Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 07, 2018

Brief overview on dividends from Temasek-linked companies

- Seven out of the eight Temasek-linked companies (TLCs) show no notable change in dividend policies after 2015.

- Dividends paid in recent years are underpinned by underlying performance or are consistent with existing payout patterns or policies.

- Aggregate dividends from eight TLCs remained relatively flat over the period between 2015 and 2017.

Temasek Holdings (Temasek) is one of the three institutions that contribute to the Singapore government's budget via the Net Investment Return Contribution (NIRC) framework. This framework was introduced in 2008 and returns from the state-owned investment firm were recently included in 2015.

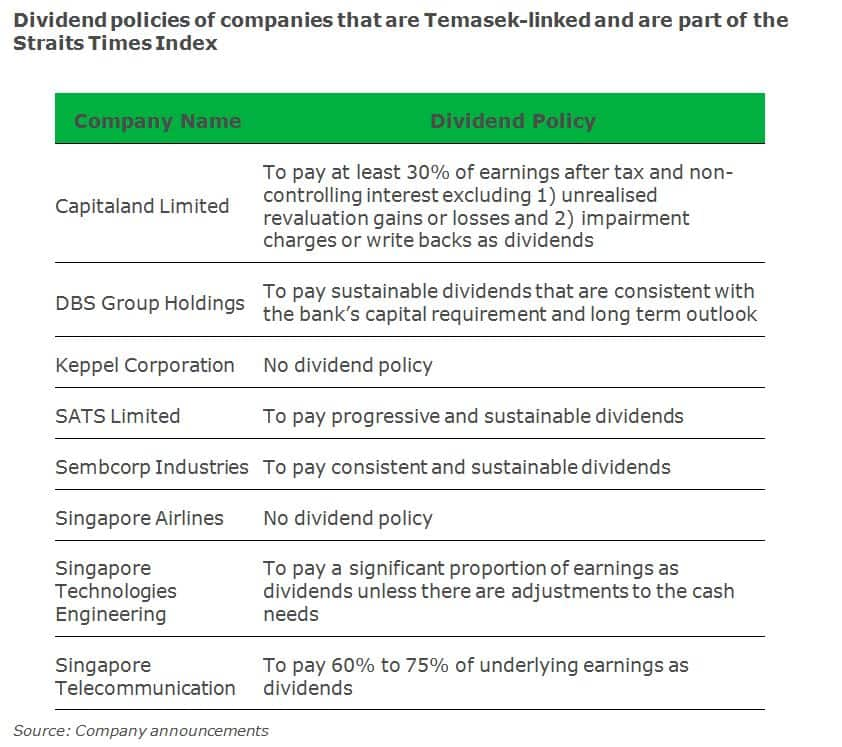

While we understand that the NIRC framework does not require Temasek to increase its dividend contribution, we evaluate the payouts from companies that Temasek has a stake in, and are part of the FTSE Straits Times Index (STI) to determine if the dividends paid after 2015 reflect any inconsistency to its historical trend, and if they can be substantiated by their underlying performance.

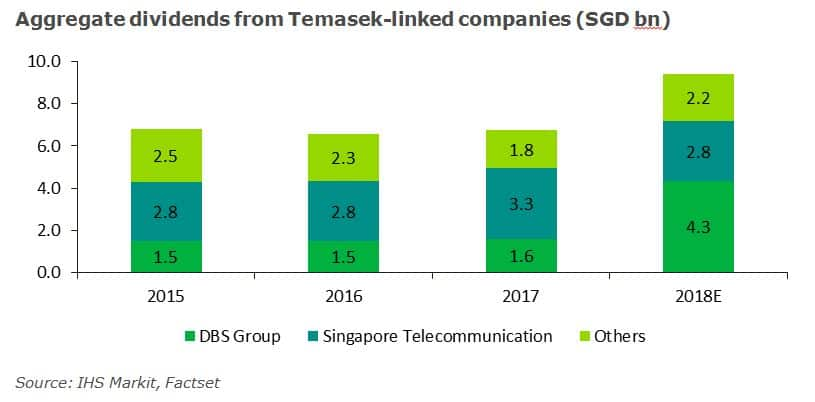

From 2015 to 2017, aggregate dividends from these TLCs fell modestly by 0.5%, from SGD 6.79bn to SGD 6.76bn, over the period. Although this period was characterized by the plunge in oil prices, the decline in dividends from Keppel Corporation and Sembcorp Industries was offset by the increase in payouts from other companies and the one-off special dividend from Singapore Telecommunications announced in late 2017.

Dividends from the eight companies account for around 40% on average of Straits Times Index's aggregate dividends, and Singapore Telecommunication was the biggest payer within the index until 2018, as DBS Group Holdings is set to surpass the telecommunication company with the generous special dividend announced earlier this year.

Our discussions will indicate that broadly speaking, the inclusion of Temasek in the NIRC framework in 2015 has not prompted companies to amend their payout pattern thereafter, as dividends paid in recent years can either be justified by their underlying performance, or are consistent with their existing dividend practice or dividend policy.

To access the report, please contact dividendsupport@ihsmarkit.com

Chong Jun Wong, Senior Research Analyst at IHS Markit

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrief-overview-on-dividends-from-temaseklinked-companies.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrief-overview-on-dividends-from-temaseklinked-companies.html&text=Brief+overview+on+dividends+from+Temasek-linked+companies+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrief-overview-on-dividends-from-temaseklinked-companies.html","enabled":true},{"name":"email","url":"?subject=Brief overview on dividends from Temasek-linked companies | S&P Global&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrief-overview-on-dividends-from-temaseklinked-companies.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brief+overview+on+dividends+from+Temasek-linked+companies+%7c+S%26P+Global http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrief-overview-on-dividends-from-temaseklinked-companies.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}