Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 01, 2020

Daily Global Market Summary - 1 September 2020

Today's torrent of economic data releases out of Europe and APAC was received with mixed results across regions. US equity markets closed higher, with the S&P 500 and Nasdaq both breaking through to new record closes (again). APAC equity markets were mixed, while Germany was the only major European market to end the day higher. Benchmark government bonds closed higher across Europe/US and the iTraxx and CDX high yield credit indices closing noticeably tighter.

Americas

- US equity markets closed higher across the region; Nasdaq +1.4%, Russell 2000 +1.1%, and S&P 500/DJIA +0.8%.

- 10yr US govt bonds closed -3bps/0.68% yield and 30yr bonds -5bps/1.43% yield.

- CDX-NAIG closed -3bps/62bps and CDX-NAHY -14bps/352bps.

- Gold closed flat/$1,978 per ounce.

- California reported 3,712 new virus cases, the lowest daily tally since mid-June. The increase was less than the 14-day average of 5,366 and reflects ongoing improvement in the state, where average daily infections exceeded 9,000 a month ago. The average rate of positive tests over the past 14 days was stable at 5.3%, according to state health data. Hospitalizations from the virus decreased 0.7% to 3,849 patients, also the lowest since June. (Bloomberg)

- Crude oil closed +0.4%/$42.76 per barrel.

- In a press release, Obsidian Energy Ltd. announced a formal non-binding business combination proposal to Bonterra Energy Corp. in a stock offer valued at C$482.4 million ($368.2 million). Under the proposal, Obsidian is prepared to offer 2 common shares for each Bonterra share. Based on 33.8 million shares outstanding and Obsidian's closing price on 28 August 2020, the total equity offer value is C$35.4 million ($27.9 million) or C$1.06 per share. The total transaction value includes the assumption of Bonterra's 30 June 2020 working capital deficit of C$299.5 million ($228.6 million) and C$147.5 million ($112.6 million) of long-term liabilities. Obsidian expects a response to its proposal as soon as possible, but on or before 4 September 2020. Bonterra shareholders will own approximately 48% of the combined company. The parties had been engaged in periodic discussions on a potential friendly business combination transaction since January 2019. Obsidian expects the merger to generate significant cost synergies that would drive very substantial accretion across all financial metrics. Bonterra's net proved reserves were 73.53 MMboe (66% liquids, 47% developed) and 2P reserves were 90.33 MMboe (66% liquids) at year-end 2019, and its net (after an applied 20% royalty) production averaged 8,145 boe/d (65% liquids) during the second quarter of 2020. Bonterra Energy is a TSX-listed conventional oil and gas company focused on the Alberta Pembina and Willesden Green Cardium light oil areas, with Shaunavon properties in the Saskatchewan Chambery field and other producing assets in British Columbia. The company is based in Calgary, Alberta. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

- Monthly GDP rose 1.9% in July following materially larger increases in May (4.6%) and June (5.7%). Nearly two-thirds of the increase in July was accounted for by nonfarm inventories; a slight accumulation in July followed a sharp paring in June. Other contributors included personal consumption expenditures and nonresidential fixed investment. The level of GDP in July was 32.6% above the second-quarter average at an annual rate. Implicit in our latest tracking forecast of 28.7% annualized GDP growth in the third quarter are moderate declines in monthly GDP in August and September. High-frequency indicators consistent with declining activity include small-business revenues (Opportunity Insight), which have been trending lower since early July and the Weekly Economic Index (New York Fed), which, as of last week, suggests less third-quarter growth than we forecast. (IHS Markit's US Macroeconomics Team)

- The seasonally adjusted IHS Markit final U.S. Manufacturing

Purchasing Managers' Index (PMI) posted 53.1 in August, down

slightly from the previously released 'flash' estimate of 53.6, but

up from 50.9 at the start of the third quarter. (IHS Markit

Economist Chris Williamson)

- The upturn in operating conditions was only the second in as many months, following the easing of COVID-19 restrictions and the reopening of large sections of the manufacturing sector.

- Overall growth was solid and the sharpest since January 2019.

- Contributing to the overall expansion was a faster increase in new order inflows in August. The rate of growth was solid and the steepest since the start of 2019.

- Firms often linked the rise in new sales to stronger client demand and increased marketing.

- New export orders also picked up, as companies registered the first upturn in foreign client demand in 2020 so far. Moreover, the pace of increase was the quickest in four years.

- Reflecting strengthened demand conditions, manufacturers recorded a steeper pace of output growth. The upturn was the quickest since November 2019.

- At the same time, goods producers expanded their workforce numbers for the first time since February.

- ISM's Business Manufacturing PMI came in better than expected at 56.0 versus 55.0 consensus.

- Total US construction spending rose 0.1% in July, splitting the

difference between our assumption of a decline and the consensus

expectation for an increase. (IHS Markit Economists Ben Herzon and

Lawrence Nelson)

- Core construction spending, which directly enters our GDP tracking, rose 0.2% in July following declines over May and June that were revised to be smaller declines.

- The upward revisions to core (and total) construction spending along with unexpected strength in July alter the recent monthly profile enough to suggest that construction activity may be at a trough that is both higher and earlier than we previously anticipated.

- Private residential construction spending rose 2.1% in July following declines over the prior four months. Going forward, we expect recent strength (through July) in single-family housing permits and indications of continued strength in residential housing markets into August (including robust homebuilder sentiment and elevated mortgage applications for home purchases) to pull private residential construction spending higher.

- Private nonresidential construction spending declined 1.0% in July and has been trending lower since February. Credit standards for approval of construction and land development loans have tightened considerably over the last six months, suggesting that private nonresidential construction could continue to languish in coming months.

- State and local construction spending declined 1.5% in July. Tightening state and local budgets will weigh on this sector in coming months.

- On balance, we expect construction spending to trend sideways in the near term.

- Hurricane Laura left most of the US Gulf Coast unscathed, but Lake Charles, Louisiana, was hit hard, and petrochemical production units in the area could be offline for weeks. Producers with assets there include Sasol, Westlake Chemical, Lotte Chemical, and LyondellBasell. Products affected include polyolefins, ethylene glycol, vinyls, and chlor-alkali. The Lake Charles area is home to 9% of US linear low-density polyethylene (LLDPE) capacity (by way of Sasol and Westlake Chemical), 10% of US low-density polyethylene (LDPE) capacity (Westlake), and 8% of US polypropylene (PP) capacity (LyondellBasell). All of this capacity is believed to be offline. On 31 August, Sasol declared force majeure on LLDPE and high-density polyethylene (HDPE) produced at its joint-venture site with Ineos in La Porte, Texas. Ineos also has force majeures in place for polyethylene, and Ineos, Formosa Plastics, and LyondellBasell have force majeures for PP. Sasol says that manufacturing at its Lake Charles Chemicals Complex (LCCC) remains shut down. "The storm resulted in widespread electrical blackouts and other damage, preventing Sasol from operating most utility systems," says a statement from the company. "High voltage transmission line corridors into the Lake Charles area are damaged, and the full assessment is still in progress by a local power company." The company says cooling towers at the facility suffered wind damage, but process equipment at the facility does not appear to have been affected, nor has flooding been an issue.

