Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 18, 2020

Daily Global Market Summary - 18 May 2020

Global equities, oil, investment grade/high yield credit indices, and even cheese futures closed sharply higher on the day, driven by Sunday night's encouraging remarks from Fed Chairman Powell combined with positive preliminary results on a COVID-19 vaccine trial. In addition, Italy is accelerating its reopening process and there are new discussions about a €500 billion European COVID-19 recovery fund, which drove Italian government bond yields sharply lower as most benchmark government bonds closed weaker on the day.

Americas

- US equity markets closed sharply higher today; Russell 2000 +6.1%, DJIA +3.9%, S&P 500 +3.2%, and Nasdaq +2.4%.

- 10yr US govt bonds closed +8bps/0.72% yield and 30yr bonds +11bps/1.44% yield.

- Credit indices closed higher across investment grade and high yield today; CDX-NAIG -5bps/90bps and CDX-NAHY -42bps/640bps.

- Investor confidence was bolstered by remarks from Federal Reserve Chairman Powell on the 60 Minutes program on Sunday evening NY time that the central bank "wasn't out of ammunition by a long shot" to support the economy at a time when states loosen their restrictions on movement and social contact. However, Chairman Powell also warned during the interview that a full US economic recovery might take until the end of next year and require the development of a Covid-19 vaccine. (FT)

- Drug maker Moderna Inc. reported early results Monday from the first human study of its experimental coronavirus mRNA vaccine that gave a positive signal about the inoculation's ability to protect people. The company said the vaccine induced immune responses in some of the healthy volunteers who were vaccinated, and the shots were generally safe and well-tolerated. The phase 1 study data reported Monday came from among the 45 people ages 18 to 55 who received three different dose levels of the vaccine. An additional 60 people over age 55 are being enrolled in the study. (WSJ)

- Crude oil closed +8.1%/$31.82 per barrel, which is the highest close since 11 March.

- Oil markets latch onto signs of improving fundamentals, pushing prices above $30/bbl. Four weeks is a long time in today's oil market. Less than a month removed from NYMEX WTI's disastrous May 2020 contract expiry, oil markets appear to be on the mend. NYMEX WTI prices surged to nearly $33/bbl in early trading on Monday, with ICE Brent breaching $35/bbl for the first time since the early March price crash. The factors underpinning this recovery are a demand inflection point as countries re-open, and a supply-driven tightening in global physical markets, reflected in the price structure, high frequency data and highly visible weekly US statistics. (IHS Markit Energy Advisory's Roger Diwan)

- The US builder confidence headline index edged up 7 points to

37, which is still 29 points below its year-earlier value. (IHS

Markit Economist Patrick Newport)

- The current sales conditions index jumped 6 points to 42.

- the index measuring sales prospects over the next six months climbed 10 points to 46.

- The traffic of prospective buyers' index rose 8 points to 21.

- The Northeast dropped another 2 points to 17; the other three regions saw gains with the West up 12 points to 44, the Midwest up 7 points to 32, and the South up 8 points to 42.

- Class III and cheese futures rocketed higher in response to the spot cheese price rallying to the highest level since February, with multiple "limit up" days throughout the week. The cheese market has recovered all of the losses seen since the COVID-19 pandemic started in the US. The deferred futures months also posted strong gains early, but traders by late week did sell off those contracts. For the week, the May Class III 2020 contract increased 69 cents to USD12.24 per cwt. The self-imposed milk production cuts from cooperatives that were planned in April, sizable USDA dairy contract awards for dairy products, and the economy starting to reopen have created a 'perfect storm' for bulls in the cheese and butter market. (IHS Markit Agribusiness' Jana Sutenko)

