Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

PUBLICATION

Nov 22, 2018

Australia continues to be generous with dividends amid uncertainty

- All sectors except the telecommunication sector are set to report higher dividends.

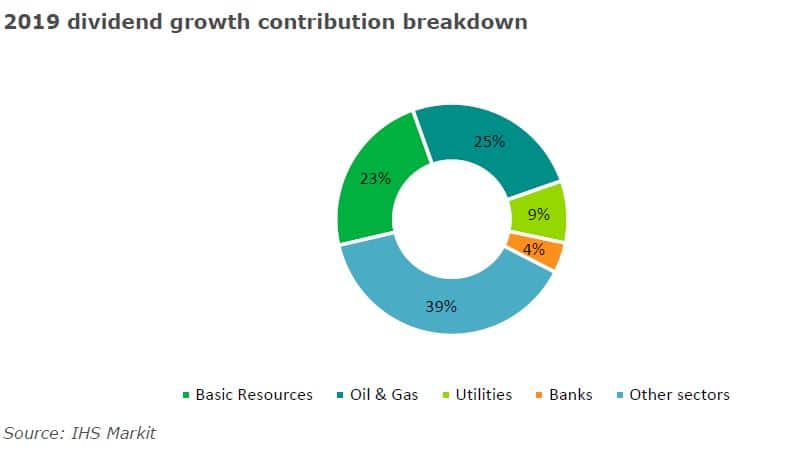

- Basic resources, oil & gas and the utilities sectors account for 57% of the estimated growth.

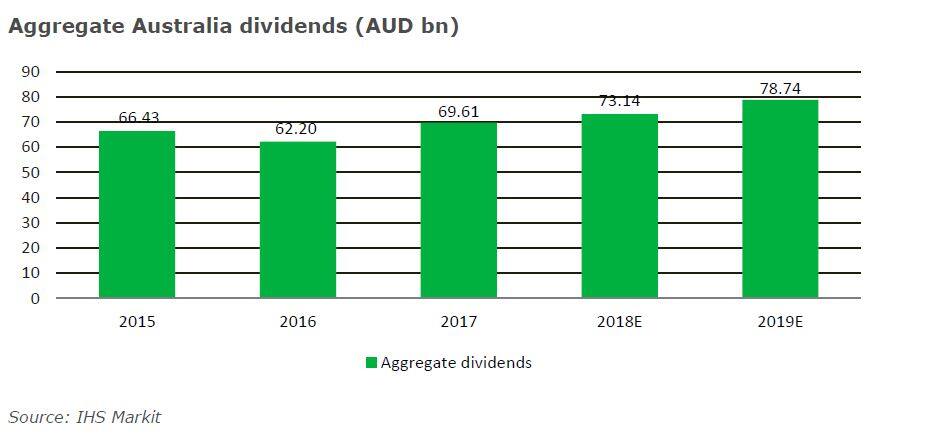

We are expecting dividends from ASX 200 to grow by 7.7% to AUD 78.74bn in 2019 against a backdrop of tougher lending standards, a sluggish housing market and intense competition in the retail sector, among other factors. Indeed, the economy is more uncertain than it was a year ago: National Australia Bank is projecting a 10% and 8% fall in house prices in Sydney and Melbourne respectively over the next 18 to 24 months; Westpac Banking Corporation forecasts a GDP growth rate of 2.7% for the coming year, lower than the Reserve Bank of Australia's (RBA) projection of 3.5%.

Nonetheless, our estimates show that we are still expecting companies to continue to be generous with dividends. While all sectors, except for telecommunication, are projected to increase their payouts, it is imperative to note that the projected growth is mostly attributed to higher dividends expected from basic resources, oil & gas and utilities sectors, underpinned by positive underlying performance. We are forecasting Australia dividends to grow by AUD 5.60bn in the coming year, these three sectors represent 57% of the dividend growth projected.

To access the report, please contact dividendsupport@ihsmarkit.com

Chong Jun Wong, CFA, Senior Research Analyst at IHS

Markit

Seolin Park, Research and Analysis Manager at IHS

Markit

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralia-generous-with-dividends-amid-uncertainty.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralia-generous-with-dividends-amid-uncertainty.html&text=Australia+continues+to+be+generous+with+dividends+amid+uncertainty+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralia-generous-with-dividends-amid-uncertainty.html","enabled":true},{"name":"email","url":"?subject=Australia continues to be generous with dividends amid uncertainty | S&P Global&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralia-generous-with-dividends-amid-uncertainty.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Australia+continues+to+be+generous+with+dividends+amid+uncertainty+%7c+S%26P+Global http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralia-generous-with-dividends-amid-uncertainty.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}