Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 01, 2020

Daily Global Market Summary - 1 July 2020

Global equities ended the first trading day of Q3 2020 mixed, but with limited price action in either direction. Credit indices and oil ended the day higher, while benchmark government bonds were lower on the day. COVID-19 cases continue to grow in the US at an alarming rate, with California now becoming a particular concern. All eyes will be on tomorrow's simultaneous releases of the US non-farm payroll and jobless claims reports at 8:30am EST on the last US trading day ahead of the July 4th holiday weekend.

Americas

- California Gov. Gavin Newsom announced today a slew of new restrictions, including the mandatory closure of many bars and indoor restaurants. Nearly 6,000 people tested positive for the new coronavirus in California Tuesday, and more than 7,000 on Monday, the highest total during the pandemic and a 45% increase over the previous week. Hospitalizations are up more than 50% from two weeks ago. The percentage of tests coming back positive was 6% on Tuesday, up more than a full percentage point from two weeks earlier. (WSJ)

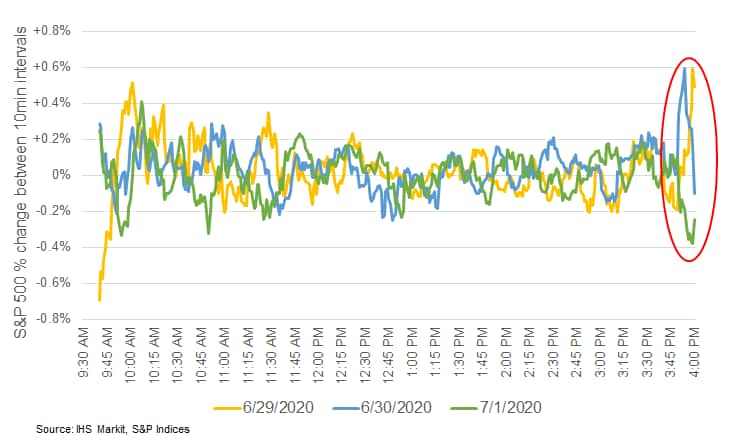

- US equity markets closed mixed, with a sudden sell-off

occurring during the last 10 minutes of the trading day; Nasdaq

+1.0%, S&P 500 +0.5%, DJIA -0.3%, and Russell 2000 -1.0%. The

chart below highlights that for the third consecutive day, most of

the largest intraday changes in the S&P 500 among 10-minute

intervals occurred within the final 15 minutes of the trading

day:

- 10yr US govt bonds closed +2bps/0.68% yield.

- CDX-NAIG closed -1bp/75bps and CDX-NAHY -5bps/511bps. Similar

to US equity indices, CDX IG/HY began to sell-off during the final

minutes of the trading session:

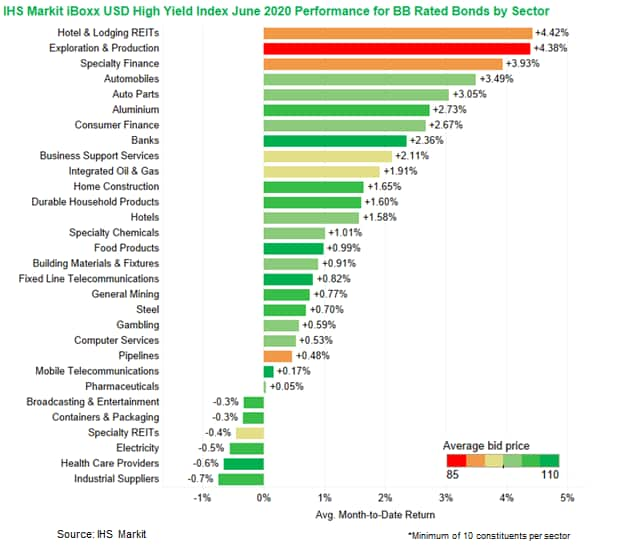

- Hotel & Lodging REITs +4.42% was the best performing sector

in June among the BB rated issues in the IHS Markit iBoxx USD High

Yield index. The charts below shows the performance of all the

sectors that had a minimum of 10 constituents, with the color of

the bars indicating the average bond bidside price in that sector

as of June 30.

- Crude oil closed +1.4%/$39.82 per barrel.

