Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 01, 2022

ASEAN manufacturing output stays resilient despite COVID-19 surge, but issues of capacity constraints persist and price gauge hits new high

Despite a broad increase in COVID-19 infections in the ASEAN region, manufacturing conditions remained resilient in February with the ASEAN manufacturing PMI little changed from the strong reading in January. Output growth was supported by robust demand for ASEAN manufactured goods. That said, supply constraints remained a prevalent issue, one that appears to be fanning further price pressures while limiting an even stronger recovery of the region.

ASEAN growth remained strong in the face of the Omicron wave

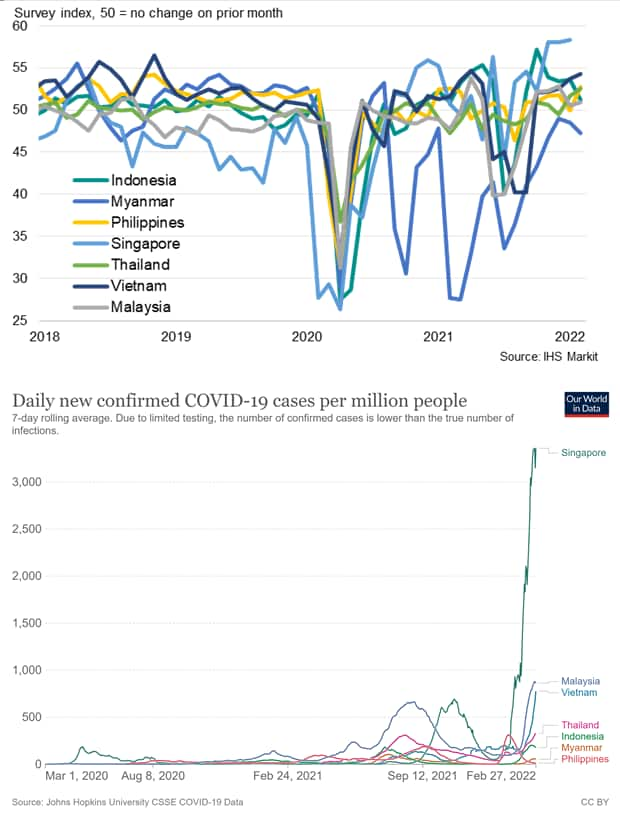

Manufacturing conditions in the ASEAN region remained resilient in February as shown by the IHS Markit ASEAN Manufacturing PMI, which was little changed at 52.5, down from 52.7 in January. Readings above 50.0 signals an improvement or increase on the previous month and February's reading for the IHS Markit ASEAN Manufacturing PMI was the fourth strongest in the nine-year history of the ASEAN PMI.

IHS Markit ASEAN Manufacturing PMI

The solid manufacturing growth was recorded despite a surge in COVID-19 infections across many ASEAN countries in February, led by Singapore on a cases-per-million-people basis. Philippines was an outlier in this regard, experiencing a continued decline in cases after the COVID-19 Omicron wave receded in January. Correspondingly, Philippines' manufacturing PMI rebounded to the highest in over three-years from January's neutral level as recovery ensued.

That said, leading the charge in manufacturing sector expansion had been Singapore in February despite the exponential increase in COVID-19 cases in the city state.

On the other end of the spectrum was Myanmar with the only manufacturing PMI reading in contraction territory amongst the seven ASEAN countries tracked by the PMI. Deteriorating COVID-19 conditions, political instability, weak demand and input shortages were some of the issues listed to have plagued the nation.

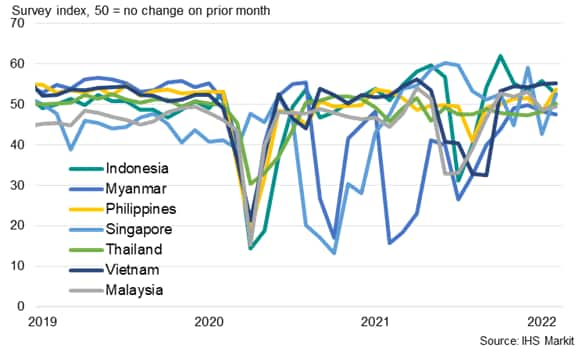

Manufacturing PMI across ASEAN countries

ASEAN output growth driven by strong demand in February

The resilient ASEAN manufacturing output growth in February was driven by improving new orders performance. The seasonally adjusted New Orders Index rested well above the 12-month average in February with five of the seven ASEAN constituent ASEAN nations reporting new orders growth. Vietnam, which led the growth of new orders in February, reflected better customer demand, including international demand, supporting its expansion. Philippines and Thailand meanwhile saw incoming new orders returning to growth in February, outlining the robust demand for ASEAN manufactured goods.