- The world's number one soft drinks company Coca-Cola has announced a reorganization of its global businesses. The nine new operating units will replace the current 17 business units and groups. These units will be highly interconnected, with more consistency in structure and a focus on eliminating duplication of resources and scaling new products more quickly. Coca-Cola is undergoing a portfolio rationalization process which will lead to a tailored collection of global, regional and local brands with the potential for greater growth. The five global categories are: 1. Coca-Cola; 2. Sparkling Flavors; 3. Hydration, Sports, Coffee and Tea; 4. Nutrition, Juice, Milk and Plant; 5. Emerging Categories. Coca-Cola has decided to create a new unit called Platform Services, which will work in service of operating units, categories and functions to create efficiencies and deliver capabilities at scale across the globe. This will include data management, consumer analytics, digital commerce and social/digital hubs. This will eliminate duplication of efforts across the company and is built to work in partnership with bottlers. The company's overall global severance programs are expected to incur expenses ranging from approximately USD350 million to USD550 million. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- US regulator the National Highway Traffic Safety Administration (NHTSA) has officially delayed the introduction of a rule requiring a minimum level of sound to be made by electric vehicles (EVs) during their operation. The regulation will now come into effect on 1 March 2021, instead of 1 September 2020 as previously planned. According to a document published by the NHTSA, the delay is in response to requests from automakers' lobby group the Alliance of Automotive Innovation. The NHTSA states that the Alliance's petition requested three changes to the phase-in period of the new rule and the compliance requirements. The rule began to be phased in on 1 September 2019 and this period was due to be completed by 1 September 2020. The alliance requested a 12-month extension of the phase-in period, as a result of the conditions of the COVID-19 pandemic; however, the NHTSA has granted only a six-month extension. The alliance also requested an alternative performance option during the phase-in period, a request that was denied. As with the agency's other rules and notices, the NHTSA will accept comments for 15 days after the ruling is published in the US Federal Register. The NHTSA's ruling acknowledges that the production shutdown related to the COVID-19 pandemic "decimated" automotive supply chains and "prevented automakers from acquiring new parts, implementing vehicle redesigns, and manufacturing automobiles". (IHS Markit AutoIntelligence's Stephanie Brinley)

- Waymo has selected a new facility in Dallas (Texas, United States) as a hub to test its fleet of autonomous trucks, reports FreightWaves. The company recently stated that it has started deploying a fleet of 13 autonomous Peterbilt trucks on the I-10, I-20, and I-45 interstate highways in Texas. Julianne McGoldrick, Waymo's spokesperson, said, "Operating in a major freight hub environment like Dallas, we can test our Waymo Driver on highly dense highways and shipper lanes, further understand how other truck and passenger car drivers behave on these routes, and continue to refine the way our Waymo driver reacts and responds in this busy driving region. It also enables us to further advance our weather testing in a diverse set of environments." Waymo joins a list of tech companies conducting autonomous vehicle (AV) operations in Dallas including Aurora, Nuro, Kodiak Robotics, and TuSimple. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Electric vehicle (EV) startup Bollinger continues to expand its planned commercial vehicle fleet solutions, revealing the Deliver-E electric van concept, designed for delivery and medium-duty truck fleets. The company is aiming for production of the electric van to begin in 2022. The Deliver-E van is designed specifically for the delivery market, with Bollinger planning to engineer the van to fit Classes 2B, 3, 4, and 5. The company says that the van's total cost of ownership (TCO) in each class will be "significantly" lower than that of gasoline (petrol) or diesel engine vehicles in the market today. Bollinger says the van will have battery packs of 70, 105, 140, 175 and 210 kWh and various wheelbase lengths, so that "the fleet customer will have a wide array of mileage range and price options to fit their specific needs". Bollinger says the Deliver-E will have the same major components as the company's other vehicles, including motors, battery, inverters, and gearboxes. However, Bollinger says that the van is based on a new platform created to address the specific needs of delivery vans. The Deliver-E will have fast charging capability of up to 100 kW DC, and it is planned to be a front-wheel-drive vehicle with a low, 18-inch load floor. Bollinger says the van will have hydraulic steering and brakes, and anti-lock brakes, traction control and stability control, and independent front and rear suspension as standard. Bollinger has made several announcements in 2020 as it moves closer to beginning production, and reports in late August suggested it is moving closer to announcing a third-party manufacturer. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The Central Bank of Colombia (Banco de la República: Banrep)

voted on 31 August to cut interest rates from 2.25% to 2.00%. The

bank has cut interest rates by 225 basis points since the beginning

of 2020; IHS Markit assesses that this will be the last rate cut

and that rates will remain at 2% through 2021 and much of 2022.

(IHS Markit Economist Ellie Vorhaben)

- Among many variables, the central bank is most concerned about inflation, labor market conditions, and financial conditions. In terms of price pressure, Colombia's inflation is very low, falling below 2% in July for the first time since 2013, by reaching 1.97%. Expectations are below the central bank's target of 3% for year-end 2021, at 2.87%.

- In July, employment numbers improved for the first time during 2020. Although IHS Markit agrees with the central bank that the worst of the economic contraction and its impact on the labor market passed in the second quarter, July's data mean that there are still 4.95 million fewer employed individuals than there were at the end of 2019. The national unemployment rate averaged 20.5% in July and the bank writes that wages are falling, which means that private consumption will remain weak.

- As it did during the last monetary policy meeting, Banrep notes that financial markets are improving and that high liquidity levels are reducing sovereign risk premiums. Colombia is a member of the OECD, has access to an USD11.4-billion flexible line of credit with the International Monetary Fund (IMF), and has an investment grade sovereign risk rating, all of which lower financing costs and support the financial system.

- IHS Markit assesses that inflation will not reach the central bank's target until late 2021, while unemployment will decline in 2021; however, it will remain high at an average of 13.4%. Foreign-exchange reserves will remain more than sufficient over the short term, in the absence of any unexpected shocks.