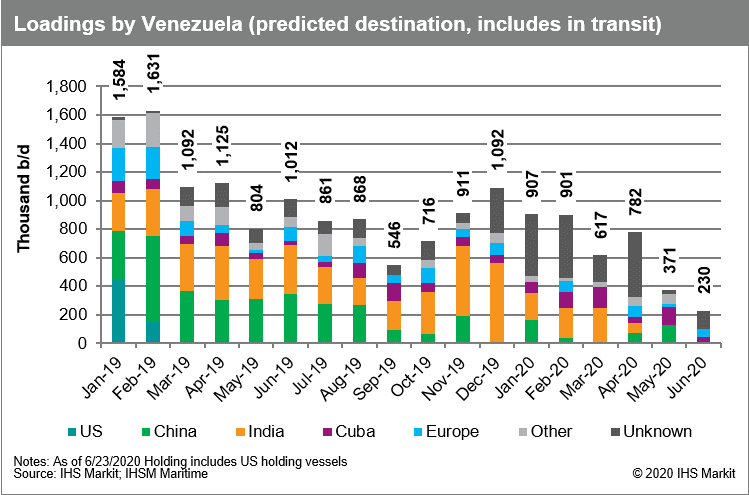

- Venezuelan oil supply plunged to a historic new low in June,

falling below 250,000 b/d according to our latest estimates. Low

oil prices have hurt national oil company PDVSA, exacerbating the

many challenges that have contributed to the country's spectacular

decline over the past five years. But the main impetus for this

most recent leg down in supply has been the Trump administration's

concerted effort to sanction the tanker companies and traders that

link Venezuelan oil with the global market. The effort has caused

havoc for PDVSA's logistics and choked off the Venezuelan oil

trade. Loadings from Venezuela were only around 230,000 b/d over

the first 20 days of June, according to our vessel tracking data,

down from an average of 900,000 b/d earlier this year. With PDVSA

struggling to get oil to market, inventories are bloating, and

production is being forced to shut in. So long as the US

sanctioning effort continues, PDVSA is likely to see supply remain

in this new very low range and there is a risk of exports falling

to close to zero in the coming months. (IHS Markit Energy

Advisory's Roger Diwan, Karim Fawaz, Justin Jacobs, Edward Moe, and

Sean Karst)

- The Federal Open Market Committee (FOMC) met on 9 and 10 June amid indications that economic activity was beginning to bounce back from extreme disruptions stemming from the COVID-19 pandemic. The FOMC kept the target range for the federal funds rate at 0% to 0.25% and indicated that asset purchases would continue at least at current rates. Discussion at the meeting was particularly weighty, reflecting enormous uncertainty and elevated downside risks to the economic outlook related to the spread of the virus and the efficacy of measures taken to limit its impacts. Policymakers on the FOMC are likely to issue more detailed guidance in the near future about conditions that would keep the federal funds rate at its current setting for an extended period—likely several years. Such forward guidance will be linked to benchmarks referencing labor markets and inflation. The FOMC appears poised to adopt a policy of promoting a modest, temporary overshoot of 2% inflation as part of a commitment to seeing inflation fluctuations centered around 2% over time. There was much discussion but no consensus about targeting yields on government securities. (IHS Markit Economists Ken Matheny and Kathleen Navin)

- The seasonally adjusted IHS Markit final U.S. Manufacturing

Purchasing Managers' Index (PMI) posted 49.8 in June, up a record

10points from 39.8 in May, to signal a marked easing in the overall

manufacturing downturn. The latest figure was also slightly higher

than the earlier released 'flash' reading of 49.6. (IHS Markit

Economist Chris Williamson)

- Contributing to the slower decline in operating conditions was a stabilization of new orders.

- No change in client demand in June brought to an end a three-month sequence of contraction in new business and signaled a notable turnaround from the severe decrease seen in April. Where an increase was reported, firms linked this to a gradual pick-up in demand as customers reopened.

- New export orders continued to fall, however. Although modest, the drop in external sales was linked to some export markets remaining closed amid COVID-19 restrictions and reports of some customers switching to local suppliers.

- Meanwhile, cost burdens rose in June as suppliers hiked their prices due to logistical issues and higher shipping costs. The increase was only marginal, however. At the same time, firms partially passed on greater input prices to customers through higher selling prices.

- Employment across the manufacturing sector declined for the fourth month running in June, as firms shed workers at a moderate pace following subdued demand. Signs of excess capacity remained evident as manufacturers registered a sharp reduction in backlogs of work.

- US employers announced 170,219 planned layoffs in June,

according to Challenger, Gray & Christmas—down 57% from

May's total of 397, 016 (April marked a record-shattering high for

the index; Challenger began tracking job-cut announcements in

January 1993). It is better, but it is not great. June's number was

up 306% over the same period a year earlier.(IHS Markit Economist

Rebecca Mitchell)

- All told, Challenger recorded 1,238,364 million job cuts announced by US-based employers in the second quarter, the highest quarterly total on record. Cuts were up 257% from the first quarter of the year and up 781% from the second quarter of 2019.

- June was the fourth month to report job-cut announcements specifically because of the coronavirus disease 2019 (COVID-19) pandemic. However, just as in the previous three months, the number does not include the furloughed workers.