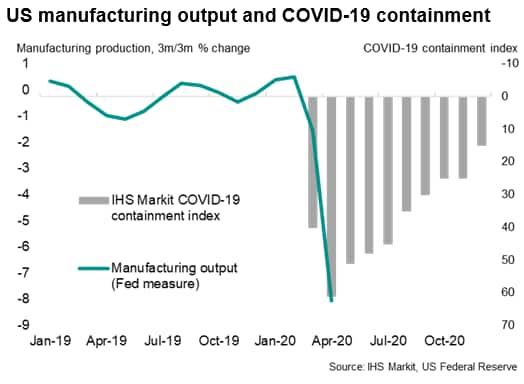

- IHS Markit's COVID-19 containment indices quantify how

containment measures are being applied in each country and the

expected expiration of each measure. These indices are based on

information relating to issues such as closures of schools,

non-essential shops and restaurants, as well as restrictions on

public gatherings, internal mobility and external borders. Analysts

forecast how these are expected to change in coming months, based

primarily on government announcements. The below chart compares the

US manufacturing output data published by the Federal Reserve to

IHS Markit's COVID-19 containment index: (IHS Markit Economist

Chris Williamson)

- General Motors (GM), Ford, and Fiat Chrysler Automobiles (FCA) opened their plants in the United States on 18 May, reports Reuters. Ford will reopen plants on two shifts for those that had been running on three shifts before the shutdown, and will reopen one shift for plants that were running on two before the shutdown. The assembly plants include Kentucky, Louisville, Chicago, Kansas City, Michigan, and Ohio, and some other component plants. GM is reopening its plants to work on one shift. In addition, GM said that it is planning to restart operations at its auto assembly plant in Silao (Mexico) on 20 May. (IHS Markit AutoIntelligence's Tarun Thakur)

- Daimler is suspending production at its plant in Alabama (United States) for a week over parts shortages, according to media reports. A Bloomberg report cites a Daimler internal notice as saying that the shutdown is a result of a shortage of components supplied from Mexico. According to the report, workers are being given the option of either using part of their vacation quota for the week or going without pay and filing for unemployment benefits. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Waymo has launched artificial intelligence (AI)-based model VectorNet to predict the behavior of pedestrians, cyclists, and drivers, reports VentureBeat. VectorNet builds representations to encode information from maps to provide accurate behavior predictions, while requiring less compute input compared with convolutional neural networks (CNNs). This report comes shortly after Waymo announced a new funding round raised USD750 million, bringing total external funding to USD3 billion. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Mexico's central bank on 14 May cut the policy rate from 6.0%

to 5.5% in an effort to support the economy amid a downturn driven

by the spread of the COVID-19 virus. This is the fourth cut this

year and the third during the COVID-19 virus pandemic. (IHS Markit

Economist Rafael Amiel)

- Banxico targets inflation at 3%, plus or minus 1 percentage point; inflation is currently at 2.15%, which is at the lower end of the targeted band, and there are no inflationary pressures. Core inflation, which excludes volatile items, such as gasoline and energy-related goods as well as agricultural products, amounted to 3.5% at the end of April. As in most countries in the region, food prices are increasing, but on the consumer price index this is more than offset by the decline in energy costs.

- The sharp depreciation of the peso and the likely pass-through effects onto domestic prices would imply an acceleration in inflation; however, IHS Markit assesses that lower oil prices, coupled with lower demand driven by the sharp recession that is just beginning, will keep inflation low.

- Mexico's foreign-exchange (FX) position remains strong and FX reserves have increased in the past two months. Banxico intervened in the FX market in late March and early April; there has been some appreciation of the peso since the intervention, but volatility persists.

- Nevertheless, given the room for policy rate cuts, we expect two additional 25-basis-point cuts during the rest of the year that will bring the rate down to 5.0% by the end of 2020.

- According to Peru's National Institute of Statistics and

Information (INEI), GDP fell by 16.26% year on year in March, the

worst pace since July 2009. (IHS Markit Economist Claudia Wehbe)

- Peru's economic activity contracted by 3.39% during the first quarter of 2020, expanding slightly by 0.78% on an annual basis.

- On the demand side, the March performance was driven by unfavorable results in both domestic and external demand, such as sharp contractions in retail sales (-6.97% year on year [y/y]), in the imports of non-durable consumption goods (-14.29% y/y), and in public investment in construction (-46.28%), as well as declining exports of traditional and non-traditional goods.

