Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 13, 2020

Daily Global Market Summary - 13 October 2020

APAC equity markets closed mixed, while US and European markets closed modestly lower. US government bonds closed sharply higher after yesterday's market holiday, with most benchmark European government bonds also higher on the day. iTraxx and CDX indices closed wider across IG and high yield, with iTraxx-Xover underperforming CDX-NAHY. The US dollar and oil closed higher, while gold and silver were lower on the day. Q3 earnings season began today with some optimism evidenced by reports of sharp decreases to bank loan loss reserves, compared to the prior two quarters, for the first set of banks that reported.

Americas

- US equity markets closed lower today; Russell 2000 -0.7%, S&P 500/DJIA -0.6%, and Nasdaq -0.1%.

- 10yr US govt bonds closed -5bps/0.73% yield and 30yr bonds -7bps/1.51% yield.

- CDX-NAIG closed +2bps/55bps and CDX-NAHY +2bps/365bps.

- DXY US dollar index closed +0.5%/93.53.

- Gold closed -1.8%/$1,895 per ounce and silver -4.5%/$24.13 per ounce.

- Crude oil closed +2.0%/$40.20 per barrel.

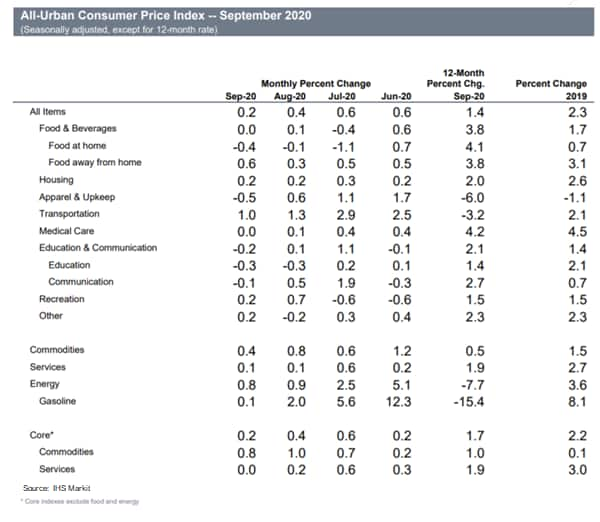

- US CPI rose 0.2% in September following larger increases during

each of the prior three months. During September, the CPI for

energy rose 0.8% while the food index was unchanged (0.0%). The

core CPI, which excludes the direct effects of movements in food

and energy prices, rose 0.2%. (IHS Markit Economists Ken Matheny

and Juan Turcios)

- Price declines in sectors that experienced plummeting demand owing to COVID-19 were partially reversed beginning in June. Some of those rebounds stalled in September. Price declines were recorded in September for some sectors impacted during the earlier stage of the pandemic, including for apparel (down 0.5%), lodging away from home (down 0.4%), motor vehicle insurance (down 3.5%), and airline fares (down 2.0%).

- Rent inflation continued to ease in recent months. Some landlords have agreed or been forced to accept lower rents. Rent of primary residence and owners' equivalent rent each rose just 0.1% in September following similar increases in August. Their 12-month rates of change have slowed substantially from 3.8% and 3.3% in February to 2.7% and 2.5% as of September, respectively.

- Despite monthly increases from June to August, trend inflation rates for the overall and core CPI remained below pre-COVID rates through September. Twelve-month increases for core and headline CPIs were 1.7% and 1.4%, respectively, in September, versus pre-pandemic rates of 2.4% and 2.3%.

- The CPI for used cars and trucks surged in recent months,

rising 15.1% (not annualized) from June to September to a nearly

19-year high. This index rose 6.7% in September, more than

accounting for the increase in the core CPI in September.

- JPMorgan Chase & Co. said Tuesday that third-quarter profit

rose 4% from a year ago, beating Wall Street estimates. Citigroup

Inc. too, delivered better-than-expected results. (WSJ)

- JPMorgan set aside $611 million for potential future loan losses, far less than expected and the $10.47 billion it booked in the second quarter.

- Citigroup set aside $2.26 billion, down from more than $7 billion in each of the past two quarters.

- Both banks were able to release some of their previous reserves.

- JPMorgan has nearly $34 billion set aside for potential losses. If the economy recovers apace, that might be $10 billion more than it needs, JPMorgan Chief Executive James Dimon said. In a double-dip recession, he said, the bank could need another $20 billion in reserves.

