Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 19, 2018

Chinese economy set for best quarter since 2010, despite February dip

- Caixin Composite PMI Output Index down from January peak but still signals solid growth

- Robust order book growth and improved business optimism point to room for further economic expansion

- Cost pressures ease but remain strong

China’s economy lost a little momentum in February, but business activity growth remained solid, putting the country on course for its best quarter for over seven years. However, the labour market remained stagnant.

Broad-based growth

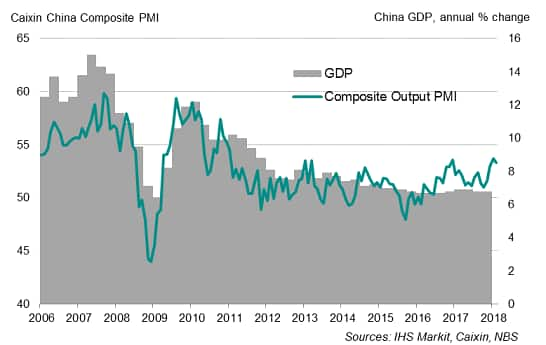

The Caixin Composite PMI™ Output Index fell from 53.7 in January to 53.3 in February, but remained among the strongest seen in recent years. The latest survey data took the average PMI reading so far in the first quarter to the highest since the fourth quarter of 2010, suggesting that GDP growth picked up in the first two months of 2018.

China PMI and economic growth

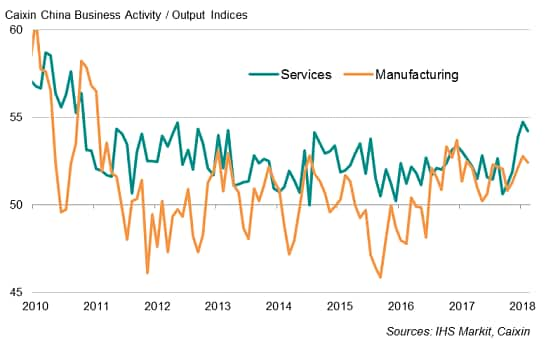

Growth remains encouragingly broad-based. The service sector led the upturn, enjoying one of the best growth rates seen over the past five years, while the manufacturing economy continued to grow at a rate above the average seen in the near nine-year period since the global financial crisis.

Broad-based upturn

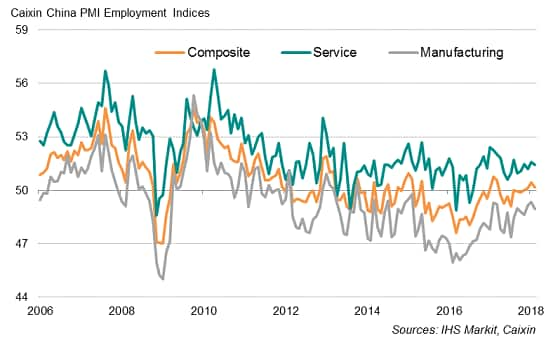

The only blight on the survey was that overall employment gains remained fragile. Staff numbers were broadly stagnant in February. Steady employment growth in services was almost entirely offset by a steeper rate of job shedding in the manufacturing sector, with reports of factories down-sizing their workforce.

China employment

Cost pressures

Companies continued to struggle with rising costs. While easing to a six-month low, input cost inflation remained marked. Anecdotal evidence revealed that increased costs for fuel and raw materials, in particular steel, copper and chemicals, were especially widely reported.

Average selling prices rose as firms sought to pass higher costs on to customers, albeit increasing to a lesser extent than late last year to hint at some downward pressure on margins.

Outlook

Survey data suggest that growth will continue to pick up in coming months. A robust increase in order books and a rise in business optimism about the year ahead to an eight-month high during February bode well for the Chinese economy in coming months.

The solid performance seen in early-2018 poses upside risk to GDP estimates, with most analysts still projecting a slowdown in economic activity. IHS Markit now sees China’s economy expanding by 6.7% this year, up from 6.6% in an earlier estimate, but slowing down from 6.9% in 2017.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-economy-set-for-best-quarter-since-2010-despite-february-dip.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-economy-set-for-best-quarter-since-2010-despite-february-dip.html&text=Chinese+economy+set+for+best+quarter+since+2010%2c+despite+February+dip","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-economy-set-for-best-quarter-since-2010-despite-february-dip.html","enabled":true},{"name":"email","url":"?subject=Chinese economy set for best quarter since 2010, despite February dip&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-economy-set-for-best-quarter-since-2010-despite-february-dip.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+economy+set+for+best+quarter+since+2010%2c+despite+February+dip http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-economy-set-for-best-quarter-since-2010-despite-february-dip.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}