- During the February-April moving quarter, there was a 25% decrease in employment in comparison with the same moving quarter in 2019, the equivalent to 1.217 million persons, mainly affecting the construction and manufacturing sectors. The unemployment rate stood at 9.0% compared with 7.3% during the respective 2019 quarter.

- IHS Markit projects real GDP growth forecast in the neighborhood of -4.7% for 2020 as risks remain to the downside despite the announcement of a USD25-billion economic stimulus package (equivalent to 12% of GDP) to attempt to counter the negative effects of the coronavirus disease 2019 (COVID-19)-virus outbreak.

Europe/Middle East/ Africa

- European equity markets closed sharply higher across the region; Germany +5.7%, France +5.2%, Spain +4.7%, UK +4.3%, and Italy +3.3%.

- 10yr European govt bonds closed mixed with Italy -18bps, Spain -1bp, Germany +6bps, and France/UK +2bps.

- iTraxx-Europe investment grade index closed higher today at -6bps/84bps and iTraxx-Xover high yield -42bps/499bps.

- Brent crude closed +7.1%/$34.81 per barrel.

- The European Securities and Markets Authority said today that regulators in Austria, Belgium, France, Greece and Spain opted to lift restrictions on short selling of equities in their country's markets. Italy also ended measures that were set to expire in June. (WSJ)

- 10yr Italian govt bond closed sharply higher at -18bps/1.67% yield after German Chancellor Angela Merkel and France's President Emmanuel Macron today proposed a €500 billion recovery fund for the European countries most impacted by the COVID-19 pandemic.

- Italy has reopened shops, restaurants and hair salons from

today (18 May) providing social distancing rules are enforced to

control the coronavirus disease 2019 (COVID-19) virus. This was

sooner than expected, after the government had previously targeted

1 June for the grand reopening. (IHS Markit Economist Raj Badiani)

- The shutdown entailed the closure of non-essential retail premises from 11 March, which led to plunging retail spending. Specifically, retail sales in volume terms declined by 21.3% between February and March, and were 19.5% lower than a year earlier. The largest year-on-year (y/y) drops occurred in clothing (57.1%), sporting equipment, games and toys (54.2%) and shoes, leather goods and travel items (54.1%).

- Other major signposts in the exit strategy will be the opening of gyms, swimming pools and sports centers on 25 May, followed by cinemas and theatres on 15 June.

- With the economy projected to shrink by around 11.2% (IHS Markit) in 2020 accompanied by a spiraling public debt ratio, the government has decided to accelerate its COVID-19 exit strategy to start normalizing economic activity.

- Fiat Chrysler Automobiles (FCA) has confirmed that it has applied for state-backed loan guarantees from the Italian government, following media reports. In a statement, the company said that it is in discussions with the Ministry of Economy and Finance (MEF) and the Ministry of Economic Development (MISE) to obtain a guarantee from Italy's Export Credit Agency, SACE, under the recently enacted Liquidity Decree to help companies affected by the COVID-19 virus pandemic. (IHS Markit AutoIntelligence's Ian Fletcher)

- Pirelli has announced that its profits dropped during the first quarter of 2020 on weaker sales because of the coronavirus disease 2019 (COVID-19) virus pandemic. The company said in a statement that for the three months ending 31 March, its revenues are down by 20% year on year (y/y) to EUR1,052 million. Its adjusted earnings before interest, tax, depreciation and amortization (EBITDA) fell by 22.6% y/y to EUR244.2 million, while adjusted earnings before interest and tax (EBIT) have contracted by 35.6% y/y to EUR141.1 million, although it still has a margin of around 13.4%. Net profit ended the quarter at EUR38.5 million, a fall of 62% y/y. (IHS Markit AutoIntelligence's Ian Fletcher)

- The deep recession caused by the COVID-19 virus and the

measures taken to contain its spread are expected to depress

Germany's tax revenues in 2020 by almost EUR100 billion, a loss of

12% compared with the government's expectations only six months

ago. The knock-on effect of lower GDP levels in 2021-24 is reducing

revenue projections by roughly EUR40 billion in each of the

subsequent years. (IHS Markit Economist Timo Klein)

- The underlying assumption for nominal GDP growth in 2020 has deteriorated to a degree never seen before. Germany's GDP is now expected to contract by 4.7% year on year (y/y) instead of growing by 2.9%. Owing to the partial economic rebound, the nominal growth assumption for 2021 was raised from 3.1% to 6.8%, while the assumptions for 2022-24 have been kept at 2.8%.