- Year to date (YTD), 1,585,047 cuts have been announced, 379% higher than the same period in 2019 and 77% higher than the previous January-June record of 896,657 cuts in 2009.

- Out of the 30 industries tracked by Challenger, only three—pharmaceuticals, chemicals, and financials—posted fewer losses in the first half of 2020 than they did in 2019.

- Unsurprisingly, the hardest-hit sector and recipient of the lion's share of the coronavirus-related cuts continues to be the entertainment/leisure sector, which encompasses bars, restaurants, hotels, and amusement parks. YTD, companies in the entertainment/leisure sector have announced 671,840 cuts, 7,535% higher than during the same period in 2019.

- Total US construction spending declined 2.1% in May, a bit less

than IHS Markit had expected. Since reaching a peak in February,

nominal construction has declined 5.9%. This compares favorably to

nominal monthly GDP, which we estimate declined 12.5% from February

to May. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- Given its general acceptance as an essential activity, construction spending has held up reasonably well, although financial strains and other challenges facing construction could prevent an upturn in coming months.

- Core construction spending declined 2.5% in May, less of a decline than we expected. However, the data through May did not alter our estimate of second-quarter GDP growth to the nearest 0.1 percentage point (-35.6%).

- This morning's report included annual revisions. The most significant one was to the multifamily residential category—its seasonally and not-seasonally adjusted estimates were revised back to 2004 and 2009, respectively, based on a methodological improvement. This raised its level over the entire 2009-20 interval; the 2019 spending level totaled $80.2 billion (previously $61.3 billion).

- Bankrupt Hertz Global Holdings Inc. and its bondholders are squaring off over how to shrink its nearly half-a-million vehicle fleet. The cars are housed in an entity linked to Hertz's asset-backed securities and leased to the rental giant. Normally, when a company with ABS files for bankruptcy, it must choose to confirm or reject the entire master lease tied to the debt. Hertz wants a judge to allow it to convert the master lease into 494,000 separate agreements so it can reject the terms on 144,000 vehicles. That would allow Hertz to save roughly $80 million a month while it hangs onto the remainder of the cars as it seeks to emerge from bankruptcy a viable company. If the motion fails, Hertz may press for a reduction in payments to creditors, according to people familiar with the matter. (Blomberg)

- The United Auto Workers' (UAW) local union has reportedly requested that General Motors (GM) temporarily suspend production at its assembly plant in Arlington, Texas, United States, as the state is seeing increases in cases of COVID-19. An Automotive News report quotes a statement on the union's website as saying, "Due to the most recent data on the COVID-19 outbreak, the Bargaining Committee has asked General Motors to shut down Arlington Assembly until the curve is flattened for the benefit and well-being of our members. Every day we are setting new records in the number of people who are testing positive in the Dallas-Fort Worth area." The report also cites a GM spokesperson as saying, "We're aware of the request and haven't made changes to our production plans because we have protocols designed to keep the virus out of the facility and have multiple layers of protection in the plant to prevent a spread of the virus. There's no need to interrupt production." The GM plant in Arlington is beginning production of the automaker's latest full-size sport utility vehicles (SUVs), which will be significant for GM's sales and revenue because of their high prices and profit margins. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Lyft is resuming autonomous vehicle (AV) operations in Palo Alto, California (United States), more than three months after suspending its operations in response to shelter-in-place orders due to the coronavirus disease 2019 (COVID-19) virus pandemic (see United States: 18 March 2020: Uber, Lyft suspend pooled rides; Waymo, Cruise, Argo postpone self-driving tests). The company has rolled out some of its AVs for testing at its closed track in Palo Alto, but it has not resumed a pilot program that provides rides to Lyft employees in the city. The company has listed some safety measures that it plans to undertake, including regular sanitizing of its vehicles and requiring engineers to wear a face shield and have temperature checks. Lyft initiated its AV operations in July 2017 to build an open platform for AVs, which the company refers to as Level 5. Lyft's Level 5 division comprises 400 employees, including autonomy and robotics experts who have previously worked at Waymo, Ford, Apple, Tesla, Google, and Microsoft. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The United States-Mexico-Canada Agreement came into force today (1 July), replacing the 1994 North American Free Trade Agreement. The United States-Mexico-Canada Agreement (USMCA) updates the 25-year-old North American Free Trade Agreement (NAFTA), with modifications including a focus on resolution of disputes at a local level prior to international arbitration. The USMCA includes new provisions on intellectual property, digital trade, taxing of shipment value levels, financial services, currency manipulation, labor, and the environment. Notably, the USMCA increases local content requirements in the automotive sector from 62.5% within member countries to 75%. NAFTA's investor-state dispute mechanism has also been modified to favor the resolution of US-Mexico disputes in local courts by delaying for at least 30 months their potential elevation to international arbitration, although key sectors such as hydrocarbons, electricity, telecoms, transport, and infrastructure will be exempt (agribusiness not included). The USMCA's entry into force increases the stability of the Mexico-US trade relationship (worth USD614.5 billion in 2019), but sunset provisions threaten to generate trade regulation uncertainty every six years. (IHS Markit Country Risk's Johanna Marris)