- US-based electric vehicle (EV) maker Tesla announced that it is going to release its 'Full Self-Driving (FSD) Beta' driving functionality to some of its customers who are "expert and careful drivers" in the third week of October, reports Electrek. CEO Elon Musk announced on microblogging site Twitter that "Limited FSD beta releasing on Tuesday next week, as promised. This will, at first, be limited to a small number of people who are expert & careful drivers." According the source, there was no further information available on upcoming software update for the broader fleet. In August, Elon Musk tweeted that, "The FSD improvement will come as a quantum leap, because it's a fundamental architectural rewrite, not an incremental tweak. I drive the bleeding edge alpha build in my car personally. Almost at zero interventions between home & work. Limited public release in 6 to 10 weeks." Beta releases help the manufacturer in reducing the impact on users, and often incorporates usability testing. In December 2020, Tesla said it is "very close" to developing fully autonomous vehicles (AVs) and expects to have basics of that technology within this year. Level 5 is the highest level of autonomy that enables the vehicle to operate itself in all scenarios with no human drivers required. (IHS Markit Automotive Mobility's Tarun Thakur)

- Hino Trucks has announced Project Z, its path to zero-emission Class 4 to Class 8 trucks in the US market, including plans for the production of zero-emission vehicle (ZEV) products prior to 2024. Through a virtual event, Hino showed a range of products leveraging technology from partners. Among them was a Class 5 Sea-Electric Sea-Drive 120a on a Hino M5 chassis and a Hino XL Series Class 8 tractor powered by Toyota's fuel-cell system. Hino also displayed a battery electric Class 7 tractor with the Hexagon Purus full electric drive system and a Hino XL Series Class 8 box truck powered by XOs Trucks' X-Pack battery and electric drive system. Hino's formal statement did not provide details of the specifications, but Trucking Info reported on the solutions shown. According to Trucking Info, the M5 truck has a gross vehicle weight (GVW) 19,500 pounds and is being tested by office supply company Staples in southern California, United States. The model has a Sea-Electric Sea-Drive 120a electric powertrain with 138-kWh batteries, developing 170 horsepower and 1,100 pound-feet of torque. Reportedly, Tony Fairweather, president of Sea-Electric, said that the pack can deliver 240 miles of range. He added, "But with a 5,000 to 6,000-pound payload and the air conditioning operating normally, it will travel about 150 miles." The XL8 box truck uses the XOs Trucks X-Pack modular battery and electric drive system and can be scaled. The demonstrator had a 10-battery system for about 250 miles of range. In the X-Pack system, each battery module is air cooled and has its own charging electronics, enabling a module to be removed quickly, rather than the entire pack having to be replaced. Reportedly, the Hexagon Purus System displayed in the Class 7 XL7 4x2 tractor had saddle-mounted 220-kWh battery packs in vibration-minimizing racks and used Alison Transmission's Gen Power 100D e-axle, with two traction motors capable of producing 400 kW (about 500 horsepower) continuously and a peak of 600 kW, and 33,000 pound-feet of torque. (IHS Markit AutoIntelligence's Stephanie Brinley)

- According to Guatemala's central bank, the Bank of Guatemala

(Banco de Guatemala), the Guatemalan economy contracted by 9.6%

year on year (y/y) in the second quarter of the year, driven by

declines in most economic sectors. Based on the quarterly data, as

well as IHS Markit's expectation that economic recovery will be

gradual through the rest of the year, we will make a downward

revision to our 2020 GDP forecast this month. (IHS Markit Economist

Lindsay Jagla)

- Recently published data by the central bank show that Guatemala's economy contracted by 9.6 % y/y. In quarterly terms, Guatemalan GDP contracted by 10.7% in the second quarter of 2020 following a 2.0% contraction in the first quarter.

- Like in many countries in 2020, the Guatemalan government has tried to slow the spread of the COVID-19 virus through various social-distancing measures, including curfews, shop closures, and restrictions on large gatherings. This has resulted in low internal demand, with public consumption declining by 9.7% quarter on quarter (q/q) as the economic slowdown lowered both consumer confidence and disposable income, and investment fell by 2.9% q/q as various business operations halted and investor sentiment declined.

- Imports fell by 18.8% primarily because of this contraction in domestic demand, as imports of consumer goods were affected. Low oil prices also played a role, reducing the cost of petroleum imports into Guatemala.

- Amid the economic shutdown, the Guatemalan government took some measures to provide fiscal stimulus to mitigate the economic downturn, while boosting spending on public health and efforts to combat the rising health emergency. Government consumption grew by 6.2% q/q, and we expect the fiscal deficit to be approximately -6.3% of GDP in 2020 and again in 2021.

- The global economic downturn has affected Guatemala's GDP, particularly through declining export demand. Economic decline among Guatemala's major trading partners, especially the United States (which receives more than 30% of Guatemala's exports) resulted in Guatemalan exports declining by 18.3% q/q.

- Most of the economic sectors on the supply side contracted, with the greatest quarterly declines in accommodation and food service (38.4%), transportation and storage (27.8%), education (19.9%), and electricity, water, and sanitation (17.7%). The only sectors that grew on quarterly terms were construction (7.0%), which still declined in yearly terms, and real estate (0.8%).