Europe/Middle East/Africa

- Most European equity markets closed lower except for Germany +0.2%; UK -1.7% and France/Italy/Spain -0.2%.

- 10yr European govt bonds closed higher across the region; Italy -5bps and Spain/UK/France/Germany -2bps.

- iTraxx-Europe closed -2bps/52bps and iTraxx-Xover -11bps/311bps.

- Brent crude closed +0.7%/$45.58 per barrel.

- The unemployment rate in the eurozone rose from 7.7% in June to

7.9% in July, in line with market consensus expectations (based on

Reuters' survey) once the marginal downward revision to June's rate

has been accounted for. (IHS Markit Economist Ken Wattret)

- This leaves the eurozone's unemployment rate just 0.7 percentage point higher than its pre-COVID-19-virus cycle low of 7.2% in February, although we expect much larger increases going forward.

- The level of unemployment in the eurozone rose by 344,000 in July, following a similar increase in June, with both increases surpassing the biggest monthly gains during the eurozone crisis from 2011-12. However, the magnitude of the recent increases remains far below the peak month-on-month (m/m) rise of 637,000 at the height of the global financial crisis (GFC).

- Unemployment rates across the eurozone member states have been rather volatile since the onset of the COVID-19 virus and have been subject to large revisions. Some of the member states, including France and Italy, experienced a sharp fall initially, reflecting the exclusion of those not considered to be actively seeking work.

- Eurozone HICP inflation in the eurozone surprised massively to

the downside in August's flash estimate, dropping from 0.4% to

-0.2%, well below the market consensus expectation of 0.2% (taken

from the Reuters poll). (IHS Markit Economist Ken Wattret)

- The headline inflation rate fell below zero for the first time since May and unusually, this was not due to swings in energy prices. Rather, the recent gradual upward pressure on the inflation rate for energy continued (from -8.4% to -7.8% y/y), reflecting the lagged impact of higher oil prices and base effects.

- The key reason for the major surprise in August's HICP release was the magnitude of the falls in underlying inflation rates. The rate excluding food, energy, alcohol and tobacco prices, for example, plunged from 1.2% in July to just 0.4% in August, a record low.

- We had expected that July's record acceleration in non-energy industrial goods inflation would reverse in August, which indeed it did. The y/y rate plunged from 1.6% to -0.1%, below the average rate of 0.2% between April and June. The recent volatility reflects delays to the timing of seasonal price reductions and what looks like unusually aggressive discounting in some items.

- At the same time, services inflation decelerated again in August, from 0.9% to just 0.7%, also a record low. National details already released suggest that weakness in the HICP items hit hardest by the effects of COVID-19 virus such as recreation and culture prices, continued to weigh.

- Unprocessed food prices also contributed to the negative headline inflation rate in August, with the y/y rate of 2.3% well down on April's 7.6% peak.

- The European Fund and Asset Management Association (EFAMA) was reported by the Financial Times (FT) on 31 August to have written to EU regulatory bodies requesting a delay to recent guidelines regarding ESG disclosures by asset managers. The sensitivity relates to EU requirements for fund managers to collect and disclose to investors the environmental, social and governance risks contained within their asset portfolios from March 2021. The trade association reportedly describes this timetable as "unrealistic [and] clearly not feasible for …an entirely new and complex legal framework", arguing that companies "seem unaware of the new regulatory requirements": as a result they "do not possess the necessary data". EFAMA also expressed concern that asset managers will face a bottleneck when rushing to obtain pre-deadline regulatory approval for updated disclosures. It has called for a delay until at least January 2022. EFAMA represents the European asset management community, covering 28 member associations. It flags that European entities managed EUR17.8 billion in assets at end-2019, through 34,200 UCITS (undertakings for collective investments in transferrable securities) and 29,000 AIF (alternative investment funds). Its request represents a test of EU policy flexibility. While some modest leeway may be granted since many firms are facing severe operational difficulties due to the coronavirus disease 2019 (COVID-19) virus pandemic, we expect only limited regulatory flexibility. (IHS Markit Economist Brian Lawson)

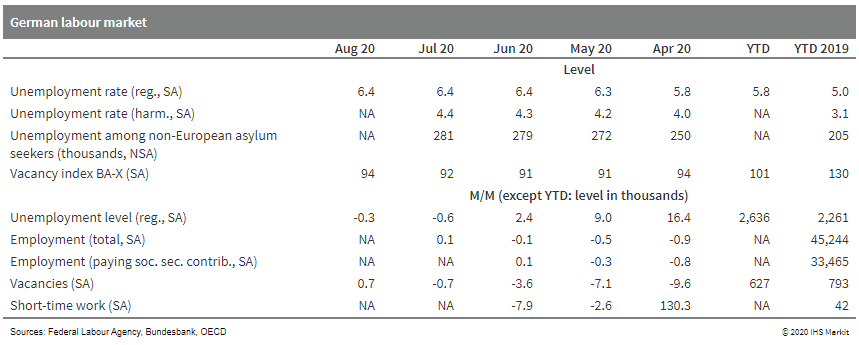

- Seasonally adjusted German unemployment declined by 9,000 in

August, its second consecutive dip after -17,000 in July. The

August decline could have been larger if it were not for an

unusually high number of school leavers that registered for

unemployment quite late because of a delayed end of their school

year owing to the fallout from the pandemic. (IHS Markit Economist

Timo Klein)

- The unemployment level at the end of August was 2.915 million, compared with a cyclical low of 2.264 million in March.

- Separately, the Labor Agency reported that there was virtually no additional COVID-19-virus effect on unemployment during July and August (-3,000 and +2,000, respectively), in contrast with 60,000 in June, 197,000 in May, and 381,000 in April.

- The German unemployment situation has now stabilized at levels last observed in mid-2015, as the unemployment rate increased from 5.0% in March (close to 40-year lows) to 6.4% during June-August.

- Seasonally adjusted underemployment (as opposed to unemployment) - which alternated between outperforming and underperforming changes in unemployment during 2019 depending on fluctuations in the number of people receiving some form of (non-insurance related) government support, which affect the underemployment data but not official unemployment - increased by 11,000 month on month (m/m) in August. These data are worse than headline unemployment numbers owing to a declining number of people benefitting from public support measures (-15.6% year on year [y/y] in August, down from July's -12.3% and contrasting sharply with +1.9% y/y back in March). This is technically induced, as the COVID-19 virus-related restrictions and the surge in short-time work applications have left little room to process support measures such as trainings.

