Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 31, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in stocks ahead of earnings announcements in the coming week, plus names identified at risk of experiencing a short squeeze.

- High conviction short sellers rush to Approach Resources as senior debt downgraded

- Ubiquity Networks most likely to squeeze out of money short sellers ahead of earnings

- Japanese consumer technology firms the most shorted ahead of earnings in Apac

North America

Dominating the most shorted ahead of earnings this week in North America are Energy and Pharmaceutical firms. Leading the pack is Rex Energy with 48% of shares outstanding on loan.

Shares in the company are down 51% over the last month and 84% over the last 12 months as low oil prices continue to impact the firm and the industry.

Moody's recently downgraded senior notes in shale oil company Approach Resources, which is the most in demand short from sellers ahead of earnings. The cost to borrow has soared close to 30% with 39% of shares currently out on loan.

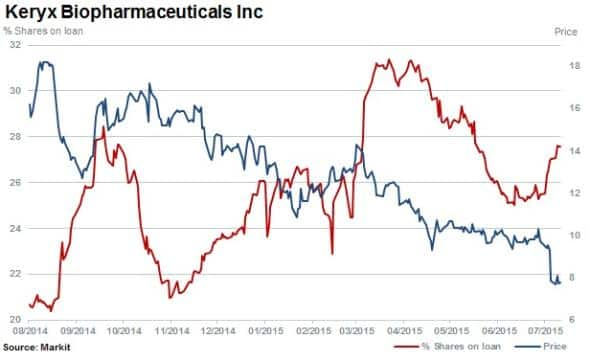

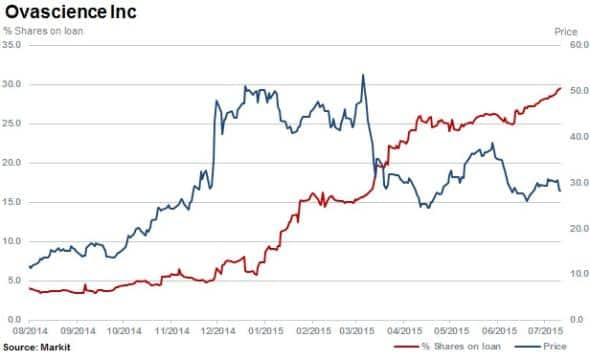

Keryx Biopharmaceuticals and Ovascience are the most short sold Biotech stocks ahead of earnings with 28% and 30% of shares out on loan respectively.Both names see high utilisation levels of above 80% but short sellers are prepared to pay more 12 fold more to short Keryx, with a fee above 10%.

High risk of squeezing

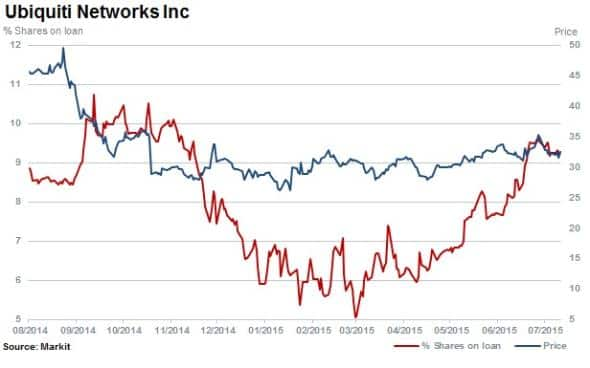

Ubiquity Networks is ranked among the top companies expected to squeeze currently, leading into their earnings announcement. Nearly all short sellers are out of the money on the name with a high concentration of sellers near breakeven, increasing the sensitivity to sudden price movements.

Europe

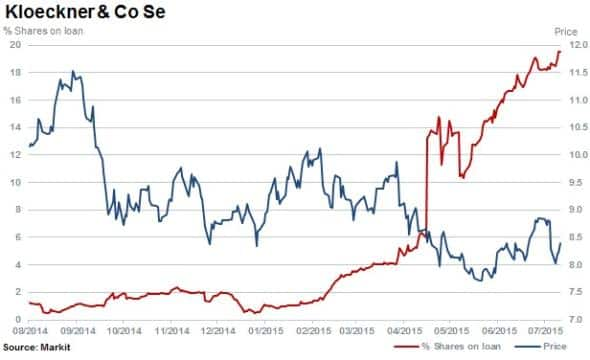

Most shorted ahead of earnings in Europe this week is Klockner with 20% of shares out on loan. The steel and metal products distributor has seen short sellers continue to add to positions over the last 12 months while the share price has fallen 15%.

