Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 24, 2021

Asia-Pacific Economies Hit by Rising New Covid Waves

An increasing number of Asia-Pacific (APAC) economies have been hit by escalating Covid-19 waves during April and May, reflecting factors such as increased transmissibility of new Covid-19 virus strains as well as very low Covid-19 vaccination rates as a share of population in many APAC economies.

India's rapidly escalating new Covid-19 wave has become a terrifying human tragedy. A number of other Asian economies, including Japan, Malaysia, Philippines, Thailand, Singapore, Vietnam and Thailand have also been impacted by rising new daily Covid-19 cases. These new waves have triggered a wide range of new restrictive measures across many APAC economies, which will impact on domestic demand and the path of economic recovery in coming months.

New Covid waves hit APAC economies

While rapid vaccination rollout rates in some countries such as the US and UK have resulted in sharp decelerations in their domestic Covid-19 waves, many Asian economies with low vaccination rates have experienced substantial increases in daily new Covid-19 cases since March. In India, daily new Covid-19 cases rose from 15,700 on 2nd March to 414,000 by May 6th, before easing to 267,000 reported daily new cases by May 18th. In Japan, daily new cases rose from 1,000 on 1st March to 7,700 by 6th May, easing to 3,300 by May 18th. In Thailand, daily new cases rose from zero on 1st March to 9,600 on 17th May. A number of other Asian economies, including Malaysia, Philippines and Vietnam, have also seen significant increases in new Covid-19 cases. Taiwan, which had been extremely successful in containing new Covid-19 cases during 2020, has also been hit by a large number of new cases during May.

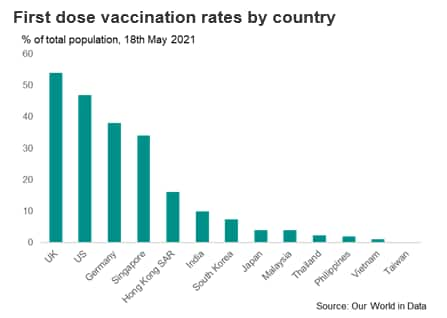

Covid-19 vaccination rates are extremely low in most Asian economies compared with global leaders in vaccination rollout such as the US and UK. Even the APAC nations which are members of the OECD grouping of advanced economies, namely Australia, Japan, New Zealand and South Korea, have first dose vaccination rates which are very low compared to the US, UK and EU. In contrast, Singapore has led the APAC countries in achieving very high first dose vaccination rates that are comparable to the global leaders.

The severe escalation in Covid cases across many APAC economies in recent weeks has been an unfolding human tragedy, with rising loss of life in many Asian countries, particularly in India, during April and May. Governments have responded with significant new restrictive measures to try to contain the new Covid waves. In India, many states and cities have imposed lockdown conditions since mid-April. Japan's central government declared a third state of emergency from 25th April until 31st May, due to the COVID-19 pandemic. Malaysia and Thailand have also imposed significant lockdown measures to try to contain their escalating new Covid waves.

Economic impact on APAC economies

Increasingly substantial lockdown measures have been put in place in many APAC economies since April which are directly having an impact on consumer spending and industrial production. The widespread lockdowns that have been implemented in India in many states and cities since mid-April will increasingly be reflected in high frequency economic indicators for April and May. Similarly, lockdown measures in Malaysia, Thailand, Vietnam, Singapore and the Philippines are impacting on domestic economic activity.

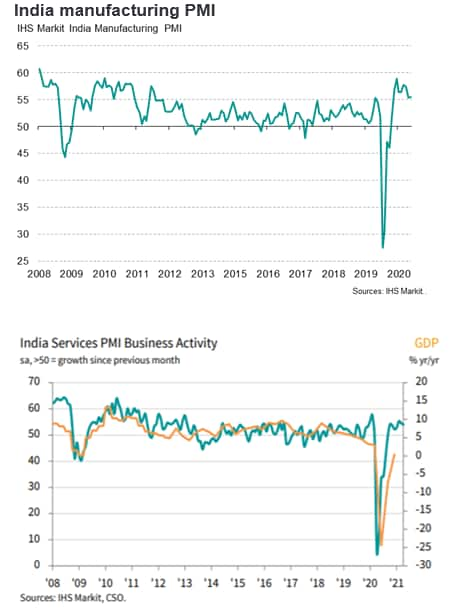

In India, a number of monthly economic indicators for April have already shown significant contraction, although more severe impact effects are expected for May as many parts of the nation have remained under strict lockdown conditions.

Falling from 54.6 in March to 54.0 in April, the India Services PMI Business Activity Index pointed to the slowest increase in output for three months. The latest reading still signaled expansion, albeit moderating. Anecdotal evidence indicated that ongoing growth of new work underpinned the rise in output, which was nevertheless stymied by the intensification of the Covid-19 crisis.