- The setback to the multi-year upward trend for employment has

halted for now. In July (employment data lag unemployment numbers

by one month), seasonally adjusted employment rebounded by 53,000,

following June's decline of 34,000 and a cumulative plunge by

700,000 during March-May. This contrasts with an average monthly

increase of 21,000 during 2019 and even of 40,000 during the

cyclical upward trend between March 2010 and the end of 2018.

- German automotive light specialist Hella is looking to spin off its driver assistance software unit, according to a Bloomberg report. The company is working with financial advisers on the sale which it hopes will net a figure in the region of several hundred million euros. However, no final decision has been made on the sale and no interested parties have been linked with the acquisition. The Hella Aglaia Mobile Vision GmbH unit makes embedded software systems used for assisted driving functions as well as autonomous cars. The company's automated vehicle technology offering is interesting, as unlike rival offerings from Mobileye, which sells integrated solutions with hardware and software packaged together, Aglaia's software is designed to be paired with chips, cameras and sensors made by other companies. The unit may attract interest from automotive suppliers, carmakers investing in autonomous vehicle operation and technology companies, according to those close to discussions regarding the potential sale. (IHS Markit AutoIntelligence's Tim Urquhart)

- Nestlé Health Science (NHSc), part of consumer goods company Nestlé (Switzerland), has entered into a definitive agreement to acquire Aimmune Therapeutics (US) for USD34.50 per share, a 174% premium to Aimmune's closing price on 28 August 2020. The all-cash transaction values the company at USD2.6 billion. The acquisition was unanimously approved by the Board of Directors of Aimmune, although Greg Behar, CEO of NHSc and an Aimmune director, abstained from voting because of his involvement with both companies. The transaction will be completed in the fourth quarter of 2020, pending customary closing conditions including the tender of a majority of outstanding Aimmune shares. With this acquisition, Nestlé will gain access to Palforzia (Peanut [Arachis hypogaea] Allergen Powder-dnfp), the first food allergy treatment with transformative potential for the lives of millions of people with peanut allergies. Palforiza is an oral immunotherapy that was recently approved by the US FDA for the mitigation of allergic reactions because of peanut allergies in patients aged four and older. (IHS Markit Life Science's Margaret Labban)

- ISTAT estimates that the Italian economy shrunk by 12.8%

quarter on quarter (q/q) in the second quarter, revised downwards

from the initially reported 12.4% q/q drop in the 'flash' release.

(IHS Markit Economist Raj Badiani)

- In annual terms, the economy shrunk by 17.7% year on year (y/y) and 5.6% y/y in the second and first quarters, respectively.

- This is broadly in line with our second-quarter assessment in our July update, when we estimated that real GDP shrank by 13.0% q/q and 17.8% year on year (y/y).

- In addition, it implies that Italy remains in a technical recession (defined as two successive quarters of q/q decline) after it contracted by 5.5% q/q in early 2020 and 0.2% q/q in the fourth quarter of 2019.

- Saipem has signed into a Memorandum of Understanding (MOU) with AGNES and QINT'X for the development of a wind farm off the coast of Ravenna, Italy, in the Adriatic Sea. The project will involve the installation of around 56 turbines on fixed offshore foundations at two different sites. One of the locations will be more than 8 nautical miles (14.8 km) from shore while the other will be more than 12 miles (22 km) from shore. The project's total power capacity is estimated to be around 450 MW. Innovative technologies, like a floating solar technology, based on Moss Maritime's technology, which is a part of Saipem's XSIGHT division will be utilized in the project as an integrated solutions development. AGNES is a company that develops renewable energy projects in the Adriatic Sea, in particular offshore and nearshore wind farms, floating solar panels, energy storage systems and hydrogen production from renewable sources. QINT'X is an Italian company specializing in renewable energy: solar, wind and hydroelectric energy; and electric vehicles. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- Cavonix has selected LeddarTech's Leddar Pixell Cocoon LiDAR sensor for its autonomous shuttles and off-road trucks, according to a company statement. Cavonix said LeddarTech's technology will enable it to deliver enhanced safety for its customers. LeddarTech claims that its Cocoon LiDAR is designed to create a 360-degree cocoon to provide enhanced collision prevention in autonomous vehicles (AVs). Frantz Saintellemy, president and COO of LeddarTech, said, "We are honored that our LiDAR solutions were selected and trusted by Cavonix to support its autonomous shuttle and off-road trucking customers. What Cavonix has been able to achieve in a relatively short period is impressive, and we look forward to their future developments using LeddarTech technologies. Making mobility applications safer is at the core of our strategy. Our technology offers the right balance of performance and cost-effectiveness and is ready for deployment today." Cavonix is a UK-based startup that focuses on developing autonomous control systems for vehicle manufacturers and technology companies. The company specializes in mobile autonomy, navigation, and perception for the development of AVs. To achieve this, Cavonix has developed three business functions that includes real-time software for control of connected AVs, CAVLab; sensor fusion system that enables vehicles to navigate in controlled environments, CavSense; and fleet management telemetry system, CavTrak. LeddarTech develops high-performance, low-cost LiDAR solutions for advanced driver assistance system (ADAS) and AV operation applications. LiDAR sensors are necessary for AV operation as they measure distance via pulses of laser light and generate 3D maps of the world around them. Recently, LeddarTech opened a new research and development facility in Toronto, Canada, for developing its solid-state LiDAR platform. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Car finance applications in the United Kingdom grew strongly during July and August, according to the latest data published by credit-check firm Experian. According to a company statement, applications for both personal contract purchase (PCP) and hire purchase (HP) agreements grew by 27.7% year on year (y/y) during July, plus a further increase of 18.6% y/y in the first three weeks of August. The company also stated that the deficit of 390,000 applications seen up to 1 June in 2020 due to the lockdown measures to control the COVID-19 virus outbreak has now been reduced to 234,000 applications. The data released by Experian reflects the recent shift in passenger car demand seen after the market collapsed in March, April, and May as a result of the decision to close dealerships as part of the government's measures to prevent the spread of the COVID-19 virus. During these months, Experian saw the number of applications for checks drop by 18.4% y/y, 82.1% y/y, and 57.4% y/y, respectively. The latest uplift in applications, which began in June with a 13.4% y/y increase, seems to be borne out in the registration data, with July seeing an uplift of around 11% y/y (see United Kingdom: 5 August 2020: UK passenger car registrations grow 11% y/y in July as dealers reopen). With August typically such a weak month for demand, it is highly possible that there could be another month of growth. However, we will have to wait until September for a true picture of the health of the UK passenger car market, as this is one of the two biggest volume months for the market thanks to the age-related number-plate change. (IHS Markit AutoIntelligence's Ian Fletcher)

- Declines have returned to the French passenger car market in

August as more changes were made to the government-backed

incentives available at the beginning of the month. According to

data published by the French Automobile Manufacturers' Committee

(Comité des Constructeurs Français d'Automobiles: CCFA),

registrations have dropped by 19.8% year on year (y/y) to 103,631

units this month. There was no benefit from working day factors.