- After a strong few months, Uruguayan beef exports are facing headwinds in the US market, where two of the South American country's largest meat plants have been suspended by the USDA's Food Safety and Inspection Service (FSIS). Uruguayan beef exports rose steadily in the first seven months of this year to the point where more than 7,000 tons per month were being shipped in June and July. Shipments then fell back sharply - with volumes sliding to less than half this amount in September. Uruguay was then dealt a further blow as it emerged that FSIS had suspended imports from two of its largest meat plants - both owned by Athena Foods, a subsidiary of Brazilian beef giant, Minerva. The first suspension applied to Frigorifico Pul (Pulsa) and came into effect on August 20. This was then followed by the suspension of Frigorifico Carrasco on September 23. Local press reports suggest the suspensions were linked to E.Coli contamination. The reversals will come as a blow to Uruguay given the importance of the US as a buyer of high value grass-fed beef. A new study from Uruguay's National Meat Institute (INAC) shows that US consumers are willing to pay 70% more for grass-fed beef, like that produced by the South American country. The US is currently the third largest buyer of Uruguayan beef only behind China and the EU. Until 2019, Uruguay was able to profit from the exclusion of Argentina and Brazil from the US market for fresh beef. This advantage has now gone however as both the neighboring countries have since regained market access. Uruguay is also at a disadvantage to key rivals such as Mexico, Canada and Nicaragua - all of which enjoy duty-free access to the US market. Australia and New Zealand also benefit from having much larger tariff-rate quotas than that given to Uruguay. Australia can supply up to 433,000 tons free of tariffs, while New Zealand can supply 213,000 ton with an in-quota tariff of USD44 per ton. Neither of these quotas were filled in 2019. (IHS Markit Food and Agricultural Commodities' Max Green)

Europe/Middle East/Africa

- European equity markets closed lower across the region; Spain -1.1%, Germany -0.9%, Italy -0.8%, France -0.6%, and UK -0.5%.

- Most European govt bonds closed higher; UK -3bps, Germany/France/Italy -1bp, and Spain flat.

- iTraxx-Europe closed +1bp/52bps and iTraxx-Xover +10bps/317bps.

- Brent crude closed +1.7%/$42.45 per barrel.

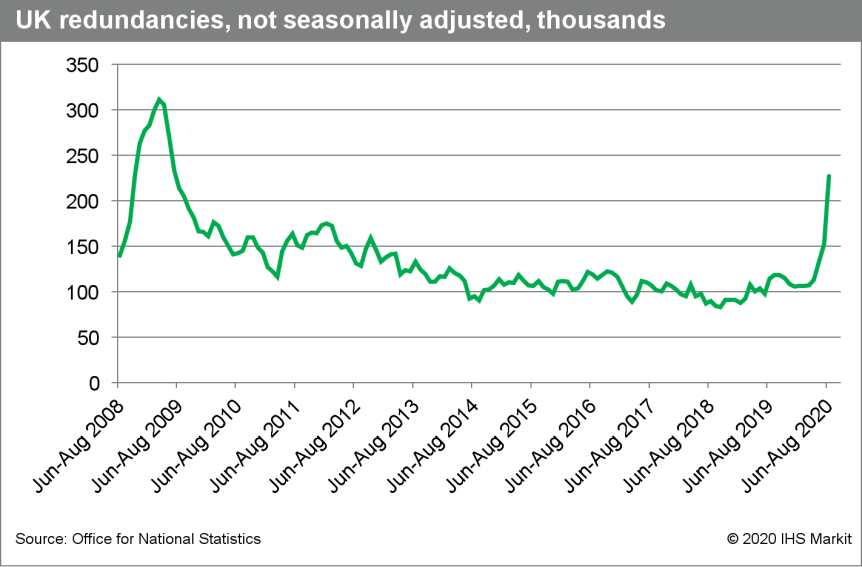

- According to the UK's Office for National Statistics (ONS), the

number of workers on payroll plunged by 629,000 over the 12-month

period. More encouragingly, the number of payrolled employees

increased by 0.1% in September - equivalent to 20,000 people. (IHS

Markit Economist Raj Badiani)

- The new release is based on experimental data of the number of employees on payroll using the HM Revenue and Customs' Pay As You Earn Real Time.

- The claimant count, which measures the number of people claiming benefit principally for being unemployed, was 2.7 million in September and represented an increase of 120.3%, or 1.5 million, since March. The claimant count also includes the increasing number of people becoming eligible for unemployment-related benefit support despite still being employed.

- According to the ONS, total UK employment (all aged 16 plus) shrunk by 153,000 to 32.591 million in the three months to August compared with the three months to May.

- In annual terms, the number of employed people in the three months to August was 0.3% lower compared with a year earlier.

- The number of unemployed people on the Labour Force Survey (LFS) or the International Labour Organization (ILO) measure increased by 138,000 in the three months to August, standing at 1.522 million. The unemployment rate increased to 4.5% in the three months to August, the highest level in more than three years.

