Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 08, 2019

Caixin PMI shows Chinese business activity growth quicken to five-month high

- Caixin China Composite PMI rises to five-month high, led by manufacturing recovery

- Order book volumes, backlogs and jobs all rise at a faster rate…

- … but business sentiment among lowest since 2012

Growth in China's business activity gained further momentum at the end of the third quarter, according to the latest Caixin PMI data, led by faster manufacturing growth. Near-term indicators, such as new orders, backlogs of work and employment all showed accelerated improvements. However, longer-term prospects remained subdued, with concerns often relating to trade tensions.

Steady third quarter growth

The Caixin China Composite PMI, compiled by IHS Markit, rose from 51.6 in August to 51.9 in September, signalling a modest improvement in the health of the economy. The latest reading was also the highest for five months.

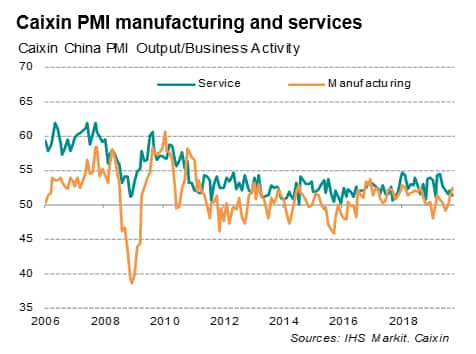

The stronger upturn in business activity reflected accelerated manufacturing output growth, which indicated the joint-strongest expansion since 2016 and helped offset slower service sector growth.

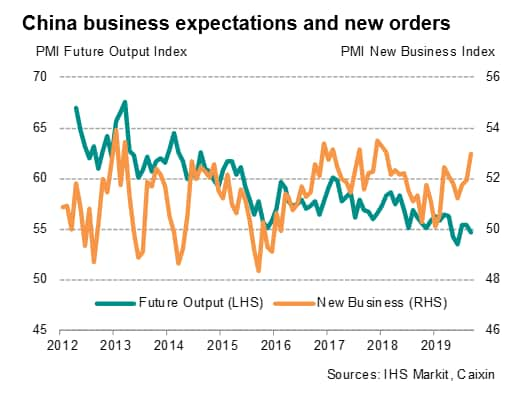

Demand conditions also strengthened in September. Overall new business volumes increased at the fastest pace for just over one-and-a-half years, driven mainly by the domestic market as foreign demand continued to weaken. New export business fell for a second straight month, underscoring the negative impact of deteriorating global trade conditions.

With backlogs of work now increasing at the joint-quickest rate since early-2011 during September, hinting at tighter operating capacity, companies stepped up their hiring. Job creation was not only reported for a second month in a row in September, but also ran at the fastest pace since the start of 2013. That said, overall employment growth was predominantly from the service sector, as factory job levels remained stagnant.

Manufacturing improves on stimulus

September saw the best improvement in manufacturing conditions since February 2018, driven by accelerated growth in both production and new orders. However, this improvement was uneven across the sector. Delving into the details of the survey revealed that, while sustained output growth was evident across the three firm sizes (small, medium and large), large Chinese manufacturers saw the fastest expansion in production, suggesting that current fiscal stimulus may have benefitted larger goods producers more than their small-to-medium-sized counterparts.

Services activity cools

Business activity in the service sector meanwhile cooled in September, showing the smallest expansion for seven months. However, other survey indicators suggest an improvement in the situation could be around the corner. New business growth was the fastest since the start of 2018, which led to the first time in nine months that a rise in unfinished workloads was reported. Services job creation also accelerated to a rate not seen since January 2017.

Trade woes

Unfortunately, the improved readings on overall output and order books was not matched by a rise in optimism among Chinese firms. Business sentiment about output over the next 12 months, while positive, slipped to a three-month low, and remained well below the historical average. The chief concern highlighted by companies continued to be the impact of the US-China trade war.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-pmi-shows-chinese-business-activity-growth-quicken-Oct19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-pmi-shows-chinese-business-activity-growth-quicken-Oct19.html&text=Caixin+PMI+shows+Chinese+business+activity+growth+quicken+to+five-month+high+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-pmi-shows-chinese-business-activity-growth-quicken-Oct19.html","enabled":true},{"name":"email","url":"?subject=Caixin PMI shows Chinese business activity growth quicken to five-month high | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-pmi-shows-chinese-business-activity-growth-quicken-Oct19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Caixin+PMI+shows+Chinese+business+activity+growth+quicken+to+five-month+high+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-pmi-shows-chinese-business-activity-growth-quicken-Oct19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}