- Wage growth assumptions are even more important for tax revenue estimates. For 2020, the projection has been reduced from 3.2% to -1.5%, whereas that for 2021 was increased from 3.2% to 4.1%. Once again, assumptions for 2022-24 were retained at 2.8%.

- The government projects that the overall public-sector tax revenues will decline from EUR799.3 billion in 2019 (then up by 3.0% y/y) to EUR717.8 billion in 2020 (-10.2% y/y), subsequently rebound by 10.4% to EUR792.5 billion in 2021, before resuming a moderate growth path averaging 3.7% during 2022-24.

- Fitch revised its outlook on France's sovereign rating to

Negative owing to the impact of the COVID-19 virus shock on

economy. The rating has been affirmed at AA, but the impact of the

COVID-19 virus shock on the economy and public finances has caused

Fitch to revise the outlook from Stable to Negative. (IHS Markit

Economist Diego Iscaro)

- A combination of falling activity with the large fiscal measures put in place to limit the impact of the COVID-19 virus shock on the economy will lead to a large increase in government borrowing and indebtedness. Fitch notes that France's public-debt levels are already high compared with other AA-rated sovereigns, while fiscal consolidation since the global crisis has been limited.

- Fitch expects France's GDP to decline by 7.0% in 2020, in line with its estimate for the eurozone. It then expects France's real GDP to partially recover by 4.1% in 2021, although it projects the level of the country's real GDP during the fourth quarter of 2021 to be around 2.4% below where it was during the fourth quarter of 2019.

- The ratings agency projects the fiscal deficit to widen from 3.0% of GDP in 2019 to 9.2% this year, driving the gross general government debt ratio to 115.3% by the end of 2020.

- Poland's first-quarter GDP results were stronger than

anticipated, but a significant deterioration is expected starting

in the second quarter owing to weakening household demand and fixed

investment. First-quarter data showed only modest effects from the

lockdown, which took effect in mid-March. (IHS Markit Economist

Sharon Fisher)

- Seasonally adjusted GDP fell by 0.5% quarter on quarter (q/q), somewhat less pronounced than our new May forecast (at -1.0% q/q).

- GDP rose by 1.6% y/y in seasonally adjusted terms and by 1.9% y/y in unadjusted terms.

- Seasonally adjusted GDP fell by 0.5% quarter on quarter (q/q), somewhat less pronounced than our new May forecast (at -1.0% q/q).

- Although the first-quarter results were somewhat better than expected, IHS Markit plans to keep its 2020 GDP growth forecast for Poland stable at -4.7% in the May detailed forecast round. Confidence data signal a much steeper drop in economic activity in April than in March, and IHS Markit is projecting a severe second-quarter decline that will keep y/y growth negative at least through early 2021.

- Romanian GDP increased by 0.3% quarter on quarter in the first

quarter of 2020, but expectations in most sectors fell to

historical lows in April. IHS Markit expects the economy to

contract by 7% in 2020. (IHS Markit Economist Vaiva Seckute)

- Seasonally and working-day-adjusted GDP rose by 2.7% year on year (y/y) in the first quarter of 2020, a deceleration from 3.9% y/y in the previous quarter. However, a significant revision is possible to this estimate as alternative data sources had been used because of a high non-response rate amid the COVID-19-virus crisis.

- The construction sector sustained its growth momentum in March, as companies operating in Romania have also been announcing plans for new investments in logistic infrastructure and retail trade facilities this year.

- Retail trade continued driving the economy in the first quarter; however, the momentum started to fade in March.

- Contraction in industry reached almost 15% y/y in March, with a likely further acceleration in decline in April.