- PolyOne today announced completion of the acquisition of the color masterbatch businesses of Clariant and the Clariant Chemicals India affiliate. PolyOne also announced that it had changed its name and will now be called Avient Corp. "We proudly welcome our newest associates…They are joining us on Day 1 of this new era for our company, which as of today will be named Avient," says Robert Patterson, chairman, president, and CEO of Avient. He says the new brand brings together two world leaders to create a specialty company. The agreement to acquire the Clariant masterbatch business was announced in December 2019. The business includes 46 manufacturing operations and technology centers across 29 countries and approximately 3,500 employees, who will join Avient's color, additives, and inks segment. The combined net purchase price is $1.44 billion, representing a 10.8 times (x) multiple of 2019 adjusted EBITDA, or 7.5x including anticipated synergies.

- Colombia's central bank yesterday (30 June) voted to cut interest rates from 2.75% to 2.50% (a historical low), while also announcing extended liquidity and credit support. The economy slowed significantly during the first quarter and is set to have declined at a much sharper rate during the second quarter; inflation is below target and provides the bank with plenty of room to cut rates further. Inflation in Colombia fell to 2.85% in May (the target is 3%), while basic inflation fell to 2.44%, and expectations are now below target. Weak domestic demand is underpinned by deteriorating labor market conditions: unemployment reached 17.8% in May, a sharp increase from the end of 2019 when unemployment was 9.5%. (IHS Markit Economist Ellie Vorhaben)

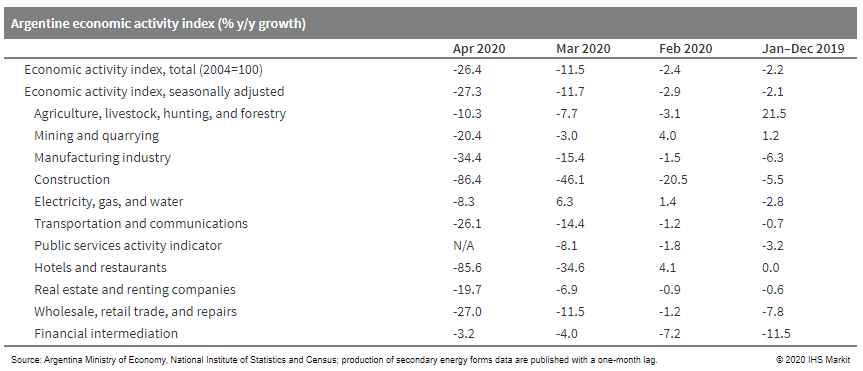

- According to data from Argentina's National Institute of

Statistics and Census (Instituto Nacional de Estadística y Censos:

INDEC), the economic activity index decreased by 26.4% year on year

(y/y) in April. The seasonally adjusted data show a 17.5%

month-on-month (m/m) decrease during the month. For the first four

months of 2020, the steep declines in April and March drove down

the average to an 11% y/y decline. (IHS Markit Economist Paula

Diosquez-Rice)

- By sector, the economic activity index data show only declines in April. For example, there were steep declines in the construction sector, which decreased by 86.4% y/y; the hospitality sector, which was down by 85.6% y/y; the manufacturing sector, which fell by 34.4% y/y; the wholesale and retail sector, which shrank by 27.0% y/y; and the transport and communication sector, which dropped by 26.1% y/y.

- Argentine real retail sales increased by 0.2% y/y in supermarkets but plunged by almost 100% y/y in shopping centers in April as these were not considered essential and remained mostly closed. In terms of supermarket sales, the main drivers of growth were electronics and appliances, pantry dry goods, dairy products, and fresh produce.

- Argentina's manufacturing capacity decreased to 42% in April.

Chemicals had the highest utilized capacity, at 69.3%, followed by

paper and cardboard, food and beverages, and editing and printing.

The sectors with the least utilized capacity were the automotive

industry, at 0%, and the textiles industry, at 4.2%.

Europe/Middle East/ Africa

- Most European equity markets closed modestly lower; Germany -0.4%, Italy/France/UK -0.2%, and Spain -0.1%.

- 10yr European govt bonds closed lower across the region; Germany/France +6bps, Spain/UK +4bps, and Italy +1bp.

