric (PPE) to China under its partnership with FAW. The PPE, an EV architecture jointly developed by Audi and Porsche, will house the production of several all-electric Audi models in China from 2024 onwards. Specific model plans are still in the works, although it is clear that the new models based on the PPE will be positioned in a higher-segment to rival premium EVs introduced by rivals. The signing of the MOU will lead to the formation of a new JV between FAW and Audi to focus on the development and production of EVs in China. The announcement marks an importance step in Audi's plan to transform its product line with a new range of EVs as part of the e-tron series to compete with EV start-ups and established premium carmakers. Audi has several localized EVs on the Chinese market already, including the Audi e-tron Q2L and the Audi e-tron; however, these two models are still based on platforms designed originally for internal combustion engine vehicles. Between now and 2024, Audi is expected to begin production of several new EVs based on the Volkswagen (VW) Group's MEB platform to broaden its all-electric offering. New models in the pipeline include the Audi Q4 e-tron, which will begin production in the FAW Audi's Foshan plant (China) in 2022. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Velodyne Lidar and Baidu have entered into a three-year sales agreement. Baidu will use Velodyne's Alpha Prime LiDAR sensors to enable real-time localization and object detection functions for its autonomous vehicle (AV) applications. LiDAR sensors are necessary for AVs as they measure distance via pulses of laser light and generate 3D maps of the world around them. Wei Weng, executive director of Velodyne Lidar Asia, said, "Velodyne greatly values our relationship with Baidu, a strategic business partner and investor, and we are deeply committed to our combined work in the Chinese market. They are a trailblazer of intelligent driving technology and deployment, and their accomplishments and influence span global markets. Alpha Prime provides safe, efficient navigation for autonomous vehicles." Baidu has been a strategic investor in Velodyne since 2016. It launched its AV platform, Apollo, in July 2017 and has attracted more than 200 partners for it; the Apollo Go Robotaxi service for the public is operational in Beijing, Cangzhou, and Changsha. The company has obtained 150 licenses to test AVs and has conducted road tests in 24 cities, covering more than 6 million km. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- New vehicle sales in the Philippines fell by 22.9% year on year (y/y) during September to 24,523 units, reports The Manila Times, citing data released by the Chamber of Automotive Manufacturers of the Philippines Incorporated (CAMPI) and the Truck Manufacturers Association (TMA). Sales of passenger vehicles (PVs) stood at 8,556 units during the month, down by 12.0% y/y, while commercial vehicle (CV) sales were down by 27.7% y/y to 15,967 units. On a year-to-date (YTD) basis, total sales were down by 44.6% y/y to 148,012 units, comprising 44,079 units of PVs, down by 45.1% y/y, and 103,933 units of CVs, down by 44.4% y/y. The plunge in the Philippines' new vehicle market during the first nine months of 2020 can be attributed to the fact that the country was in a state of public health emergency and that the government had imposed the enhanced community quarantine (ECQ) order from the second half of March owing to the COVID-19 virus pandemic. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-october-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-october-2020.html&text=Daily+Global+Market+Summary+-+14+October+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-october-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 14 October 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-october-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+14+October+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-october-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}