(IHS Markit AutoIntelligence's Ian Fletcher)

- The latest decline means that the market has fallen by 32% y/y to 998,409 units during the first eight months of 2020.

- From an OEM perspective, the situation has been very mixed. Groupe PSA led the way in terms of volume with 34,268 units.

- Despite recording a further fall, this rate of decline has been slower than the market as a whole at 8.4% y/y.

- Helping it to achieve these only modest declines has been its leading Peugeot brand which slipped by 3.5% y/y to 18,997 units, while Opel has also seen a relatively small 3.7% y/y retreat to 3,188 units.

- Citroën has contracted by 13.3% y/y to 11,190 units while DS Automobiles has tumbled by 40.5% y/y to 893 units.

- Renault Group's falls have been in line with the market as a whole, retreating by 20% y/y to 21,724 units. The main reason for this has been a 24.4% y/y fall suffered by the Renault brand to 14,158 units, while Dacia slid by just 6.4% y/y to 7,538 units.

- Alpine's registrations collapsed by 92.8% y/y to just 28 units.

- It was also a very mixed performance for the non-domestic OEMs. Volkswagen (VW) Group led the way in terms of registrations with 11,704 units, but fell 35% y/y. The biggest drag has stemmed from the VW brand; its sales dropped by 50.2% y/y to 4,251 units. Its other core brands suffered a decrease of around one-fifth, with Audi down by 21.5% y/y to 2,990 units, SEAT declining by 22% y/y to 2,306 units, and Skoda retreating by 21.4% y/y to 1,900 units. Its sports and luxury brands fared little better.

- According to the detailed release, in the second quarter of

2020 the Danish economy contracted by 6.9% quarter on quarter (q/q)

or 8.2% year on year (y/y). This is slightly better than the flash

estimate of a drop of 7.4% q/q. First-quarter GDP remained

unchanged with a contraction of 2.0% q/q or 0.1% y/y. (IHS Markit

Economist Daniel Kral)

- The detailed breakdown shows that household consumption was the main drag, dropping by 7.2% q/q. This is the result of households significantly changing their behavior and cutting back on spending at a record pace as a result of the pandemic.

- Net exports were also a drag, as exports of goods and services declined by 14.1% q/q, while imports by 13.8% q/q. This is better export performance than many other small West European economies, due to Denmark's specialization in non-cyclical industries, including pharmaceuticals.

- Fixed investment and government consumption were a drag, declining by 7.0% and 1.5% q/q, respectively. Inventories were the only sub-category contributing positively to headline growth.

- Denmark was among the first European countries to go into lockdown and come out of it. According to high frequency indicators and real-time activity trackers, the recovery has gained momentum from May, remaining strong throughout June-August.

- According to our August forecast, we expect a strong bounce-back in the third quarter that will gradually fade in the coming quarters. For the full year, we expect GDP to drop by just over 5%, much better than the eurozone.

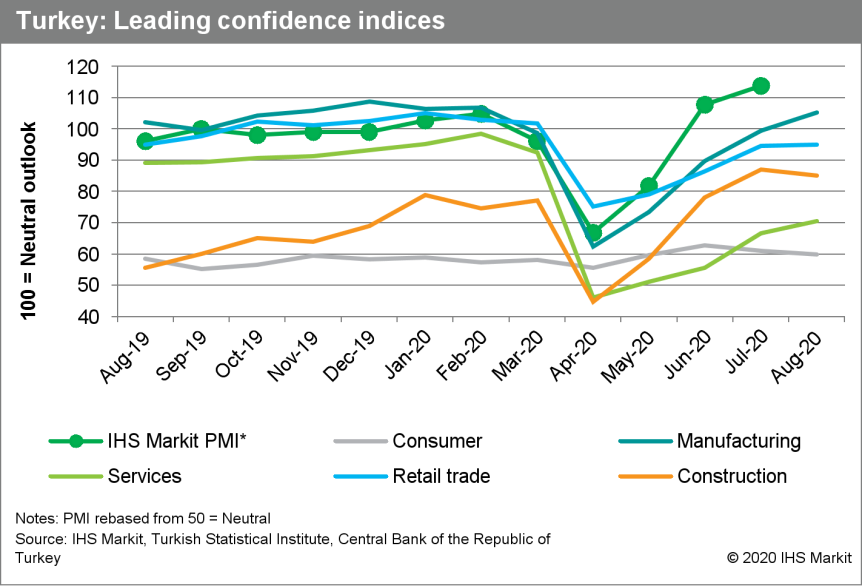

- In the second quarter of 2020, Turkish GDP dropped by 9.9% y/y

according to data from the Turkish Statistical Institute

(TurkStat). In seasonally adjusted data, the economy shrank by

11.0% quarter on quarter (q/q). (IHS Markit Economist Andrew Birch)

- With the seasonal, q/q loss in April-June 2020, Turkey officially entered into a recession - two consecutive quarters of loss - after GDP had slipped 0.1% q/q in the first quarter. The economy in 2019 had just emerged from a recession over the final two quarters of 2018, triggered by the lira collapse that year and officials' efforts to stabilize the currency.

- As mentioned, though economic losses were severe in domestic demand, the evaporation of exports of goods and services was, by far, the biggest headwind to overall economic activity in the second quarter. Total exports in April-June 2020 were down by around one-third in real terms both as compared to a year earlier and to the previous quarter, in seasonally adjusted terms.

- The spread of the COVID-19 virus devastated demand from Turkey's primary export partner, the European Union. While the spread of COVID-19 also had a direct negative impact on Turkish domestic demand, lost export earnings hurt the economy more than anything else in the second quarter.

- Continued, expansionary economic policies throughout the second quarter moderated the decline of domestic demand in the second quarter. At the end of June, total bank lending had grown by 28.0% y/y according to data from the Banking Regulation and Supervision Agency (BDDK). Annual bank lending growth had accelerated sharply over the course of the second quarter, from 14.2% y/y as of the end of the first quarter and from 10.9% y/y as of the end of 2019.