- iTraxx-Europe -1bp/65bps and iTraxx-Xover -12bps/370bps.

- Brent crude closed +1.8%/$42.03 per barrel.

- Zoetis has bolstered its Pharmaq aquaculture health business by purchasing Scottish firm Fish Vet Group. Fish Vet - established in 1995 and based in Inverness - develops and commercializes vaccines, diagnostics and services for aquaculture. It previously belonged to UK firm Benchmark, which is currently divesting non-core assets. Benchmark said Fish Vet was sold for a total cash consideration of £14.4-14.7 million ($17.8-18.2 million). The transaction follows the recent sale of Improve International, as Benchmark becomes a more streamlined and profitable business focused on genetics and nutrition. The acquisition will allow Pharmaq's new reference laboratory in Norway to offer fish farmers improved environmental testing capabilities. Fish Vet helps fish producers comply with strict regulatory standards by offering surveys and analysis to "monitor potential environmental impact and inform responsible fish disease treatments, as part of a sustainable aquaculture system". The company's testing and analysis enables producers to check the environmental impact of existing fish farms and calculate the potential consequences of new locations. Fish Vet also allows customers to determine and monitor seabed conditions, as well as provide input to required regulatory submissions. (IHS Markit Animal Health's Joseph Harvey)

- According to Federal Statistical Office (FSO) data, Germany's

real retail sales excluding cars rebounded by an astonishing 13.9%

month on month (m/m; seasonally and calendar adjusted) in May,

their largest monthly increase ever. Notwithstanding the key factor

of the reopening of stores for non-essential goods, the magnitude

of this increase remains remarkable. (IHS Markit Economist Timo

Klein)

- This sizeable recovery also boosted unadjusted year-on-year (y/y) rates from -6.4% to 3.8% in real terms and from -5.2% to 4.6% in nominal terms, despite the dampening influence of a missing shopping day relative to May 2019.

- In shopping-day adjusted terms, May's annual rates are far above average growth of 3.1% (real) and 3.6% (nominal) in 2019.

- Major categories of the price-adjusted y/y data for May (total 3.8% y/y) reveal that food sales (4.9%) remained modestly ahead of non-food sales (3.5%), but this still implies a huge rebound of the latter as consumers satisfied their pent-up demand owing to the temporary closure of most non-food retail outlets between mid-March and late April.

- Food sales broadly retained the same growth pace as in the month before, probably still benefitting from substitution effects as restaurants only opened gradually during May and with reduced capacity.

- Among non-food sales, 'internet and mail orders' (up by 28.7% y/y) stayed ahead of the rest in annual terms, with 'furniture/household goods/DIY' now in second place at 8.6% y/y.

- 'Specialty stores such as for toys, books, jewelry' narrowly posted positive annual growth as well (1.4%), but sales at general department stores "only" recovered from April's -40.3% to -8.3% y/y, and the previously outperforming pharmaceutical/cosmetic goods category softened to -6.3% y/y.

- The most extreme decline continues to be seen in textiles/shoes at -22.6% y/y - although still a major improvement from April's -70.7% y/y.

- The GfK consumer confidence index has been recovering during the last two months, but its increase from a low-point of -23.1 to -9.6 means that less than half of the downturn from the levels around 9.0 in early 2020 has been recouped. Among the three components that determine the headline index, households' assessments of their personal financial situation are still below their long-term average, whereas the willingness to make major purchases has recovered to a greater extent and last exceeded its long-term average.

- Seasonally adjusted German unemployment has increased by 69,000

in June, much less than the average monthly increase of 305,000 in

April-May. The unemployment level at end-June was 2.943 million,

which compares to only 2.265 in March. (IHS Markit Economist Timo

Klein)

- Separately, the Labor Agency has calculated the COVID-19 effect, estimating that this is responsible for a monthly increase by 60,000 in June, following 197,000 in May and 381,000 in April.

- The German unemployment situation in mid-2020 has now returned to conditions that prevailed in mid-2015, as the unemployment rate has now increased from 5.0% in March (close to 40-year lows) to 6.4% in June.

- Seasonally adjusted underemployment (as opposed to unemployment), which had deviated in both directions during 2019 due to fluctuations in the number of people receiving some form of (non-insurance related) government support - included in the underemployment but not the unemployment number - only increased by 56,000 month on month (m/m) in June. As already seen in recent months, this is related to a declining number of people benefiting from such public support measures: -17.0% y/y in June, similar to May's -16.1% but contrasting sharply with +1.9% y/y as recently as in March. This is technically induced, as the contact impediments (to contain the spreading of the virus) and the surge in short-time work applications has left little room for processing support measures such as training.

