Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 10, 2020

High-frequency Commodities at Sea data shows Chinese imports drop persisting, crude recovers and no significant signs of normalcy for dry bulk yet

Commodities at Sea (CAS) analysis:

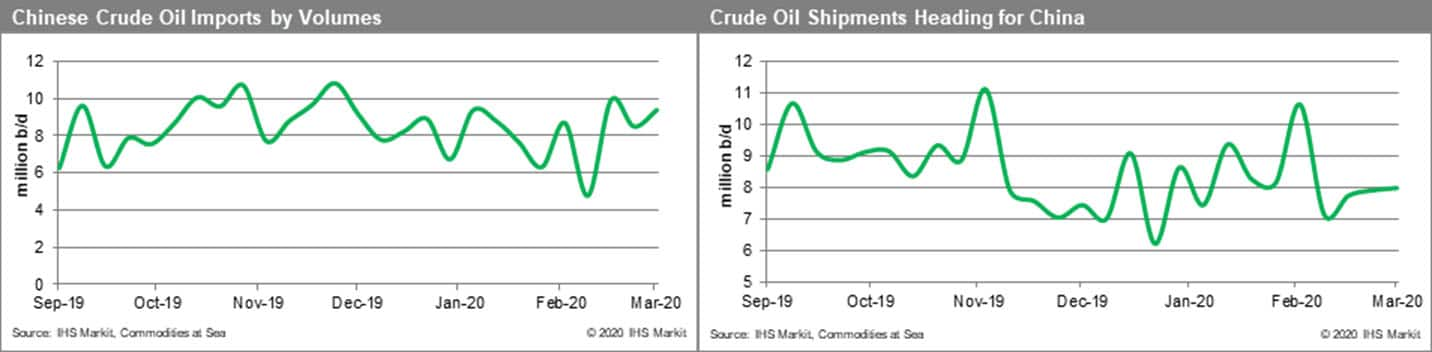

- Crude oil imports recover in late February, iron ore, coal, minor bulks seeing double dip.

- Chinese imports of crude oil recovered quickly after falling to

four Mn b/d in Week 07, but demand is still dramatically down.

- Crude oil shipments heading for China have remained below eight million b/d since mid-February.

- Chinese demand is still estimated to be rather low. Floating storage is expected to start increasing.

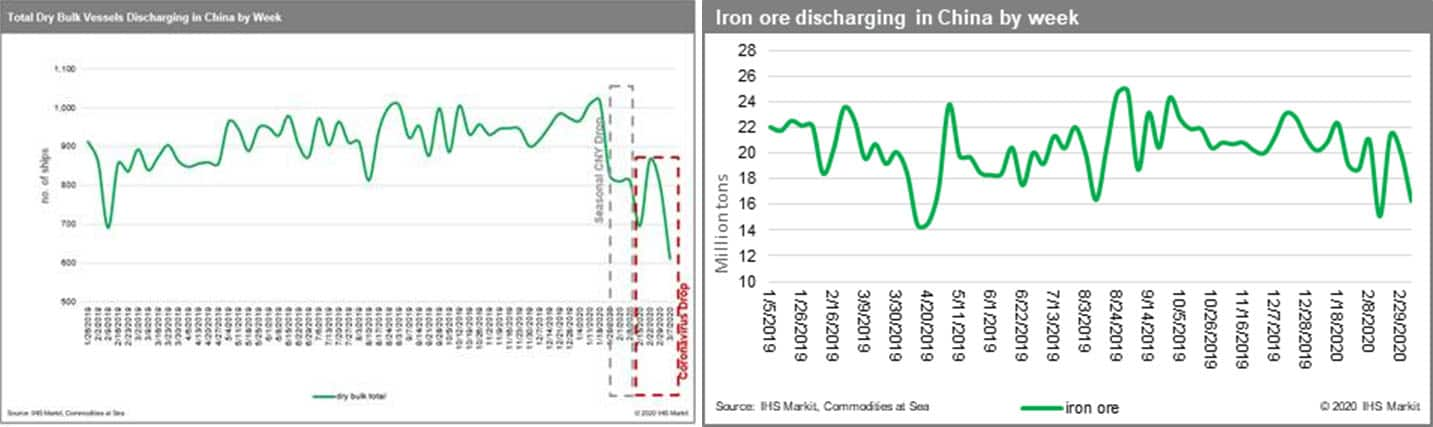

- Since the n-Cov19 outbreak, still visible stress on dry bulk

vessel discharges at the hundreds of Chinese ports.

