Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 01, 2018

CCR KVA with Least Squares Monte Carlo

The Basel III/IV framework contains a number of new and updated measures to increase bank liquidity, decrease bank leverage, and to strengthen risk management and regulation in the banking and financial sector. The latest amendments were just finalized in December 2017, and all features are expected to be implemented or phased in by 2022. The framework increases capital charges substantially and makes banking activities more capital intensive. The cost of holding regulatory capital over the lifetime of a portfolio to buffer and control counterparty losses therefore is finding its way into derivatives pricing in the form of the capital valuation adjustment (KVA). It supplements other upfront adjustments such as credit, debit, funding, and collateral/margin valuation adjustments (CVA, DVA, FVA, and ColVA/MVA, respectively).

Estimating the lifetime cost of capital, or KVA, is a non-trivial

task. The capitalization of counterparty credit risk under Basel

III/IV builds on frameworks for counterparty default (CCR) risk and

credit valuation adjustment (CVA) risk and is reinforced by the

leverage ratio and the (risk-weighted) capital floor as backstops.

But even without considering the impact of these backstops, pricing

capital requirements can be challenging, as it requires fast and

accurate numerical estimation of exposures over potentially long

time horizons and high-dimensional risk factor spaces.

Both CCR and CVA capital use as one of the inputs the exposure-at-

default (EAD), whose non-internal model method (non-IMM)

alternatives were updated in Basel III/IV to the standardized

approach for measuring counterparty credit risk (SA-CCR). With the

new SA-CCR methodology, EADs are more risk-sensitive generally, but

also tend to be more conservatively calibrated than the previous

non-IMM methods, in particular in the absence of collateral. The

Basel III/ IV CCR capital framework, however, opens the door to

adjusting the EAD for incurred CVA as a capitallowering measure.

This follows from the fact that the upfront CVA already realizes

the expected cost of counterparty credit default. Its impact

therefore is recognized in Basel III/IV by the introduction of the

outstanding EAD, i.e. the maximum of zero and the EAD less the

incurred CVA, in lieu of solely the EAD (this applies to CCR

capital calculations only).

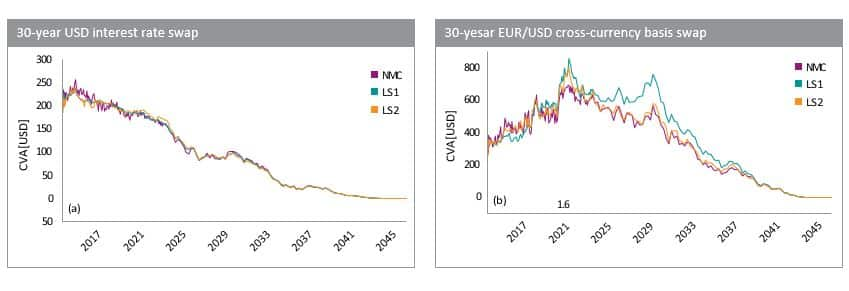

Under SA-CCR, estimating the EAD over the lifetime of a transaction or portfolio is relatively straightforward. The SA-CCR formulae can be embedded within a single Monte Carlo pass and evaluated for each path and time step. Factoring in the incurred CVA on the other hand is computationally more elaborate and, taking the brute force route, requires lengthy nested Monte Carlo simulations. To avoid this bottleneck, one may resort to least squares Monte Carlo where the incurred (or forward evaluated) CVA is approximated efficiently over the entire time horizon by regressionbased proxies (see Figure 1).

Figure 1: One-path incurred/forward CVA projections for (a) a 30-year USD interest rate swap and (b) a 30-year EUR/USD cross-currency basis swap, based on nested Monte Carlo (NMC) and two types of least squares Monte Carlo (LS1 and LS2). In the present case, approach LS2 utilizes more explanatory variables than LS1 and tends to agree better with the nested Monte Carlo benchmark.

The success and accuracy of the regression approach, of course, depends on a number of different factors, chiefly among them the choice of regression basis functions and explanatory variables, but also, to equally important extent, the way the regressionbased proxies are used in subsequent computations. For CCR capital and CCR KVA calculations, the incurred/forward CVA enters the outstanding EAD, which in turn makes up part of the risk-weighted asset (RWA) that the CCR risk framework relies on. The outstanding EAD thus has to be manipulated accordingly to keep estimator bias at bay. This is akin to the Longstaff-Schwartz approach to Bermudan option pricing1. Hence, as with the Bermudan option exercise boundary, the overall accuracy for CCR KVA computations therefore ultimately comes down to accurately approximating the trigger boundary of the max-operator of the outstanding EAD.

Some questions that arise naturally in this context are the

following: What is the actual impact of the incurred CVA on CCR

capital and/or CCR KVA? How accurate is the regression approach

typically? And, under what circumstances do the approximations

become increasingly challenging for CCR capital and CCR KVA? These

questions are hard to answer in general terms as portfolios and

netting sets can have complicated exposures and the time structure

of the CCR KVA integrand (partially determined, for example, by the

counterparty survival probability and/or the dynamics of the

internal ratings based (IRB) CCR risk weights) can sensitively

impact the final CCR KVA result.

The regression approach obviously also becomes more challenging the

larger the number of underlying risk factors. Simple instruments,

however, such as an interest rate swap or a cross-currency basis

swap (both without collateral) indicate that the SA-CCR EAD tends

to outsize the incurred/forward CVA, typically by up to a few

multiples. The reduction of CCR KVA due to upfront CVA therefore is

tangible, and even rough incurred/forward CVA proxies can lead to

good results.

In very rare circumstances, SA-CCR EAD and incurred CVA can be made

of roughly equal size, giving rise to relatively small CCR KVA. In

these cases, higher accuracy of the forward CVA estimate may be

desirable and can be achieved through further refinement of the

regression approach. Compared with other valuation adjustments, CCR

KVA appears to be smaller overall than the corresponding CVA KVA

(excluding CVA hedging) or the upfront CVA.

In a nutshell, even though the updates for counterparty credit risk

put in place by the Basel III/IV regulation have made counterparty

credit risk capital and the cost of capital more severe - to

encourage collateralization, hedging, and central clearing -

upfront CVA has a real, mitigating impact on CCR capital and CCR

KVA. The impact can be computed efficiently with exposure

simulations, and the accuracy can be reasonably well controlled by

utilizing a regression based proxy for incurred/forward CVA.

More details are available here.

1 Longstaff, F. A. and Schwartz, E. S. (2001) Valuing American Options by Simulation: A Simple Least-Squares Approach. The Review of Financial Studies, 14, 113

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fccr-kva-with-least-squares-monte-carlo.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fccr-kva-with-least-squares-monte-carlo.html&text=CCR+KVA+with+Least+Squares+Monte+Carlo+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fccr-kva-with-least-squares-monte-carlo.html","enabled":true},{"name":"email","url":"?subject=CCR KVA with Least Squares Monte Carlo | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fccr-kva-with-least-squares-monte-carlo.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=CCR+KVA+with+Least+Squares+Monte+Carlo+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fccr-kva-with-least-squares-monte-carlo.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}