- The multi-year upward trend for employment continues to correct now. In May (employment data lag unemployment numbers by one month), seasonally adjusted employment fell by 314,000, following declines by 273,000 in April and 39,000 in March.

- Meanwhile, company announcements about planned (new) short-time work, which are one month further ahead, were at 0.342 million during 1-25 June. This is down sharply from 1.14 million in May, 8.02 million in April, and 2.64 million in March.

- Seasonally adjusted vacancies are already available until June. They declined by 20,000 m/m, the pace thus slowing down from April's -67,000 and May's -45,000 m/m. June's level of 563,000, representing a return to conditions in 2015, compares to an all-time high of 810,000 in December 2018 and a cyclical trough of 281,000 in the wake of the global financial market crisis in July 2009.

- Daimler Trucks is consistently driving forward series production of fuel cells with Daimler Truck Fuel Cell GmbH & Co. KG. In the past 10 years, experts from Daimler have already built up extensive know-how in this field and have developed production methods and processes. In close co-operation with their colleagues in Vancouver (Canada), and with the ongoing fuel cell development activities, the Stuttgart-based experts are now transferring that experience to the direct preliminary stage of future series production. Investments are being made in new state-of-the-art facilities covering every single process stage of fuel cell production: from membrane coating and stack manufacturing to the production of fuel cell units. Commenting Martin Daum, Chairman of the Board of Management for Daimler Truck said, "We are pursuing the vision of the CO2-neutral transportation of the future. The hydrogen-based fuel cell is a key technology of strategic importance in this context. We are now consistently following the path towards the series production of fuel cells and are thus doing absolutely pioneering work - and this goes beyond the automotive industry. We will invest a very substantial sum in the coming years to achieve this." In April this year Daimler announced a non-binding agreement with the Volvo Group to establish a new joint venture (JV) for the development and marketing of fuel cell systems to be used in heavy-duty commercial vehicles and other applications. (IHS Markit AutoIntelligence's Tim Urquhart)

- Portuguese industrial production rose by 2.5% month on month

(m/m) in May, according to seasonally and working-day-adjusted data

released by Statistics Portugal. Production had declined by 19.3%

m/m in April and 8.5% m/m in March. (IHS Markit Economist Diego

Iscaro)

- Output still fell by 26.0% when compared against May 2019, following an annual drop of 27.4% in April.

- The breakdown by type of production shows production of consumer goods rising by 9.0% m/m, boosted by a 58.9% m/m increase in production of consumer durables. Production of investment goods also rebounded by 26.9% m/m, following a fall of 31.3% m/m in April.

- Energy production, which accounts for 17% of total production, declined by 14.9% m/m in May. On a year-on-year (y/y) basis, production fell in all sectors, but the decline was particularly acute for consumer goods.

- The m/m increase was weaker than expected, although the sharp drop in energy production (likely still affected by drought conditions, which hit production of hydro-electric-generated energy) distorted the figures. Data on car production for May, released in mid-June, had already suggested a slow recovery in output.

- The Swedish central bank (Riksbank) voted to provide more stimulus to support the economic recovery in its end of June meeting. However, it has kept the policy rate (repo rate) unchanged; the last move was a rise of 25 basis points, to 0%, in December 2019. Most recently, the Riksbank has expanded the asset purchase program from SEK300 billion to SEK500 billion (from 6% to 10% of 2019 GDP), extended it from September 2020 to June 2021 and will begin buying corporate bonds on top of government, municipal, and mortgage bonds and commercial paper. As a result, its balance sheet is expected to double to close to 20% of GDP by mid-2021. Additionally, to support lending to the economy, the Riksbank cut the interest rate on the standing facility for lending to banks from 0.2 to 0.1%, while offering longer maturities. (IHS Markit Economist Daniel Kral)

- The global pandemic has severely undercut export demand,

particularly to the European Union. With exports plunging for the

third consecutive month, Turkey's merchandise-trade deficit has

grown rapidly, as its own import demand has not fallen nearly as

sharply. The rapid deterioration of the trade deficit is projected

to push the current account back into deficit for 2020 as a whole.

- For the third consecutive month, Turkish exports were substantially down from year-earlier levels, as the fight against the COVID-19 virus pandemic continues to devastate demand in foreign markets. In May, shipments to the European Union - Turkey's largest export market - plunged by 44.3% year on year (y/y). (IHS Markit Economist Andrew Birch)

- While the pandemic has decimated foreign economic activity, the less stringent crackdown within Turkey and sustained expansionary economic policies have mitigated the drop-off of imports. While still down significantly on year-earlier levels, import losses have been substantially less than have been export declines.

- As a result, Turkey's merchandise-trade deficit has widened substantially from a year earlier. For January-May 2020 as a whole, the merchandise-trade deficit reached USD21.0 billion, more than twice as large as it had been in the same period of 2019.

