Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 30, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in companies announcing earnings in the coming week

- Team Inc has 14% of shares out on loan ahead of earnings

- Tesco short interest approaching recent highs after a post Brexit surge

- Japan home to 12 of the 14 heavily shorted Asian companies announcing earnings this week

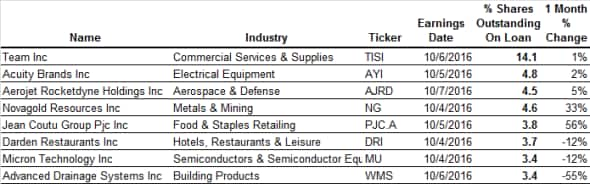

North America

The most shorted company announcing earnings this week is US listed Team Inc, which inspects high pressure pipes and pressure vessels commonly found in oil refineries and chemical plants. The company announced disappointing numbers in its last set of earnings as a lack of demand combined with currency headwinds led the company to announce a surprise loss. Short sellers have latched on to these lackluster numbers as Team's short interest more than doubled in the last three months to the current all-time high of 14% of shares outstanding.

The largest jump in shorting activity leading up to earnings was seen in Canadian pharmacy operator Jean Coutu group whose short interest has jumped by 56% in the last month. Jean Coutu's CEO bemoaned Quebec's challenging regulatory environment in his last earnings statement in July, which could be a headwind for the company's growth ambitions in the near term. These comments have resonated with short sellers as the proportion of Jean Coutu shares out on loan has more than doubled since.

Another firm experiencing a material increase in short interest is Novagold Resources, whose short interest has jumped by a third in the last month. Short sellers have shown commitment to their Novagold plays over the last few months; staying in the trade despite losses incurred as the company's shares more than doubled as gold and precious metals rallied. Novagold's stocks are giving up some of their recent ground however, and short sellers have been busily adding to their positions.

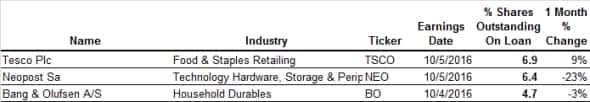

Europe

Tesco is the most shorted out of a relatively small crop of earnings announcements in Europe this week, as just under 7% of its shares are out on loan. The recent spike in Tesco short interest puts it within touching distance of the all-time highs set earlier in the year as the "big four" domestic supermarket retailers continue to struggle with relentless competition from German discounters as well as the potential pressures faced by consumers as the pound continues its post Brexit slump.

The other two relatively heavily shorted companies announcing earnings this week, Bang and Neopost, have seen covering in the last month with the latter seeing shorts close out nearly a quarter of their positions.

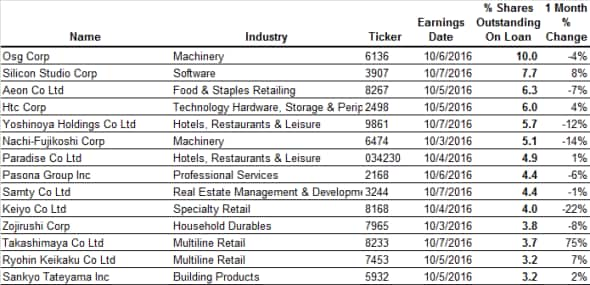

Asia

Japan is home to the majority of heavily shorted Asian companies announcing earnings next week. Industrial machinery firm OSG leads the pack of 12 Japanese firms which have more than 3% of shares outstanding on loan ahead of imminent earnings, with a tenth of its shares now shorted. OSG's short interest has surged over the last 12 months as the Japanese central bank's efforts to weaken the yen and kick start economic activity started to lose ground. This slowing economic momentum has taken a third off the value of OSG shares.

Retailers are also feeling the pinch of Japan's spendthrift consumers and short sellers are looking to profit from this with relatively large short positions in retailers Aeon, Keiyo, Takashimaya and Ryohin. Fast food operator Yoshinoya also sees relatively high short interest as 5.7% of its shares are out on loan.

Taiwanese cell phone manufacturer HTC is most shorted non-Japanese company announcing earnings this week with 6% of its shares out on loan. HTC shares have lost more than half their value in the last few months, but the company is still experiencing heavy demand to borrow, with more than 4% of its shares out on loan over the last 12 months.

Simon Colvin, Research Analyst at IHS Markit

Posted 30 September 2016

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30092016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30092016-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30092016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30092016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30092016-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}