Asia-Pacific

- Most APAC equity markets closed higher except for India -3.4%; Australia +1.0%, Hong Kong +0.6%, Japan/South Korea +0.5%, and China +0.2%.

- Pharmaceutical manufacturers in India continue to face disruptions to operations despite the wide resumption of drug manufacturing activities amid the ongoing COVID-19-related lockdown. According to The Times of India, "a steady supply of medicines, particularly in remote areas, may be impacted as drug companies continue to face challenges in distribution and logistics." Although pharmaceutical companies are permitted to operate despite lockdown restrictions, most units are only operating at 50-60% capacity, due in part to travel restrictions that are preventing people from getting to work at production facilities. Additionally, containers containing key starting materials and APIs remain stuck at ports because of staff shortages at ports and among importing agents. (IHS Markit Life Science's Sacha Baggili)

- Japan's real GDP growth fell by 0.9% quarter on quarter (q/q),

or 3.4% q/q annualized, for the first quarter of 2020 following a

1.9% q/q (or 7.3% q/q annualized) drop in the previous quarter.

While all major components, except government consumption, declined

because of the spread of the COVID-19 virus and related containment

measures, the major factor behind the contraction of real GDP

growth was consumer spending, which fell by 0.7% q/q. (IHS Markit

Economist Harumi Taguchi)

- Japan's containment measures for the COVID-19 virus in the first quarter were modest, as stores and restaurants remained open. Spending on non-durable and durable goods rose by 1.1% q/q and 1.6% q/q, respectively, reflecting the drop-out downside from disruption caused by the consumption tax increase and natural disasters in October 2019.

- Spending on semi-durable goods and services continued to drop, by 5.2% q/q and 2.3% q/q, respectively, in response to social distancing moves and the government's request that sports and cultural events be cancelled or postponed in March.

- According to the Ministry of Economy, Trade and Industry, the Indices of Tertiary Industry Activity (ITIA) fell by 5.7% month on month (m/m) in March, with an 8.3% m/m drop for broad-ranging personal services, including eating and drinking places and take-out and delivery services (down 24.4% m/m), accommodations (down 46.3% m/m), sports facilities (down 25.3% m/m), amusement and theme parks (down 93.6%), and passenger transport (down 50.1% m/m).

- Private residential investment continued to decline (down 4.5% q/q), reflecting continued sluggishness for new housing starts following the consumption tax increase.

- Private capital expenditure (capex) also fell (down 0.5% q/q) in line with declines in machinery orders and manufacturers' shipments of capital goods.

- Public investment turned to a decline (down 0.4% q/q) following four consecutive quarters of increases, as the effects of fiscal stimulus moves introduced early 2019 faded.

- The results for the first quarter are largely in line with IHS Markit forecast for a decline of 3.8% q/q annualized. Real GDP will probably continue to decline with a sharper contraction in the second quarter due to stronger containment measures in response to a state of emergency in effect in April and May. We maintain our outlook for Japan's real GDP to shrink by 5.5% in 2020.

- Toyota has announced its plans to cut domestic production in June by around 40% owing to the COVID-19 virus, according to a company statement. Production at all Japanese plants will be halted for four days between 5 June and 26 June. The Takaoka plant, production line #2, and Toyota Industries Corporation, production lines #301 and #302, will operate during these four days as an exception. In addition, production at 10 production lines at seven plants will remain suspended for two to seven days in June. (IHS Markit AutoIntelligence's Tarik Arora)

- In the full fiscal year (FY) 2019/20, Subaru reported net income of JPY152.6 billion (up 7.9% y/y) and operating income of JPY210.3 billion (up 15.7% y/y). Revenue during the full FY stood at JPY3.34 trillion (up 6% y/y). The automaker sold 1.033 million vehicles during the year to register 3.3% y/y growth. Domestic sales during this year declined 7.6% y/y (125,800 units), and overseas sales increased 5% y/y to around 908,000 units. Sales in the US were up 6.4% y/y to 701,600 units in April-March. Overseas sales increased as sales in the US jumped, driven by strong demand for the Ascent and Forester. (IHS Markit AutoIntelligence's Tarik Arora)