- Elsewhere, TurkStat's surveys of the services, retail trade,

and construction sectors all showed recovery from April, although

all remained in pessimistic territory as of August. Consumer

sentiment has been the least resilient, remaining only barely above

its April low point.

Asia-Pacific

- APAC equity markets closed mixed; Australia -1.8%, Japan flat, Hong Kong Flat, Mainland China +0.4%, and India +0.7%.

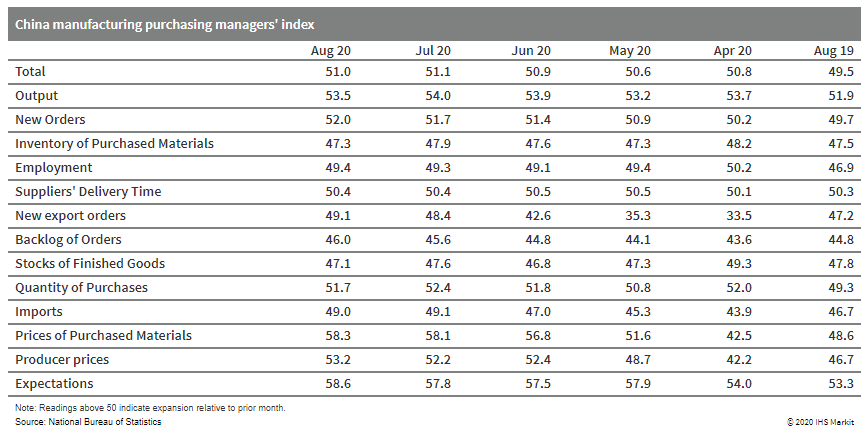

- China's official manufacturing purchasing managers' index (PMI)

came in at 51.0 in August, down 0.1 point from July. But it was the

sixth consecutive month above the 50 expansionary threshold and

above the level a year ago. (IHS Markit Economist Yating Xu)

- Demand continued to recover as sub-index of new orders rose to the highest since October 2018 and new export orders rose to the highest since the beginning of this year. Output sub-index edged down but remained significantly above the level a year ago. With improved demand, inventory continued to be digested and prices rose further. Also, employment sentiment continued to improve.

- By sector, high-tech manufacturing equipment manufacturing led the headline growth. Improvement in exports was concentrated in non-metal products, non-ferrous metals and metal products.

- Manufacturing PMI showed continuous recovery in medium-sized firms and stabilization in large firms, while sentiment further deteriorated in small firms with its PMI declining by 0.9 points from July to 47.7 in August.

- China's non-manufacturing PMI rose by 1.0 point to 55.2 in August, entirely due to acceleration in services, while construction activities slowed.

- Construction PMI declined by 0.3 point to 60.2, while expectation sub-index rose by 0.3 point from July, reflecting faster infrastructure investment growth after the flood under stronger fiscal support.

- Service PMI picked up by 1.2 points to 54.3, with continuous improvement in catering, accommodation and culture and sports, as well as sustained strength in rail transportation and air transportation as well as internet and software.

- The composite output PMI, covering both manufacturing and

non-manufacturing sectors, recorded at 54.5, up 0.4 point from the

previous reading.

- LyondellBasell and Liaoning Bora Enterprise Group have commenced operations at their 1.1-million metric tons/year ethylene plant and associated polyolefins complex at Panjin in Liaoning Province, northeastern China. The cost of the project is approximately $2.6 billion. The two companies in September 2019 established a 50/50 joint venture (JV), Bora LyondellBasell Petrochemical Co., for the project. The ethylene plant has the flexibility to consume naphtha and liquefied petroleum gas. The downstream complex includes units producing 800,000 metric tons/year of polyethylene (PE) and 600,000 metric tons/year of polypropylene (PP) using LyondellBasell's Hostalen ACP PE technology and the company's Spheripol and Spherizone PP processes. The complex will supply the packaging, transportation, building and construction, and healthcare and hygiene industries. The materials produced at the facility will be sold for use within China. The two companies are planning medium-to-long-term collaboration on additional petchem projects that could be deployed in multiple phases over the next 10 years. According to IHS Markit, Asia is the largest and fastest-growing polyolefins market in the world. China accounts for more than 60% of the Asian polyolefins market and represents 40% of worldwide polyolefins growth.

- As per IHS Markit's Commodities at Sea, the discharge of major bulk commodities namely iron ore, coal, and bauxite into China (Mainland) slowed down significantly during August 2020. As per Bulkers at Sea, there has been huge congestion at the Chinese ports which reached a significantly high level during the mid of August. Thereafter congestion started reducing but still is above the last three-year levels. During August 2020, discharge of iron ore, coal, and bauxite is calculated at 98.9mt (down 8pc m-o-m but up 2pc y-o-y), 15.4mt (down 25pc m-o-m and down 39pc y-o-y), and 7.2mt (down 34pc m-o-m and 16pc y-o-y). Overall, in the first eight months of this year discharge of iron ore, coal and bauxite are calculated at 774mt (up 9pc y-o-y), 173mt (up 1pc y-o-y), and 66mt (up 5pc y-o-y). In the last two months, there has been a decline in the imports of coal into China. Three factors are primarily responsible for the decline, first is the tightness in the import quota allocated by the Chinese authorities to the power plants, second is a delay in customs clearance and third is the strong hydro generation in the country. Imported thermal coal prices into China have declined to levels last seen four years ago as almost all power plants are reported to have run out of their import quotas. As per IHS Coal, Metals and Mining, inventories at the 530 major power plants across China were 80.2mt or 18 days on 23 August, down from the recent high of 89.2mt or 23 days at end-July, and also lower than 83.mt or 19 days a year earlier. This is despite coal burn at the 530 major power plants has dropped to 3.99mt/d on 23 August, from 4.42mt/d between 1-18 August and 4.06mt/d a year earlier. Hydro generation is expected to be strong this year until October with weather forecasts suggesting rainfall before mid-September up 30-80% from normal levels in most regions. There are reports that the Chinese Government has delayed import licenses targeting Australian bulk commodities as the trade relations between the two countries have gone sour. Earlier to issue import licenses where it used to take just a couple of days but now it is taking weeks, and this is specific to Australian bulk commodities. (IHS Markit Maritime & Trades' Rahul Kapoor and Pranay Shukla)