- ONS Deputy National Statistician Jonathan Athow said, "Overall employment is down about half a million since the pandemic began and there are particular groups who seem to be most affected, young people in particular." He confirms that a large number of redundancies have taken place in the hospitality, travel, and recruitment sectors.

- Worryingly, the pace of redundancies is accelerating. Specifically, the number of redundancies increased by 114,000 to 227,000 in June-August compared with the three months to May. This was the highest level since May-July 2009.

- More encouragingly, the number of job vacancies continued to recover after falling sharply during the COVID-19 virus-related lockdown. Specifically, it rose by 144,000 to 488,000 in the three months to September compared with the record low in April-June. However, it had stood at 818,000 in the three months to February.

- Nominal wage developments were more positive. Average annual weekly earnings (total pay including bonuses) growth stood at 0% in the three months to August. In addition, regular pay (which excludes bonus payments) growth rose for the second time in 12 months, standing at 0.8% year on year (y/y) in the three months to August.

- However, total pay in real terms fell by an acute 0.8% y/y in the three months to August, which was the fifth successive drop on this measure.

- Despite the number of payrolled employees stabilizing in September and improved vacancies, we anticipate tougher labor market conditions in the next few quarters.

- The number of redundancies could rise notably in the latter

stages of 2020 and early 2021 after the introduction of tougher

local COVID-19 virus restrictions and the imminent end of the

furlough scheme.

- Nissan has announced that it is collaborating with partners on a new autonomous vehicle research project in the United Kingdom known as ServCity. According to a statement, the aim of the project is to "help cities solve how they can harness the latest autonomous vehicle technologies and successfully incorporate them into a complex urban environment." The project, which will take place over the next 30 months, will also involve the Connected Places Catapult, TRL, Hitachi, and the University of Nottingham (United Kingdom). The project will also benefit from funding from the UK government's Intelligent Mobility fund, which is administered by the Centre for Connected and Autonomous Vehicles (CCAV) and delivered by the UK's innovation agency, Innovate UK. ServCity appears to be following on from the HumanDrive project, which ended in February 2020. This tackled autonomous driving on country lanes and motorways, overcoming challenges such as roundabouts and country lanes with no markings, white lines, or curbs. It eventually saw a Nissan Leaf complete a 230-mile journey using autonomous technology between Nissan's European technical center in Cranfield to the automaker's factory in Sunderland, UK. The company said that the knowledge and experience gained in the HumanDrive project will contribute to the ServCity project, which, through a combination of test simulations, end-user experience research, and real-world trials, will provide information on how cities can exploit the potential of future mobility solutions and accelerate their deployment. (IHS Markit Automotive Mobility Ian Fletcher)

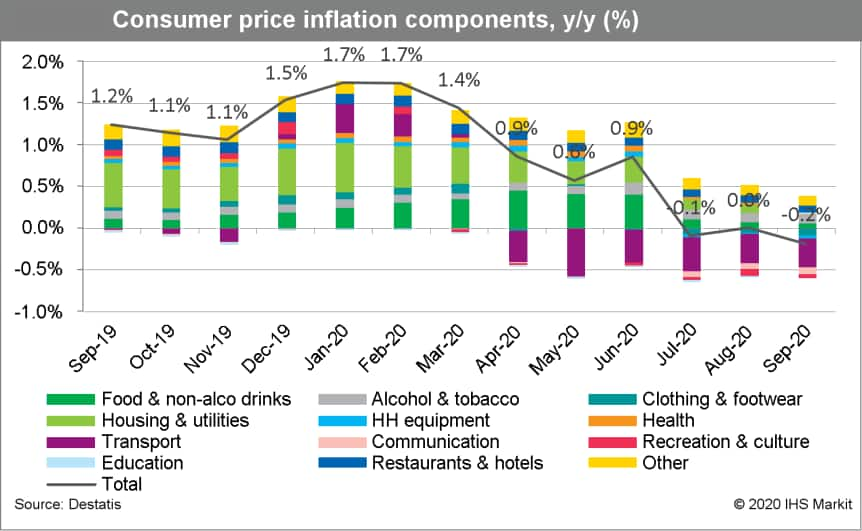

- Final September data based on national methodology from

Germany's Federal Statistical Office (FSO) have confirmed the

'flash' data released on 29 September, showing a month-on-month

(m/m) decline by 0.2% and a dip of the annual inflation rate from

0.0% in August to -0.2% in September. (IHS Markit Economist Timo

Klein)

- The EU-harmonised consumer price index (CPI) measure even declined by 0.4% m/m, depressing its annual rate from -0.1% to -0.4% Germany's harmonised inflation has thus moved marginally below the eurozone average again (-0.3%), with the spread between the two thus switching back from +0.1 percentage point in August to -0.1 point in September. If we remove the direct impact of Germany's VAT cut, the country's inflation is currently between 0.5 and 1.0 percentage point above that of the remainder of the eurozone.

