Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 29, 2015

Fed to focus on signs of further slowdown as US economic growth slips to 1.5% in Q3

As expected, the pace of US economic growth slowed sharply in the third quarter, according to the first official estimate of gross domestic product. GDP rose at an annualised rate of 1.5%, just below market expectations of a 1.6% rise and down from 3.9% in the second quarter.

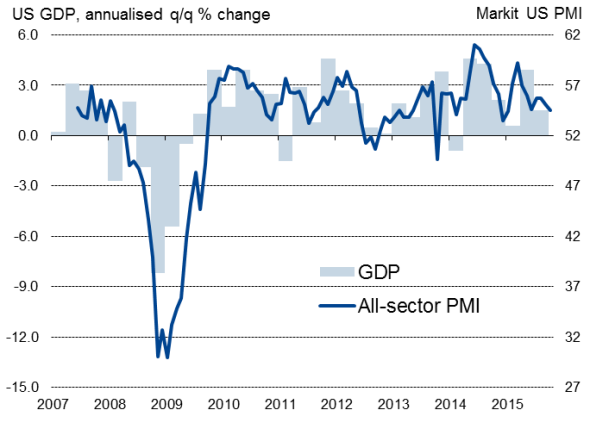

US economic growth and the PMI

Sources: BEA, Markit.

Inventory drag

The slowing had been flagged well in advance by the monthly business surveys and higher frequency data, and is therefore unlikely to have a major impact on policymaking. Instead, the Fed will be firmly focused on how the fourth quarter is playing out, writing off some of the third quarter weakness as temporary.

In particular, third quarter GDP was dragged down by a far smaller accumulation of inventories than in the second quarter, which is estimated to have reduced growth by 1.4%. This could therefore reverse in the fourth quarter as stock levels are rebuilt.

Robust domestic demand

The composition of growth was also noteworthy from a policy perspective. As expected, exports acted as drag on growth, reflecting sluggish demand in overseas markets and the dollar's appreciation, as did the energy sector, which is slashing capacity due to falling prices. But, importantly, consumer spending remained robust, with growth of expenditure merely easing from 3.6% in the second quarter to 3.2% and hinting at only a modest slowing of demand in the domestic economy.

Fourth quarter outlook

The big question is therefore whether the slowdown is intensifying as we move towards the end of the year, causing the Fed to hold off hiking rates at its December meeting.

So far, the high frequency data suggest that the US economy has entered the fourth quarter on a weak footing.

The October flash PMI business surveys, which have a strong correlation with the GDP trend, point to a further GDP slowdown, with business activity rising at the weakest rate for nine months. Non-farm payroll growth has also weakened in recent months alongside a reduction in hiring, with survey data showing job creation hitting an eight-month low at the start of the fourth quarter.

The US GDP data also add to signs that the global economy slowed in the third quarter, something which will worry policymakers, even if they are loathe to openly admitting it. A slackening of UK GDP growth (the only other developed economy to have so far reported third quarter GDP) from 0.7% to 0.5% has been accompanied by a moderation of growth in China, which slipped to an annual rate of 6.9%, its lowest since 2009.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102015-Economics-Fed-to-focus-on-signs-of-further-slowdown-as-US-economic-growth-slips-to-1-5-in-Q3.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102015-Economics-Fed-to-focus-on-signs-of-further-slowdown-as-US-economic-growth-slips-to-1-5-in-Q3.html&text=Fed+to+focus+on+signs+of+further+slowdown+as+US+economic+growth+slips+to+1.5%25+in+Q3","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102015-Economics-Fed-to-focus-on-signs-of-further-slowdown-as-US-economic-growth-slips-to-1-5-in-Q3.html","enabled":true},{"name":"email","url":"?subject=Fed to focus on signs of further slowdown as US economic growth slips to 1.5% in Q3&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102015-Economics-Fed-to-focus-on-signs-of-further-slowdown-as-US-economic-growth-slips-to-1-5-in-Q3.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fed+to+focus+on+signs+of+further+slowdown+as+US+economic+growth+slips+to+1.5%25+in+Q3 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102015-Economics-Fed-to-focus-on-signs-of-further-slowdown-as-US-economic-growth-slips-to-1-5-in-Q3.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}