Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 02, 2018

Cybersecurity factors powered by BitSight

Research Signals - February 2018

Chief financial officers rate hacking the top external risk in a recent survey, with good reason. High profile cybersecurity attacks dominated the news cycle in 2017, including the Equifax data breach, the NotPetya worm, and the breach of the Securities and Exchange Commission’s Edgar system, housing financial reports and other public company statements. Given the pervasiveness of cyber risks, we have partnered with BitSight Technologies to introduce factors derived from their Security Ratings that quantify cybersecurity risks to enhance stock and portfolio risk management.

- BitSight captures company-specific cybersecurity risk through a proprietary process, providing quantifiable Security Ratings

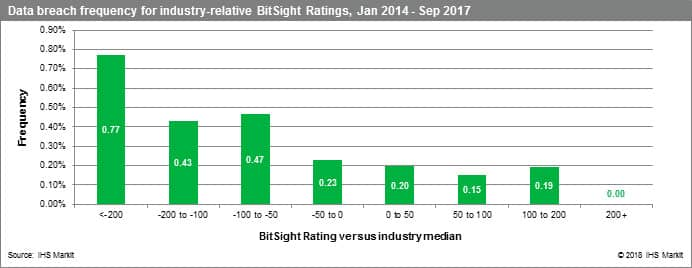

- We find BitSight Security Ratings are predictive of data breach events, and such events on average have a negative impact on excess stock price returns of 44 bps over the first 10 days from when a breach is identified

- In addition to the normalized systematic BitSight Rating and their underlying related vectors that provide transparency, we construct 16 derived factors measuring changes in ratings and industry-relative positioning, among others

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcybersecurity-factors-powered-by-bitsight.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcybersecurity-factors-powered-by-bitsight.html&text=Cybersecurity+factors+powered+by+BitSight","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcybersecurity-factors-powered-by-bitsight.html","enabled":true},{"name":"email","url":"?subject=Cybersecurity factors powered by BitSight&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcybersecurity-factors-powered-by-bitsight.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Cybersecurity+factors+powered+by+BitSight http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcybersecurity-factors-powered-by-bitsight.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}