- The Swiss food and beverage giant Nestle agreed to sell its local brands to Tsingtao Brewery Group last week. The company will focus on high-end water business, including brands like Perrier, S. Pellegrino and Acqua Panna. This deal comprises the sale of several Chinese brands including Dashan, Yunnan Shan Quan and three factories located in Kunming, Shanghai and Tianjin. Tsingtao will produce and market Nestle Pure Life in China under a licensing agreement between the parties. Globally, Nestle has prioritized its international brands. "This strategy offers the best opportunity for long-term profitable growth in the category, while appealing to environmentally and health-conscious consumers," said Mark Schneder, Nestle chief executive. In China, Perrier water has achieved good performance through online and the foodservice such as bars and cafes in tier one and two cities since its launch several years ago. Nestle is expanding the brand into new markets such as Chengdu and Wuhan. Italy's bottled water company Ferrarelle recently (June 2020) established a distribution agreement with Danone, intending to expand its international business which currently contributes 4% of total sales. It is believed that Danone will eventually introduce Ferrarelle to China. The Chinese beer market is stagnant and buying water business can help Tsingtao to diversify its product portfolio. Tsingtao Beer's saw its H1 revenue fall by 5.27% to reach CNY15.7 billion compared with the year before. Its net profit was CNY1.86 billion, up by 13.8%. Tsingtao is planning to expand into sparkling bottled water, whisky and distilled bottled water. In January-July 2020, GTT data shows that China imported 97 million liters of bottled water (HS code 220210) for direct consumption from the world, up from 64.6 million a year ago. Thailand accounted for half of the volume. France was the second largest supplier. Its shipments to China reached 14.2 million liters, up by 16% in the same period. (IHS Markit Food and Agricultural Commodities' Hope Lee)

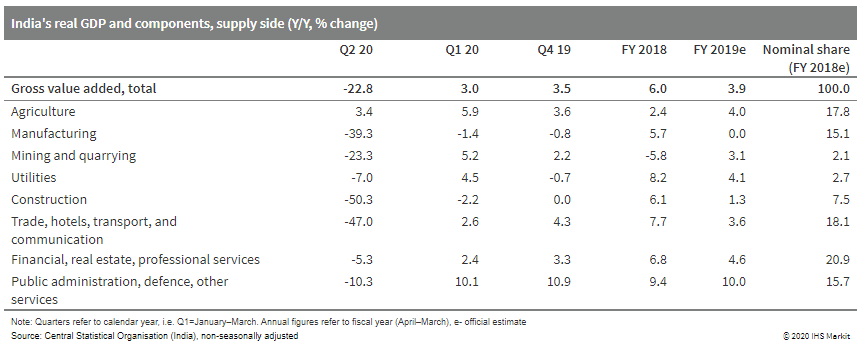

- Indian GDP contracted by 23.9% year on year (y/y) in the

April-June quarter of 2020, reflecting the effects of the

protracted lockdown measures that severely constrained industrial

production and consumption spending for a significant part of the

quarter. (IHS Markit Economist Rajiv Biswas)

- Manufacturing output declined by 39.3% y/y in the April-June quarter of 2020, as industrial production was severely curtailed during most of April and only gradually restarted during May.

- Construction output was also badly disrupted because of the strict lockdown measures in force, with output declining by 50.3% y/y in the April-June quarter.

- Due to the strict restrictions on movement by households in the first phase of the lockdown measures, output from the trade, hotels, transport, and communication sector declined by 47% y/y in the April-June quarter.

- In contrast to the situation in manufacturing and services, the agricultural sector recorded a small positive expansion of 3.4% y/y in the April-June quarter.

- Measured in terms of expenditure, private consumption expenditure fell by 26.7% y/y in the April-June quarter because of the lockdown effect, with overall consumption expenditure contraction mitigated by the 16.4% y/y growth rate in public consumption.

- Meanwhile, fixed investment fell by 47.1% y/y in the April-June

quarter. Exports fell by 19.8% y/y in the April-June quarter, hit

by the effect of the domestic lockdown on industrial production as

well as the slump in world demand because of lockdown measures in

many of India's largest export markets.

- Tata Motors and Hyundai won a tender floated by Energy Efficiency Services Ltd (EESL), a joint venture (JV) between public-sector undertakings under the Indian Ministry of Power, to supply 250 electric vehicles (EVs) to the Indian government, reports The Economic Times. Tata will supply 150 units of its electric Nexon, while Hyundai will supply 100 units of its electric Kona. The latest development is part of a tender opened by EESL in February this year to procure 1,000 EVs with a range of at least 180 km per charge. However, 750 vehicles of the tender, which were meant for e-taxis, have been put on hold, said Saurabh Kumar, managing director of EESL. "The e-taxi operators were wary of any fresh investments at this time, so we will let the tender lapse and wait till demand revives for e-taxis," Kumar said. This is the first such tender by EESL in nearly two years. In November 2019, EESL announced plans to scale down its order for 10,000 EVs by 70%, first placed in 2017 but later extended to March 2020 because of subdued demand and some issues pertaining to the vehicles' range. The agency could only procure 3,000 such vehicles. Tata and Mahindra & Mahindra (M&M) secured part of the 2017 tender to supply EVs, with the former expected to supply 60% of the total order and M&M expected to supply the rest. Additionally, EESL is accelerating efforts to install public EV charging stations and aims to set up around 2,000 EV chargers in India during the current fiscal year (FY) 2020/21. (IHS Markit AutoIntelligence's Isha Sharma)

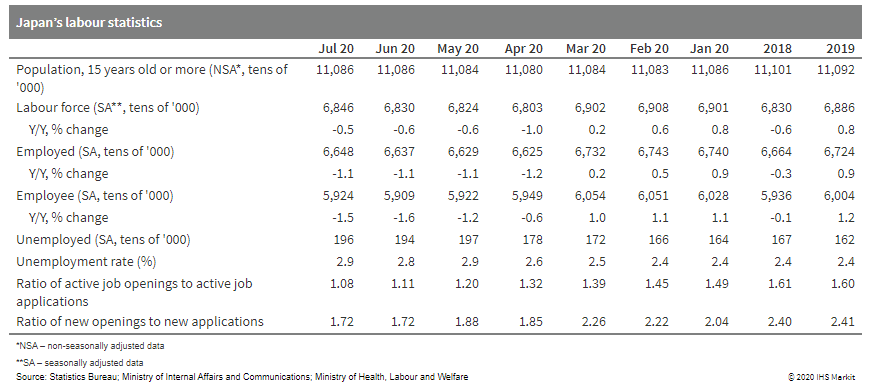

- Japan's unemployment rate rose to 2.9% in June in July, as an

increase in labor participation offset a slight rise in the number

of employees from the previous month. Although easing containment

measures lifted the number of self-employed and lowered the number

of employees on furloughs, the number of non-regular employees

continued to decline, reflecting severe business conditions,

particularly for services. (IHS Markit Economist Harumi Taguchi)

- Due to the reopening of businesses, the number of active job openings rose from the previous month for the first time in 14 months. However, a continued rise in the number of active job applications made for tighter employment conditions, as the ratio of active job openings to active job applications continued to decline (to 1.08). The number of new job openings declined by 28.6% from a year earlier.