- At 0.5% year on year (y/y), the CPI excluding food and energy as a measure of core inflation softened once more from 0.7% in August, which partly reflects a base effect. Nevertheless, this is almost a percentage point below the annual pace measured between mid-2019 and mid-2020, most of which reflects the VAT cut rather than the recession triggered by the pandemic.

- September's component breakdown reveals that energy had a moderate dampening impact in m/m terms (-0.7%), with its annual rate also slipping from -6.3% in August to -7.1% in September. The prices of housing and utilities (specifically household energy) had the largest dampening impact on the annual rate, followed by clothing and footwear, household equipment and furniture, and "miscellaneous goods and services". The only noteworthy offset of some weight to the upside was recreation and culture (which includes package tours).

- The FSO did not attempt to officially quantify possible effects from the VAT cut on measured inflation and only stated the obvious that this factor remains an important dampening influence on the y/y comparison.

- The split between goods and services show that goods deflation became more pronounced (its y/y rate was down from -1.3% in August to -1.7% in September), whereas service-sector inflation was steady at 1.0%.

- Average underlying inflation, which had been at around 1.2% during 2016-17 before firming to the 1.5% area during the last two years, will now remain around 0.5% throughout the second half of 2020 but rebound to above 1.0% in early 2021.

- Germany's headline inflation should remain in negative

territory during the remainder of 2020 but move broadly sideways

around -0.3%. It is expected to increase to 0.5-1.0% during

January-June 2021, when the original VAT rates are restored and

above 1.5% (to as much as 2.0%), as base effects from this year's

VAT cut kick in.

- The International logistics and freight company DB Schenker is about to add 36 more Fuso eCanter models to its fleet as it looks to further electrify its inner-city delivery fleet in Germany, according to a company statement. DB Schenker has already been using the FUSO eCanter in Berlin since 2018 delivering parcels in the city center. Since 2019, the company has added more vehicles in Paris, Frankfurt and the Stuttgart area. Hartmut Schick, President and CEO of Mitsubishi Fuso Truck and Bus Corporation said, "We are very happy to take our partnership with DB Schenker to the next level with these 36 locally emission-free FUSO eCanter trucks. Together, we are taking a further step in electrifying urban logistics, contributing to decreased noise and air pollution in major cities across eleven European countries. This announcement represents the biggest eCanter fleet deal to date and I would like to thank DB Schenker for their continued trust in FUSO on our shared mission towards CO2-neutral transportation." The eCanter was the world's first widely commercially available electric medium/heavy commercial vehicle, and DB Schenker has been an early adopter as it looks to electrify its inner-city delivery fleet. DB Schenker will use the all-electric light-duty trucks with an output of 129 kW and a payload of up to 3.2 tons to deliver to customers in inner-city locations in 20 European cities in Germany, Finland, Denmark, the UK, France, Ireland, the Netherlands, Norway, Austria, Spain, and Italy. The truck has a range of about 100km and is perfectly suited to a short inner-city journey duty cycle. (IHS Markit AutoIntelligence's Tim Urquhart)

- Daimler and Swiss reinsurance company Swiss Re have announced a joint venture (JV) that will help process the data generated by the autonomous vehicle technology to help insurers to quantify risk, according to a Reuters report. The two companies have established an entity called Movinx, which is based in Berlin; both parties will have a 50% stake. Pravina Ladva, Swiss Re's digital transformation officer said, "Even before cars come off the manufacturing line, we know the specific features and how that car would react in an emergency situation and we can provide a score to insurance partners to better underwrite the risk."Swiss Re already takes into account the number of advanced driver assistance systems (ADAS) fitted to a car, when pricing risk into premiums, while also looking at extra associated repair costs as a result of such technology being fitted to cars. While there are obvious privacy and data protection issues that need to be considered, many drivers already allow insurers to fit black boxes to their cars to monitor speed and other driving behaviors, so there is already a well-established precedent for insurers to access drivers and vehicle data. (IHS Markit AutoIntelligence's Tim Urquhart)

- The first of five floating semisubmersible foundations for the Kincardine floating offshore wind farm have been loaded out at Spanish fabricator Navantia's yard in Fene, Spain, and shipped to Rotterdam, The Netherlands, for the installation of the 9.5 MW turbines. Boskalis' heavy lift transporter Fjord will carry out the transportation for all the foundations. The assembly will then be towed to the wind farm site 15 km off the coast of the south-east coast of Kincardineshire, Scotland. Anchor-handler Boka Falcon will undertake the tow, and anchors and chain installations at site at water depths of around 60 to 80 meters. The foundation loaded out is the first of three completed foundations for the 50 MW wind farm, touted as the largest floating wind farm. The wind farm will comprise of five 9.5 MW and a single 2 MW turbine, which was installed and operational in 2018. The project is expected to be fully operational by the end of 2020. The Kincardine project is majority owned and developed by the Spain's COBRA Group. The company awarded the foundations fabrication contract in the first quarter of 2019 to joint-venture company Navantia-Windmar, with the works commencing in May 2019. Boskalis confirmed the transportation and installation contract in September 2020. The semisubmersible utilizes Principal Power's WindFloat design. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- According to all measures, on an annual basis Swedish headline