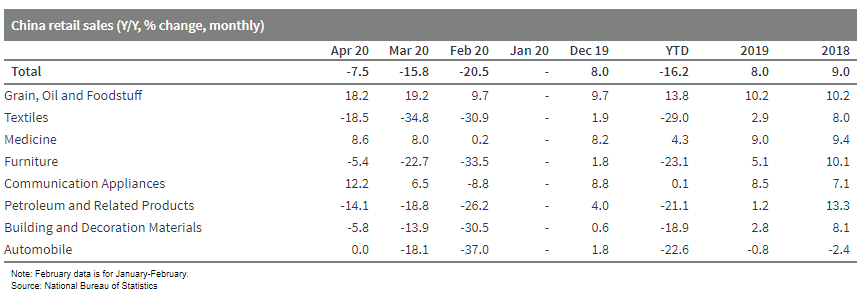

- Most of China's macro indicators continued to improve in April

with easing monetary policy and ongoing work resumption; headwinds

from global economic shock, rising unemployment rate and declining

profits will be obstacles for Chinese government to revive the

economy from the demand side. (IHS Markit Economist Yating Xu)

- China's month on month (m/m) industrial value-added growth was 2.3% in April, following a 33.0% m/m expansion in March, suggesting consecutive sequential recovery in industrial production. However, the year-to-date growth remained in 4.9% y/y contraction.

- 28 out of 41 surveyed sectors reported increase in production in April, compared to 16 in March. Manufacturing led the headline growth, with raw chemical materials and products, ferrous metals smelting and pressing, non-ferrous metals smelting and pressing and equipment manufacturing all reporting increase in production from a year ago.

- Auto manufacturing registered 5.8% y/y growth, compared to a 22.4% contraction in the previous month.

- Service production index fell 4.5% in April, improving from a 9.1% drop in the first quarter, suggesting a sequential improvement in service sector with the ongoing work resumption and easing restrictions.

- The year-to-date Fixed asset investment (FAI) declined 10.3% y/y in April, compared to a 16.1% y/y contraction in the first quarter. The April FAI increased 6.2% from a month ago, following a 6.1% m/m expansion in March.

- Nominal retail sales contracted 7.5% y/y in April, compared to a 15.8% y/y decline in March.

- Auto sales recovered to the level a year ago from a 18.1% y/y contraction; sales of oil products, furniture, clothing and building materials declined at a slower pace.

- Online sales rose 1.7% y/y through April, compared to a 0.8%

y/y contraction in the first quarter. Online commodity sales growth

continued to accelerate to 8.6% y/y expansion, driving up its share

in total retail sales to 24.1%. The gap between online sales and

online commodity sales reflected the flattering online service

consumption.

- New home price inflation of 70 major cities across China

surveyed by the National Bureau of Statistics (NBS) averaged at

0.4% month-on-month (m/m) in April, sustaining the recovery since

March. (IHS Markit Economist Lei Yi)

- Pent-up housing demand got further released thanks to the removal of widespread shutdowns, as well as the 10-basis point reduction in the five-year loan prime rate (LPR), which drove down mortgage rates.

- Up to 50 out of the 70 surveyed cities reported higher new home prices than the previous month. The pickup in m/m price inflation was especially strong in tier-2 and tier-3 cities, up by 0.3 percentage points from March, compared with an average of only 0.1 percentage points increase in four tier-1 cities.

- Year-on-year (y/y) new home price inflation fell to 5.2% y/y on average, with tier-1 cities registering the biggest drop across city tiers. As of April, y/y price inflation has been declining for 12 consecutive months in tier-2 cities, 13 for tier-3.

- Further recovery in the housing market is expected, especially with the upcoming National People's Congress to bring more stimulus measures to stabilize the economic outlook. Nevertheless, with the government's strict stance against speculation still in place, weak home price inflation most likely will stay for the rest of the year.

- Surveyed unemployment rate inched up again to 6% in April, suggesting lingering pandemic impact on potential buyers' purchasing power would rule out the possibility of a substantial demand rebound.