- South Africa's seasonally adjusted annualized rate (SAAR) of

real GDP contracted by 2.0 quarter on quarter (q/q) and 0.3% year

on year (y/y) during the first quarter of 2020, latest statistics

from Statistics South Africa (StatsSA) show. This represents the

third consecutive quarterly contraction in South Africa's SAAR GDP.

- The largest negative contributors to the first-quarter GDP were the mining and manufacturing sectors, in which activity fell by 21.5% and 8.5% respectively in real seasonally adjusted annualized terms. (IHS Markit Economist Thea Fourie)

- Sectors that made the biggest positive contribution to the first quarter's GDP included agriculture (up 27.8%, contributing 0.5 percentage point), finance (up 3.7%, contributing 0.8 percentage point), and general government services (up 1.0%, contributing 0.1 percentage point).

- Both household and government consumption expenditure made a positive contribution to real GDP during the first quarter. Household final consumption expenditure increased by 0.7% q/q in real seasonally adjusted annualized terms, while government final consumption expenditure increased by 1.1% q/q.

- Real gross fixed capital formation contracted by a massive 20.5% q/q in SAAR terms in the first quarter. In addition, there was a 3.4% q/q fall in the change of inventories, a 2.3% q/q fall in exports, and a 16.7% q/q slowdown in imports.

Asia-Pacific

- APAC equity markets closed mixed; China/India +1.4%, Australia +0.6%, Hong Kong +0.5%, South Korea -0.1%, and Japan -0.8%.

- The diffusion index (DI) of current business conditions in the

Bank of Japan (BoJ)'s June 2020 Tankan survey for large

manufacturing groupings moved down with the second-largest

quarter-on-quarter (q/q) decline (26 points) to -34, marking the

lowest figure since June 2009. This reflected declines in the DIs

for all manufacturing industries, including a 55-point drop for

autos to -72. (IHS Markit Economist Harumi Taguchi)

- The DI for large non-manufacturing groupings also fell sharply, dropping by 25 points to -17, the largest q/q drop since the survey started.

- Although stay-home/working-from-home lifestyles lifted the DI for retail stores (up nine points to 2), COVID-19 virus containment measures severely dampened personal services (down 64 points to -70) and accommodations and eating and drinking services (down 32 points to -91).

- Containment measures also hit businesses for small-sized enterprises, as the DIs of small-sized manufacturing and non-manufacturing industry groupings marked the largest q/q declines to -45 and -26, respectively.

- With the lifting of Japan's state of emergency in late May, the forecast DI for three months out improved for large manufacturing and non-manufacturing groupings by seven points to -27 and by three points to -14, respectively, suggesting that large enterprises expect business conditions to improve moderately despite a continued deterioration on expectations of weak domestic and external demand.

- The forecast DIs for small enterprises anticipate more severe business conditions even three months out.

- Sales plans for fiscal year (FY) 2020 (beginning from April) were revised down from the March survey in all sized, all industry groupings, reflecting repercussions from domestic and external containment measures and sluggish outlooks.

- Although large enterprises expect sales to swing to a marginal rise in the second half of FY 2020, the sales for all enterprises in FY 2020 are projected to decline by 3.9% year on year (y/y), following a 1.4% y/y fall in FY 2019.

- The outlook for current profits for all enterprises in FY 2020 was also revised to a contraction of 19.8% y/y, following a 9.6% y/y decrease in FY 2019.

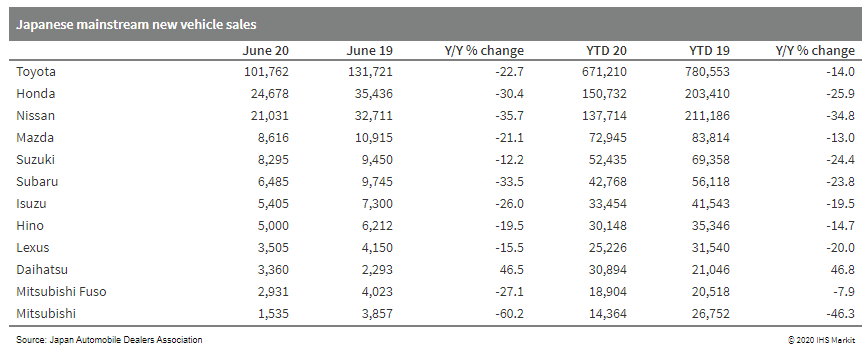

- Japanese new vehicle sales, including mainstream and

mini-vehicles, were down by 23% year on year (y/y) in June to

347,371 units. In the year to date (YTD), sales declined by 20% y/y

to 2.207 million units. (IHS Markit AutoIntelligence's Nitin

Budhiraja)

- Japanese sales of mainstream registered vehicles were 214,857 units, down by 26% y/y during June, according to data released by the Japan Automobile Dealers Association (JADA) today (1 July).