consumer price inflation dropped in September. The consumer price

index (CPI), which is the national definition, came in at 0.4% year

on year (y/y), down from 0.8% in August. According to the

EU-harmonised measure (HICP), inflation was 0.6% y/y, down from

1.0% in August. (IHS Markit Economist Daniel Kral)

- CPI at fixed interest rates (CPIF), which is the most closely watched indicator by the central bank, dropped to 0.3% y/y in September, which is 0.2 percentage point (pp) below the Riksbank's September forecast. CPIF excluding energy came in at 0.9% y/y, down from 1.4% in August and 0.3 pp below the Riksbank's September forecast.

- On an annual basis, fuel (-0.3 pp), recreation and culture (-0.3 pp), electricity (-0.2 pp), or package holidays (-0.2 pp) were the largest negative contributions to headline CPIF inflation. Conversely, rent (+0.2 pp) and restaurants (+0.2 pp) were the main positive contributors.

- On a monthly basis, CPIF increased by 0.1% month on month (m/m), compared with an increase of 0.5% m/m in September 2019. The main contribution to the monthly rate came from the prices of clothing, which added 0.3 pp to the headline rate. This was offset by lower prices for food (-0.2 pp), or package holidays (-0.2 pp).

- Inflation continues to be significantly below the Riksbank's target and latest forecast, although the central bank has remained on hold in the last monetary policy meeting. Inflation in the coming months is likely to continue to be muted and choppy.

- Based on the September monetary policy report, the repo rate is expected to remain unchanged throughout the forecast horizon. In the October forecast round, we have pushed back the first repo rate rise from mid-2024 to mid-2026, following a delay in the first policy rate rise in the eurozone to mid-2028.

Asia-Pacific

- APAC equity markets closed mixed today; Australia +1.0%, Japan +0.2%, India +0.1%, and Mainland China/South Korea flat.

- China's premium vehicle segment has witnessed a strong rebound

in the second and third quarters, after sales in the segment

contracted 28% year on year (y/y) in the first quarter amid the

coronavirus disease COVID-19 pandemic. (IHS Markit

AutoIntelligence's Abby Chun Tu)

- According to IHS Markit's forecasts, sales of premium vehicles in China increased 17.6% y/y to 896,829 units in the second quarter and are expected to grow 19% y/y to 938,664 units in the third quarter.

- Despite disruptions from the COVID-19 virus outbreak that suppressed auto demand in the first quarter of 2020, China's premium vehicle market is forecast to grow consistently through 2025.

- Automakers' latest premium-vehicle sales data for the first three quarters indicate robust growth in sales in the Chinese market. German premium brands remain leaders in terms of sales volume.

- In the first three quarters, Mercedes-Benz's deliveries in China rose by 8.3% y/y to over 569,689 units, setting a new record for the brand in the Chinese market. Mercedes-Benz's deliveries in the third quarter surged 23.4% y/y to 223,631 units.

- Sales of BMW, including the BMW and MINI brands, in China rose by 6.4% y/y to 559,681 units in the first three quarters and surged 31.1% y/y to 230,612 units in the third quarter.

- The strong sales in the third quarter make China the fastest-growing market for BMW, with the country contributing nearly 40% of the automaker's global sales.

- The city of Shenzhen is expected to play an increasingly

prominent role in leading the integration of the Greater Bay Area

thanks to the higher level of autonomy granted in carrying out

market-friendly reforms. (IHS Markit Economist Lei Yi)

- Mainland China issued a reform plan for 2020-25 on 11 October, aiming to further develop Shenzhen into a key pilot zone for socialism with Chinese characteristics—an idea first approved a year ago. Additionally, 2020 also marks the 40th anniversary of the establishment of southern China's first special economic zone.

- The plan divides the six-year development into three stages. In the first stage, a batch of major reforms will be introduced within 2020 to facilitate market-based allocation of production factors and improve the business and scientific innovation environments and the utilization of urban spaces. In the second stage, progress is to be made in institutional building and formulation of replicable systems for nationwide implementation by 2022. The third stage involves basically completing pilot reform tasks by 2025.

- In terms of market-based factor allocation, Shenzhen has been encouraged by the central government to explore reforms in land resource management on its own authority, allowing for mixed-use land for industrial and service development. The city will also establish a data platform for the Greater Bay Area and further research on data-related transactions; this may involve setting up a data exchange.

