Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Nov 11, 2015

Indian credit outperforms Brics, but politics concern investors

India has been a bright spot in emerging markets over the past two years, but political tensions look set to derail progress.

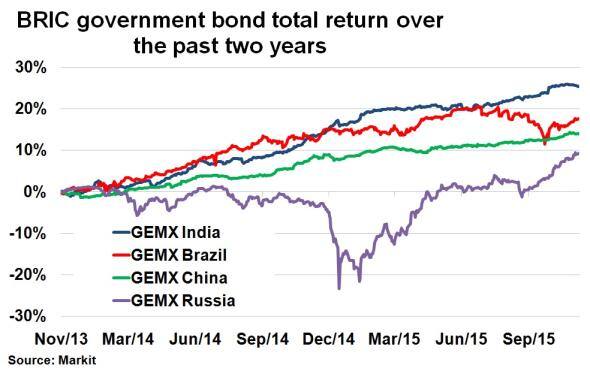

- Indian government bonds have outperformed Bric peers over the past two years

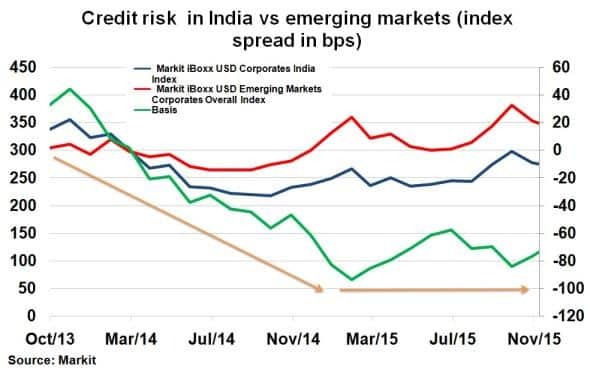

- Indian corporates rallied as Modi came to power, but have since seen credit risk flatten

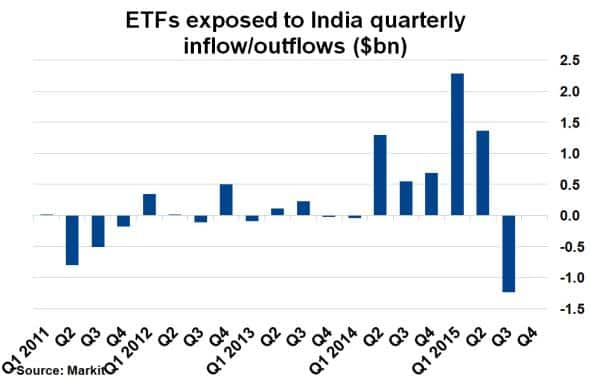

- ETFs exposed to Indian assets saw $1.2bn of outflows in Q3, the highest in five years

This week Goldman Sachs announced the closure of its dedicated Bric (Brazil, Russia, China and India) fund after nearly ten years. The move signalled the end of the Bric era, as this year saw recessions plague Russia and Brazil while growth in China stalled.

India, however, has remained a bright spot, and the performance of its government bonds highlights this. Over the past two years, Indian government bonds have returned 25% on a total return basis, according to Markit's iBoxx indices. Conversely, Bric peers have lagged with Chinese government bonds returning only 14% over the same period. Brazilian government bond returns were actually on par with that of India in June this year, but a slump in commodity prices and political turmoil in Brazil sent returns diverging.

The stability of Indian government bond returns over the past two year's signals investors' confidence. Having largely avoided any external shocks, India has remained fiscally prudent while providing robust growth. The period has also coincided with a rise in power of the current Prime Minister Narendra Modi, known for his progressive economic agendas.

Corporates fall flat

Since Modi started gaining traction in late 2013, investors have flocked to Indian corporate bonds. The basis between the Markit iBoxx USD Corporates India index spread and the Markit iBoxx USD Emerging Markets Corporates Overall index spread fell from 33bps to -38bps leading up to his election win in May 2014. This highlights the positive reaction from bond investors in the wake of the Modi election. Indian corporates then further outperformed emerging markets in 2014, partly due to being insulated against commodity price shocks. However, the basis has flattened over the last eight months, suggesting a stall in the post Modi rally.

Last Bric to stumble

Last month, Moody's Analytics issued a note stating that rising internal tensions in India could derail Modi's economic reform plans. The task was made harder last week when his party was comprehensively beaten in state elections in Bihar. Credibility abroad is also of key concern if Modi cannot reign in nonconformist members of his party.

Investors have been quick to react to the brewing political tensions. ETFs tracking Indian assets saw $1.2bn of outflows in Q3, the highest in five years and the first negative outflow quarter of the Modi era. Investors have also stayed away in the current quarter so far, as investment sentiment wanes in the world's largest democracy.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcredit-indian-credit-outperforms-brics-but-politics-concern-investors.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcredit-indian-credit-outperforms-brics-but-politics-concern-investors.html&text=Indian+credit+outperforms+Brics%2c+but+politics+concern+investors","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcredit-indian-credit-outperforms-brics-but-politics-concern-investors.html","enabled":true},{"name":"email","url":"?subject=Indian credit outperforms Brics, but politics concern investors&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcredit-indian-credit-outperforms-brics-but-politics-concern-investors.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Indian+credit+outperforms+Brics%2c+but+politics+concern+investors http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcredit-indian-credit-outperforms-brics-but-politics-concern-investors.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}