India's auto manufacturing sector has already been badly hit during April by the pandemic escalation and lockdown measures. Data from the Society of Indian Automobile Manufacturers for April showed that sales of passenger vehicles fell by about 10% m/m compared to March 2021, reflecting widening lockdown restrictions across many states. Sales of two-wheelers fell by 33.5% m/m. The Indian electronics sector has also been hit by the escalating pandemic. India's cement industry has also been badly hit by the impact of lockdowns on construction activity, resulting in sharp declines in cement output. In the electronics sector, the Foxconn iPhone12 factory in Tamil Nadu is reported to have cut production by 50% for health reasons due to Covid-19 cases.

A key disruption to economic activity has been due to a number of Indian ports declaring force majeure for various periods during May 2021 with reduced operations due to the impact of lockdowns and staffing shortages as a result of the pandemic. Indian ports that have declared force majeure with reduced operations in May include Visakhapatnam, Gangavaram, Vizag, Kandala, Karaikal, Gopalpur, Mangalore and Chennai. This is creating significant supply chain disruptions to imports of key raw materials and intermediate goods, as well as impacting on India's export shipments. Compounding India's port sector problems, Pipavav port has been forced to halt operations during late May until the beginning of June due to infrastructure damage caused by Cyclone Tauktae.

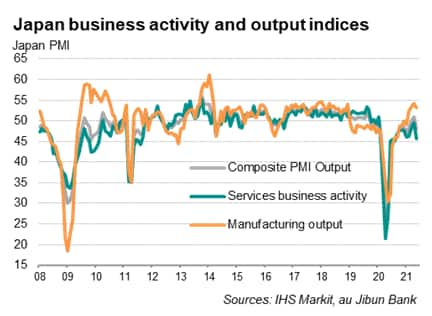

Japan's Q1 2021 GDP was also impacted by tighter pandemic-related restrictions related to the state of emergency, contracting by 1.3% quarter-on-quarter, or down 5.1% at an annualized rate. A key factor driving the contraction was a 1.4% q/q decline in private consumption, while government consumption also contracted by 1.8% q/q. Tighter restrictions due to the Covid-19 pandemic hit household consumption, notably on sales of restaurants and cafes. Japan's Prime Minister Yoshihide Suga has so far declared a state of emergency in nine prefectures including Tokyo and Osaka until 31st May, with restaurants and bars being impacted by shorter trading hours and restrictions on sale of alcohol.

Latest PMI survey data shows that Japan's services industries have been negatively impacted by the stricter restrictive measures that have been imposed as a result of the latest Covid-19 wave. The au Jibun Bank Flash Japan PMI Services Business Activity Index fell sharply, from 49.5 in April to 45.7 in May, indicating a significant deterioration in service sector activity during May. The monthly decline in the survey was one of the most marked since August 2020.

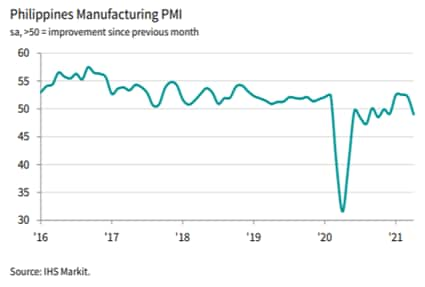

In the Philippines, the escalating Covid-19 wave in March and April resulted in strict lockdown measures that impacted on April economic activity. The IHS Markit manufacturing PMI survey for the Philippines showed a renewed contraction in output levels across the goods-producing sector during April. A resurgence in COVID-19 case numbers led to tighter lockdown restrictions amid efforts to control the spread of the disease. As a result, many factories suspended their operations, and client demand declined sharply.

The IHS Markit Philippines Manufacturing PMI fell to 49.0 in April, sharply down from 52.2 in March, to signal a marginal contraction in operating conditions across the Filipino manufacturing sector. The headline index had dropped below the 50.0 neutral value after three successive months of growth.

Manufacturers in the Philippines highlighted a steep decline in output at the start of the second quarter, which was largely attributed to enhanced community quarantine (ECQ) measures, undertaken to control the spread of the disease. The rate of decline was solid, and among the quickest in the survey to date. As a result of tightening lockdown measures many clients suspended their operations, with demand faltering for the first time since December 2020.

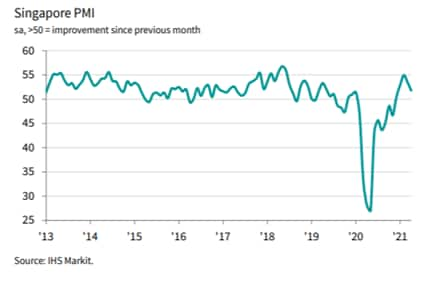

In Singapore, the IHS Markit Singapore PMI fell to 51.8 in April from 53.5 in March, signalling a softer pace of expansion in business conditions for Singapore's private sector. The moderation reflected renewed COVID-19 concerns, particularly as new overseas infections rose, affecting demand from abroad. With an upsurge in domestic Covid cases during May, the Singapore government has imposed significant new restrictions to try to curb the escalation in cases, which is expected to impact on consumer spending in the near-term until restrictions can again be eased back.