- This figure excludes mini-vehicles, thus covering all vehicles with engines greater than 660cc, including both passenger vehicles and commercial vehicles (CVs), sold in Japan.

- Of this total, sales of passenger and compact cars declined by 26.6% y/y to 182,128 units in June, while truck sales were down by 21.7% y/y to 32,178 units and bus sales by 48% y/y to 551 units.

- In the YTD, sales of mainstream registered vehicles declined by

19.3% y/y to 1.399 million units. Sales of passenger cars were down

by 19.9% y/y at 1.198 million units, while truck sales fell by

15.6% y/y to 195,425 units and bus sales shrunk by 20.6% y/y to

5,845 units.

- Thailand's exports declined by 23.6% year on year (y/y) in May

2020, the sharpest contraction since July 2009. The weakness was

driven by exports to the country's major trading partners,

including the European Union, Japan, and the United States,

reflecting lower demand because of COVID-19 virus containment

measures, which offset a recovery in exports to China. (IHS Markit

Economist Harumi Taguchi)

- Industrial production also fell by 6.0% month on month (m/m) or 22.9% y/y on a seasonally adjusted basis in May.

- The accelerated contraction was largely driven by a sharp drop in production of motor vehicles (down 69.0% y/y), reflecting weak domestic and external demand.

- Although the decrease of production in motor vehicles softened from an 80.7% y/y drop in April, the continued weakness affected production of other related industries. A fall in the portion of non-metallic mineral products hints at weak construction activity.

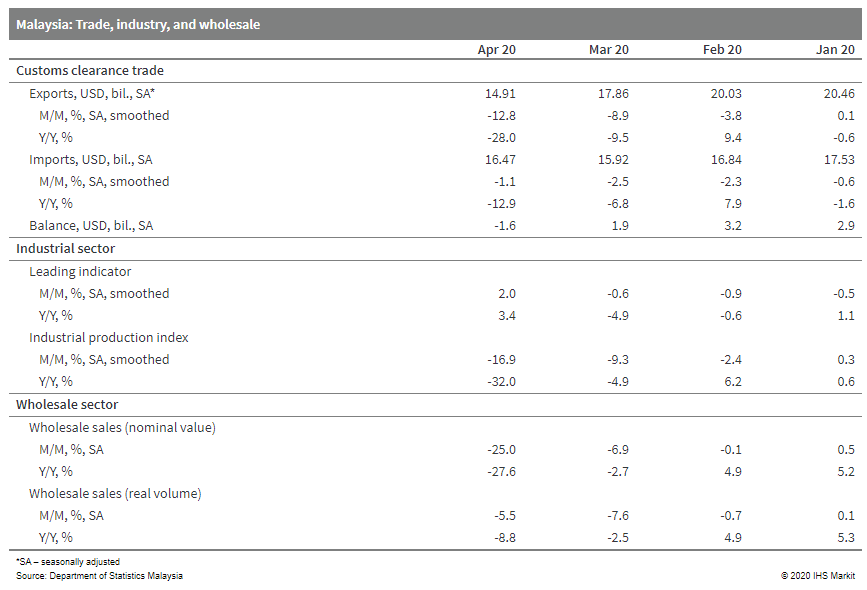

- Recent data have revealed that Malaysia's first-quarter

contraction is continuing into the second quarter. (IHS Markit

Economist Dan Ryan)

- The Malaysian ringgit has strengthened slightly over the past few months, but is still 3% weaker than the 2019 average. Given the weak economy and low interest rates, no significant appreciation is expected in the near term.

- After falling sharply in March and April, prices showed little change in May. Therefore, the worst of the deflation appears to be over, especially with the government easing its lockdown measures.

- The trade sector was hit hard by the effect of the COVID-19 virus pandemic in March and April. Imports fell in tandem with domestic spending, but exports contracted sharply because of low external demand, resulting in the first trade deficit in over 20 years.

- The decline in the industrial sector accelerated in April, pushing industrial production down nearly one-third from a year earlier.

- As expected, the unemployment rate continued rising in April, reaching nearly 5%. Previous highs were only around 3.5%.

- Household spending on retail goods showed a similar pattern to

the wholesale sector, with nominal sales down sharply through

April, whereas the decline in real spending was less dramatic. Auto

registrations posted a record low of -98.6% Y/Y, out of more than

20 years of data.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-july-2020-2.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-july-2020-2.html&text=Daily+Global+Market+Summary+-+1+July+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-july-2020-2.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 1 July 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-july-2020-2.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+1+July+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-july-2020-2.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}