Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 13, 2019

Aluminium price fall to gain momentum in second quarter

- Aluminium Users PMI reflects weak manufacturing conditions worldwide

- Falling output and new orders predicate further price drop

- Supply shortages ease after sanctions-related spike last year

Survey data has shown manufacturers struggling at the start of 2019, with heavy users of aluminium having seen business conditions deteriorate markedly so far this year. The downturn in business activity has contributed to a drop in aluminium prices which, having settled during the first quarter, slipped by over $100/MT in April to a two-year low. Recent trade war escalations risk further volatility. As demand pares back and supply concerns ease, the danger of a further price fall in the second quarter has risen.

Business conditions deteriorate in 2019

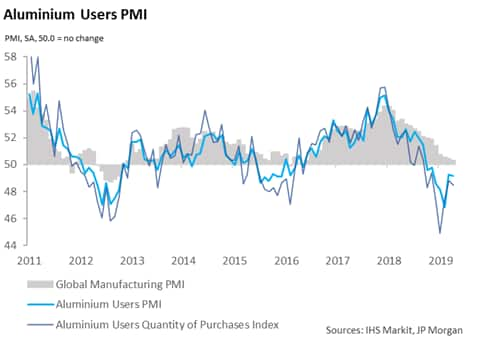

The IHS Markit Global Aluminium Users PMITM has remained in contraction territory for seven months now following the April data release. The headline PMI is a composite indicator giving an overview of operating conditions at manufacturers identified as heavy users of aluminium.

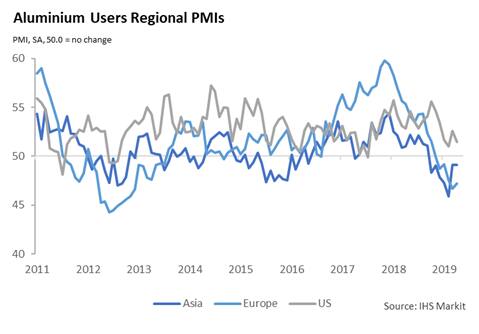

The downturn was initially driven largely by declining production at Asian users. Recently though, European users have also seen output fall, with the rate of deterioration outstripping that seen at Asian users over the past two months. Key to the recent fall in Europe was weak activity in the automotive sector alongside heightened Brexit uncertainty, according to comments from survey contributors.

The aluminium sector decline has also reflected subdued trends in the wider global manufacturing economy. The JP Morgan Global Manufacturing PMI has recorded weakening growth over the last year, with recent data signalling near-stagnation. This has led to easing demand pressures on metals and subsequently caused aluminium prices to decline over the past month.

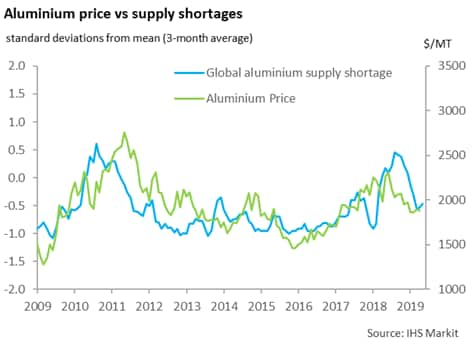

Improved aluminium supply

A second factor influencing prices is global supply. Survey data measuring the number of aluminium users stating supply issues showed a notable easing in recent months. Shortages were marked in the middle of 2018 in the wake of sanctions on Russian aluminium producer Rusal. However, these sanctions have since been lifted, helping aluminium supply to increase and prices to ease.

Inventory build adds to risk of price decline

Both demand and supply factors appear to have contributed to an aluminium price slip in April. Moreover, there are clear reasons as to why this may continue over the second quarter.

First, there remains a lack of demand for the metal predicated by weak manufacturing sales. For instance, Chinese goods exports showed an unexpected 3% year-on-year dip in April. Similarly, aluminium users worldwide have reported falling demand in each of the past seven months.

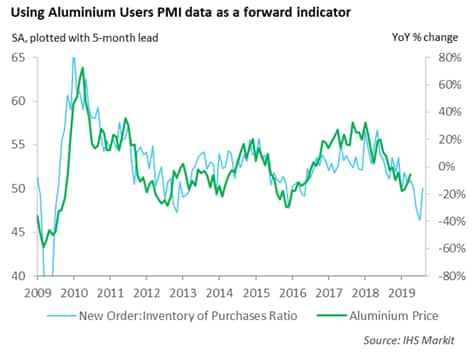

Second, PMI data also suggest that aluminium producers still hold excess supply of inputs, despite reduced purchases. The new orders-inventory of purchases ratio, shown to have a strong relationship with pricing data, has fallen markedly, albeit recovering some ground in April. This suggests that businesses may look to pare back on aluminium purchases whilst they use up current stocks. As such, the series suggests that aluminium prices could fall even further during May and beyond.

Tariff hike risks extended downturn

A third factor likely to push prices lower is the escalating trade war. On Friday, President Trump announced a hike on tariffs on $200bn worth of Chinese goods, including aluminium products. These tariffs have now risen to 25% from 10% implemented last year, and risk destabilising global trade once more.

Since the 10% tariff was applied, aluminium prices have suffered a solid declining trend, in line with a pattern of weakening global growth. Should China retaliate in the trade war, manufacturing demand could fall even further, adding downward pressure not only on aluminium but on a swathe of commodity prices.

Metal Users PMI data could offer the first sign as to how any tariff escalations will affect businesses over the coming months. Our next data release is on Friday 7th June.

PMI data provide guide to metals demand fundamentals

Using data from our survey panels across Asia, Europe and the US, IHS Markit produce data tracking trends at copper, aluminium and steel intensive goods producers. Data cover indexes for output, new orders, new export orders, input purchasing, stock holdings, prices, vendor delivery times and employment.

The aluminium PMI data are derived from monthly information provided by around 1,500 aluminium users across the world.

For further information on commodities PMI data, please contact economics@ihsmarkit.com

David Owen, Economist, IHS Markit

Tel: +44 2070 646 237

david.owen@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faluminium-price-fall-to-gain-momentum-in-second-quarter-130519.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faluminium-price-fall-to-gain-momentum-in-second-quarter-130519.html&text=Aluminium+price+fall+to+gain+momentum+in+second+quarter+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faluminium-price-fall-to-gain-momentum-in-second-quarter-130519.html","enabled":true},{"name":"email","url":"?subject=Aluminium price fall to gain momentum in second quarter | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faluminium-price-fall-to-gain-momentum-in-second-quarter-130519.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Aluminium+price+fall+to+gain+momentum+in+second+quarter+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faluminium-price-fall-to-gain-momentum-in-second-quarter-130519.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}