Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 05, 2019

Chinese economic activity resilient but confidence at survey low, hurt by trade tensions

- Caixin Composite PMI™ Output Index dips to three-month low at 51.5 in May

- Rising trade concerns drag business confidence down to a survey low

- Lack of backlog accumulation points to subdued future activity

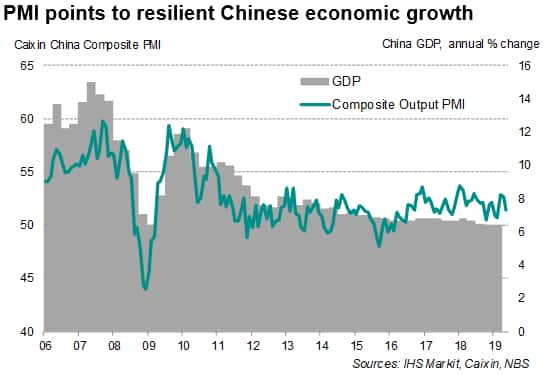

Chinese enterprises reported further growth in economic activity in May, according to the latest Caixin PMI™ surveys, although the rate of expansion slowed to a three-month low on the back of softer domestic demand. Business expectations for the year ahead meanwhile sank to the lowest in the series history, broadly reflecting rising concerns over the impact of US-China trade tensions.

With survey data also indicating a lack of accumulation in backlogs of work midway through the second quarter, owing to only a marginal gain in new work, the coming months will likely see business activity remain relatively subdued. There is also an increasing risk that an intensifying trade war will weigh further on client demand.

PMI dips to three-month low

The Caixin PMI survey's composite output index slipped to a three-month low, from 52.7 in April to 51.5 in May. Growth was led by an increase in services business activity, albeit with the rate of expansion easing, while manufacturing output was largely unchanged. Even though the average PMI (52.1) so far in the second quarter is above that of the previous two quarters, other PMI sub-indices failed to provide evidence that this pace of growth could be sustained in the months ahead, especially when exposed to a possible deterioration in global trade conditions.

Order book growth moderated to the slowest for three months, which contributed to a stagnant level of work-in-hand, suggesting that any future expansions of output could be subdued.

Furthermore, companies remained relatively cautious as softening demand amplified the need for greater cost controls. Total net employment consequently came under pressure, dipping marginally after two months of mild growth.

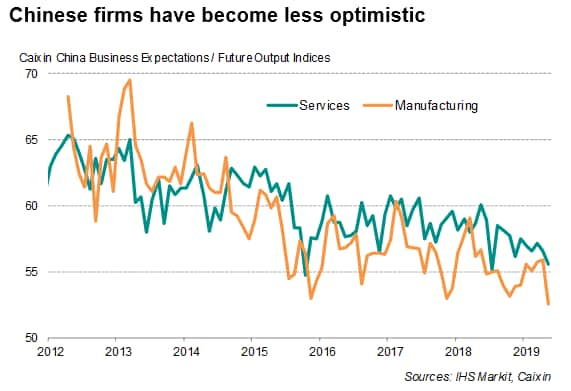

The dip in business expectations surrounding output in the year ahead represented a particular cause for concern. While still indicating positive sentiment, as optimists exceeded pessimists, the Future Output Index fell to its lowest since data on this indicator were first available just over seven years ago. According to anecdotal evidence, an expectation that US-China trade frictions could reduce output and sales was an especially common concern.

Subdued demand for investment and intermediate goods

While Caixin manufacturing PMI data continued to indicate signs of stabilisation in China's manufacturing economy, with the headline index remaining above the neutral 50.0 level for a third month running in May, manufacturing conditions remain vulnerable to a rapid escalation of trade tensions. This was highlighted by subdued growth in new orders and the lowest level of business confidence recorded among Chinese manufacturers in the series history.

Detailed data by types of manufactured product add to concerns about the health of the manufacturing sector. While orders for consumer goods continued to hold up reasonably well, sales of investment products (such as equipment and machinery) fell further in May. Demand for intermediate goods (semi-finished goods used as inputs in the production of other goods) was meanwhile stagnant.

More stimulus?

The fear is whether the headwinds facing the manufacturing sector will spread over to services. May saw softer growth in services activity, and at a pace below the series average, in part due to many service providers being reliant on a healthy goods-producing sector (transportation being the most obvious service sector whose performance is highly correlated with manufacturing). Backlogs in the service sector also continued to decline in May.

The general expectation is that any further deterioration in growth prospects will push the Chinese authorities towards considering more fiscal measures to support growth.

Bernard Aw, Principal Economist, IHS

Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-economic-activity-resilient-but-confidence-at-survey-low-hurt-by-trade-tensions-19-06-05.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-economic-activity-resilient-but-confidence-at-survey-low-hurt-by-trade-tensions-19-06-05.html&text=Chinese+economic+activity+resilient+but+confidence+at+survey+low%2c+hurt+by+trade+tensions+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-economic-activity-resilient-but-confidence-at-survey-low-hurt-by-trade-tensions-19-06-05.html","enabled":true},{"name":"email","url":"?subject=Chinese economic activity resilient but confidence at survey low, hurt by trade tensions | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-economic-activity-resilient-but-confidence-at-survey-low-hurt-by-trade-tensions-19-06-05.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+economic+activity+resilient+but+confidence+at+survey+low%2c+hurt+by+trade+tensions+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-economic-activity-resilient-but-confidence-at-survey-low-hurt-by-trade-tensions-19-06-05.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}