- With regard to further opening up to enhance the business environment, Shenzhen will build on the nationwide negative list to offer further expanded market access for investment in sectors like energy, telecommunication, public utilities, transportation, and education. Financial sector opening-up in Shenzhen will also be supported, including pilot policies for Chinese yuan "internationalization" and improving the foreign-exchange management system.

- Allowing more flexible land utilization could improve the land-use demand balance between the industrial sector and service sector, and to some extent help alleviate Shenzhen's residential land supply shortage. Among mainland China's four tier-1 cities, Shenzhen has the smallest land area amounting to about one-third of Shanghai's land area, or one-eighth of Beijing's. Additionally, according to the local housing and construction bureau in April, only 22.6% of development land in Shenzhen is allocated for residential development, compared with the national requirement of 25-40%.

- Chinese state-run enterprise Dongfang Electric Corporation (DEC) has won a bid to provide 200 MW of wind turbines to Fujian Energy Group's Changle Outer Sea Project. DEC will supply its newly developed 10 MW large capacity typhoon-proof wind turbines to the Changle Area C phase which will comprise an estimated 62 turbines generating 496 MW. This is the second batch of wind turbines and auxiliary equipment for the wind farm area. The Changle offshore wind farm is situated 31 to 50 km from shore, east of Changle, Fuzhou city, in water depths of around 37 to 45 meters. The Changle Area A has a capacity of 300 MW contributed by 40 turbines. All the foundations for Area C, and 15 of the foundations in Area A will be suction pile jackets. Earlier in August 2020, Dutch contractor SPT Offshore signed a cooperation agreement with China's Fujian Yongfu Power Engineering for the installation of the foundations. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- As per China's customs data, total coal imports in the country during September 2020 stood at 18.7mt, much lower than 30.3mt a year ago. As per IHS Markit's Commodities at Sea, total seaborne coal arrivals during the month are calculated at 14.1mt (with share of Australia at just 5.8mt). From Mongolia (via overland) during the reported month imports were at 4.7mt with most of it being metallurgical coal. Many cargoes especially of Australian origin are presently facing prolonged waiting times exceedingly more than 90 days at the Chinese ports and there were rumors that similar risks may get elevated further in the remaining months of this year, both for thermal as well as metallurgical coal of Australian origin. As of 12 October, a total of 8.7mt of coal tonnage is waiting to discharge with 6.4mt of Australian origin. Interesting out of 8.7mt waiting at anchorage, around 34percent is waiting for than 90+days. Chinese government's domestic infrastructure-led push has increased demand for both iron ore as well as metallurgical coal. To get adequate supplies of iron ore, China is heavily dependent on Australia; however, for metallurgical coal, the country is having option to switch to overland Mongolian coal. To increase the intake of Mongolian coal, China has significantly improved efficiency in customs clearance of arriving trucks via the Gashuunsukhait-Ganqmod border. During September as a result of efficient border clearance Mongolia was able to move more than 1000 truckloads from 865 truckloads/day in August. Truck movements from Shiveekhuren, Yarant, and Khangi border checkpoints have also resumed to the pre-coronavirus level. (IHS Markit Maritime & Trade's Rahul Kapoor and Pranay Shukla)

- Chinese automaker Guangzhou Automobile Group Company (GAC)

recorded an 15.6% year-on-year (y/y) increase in sales during

September to 218,042 units, according to a company statement. (IHS

Markit AutoIntelligence's Abby Chun Tu)

- Of this total, passenger car sales accounted for 217,727 units, up 15.6% y/y, while commercial vehicle (CV) sales reached 315 units, compared with 256 units in September 2019.

- On a year-to-date (YTD) basis, GAC's total sales are down 6.7 % y/y at 1.407 million units. Of this total, YTD sales of passenger cars stand at 1.405 million units, down 6.7% y/y, while YTD sales of commercial vehicles are down at 1,936 units, compared with 2,054 units in the same period last year.

- Among the group's joint ventures (JVs), Guangqi Honda ranked first with sales of 87,786 units in September, up 21.7% y/y, and 550,565 units in the YTD, down 5.7% y/y.

- Sales of GAC Toyota increased 24.6% y/y to 81,000 units in September and are up 9.5% y/y at 543,449 units in the YTD.

- GAC Mitsubishi Motors' sales plunged 38.9% y/y to 7,030 vehicles in September, with its YTD sales down 51.6% y/y at 46,711 units.

- Sales of GAC Fiat Chrysler Automobiles (FCA) tumbled 35.8% y/y to 3,862 units last month and have decreased 47.2% y/y to 27,675 units in the YTD.

- Sales of GAC's wholly owned brands totaled 38,049 units in September, up 35.8% y/y, and now stand at 236,831 units in the YTD, down 14.6% y/y.