- New vehicles sold on a wholesale basis in China increased by

4.4% year on year (y/y) to 2.07 million units during April, while

production rose by 2.3% y/y to 2.10 million units, according to

latest data from CAAM. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Sales of passenger vehicles (PV) fell by 2.6% y/y to 1.54 million units in April, while PV production decreased 4.6% y/y to 1.59 million units. In the year to date (YTD; January to April), PV sales decreased 35.3% y/y to 4.43 million units, while PV production fell by 37.8% y/y to 4.29 million units.

- Commercial vehicle (CV) demand in China surged during April, contributing to the strong rebound in new vehicle sales. In April, CV sales rose by 31.6% y/y to 533,756 units, while CV production increased 31.3% y/y to 514,167 units. In the YTD, sales of CVs fell by 12.4% to 1.33 million units, while CV production dropped by 13.1% to 1.30 million units.

- China's sales of new energy vehicles (NEVs), which include battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel-cell vehicles (FCVs), registered a decline of 26.5% y/y to 72,000 units in April, while NEV production decreased 22.1% y/y to 80,000 units.

- On 15 May, the US Commerce Department issued an order

prohibiting chip manufacturers, including non-US semiconductor

firms, from supplying Huawei with semiconductors or chip designs

produced using US software or technology. US government approval

must be obtained to resume sales. Taiwanese chip manufacturer TSMC

also announced plans to establish an advanced semiconductor

fabrication plant in Arizona. The chips it will produce are

reportedly to be used in US F-35 fighter aircraft. The US market

accounts for more than half of TSMC's sales, with contracts from

major US technology firms including Apple and Microsoft. (IHS

Markit Country Risk's John Raines and David Li)

- The US measures against Huawei represent a further punitive action against China. The move affects technology supply chains, and will affect the production of mobile telephones, telecoms equipment, server processors and surveillance cameras in the coming months.

- China's priority is not to engage in prolonged conflict with the United States, but it is likely to undertake retaliatory responses to US actions, alongside displays of willingness to negotiate on US demands, to delay the Trump administration escalating its measures against China.

- China is also likely to increase pressure on areas with significant US business presence, including Hong Kong SAR and Taiwan.

- The Express Tribune reported on 16 May that the Pakistani

government is looking to issue PKR3.0-trillion (USD18.7 billion)

worth of government securities to commercial banks. The securities

will take a variety of forms, from three-month treasury bills to

20-year bonds. About PKR2.0-trillion worth of instruments will be

used to repay existing bonds. (IHS Markit Banking Risk's Angus Lam)

- This suggests a new net issuance of PKR1 trillion to banks, which is equivalent to a 12.5% increase on the estimated PKR8.0-trillion worth of government security holdings by banks as of the end of 2019 (latest).

- As of end-2019, loan-to-deposit ratio for commercial banks was 51%. However, when government securities are included, the ratio of loan to government security investment rises to around 106%, suggesting an already tight liquidity position.

- Pakistan's banking sector's structural liquidity position is likely to be further under pressure because of the continued expectation to support government finances.

- Moody's affirmed Mongolia's long-term credit rating at B3 (60

on IHS Markit's numerical scale) while shifting its outlook from

Stable to Negative. (IHS Markit Economist Bree Neff)

- With the fall in copper and coal prices (the country's top sources of foreign-exchange earnings), Moody's expects Mongolia's current-account deficit to come in at 15-20% of GDP in 2020. Due to the losses in foreign-exchange earnings, foreign reserves will fall from USD4.4 billion as of February 2020 to USD3.0 billion by year-end 2020. However, Moody's indicated that for this to come to fruition, the government would need to secure financing for its fiscal stimulus package from official lenders.

- Moody's stated that a return to a Stable outlook would require evidence of improvements in the government's management of public finances, thus limiting the need for external borrowing. Similarly, evidence pointing to the government being able to refinance upcoming external debt repayments at reasonable rates could enable an improvement in outlook.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--18-may-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--18-may-2020.html&text=Daily+Global+Market+Summary+-+18+May+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--18-may-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 18 May 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--18-may-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+18+May+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--18-may-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}