APAC exports remain bright spot

Despite the significant negative impact of new Covid waves on domestic demand in many APAC economies during April and May, the manufacturing export sector has been performing strongly in many East Asian economies, helping to underpin overall manufacturing output.

Rebounding consumer spending and industrial production in key export markets, notably the US, China, EU and UK, is helping to drive demand for a wide range of Asia's manufacturing exports.

The strong global rebound in manufacturing output is helping to drive demand for industrial electronics products, while improving consumer spending is driving demand for consumer electronics. The rebound in global electronics demand has been reflected in the recent industrial production and exports data for many Asian economies, including mainland China, South Korea, Vietnam and Taiwan, albeit the trade figures are distorted by base effects from the severe disruption to world trade in the first half of 2020 due to the pandemic.

In the US, the Biden Administration's USD 1.9 trillion fiscal stimulus package has already resulted in stimulus checks for 160 million households, helping to sharply boost March personal incomes and driving a jump in private consumption spending. US consumer sentiment is also being supported by the rapid vaccination rollout and declining new Covid-19 cases, as well as the recovery in the US labour market and rising wages. Retail sales in electronics and appliance stores leapt by 10.5% month-on-month in March 2021. In China, retail sales have also shown significant normalization, with improving momentum in early 2021.

For mainland China, exports rose by 32% y/y in April, helped by strong demand for electronics and medical equipment. The South Korean Ministry of Trade, Industry and Energy announced that South Korea's total exports rose at a very rapid pace of 41% y/y in April. South Korea's semiconductors exports have been rising sharply for the past ten months, increasing by 30% y/y in April. In Taiwan, total April exports rose by 38.7% y/y, with semiconductors exports up 34.9% y/y. Japan's exports rose by 38% y/y in April, helped by a 34% y/y increase in exports to mainland China.

APAC near term outlook

Very low vaccination rates and escalating Covid-19 pandemic waves are already negatively impacting on the anticipated path of economic recovery for many APAC economies in 2021. Renewed lockdowns and severe restrictive measures are impacting on domestic demand in many APAC economies, even as the US, EU and UK are rebounding from their own recent Covid-19 waves due to their rapid progress with vaccinating their populations.

With many APAC economies dependent on imported Covid-19 vaccines, at least in the near-term, their ability to bring their new pandemic waves under control is likely to be built on strategies of a combination of restrictive measures as well as trying to accelerate their vaccination programs.

However the positive overall economic outlook for the GDP growth of the APAC region in 2021 is currently being underpinned by the strong economic rebound in China, which is the largest economy in the region. Furthermore, the strength of East Asian exports to key global consumer markets, notably the US, China, EU and UK, is helping to support buoyant manufacturing output in many economies.

Nevertheless, the escalating Covid-19 waves evident in many Asian economies is likely to be a significant near-term drag on their economic recovery paths, with considerable uncertainty about when their new Covid waves will come under control. Consequently, the recovery paths of many Asian economies are likely to diverge significantly during 2021 from the progress towards economic normalization that is currently underway in the US and Western Europe.

An important implication is that international travel in the APAC region is likely to remain heavily shuttered for the remainder of 2021, whereas the US, EU and UK are already discussing plans for reopening international travel between their nations by July/August 2021.

Meanwhile the negative economic consequences of the pandemic on APAC developing countries continue to mount. Many low-income developing countries across Asia are suffering severe pandemic waves, and the impact on the poor has been devastating for their livelihoods and household incomes.

Globally, the World Bank has estimated that around 150 million people fell back into extreme poverty in 2020 due to the pandemic. A large proportion of this total were in India, with the World Bank having estimated that 75 million people fell back below the poverty line in 2020. Consequently, for many Asian developing countries, the path to recovery from the pandemic remains protracted and fraught with significant uncertainties.

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasiapacific-economies-hit-by-rising-new-covid-waves-may21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasiapacific-economies-hit-by-rising-new-covid-waves-may21.html&text=Asia-Pacific+Economies+Hit+by+Rising+New+Covid+Waves+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasiapacific-economies-hit-by-rising-new-covid-waves-may21.html","enabled":true},{"name":"email","url":"?subject=Asia-Pacific Economies Hit by Rising New Covid Waves | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasiapacific-economies-hit-by-rising-new-covid-waves-may21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Asia-Pacific+Economies+Hit+by+Rising+New+Covid+Waves+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasiapacific-economies-hit-by-rising-new-covid-waves-may21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}