Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 31, 2017

Most shorted ahead of earnings

We reveal how short sellers are positioning themselves in companies announcing earnings this week

- Applied Optoelectronics sees shorts scramble to cover positions

- Short sellers target pure play European fashion firms

- Japanese retailer Edion most shorted among Asian firms

North America

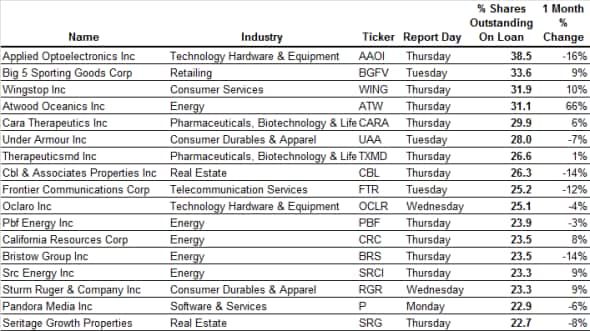

Short sellers start this week on the back foot - Applied Optoelectronics pre-announced better than expected earnings, sending its shares soaring to new all-time highs. Applied shares have more than tripled year-to-date, attracting a growing chorus of skeptics willing to bet that this momentum will reverse.

Until now, short sellers were more than willing to ride this painful trade: the demand to borrow Applied's shares climbed in lockstep with its share price. However, last week's pre-announcement - the fourth in a row - inspired some to rethink their strategy.

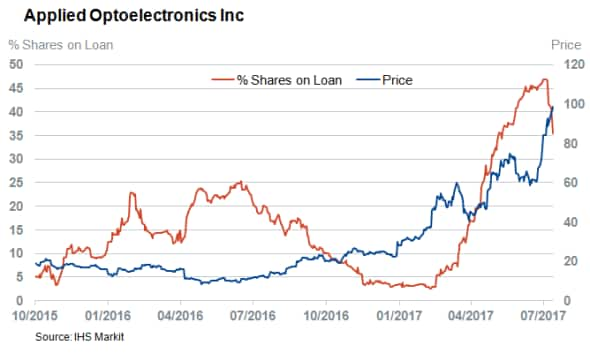

This week, 38% of Allied shares are out on loan, and while this is still an extremely high metric, it represents a sharp decline over the last month. Short seller scrutiny in the fiber optic equipment space isn't limited to Applied Optoelectronics. Competitor Oclaro also makes this week's list of shares with elevated shorting activity. It's not all bad news for short sellers this week though - Big 5 Sporting Goods is a winning bet after Hibbett Sports announced disastrous earnings and its shares fell by a quarter. Short sellers profited handsomely and borrowed an all-time high of 33% of Big 5's outstanding shares.

Sportswear shorts aren't limiting themselves to retailers in the lead-up to earnings. Under Armour also makes the list of shares with heavy short interest, and it's worth noting that all this shorting activity isn't necessarily directional. Arbitrageurs may be looking to take advantage of pricing discrepancies in Under Armour's dual share classes.

The final highlight for this week is the significant buildup in shorting activity for offshore contract rig operator Atwood Oceanics. Short sellers had been scared off after the firm announced that it was to be taken over by Ensco; the deal has since been thrown into question, as Ensco bondholders announced their discomfort with the tie-up. This uncertainty caused short sellers to rush back into Atwood, and in the last month, the firm's outstanding shares on loan surged by more than two thirds to 31%.

Europe

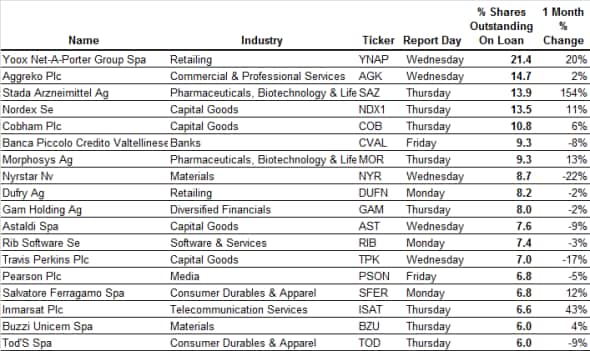

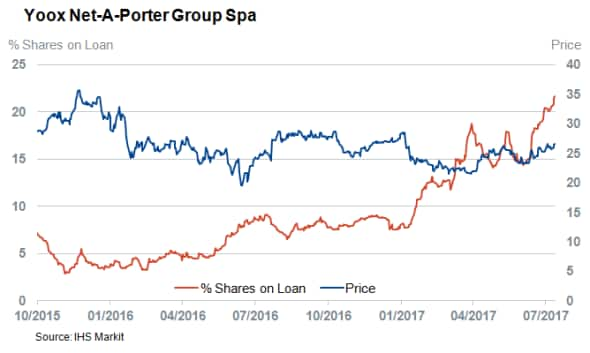

Online luxury retailer Yoox Net-A-Porter is the highest conviction European short announcing earnings this week. Short sellers have always had an eye for the firm, however, and now that fashion conglomerate LVMH is entering the online high-end fashion distribution game, short sellers have tripled their bets to the current all-time high.

Short sellers also played the hypercompetitive nature of the fashion business by taking positions in boutique high-end fashion houses that don't enjoy economies of scale and conglomerate-backed peers. Italian firms Salvatore Ferragamo and Tod's, whose combined market cap is less than a twentieth of industry titan LVMH, have seen short sellers take significant positions.

UK firms are the second most shorted on this week's list of firms announcing earnings.

With approximately 15% of its shares out on loan, UK generator rental firm Aggreko is the most shorted of this week's British bunch. Aggreko's shares are reeling from a profits warning back in March, which knocked more than 20% off its share value. Short sellers think that more bad news may be in the offing, and they have nearly doubled their positions in the last four months.

Building merchant Travis Perkins and publisher Pearson, which issued profits warnings in the last few months, are also among the firms targeted by short sellers.

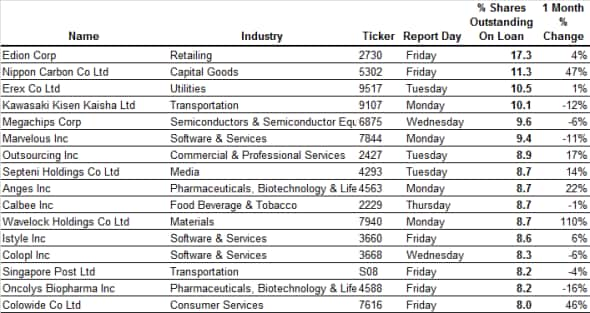

Asia

Japan continues to be a fertile ground for Asian short sellers this earnings season. All but one of the most shorted firms in the region come from the land of the rising sun. This week's list is replete with tech, media and biotech names. These high flying sectors have attracted a disproportionate amount of shoring activity over the last few months, despite the fact that few of these names have paid off for short sellers so far.

The one non-Japanese firm seeing high short interest is Singapore Post, which has an all-time high of more than 8% of its shares out on loan. The Singaporean postal operator has had to contend with the fallout from its acquisition of US web portal Trade Global back in 2015, which has led some to question its corporate governance procedures. Tough operating conditions compounded Singapore Post's problems that culminated back in May, when the firm announced it was halving its dividend.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31072017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31072017-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31072017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31072017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31072017-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}