Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jan 30, 2015

Greece and ECB battle for supremacy

Greece's CDS spreads have widened after the election result, but the implications for the broader market are less clear.

- European credit markets have held firm

- Greece's spreads have widened to distressed levels

- Raiffeisen may be contributing to bank underperformance

The result of the Greek elections on Sunday were quite clear - an emphatic victory for the anti-austerity Syriza party. The Greek public have signalled that they want to move in a different direction from the path of austerity that has caused so much discomfort.

But the implications for the broader credit markets are less transparent. Negative ancillary effects from the uncertainty surrounding Greece are battling it out with the ECB's recent QE announcement, which is compressing spreads. The Markit iTraxx Europe was trading at 58bps on Thursday, 4.5bps wider than where it started the week. This suggests that the turmoil in Greece is starting to affect risk appetite.

However, there is little sign of the contagion that afflicted the eurozone the last time Greece was dominating the agenda. Peripheral sovereign CDS have widened but the movements are modest. Spain, where the leftist Podemos party shares a similar ideology to Syriza, is now quoted at 86bps, 11bps wider than last Friday but still 10bps tighter than 2014 year-end levels.

Banks have underperformed over the week, with the Markit iTraxx Senior Financials giving up 8.5bps to trade at 66bps. The 10bps basis to the Main index is the highest for almost six months. But European banks have significantly reduced their exposure to Greece in recent years - it is now the official sector holding the baby - so it is questionable how much the Hellenic Republic is responsible for this reversal.

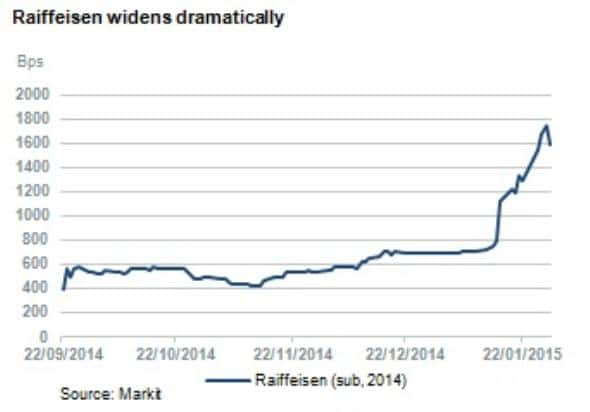

Perhaps the travails of Austrian institution Raiffeisen bank are partly to blame. The banks saw its subordinated CDS widen dramatically from 691bps to 1,746bps amid concerns about its large Russian business and the effects of the Swiss franc appreciation on its eastern European operations. Its curve is inverted, a typical sign of credit distress.

Investors are well aware that if Raiffeisen bank requires state aid, subordinated bondholders will probably be bailed in. Under the Isda 2014 definitions, this might well result in a credit event. The bank's spreads recovered on Thursday after management offered reassuring comments about reducing risk-weighted assets, but this will nonetheless be a name to watch in the coming weeks.

If the macro impact of Greece's election was ambiguous, the effect on the sovereign's own spreads was expected. Greek CDS widened to 44 points upfront under 2014 definitions, with the 2013 slightly lower at 42 points. The basis is attributable to the greater certainty around credit event triggers and deliverables under 2014 documentation. Both contracts remain relatively illiquid.

We can expect further volatility over the next few weeks as the new government negotiates with the troika, and if there is no sign of compromise then the oscillations will surely spread beyond south east Europe.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30012015-credit-greece-and-ecb-battle-for-supremacy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30012015-credit-greece-and-ecb-battle-for-supremacy.html&text=Greece+and+ECB+battle+for+supremacy","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30012015-credit-greece-and-ecb-battle-for-supremacy.html","enabled":true},{"name":"email","url":"?subject=Greece and ECB battle for supremacy&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30012015-credit-greece-and-ecb-battle-for-supremacy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Greece+and+ECB+battle+for+supremacy http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30012015-credit-greece-and-ecb-battle-for-supremacy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}