Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 31, 2016

US most fertile ground for May inflation bulls

US inflation is bounced back from its lows in the last month while the Eurozone is still stuck in deflation this has seen ETF investors add to their TIPS exposure over the month.

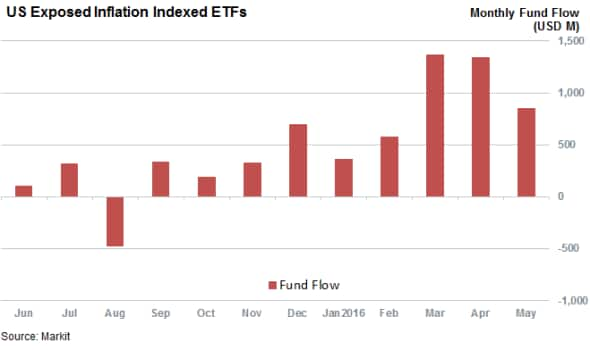

- May saw investors pour $850m into US inflation indexed bond funds

- US breakeven inflation has rebounded which helped push up inflation hedged bonds ytd

- European breakeven inflation ETFs trade lost momentum in May as deflation continued

US inflation watchers had a busy May as the most recent data from the US Bureau of Labour Statistics indicated that prices in the US grew at the fastest pace in over three years in April. The core inflation, which strips out volatile food and energy prices was more prosaic, the above expectation 0.4% headline price increase registered over the month was enough to jar the treasury market as investors put a June rate hike back on the table.

ETF investors have also been busily reacting to the recent news as US exposed inflation indexed bond ETF saw over $850m of inflows over the month as investors digested April's bumper inflation numbers. This strong inflow into the asset class marks the fourth month in a row in which investors have added more than $500m into such ETFs, taking their AUM to an all-time high $29.1bn.

These inflows indicate that inflation is starting to creep up on investor's minds as rebounding commodities prices, and better wage growth start to filter through to short term inflation gauges.

10 year breakeven jumps ahead

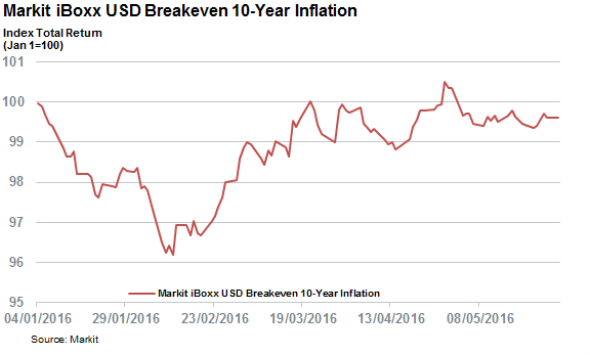

These forces are also felt in longer term inflation gauges as the recently launched Markit iBoxx USD Breakeven 10-Year Inflation Index which tracks the breakeven inflation priced into a basket of 10 year TIPS issuances has started to rebound from the lows seen earlier in the year. The index had dipped by 4% in the opening six weeks of the year indicating that the market was willing to accept less inflation protection in order to hold inflation linked treasuries bonds for the next 10 years. That gauge has since rebounded however and the Markit iBoxx USD Breakeven 10-Year Inflation total return index is now roughly back to the levels seen at the start of the year.

These rebounding inflation expectations are also seen in inflation indexed bond performance of US inflation indexed bonds is now outstripping that delivered by conventional bonds ytd. The Markit iBoxx TIPS inflation linked index has delivered 4.5% of total returns ytd, which is 1.4% more than the conventional bonds tracked by the Markit iBoxx $ Treasuries index.

European inflation less buoyant

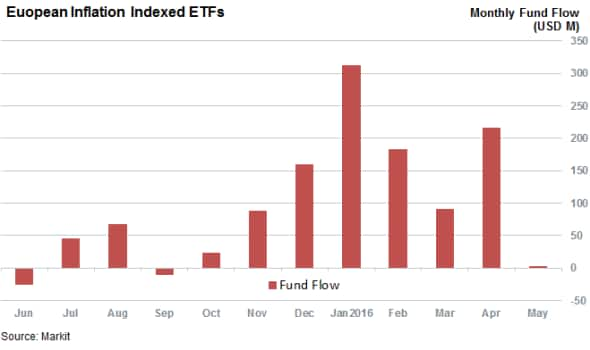

While US inflation is starting to rebound from the lows, European inflation gauges remain stubbornly in deflationary territory which has seen bets on European inflation expectations lose momentum in recent weeks. Investors had added over $800m of new assets into inflation linked European inflation ETFs, in the opening four months of the year which represents a massive 50% of the AUM seen at the start of the year.

May's inflows into these funds is set to come in at less than $3m which shows that investors are starting to tire of trade despite the fact that annualised deflation in the Eurozone halved to -0.1% according to the most recent May data.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31052016-Credit-US-most-fertile-ground-for-May-inflation-bulls.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31052016-Credit-US-most-fertile-ground-for-May-inflation-bulls.html&text=US+most+fertile+ground+for+May+inflation+bulls","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31052016-Credit-US-most-fertile-ground-for-May-inflation-bulls.html","enabled":true},{"name":"email","url":"?subject=US most fertile ground for May inflation bulls&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31052016-Credit-US-most-fertile-ground-for-May-inflation-bulls.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+most+fertile+ground+for+May+inflation+bulls http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31052016-Credit-US-most-fertile-ground-for-May-inflation-bulls.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}