- Seasonally adjusted, post-Chinese New-Year, dry bulk vessels discharging in China has nosedived ~ 30% from average levels (~ 611 vessels recorded weekly discharge in China in the week ending 07th Mar vs 900 vessels on average).

- Chinese iron ore discharges (8-week moving average) is at 19mt, 6% lower than previous year levels. For March 2020 iron ore arrivals are calculated at 76.1mt.

- As per CAS data, thermal coal arrivals in the month of March 2020 are calculated at 15.2mt, which is at almost previous year levels. However on back of restrictions actual discharges may be less than the calculation.

- CAS reveals China is still prioritizing larger vessels to discharge amid limited personnel availability at ports.

- China is the world's biggest importer of bulk commodities such as iron ore, crude oil, coal and is the demand driver of major globally-traded commodities.

- Tracking vessel discharges in real time in Chinese ports provides superior visibility into Chinese industrial activity levels before after-the-fact government reports.

- CAS model runs twice a day and provides immediate activity capture for vessel activity down to the port level.

Chinese imports of crue oil recovered quickly after falling to four Mn b/d in Week 07, but demand is still dramatically down

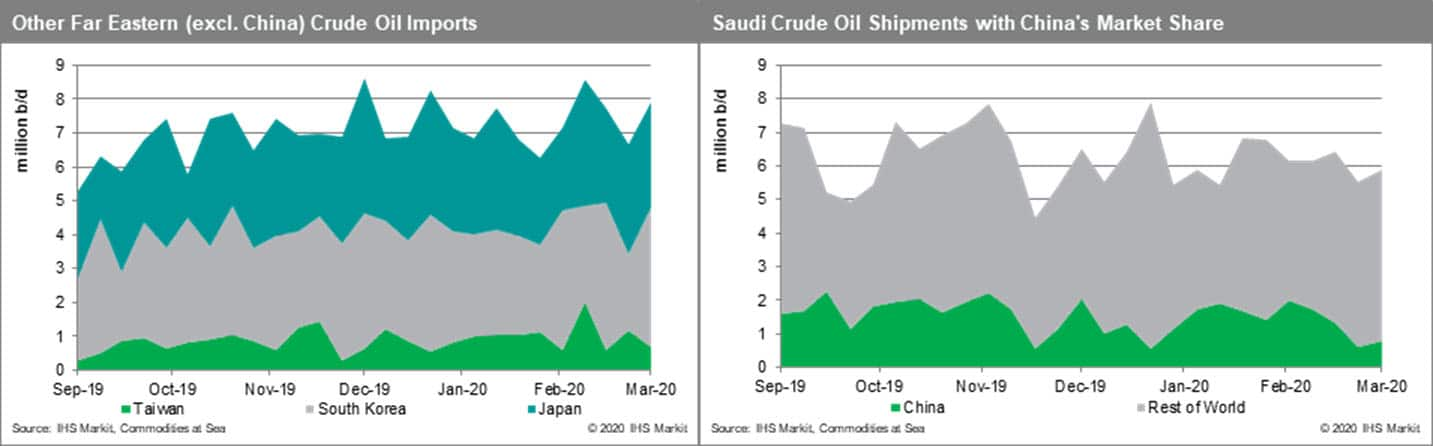

Other Far Eastern importers absorbed more in 1H February, while Saudi Arabia exports more to Rest of World as China's market share declines

Dry bulk vessels discharging in China still down ~ 30% in early March, visible stress on dry bulk vessel discharges at Chinese ports

Commodities at Sea - Data driven intelligence into commodity movements to deliver actionable insights and informed trading decisions.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcommodities-at-sea-china-imports-drop-persisting-crude-recovers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcommodities-at-sea-china-imports-drop-persisting-crude-recovers.html&text=High-frequency+Commodities+at+Sea+data+shows+Chinese+imports+drop+persisting%2c+crude+recovers+and+no+significant+signs+of+normalcy+for+dry+bulk+yet++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcommodities-at-sea-china-imports-drop-persisting-crude-recovers.html","enabled":true},{"name":"email","url":"?subject=High-frequency Commodities at Sea data shows Chinese imports drop persisting, crude recovers and no significant signs of normalcy for dry bulk yet | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcommodities-at-sea-china-imports-drop-persisting-crude-recovers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=High-frequency+Commodities+at+Sea+data+shows+Chinese+imports+drop+persisting%2c+crude+recovers+and+no+significant+signs+of+normalcy+for+dry+bulk+yet++%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcommodities-at-sea-china-imports-drop-persisting-crude-recovers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}