- The July results signal an upswing of employment in line with

business reopenings. Although reopenings will gradually lift labor

demand, the unemployment rate could rise. Social distancing could

make it difficult to improve cash flows, while a resurgence of new

confirmed cases and continued border controls could continue to

weigh on labor demand.

- A sharp decline in fixed investment suggests a downward

revision for Japan's real GDP in the second quarter of 2020. Eroded

cash flow could continue to suppress investment and wages. (IHS

Markit Economist Harumi Taguchi)

- According to statistics from financial statements for the second quarter of 2020, sales for all Japan's industrial sectors, excluding finance and insurance, fell by 10.7% quarter on quarter (q/q), and the year-on-year (y/y) contraction widened to 10.7%.

- Sales of all industry groupings, except for information and communication services, declined. Major contributors to the severe contraction were transport equipment and chemical and related products in the manufacturing sector and wholesale and retail sales as well as services (including amusement, accommodation, and life-related services) in the non-manufacturing sector.

- Ordinary profits fell by 29.7% q/q, and the y/y contraction widened sharply to 46.6%, the steepest y/y contraction since the second quarter of 2009. Ordinary profits declined for all industry groupings, particularly for transport equipment and food. The fall in ordinary profits for non-manufacturing largely reflected drops in services, transport and postal services, and wholesale and retail sales.

- While lower sales were the major reasons for a sharp decrease in ordinary profits, the weakness was partially offset by lower payroll costs, as the number of employees declined by 6.6% y/y.

- Investment in plant and equipment (including software) fell by 6.3% q/q and 11.3% y/y under the difficult business conditions. Although information and communication equipment, real estate, and some other industry groupings increased investment, eroded cash flow led to declines in fixed investment for a broader range of industry groupings, particularly for services, transport and postal services, and wholesale and retail sales.

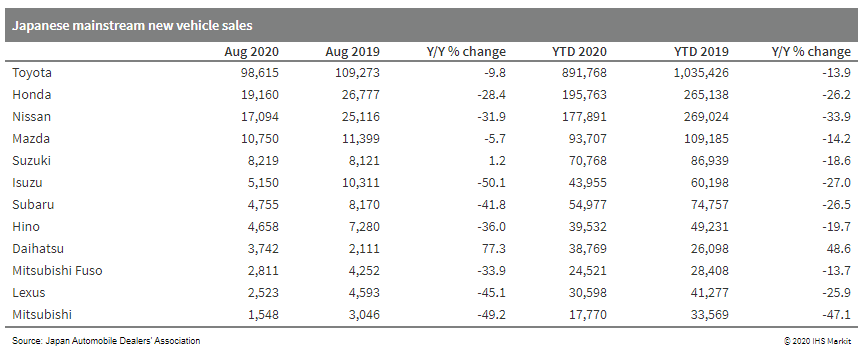

- Japanese new vehicle sales, including mainstream and

mini-vehicles, were down by 16.0% year on year (y/y) in August to

326,436 units. In the year to date (YTD), sales declined by 18.63%

y/y to 2.930 million units. (IHS Markit AutoIntelligence's Nitin

Budhiraja)

- Japanese sales of mainstream registered vehicles were 197,832 units, down by 18.5% y/y during August, according to data released by the Japan Automobile Dealers Association (JADA). This figure excludes mini-vehicles, thus covering all vehicles with engines bigger than 660cc, including both passenger vehicles and commercial vehicles (CVs), sold in Japan.

- Of this total, sales of passenger and compact cars declined by 16.1% y/y to 169,341 units in August, while truck sales were down by 29.3% y/y to 27,939 units and bus sales by 57.1% y/y to 552 units.

- In the YTD, sales of mainstream registered vehicles declined by 19.4% y/y to 1.836 million units.

- Sales of passenger cars were down by 19.5% y/y at 1.575 million

units, while truck sales fell by 18.6% y/y to 254,540 units and bus

sales shrank by 27.4% y/y to 7,103 units.

- Thailand's industrial production rose by 4.2% from the previous

month in July, and year-on-year (y/y) contraction continued to

narrow, reaching -15.4%. The sustained improvement largely

reflected increases in production of beverages and electrical

equipment and a softer decline in production of motor vehicles.

(IHS Markit Economist Harumi Taguchi)

- The improvement in industrial production is due to external and internal demand. The contraction of exports softened to a 11.9% y/y drop in July from a 24.6% y/y decrease in the previous month largely because of a 17.5% y/y rise in exports to the US and softer declines in exports to ASEAN regions, the European Union, and Japan.

- The Bank of Thailand's private consumption index rose by 2.7% from the previous month, and the y/y contraction softened to a 0.1% y/y drop in July. The improvement largely reflected continued recovery in consumption of non-durables and durables (such as cars and motorcycles).

- The July results suggest that Thailand's economy is recovering in line with easing containment measures and point to a rise in real GDP for the third quarter from the previous quarter. The economy is likely to continue to recover with the resurgence of business activity over the near term.

- The Thai government plans to offer tax incentives to individuals and companies to exchange their old vehicles for new vehicles or electric vehicles (EVs), reports the Bangkok Post, citing Minister of Industry Suriya Jungrungreangkit. The scheme will apply to vehicles powered by internal combustion engines that have been in use for over 15 years. The government will offer income tax deductions of up to THB100,000 (USD3,213) to companies and individuals who join the scheme, which will be proposed for cabinet approval in the next two or three months. The tax break will be offered for five years. "The government may lose some tax revenue [due to the scheme], but in return we will cut PM2.5 air pollution and boost car sales that have been badly hit by COVID-19. It will also boost the adoption of electric cars," said Jungrungreangkit. The government also aims to recycle the used vehicles. The government's plan is geared towards boosting new vehicle demand in the country, which has been experiencing declining sales for the past several months because of the impact of the COVID-19 virus pandemic and the country's stringent automotive loan approval process. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-september-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-september-2020.html&text=Daily+Global+Market+Summary+-+1+September+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-september-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 1 September 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-september-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+1+September+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-september-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}