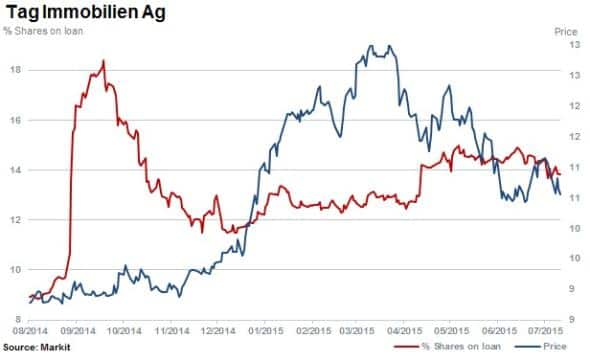

Second most shorted in Europe is Tag Immobilien with 14% of shares out on loan. The large German real estate firm has seen shares fall by 11% in the last three months while short interest has climbed higher by 8%.

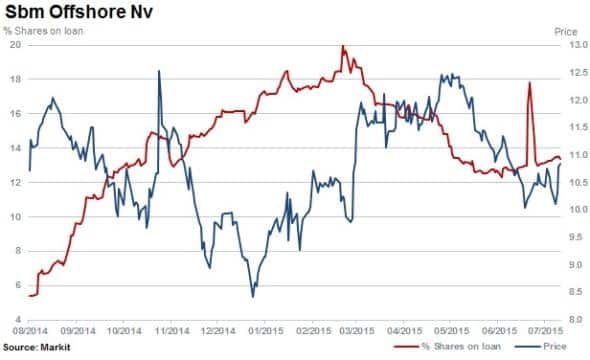

Third most shorted in the region with 13% of shares outstanding on loan is SBM Offshore which provides floating production and mooring systems to the oil industry.

Apac

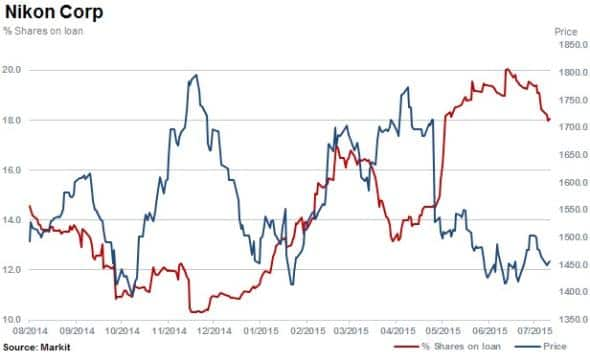

Most shorted ahead of earnings in Apac is well established Japanese consumer camera maker Nikon. With 18% of shares outstanding on loan, the product segment has continued to come under pressure recently due to weak consumer demand being impacted by smartphones.

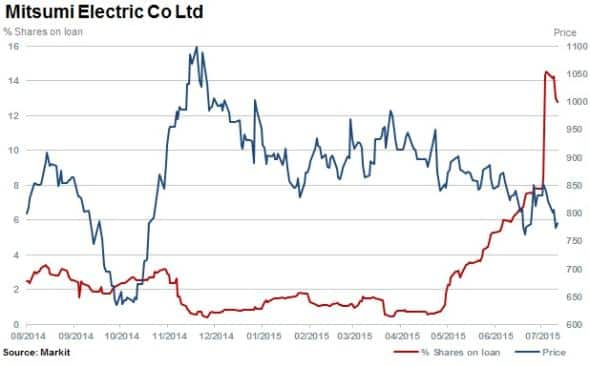

Japanese manufacturer of electrical and telecommunications components Mitsumi Electric has seen shares out on loan spike, doubling in the last weeks of July to 13%.

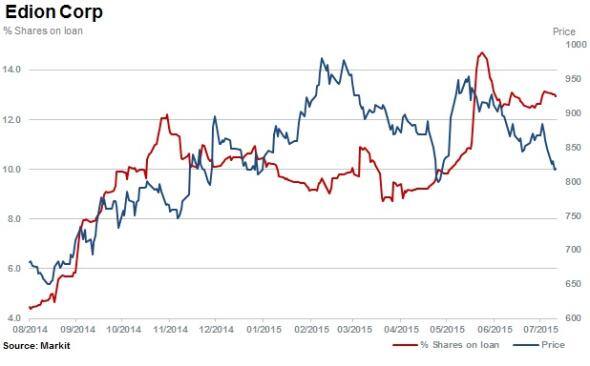

Osaka based consumer electronics retailer, maintenance and repair provider Edion has seen short interest rise to 13% of shares out on loan and is the third most shorted ahead of earnings in Apac.

*To receive more information on short interest data or our Short Squeeze model please contact us.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31072015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31072015-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31072015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31072015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31072015-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}