PMI new orders indices

Supply constraints remain prevalent issue for production

While the broad increase in COVID-19 infections in the ASEAN region appeared to have done little to dent the manufacturing sector's performance in February, an overarching theme of supply constraints continued to present itself as a key hindrance to better manufacturing output performance.

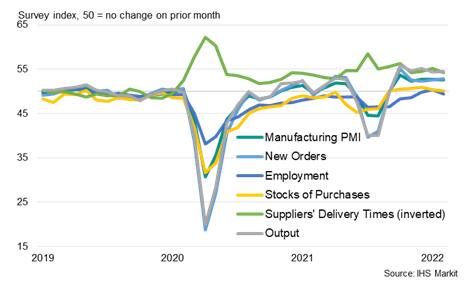

IHS Markit ASEAN Manufacturing PMI

Suppliers' delivery times across the ASEAN region continued to lengthen at a rate faster than the series average in February, even though some improvements from January were evident. Anecdotal evidence of input shortages, transportation delays and manpower issues were frequently cited as reasons for the deterioration of vendor performance. As a result, the accumulation of backlogged work continued in the ASEAN manufacturing sector, and at a severe rate.

It is important to consider the impact of these capacity pressures for the ASEAN region, with the effect being multi-fold. First, upward price pressures may be prolonged by these supply issues. Supply pressures seen in 2021 had carried forward into 2022, made worse by the latest COVID-19 Omicron wave, and may well persist throughout this year. As a result, price inflation remained steep for manufactured goods.

Second, higher prices are discouraging spending which may impede future output. ASEAN manufacturers had reported in the February survey that higher price pressures discouraged some input buying activity, which alongside the COVID-19 disruptions, led to the slowest purchasing activity growth in the current five-month sequence. This was divergent in trend from the improving new orders expansion in February. The record increase in selling price inflation in February also signalled the impetus for ASEAN manufacturers to share these cost burdens with their clients.

Finally, one can see how the issue could potentially snowball, particularly if demand growth hastens with any further recovery in new orders as the COVID-19 Omicron wave further recede.

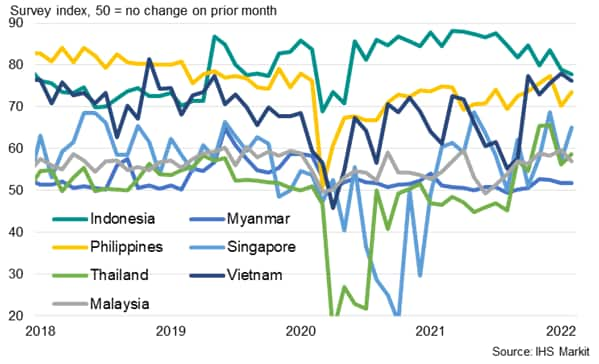

ASEAN manufacturing outlook

Despite challenging operating conditions, amid lingering COVID-19 disruptions and persistent supply issues, ASEAN manufacturers held a positive view on future outlook across all seven constituent nations in February. This reflected hopes of continued economic recovery into the next 12 months. The level of business confidence fell to a six-month low, however, and was weak by historical standards.

While further declines in COVID-19 infections are expected to provide immediate alleviation for the ASEAN manufacturing sector, the management of supply constraints may have a bigger part to play to ensure continued manufacturing output growth in the months ahead absent future COVID-19 outbreaks.

The survey data were also collected prior to the Russia-Ukraine conflict, which also adds to downside risks to business confidence, demand and supply chains while also exacerbating inflationary pressures, most notably via higher energy prices.

PMI future output indices

Jingyi Pan, Economics Associate Director, IHS Markit

jingyi.pan@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasean-manufacturing-output-stays-resilient-despite-covid19-surge-mar22.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasean-manufacturing-output-stays-resilient-despite-covid19-surge-mar22.html&text=ASEAN+manufacturing+output+stays+resilient+despite+COVID-19+surge%2c+but+issues+of+capacity+constraints+persist+and+price+gauge+hits+new+high+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasean-manufacturing-output-stays-resilient-despite-covid19-surge-mar22.html","enabled":true},{"name":"email","url":"?subject=ASEAN manufacturing output stays resilient despite COVID-19 surge, but issues of capacity constraints persist and price gauge hits new high | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasean-manufacturing-output-stays-resilient-despite-covid19-surge-mar22.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ASEAN+manufacturing+output+stays+resilient+despite+COVID-19+surge%2c+but+issues+of+capacity+constraints+persist+and+price+gauge+hits+new+high+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasean-manufacturing-output-stays-resilient-despite-covid19-surge-mar22.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}