Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

PUBLICATION

Dec 18, 2019

Banks drive European dividend growth in 2020

Banks drive European dividend growth in 2020

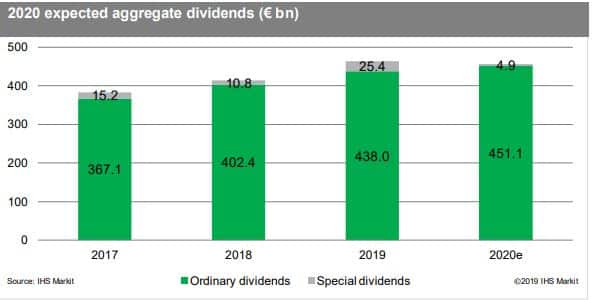

- Ordinary dividends expected to increase by 2.9% to €451bn.

- The Banking sector accounts for around 15% of overall payments while Utilities are predicted to rise by 10.5% YOY.

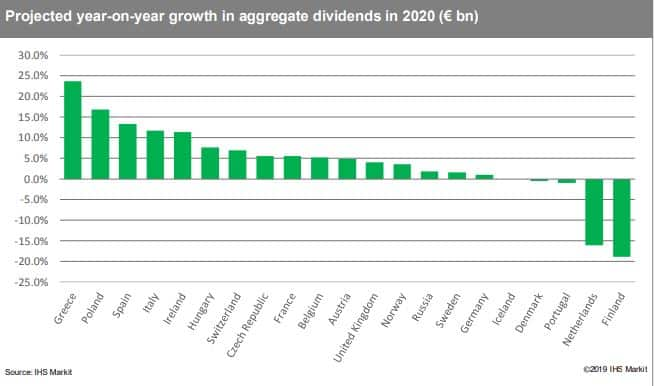

- Southern European stocks are likely to deliver the strongest growth in the region with analysts forecasting double-digit increases in Italy, Spain and Greece.

- Royal Dutch Shell, HSBC Holdings and BP remain the largest payers in EMEA.

The volatile outlook and global economic slowdown due to concerns regarding the US-China Trade War are impacting the profit expectations of European stocks. Aggregate dividends, excluding Special payments, are forecast to rise just 2.9% YOY to €451bn in total. Companies in the Banking and Oil & Gas sectors look set to remain the top contributors in 2020. The Automobile sector is expected to underperform as automaker giants Daimler, Renault and BMW are cutting their profit guidance for the coming year. This is mainly due to lower demand and higher CAPEX allocation, as companies move to environmentally sustainable vehicles.

To acess the report, pleace contact dividendsupport@ihsmarkit.com

IHS Markit provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanks-drive-european-dividend-growth-in-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanks-drive-european-dividend-growth-in-2020.html&text=Banks+drive+European+dividend+growth+in+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanks-drive-european-dividend-growth-in-2020.html","enabled":true},{"name":"email","url":"?subject=Banks drive European dividend growth in 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanks-drive-european-dividend-growth-in-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Banks+drive+European+dividend+growth+in+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanks-drive-european-dividend-growth-in-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}