- Toyota Motor, Hino Motors, Asahi Group Holdings, Seino Transportation, NEXT Logistics, and Yamato Transport have partnered to conduct on-the-road trials of heavy-duty fuel-cell electric trucks (FCETs). According to a Toyota company statement, the heavy-duty FCETs that will be developed are anticipated to have a target range of approximately 600 km. The objective is to meet high standards in both environmental performance and practicality as a commercial vehicle (CV). For the trials, Toyota will use these trucks to transport parts between Toyota plants in Aichi Prefecture and Toyota Tobishima Logistics Center. In March, Hino and Toyota announced that they have agreed to jointly develop a heavy-duty FCET. The two automakers aim to proceed with initiatives towards the vehicle's practical use through verification tests. The joint development initiative is part of CO2 emission reduction goals set by both automakers through to 2050. Toyota said that the goals can be achieved by addressing emissions from heavy-duty trucks as they account for 60% of total CO2 emissions from CVs in Japan. Toyota and Hino have positioned hydrogen as an important energy source for the future and have worked together on developing technologies and innovating fuel-cell vehicles for over 15 years since their joint demonstration trials of the fuel-cell bus in 2003. Toyota has been working on the development of fuel-cell electric trucks for several years, which includes carrying out tests using a truck from the PACCAR Kenworth brand as a base vehicle. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Jaguar India has revealed details of the upcoming I-PACE electric sport utility vehicle (SUV). According to the company's website, the I-PACE will come with a single 90-kWh battery with an all-wheel-drive (AWD) powertrain option and can accelerate from 0-100 km/h in 4.8 seconds. The maximum range of the model is claimed to be 480 km. The model will be available in the S, SE, and HSE variants, and will include features such as 19-inch diamond-cut alloy wheels, LED headlights and taillights, eight-way adjustable sports seats, and 'InControl' connected car technology. Buyers can also opt for extra equipment such as four-zone climate control, illuminated door-sill plates with the Jaguar logo, an ionizing air purifier with a PM2.5 filter, Jaguar Land Rover's (JLR)'s 'ClearSight' camera-based digital rear-view mirror, ambient interior lighting, wireless mobile charging, and an adaptive air suspension system. Jaguar is expected to launch the I-PACE by the end of this year in India. The launch of the I-PACE is part of Jaguar's intention to add around six electrified models in India in line with its global electrification plan. The automaker is also looking to upgrade some of the existing Land Rover-badged models with hybrid technology. It plans to introduce multiple products in India, from hybrid vehicles to battery electric vehicles (BEVs). The latest development also comes as the Indian government is supporting alternative powertrain vehicles through budgetary allocations for infrastructure setup and consumer subsidies. (IHS Markit AutoIntelligence's Isha Sharma)

- Ettifos has announced that it has signed a research collaboration agreement with Nanyang Technological University (NTU) in Singapore, which reinforces the research and development (R&D) partnership with NTU's Connected Smart Mobility (COSMO) Program. In a press release, Ettifos said that it would be working with NTU to create hybrid communication software, framework, and applications. The hybrid system includes both cellular vehicle-to-everything (C-V2X) and Dedicated Short Range Communication (DSRC) technologies. It will be validated on the V2X testbed infrastructure in the NTU Smart Campus. The COSMO program could allow Ettifos to establish itself as a major 5G Cellular + hybrid V2X Roadside Unit (RSU) and On-board Unit (OBU) distributor globally. It could also increase its capacity to manage and research V2X equipment management systems. The COSMO program enables participants to develop and test architecture and platforms allowing both V2X communication methodologies (DSRC and C-V2X). In October 2019, Ettifos jointly developed a software-defined radio (SDR) platform-based C-V2X solution with NXP. (IHS Markit Automotive Mobility's Jamal Amir)

- Vestas has won its ninth intertidal order in Vietnam with its recent announcement of seven V150-4.2 MW turbines for the Soc Trang 7 wind project. The company has reported winning more than 1 GW of new wind projects in the country to date. Vestas will supervise the installation of the turbines, and execute a 20-year Active Output Management 5000 (AOM 5000) service agreement designed to maximize energy production for the site. Vestas will also be providing a yield-based availability guarantee in the contract. The 29.4 MW Soc Trang 7 wind project is developed by Vietnamese developer Soc Trang Energy Joint Stock Company, a subsidiary of Xuan Cau Company Limited. The turbines will sit on customized towers placed on reinforced onshore foundations raised above sea level in the shallow intertidal range. The first phase of this wind farm comprises of seven wind turbines and an estimated investment of more than USD56.1 million. The project is expected to be completed in the third quarter of 2021. The second phase of the project is expected to kick-off in 2021 with a total capacity of 30 MW and an estimated cost of USD60.5 million. (IHS Markit Upstream Costs and Technology's Melvin Leong)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-october-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-october-2020.html&text=Daily+Global+Market+Summary+-+13+October+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-october-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 13 October 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-october-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+13+October+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-october-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}