Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 29, 2014

Esma: the tip of the shorting iceberg

Markit recently integrated publically disclosed short positions into its securities finance platform. We review the latest snapshot of the publically disclosed shorts to see how its stacks up with the wider securities lending database.

- There are currently 442 publically disclosed short positions under Esma rule 236/2012

- These disclosures cover 250 companies with an aggregate value of $14.1bn

- But we estimate undisclosed short interest (below 0.5%) represents another $28bn; double that currently disclosed

The European Securities and Markets Authority's (Esma) regulation (EU) 236/2012 requires public disclosure of short positions in European listed equities where positions are greater than 0.5% of total shares outstanding for individual companies. Trading firms are obliged to report these figures to their national regulator in an overall effort to increase transparency and stability in capital markets.

Due to reporting to multiple national regulators and agencies, depending on the domicile of the trading institution, an administrative hurdle is created. To gain an insightful and holistic vantage point, Markit has extended its Securities Finance coverage with an innovative service to include all European public short disclosures. This service incorporates historical data where possible and was officially launched on October 27th 2014.

While noble in intent, Esma's disclosure requirements do leave market observers with some unanswered questions around the extent of shorting activity that takes place below the disclosure threshold. Today's comparison of the latest Esma disclosure with the amount of stock on loan in the companies with current disclosed short positions aims to shed some light on the topic.

Public data overview

A look into the current Esma disclosures reveals a total of 442 disclosed short positions that exceed the 0.5% threshold from this September 25th.

These publicly disclosed positions are spread across 250 companies and represent $14.1bn of short exposure, as of the October 28th. While a third of the companies that have a disclosed short position are the target of a single fund, several see many more than that, for example we see 10 disclosed shorts in Swedish firm Elekta.

Esma's data does seem to underrepresent shorting activity overall, as the current aggregate value of the demand to borrow across the companies with publicly disclosed short positions represents $43.6bn, more than three times the aggregate value of disclosed positions. We estimate that the undisclosed data (positions smaller than 0.5%) across Europe for the 453 companies represent another $28bn - almost double than that currently disclosed.

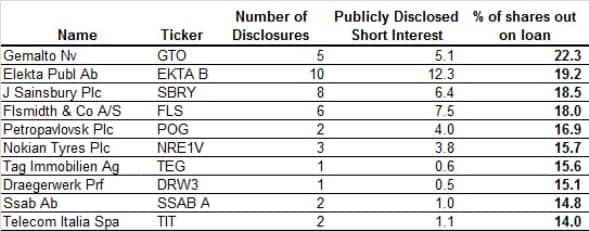

Among the ten stocks which fall under the Esma disclosure requirement which sees the largest demand to borrow, the average gap between the public disclosed short positions and demand to borrow sits at 12.7% of shares outstanding.

Over the entire publicly disclosed universe, the average disclosed short interest stands at 1.7%. This is compared with the Markit Securities Finance average demand to borrow of 3.2% of shares outstanding.

Most shorted

Elekta Ab, a Swedish-based manufacturer of medical equipment is currently the most shorted out of the public sample in terms of percentage of publicly disclosed shorts. The previously mentioned ten disclosed shorts represent 12.4% of the company's shares outstanding. We see demand to borrow the company's shares stand at 19% of shares outstanding, indicating a significant amount of shorting activity that falls below the 0.5% threshold. As seen in the graph above the company's short interest has been as high as 33% while the company's stock has declined 24% over the past 12 months.

Dutch chipmaker Gemalto, which has recently seen its shares come under pressure when Apple designed its own SIM cards in the latest iPhone release, sees the largest gap between publically disclosed short positions and demand to borrow shares in the company. There are currently 5.07% of publically disclosed positions in the firm while the demand to borrow shares in the firm sits at 22.3% - a gap of 17.3%.

Other stocks with more than 5% of publicly disclosed short positions include FLSmidth & Co with 9.5% disclosed shares shorted, which compares to 17.8% of demand to borrow. The company provides machinery to the mining and cement industry in Denmark. Currently the firm is going through a restructuring coupled with a weak outlook for mining in the region. Goldman Sachs recently downgraded the company's stock from neutral to a sell, according to Bloomberg reports.

Sainsbury's has disclosed short positions of 7.3%, while total short interest data indicates a significantly higher 18.4% as midmarket retailers in the UK continue to lose market share with German discount retailers continuing to grow.

We also see a gap in public and undisclosed shorting activity in Monetise with 6.7% shares disclosed as shorted. Its shares have fallen 58% year to date as the start-up lost shareholder Visa and struggled with newly implemented revenue recognition practices and growth guided down with ebitda profitability only reached in 2016.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102014-equities-esma-the-tip-of-the-shorting-iceberg.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102014-equities-esma-the-tip-of-the-shorting-iceberg.html&text=Esma%3a+the+tip+of+the+shorting+iceberg","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102014-equities-esma-the-tip-of-the-shorting-iceberg.html","enabled":true},{"name":"email","url":"?subject=Esma: the tip of the shorting iceberg&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102014-equities-esma-the-tip-of-the-shorting-iceberg.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Esma%3a+the+tip+of+the+shorting+iceberg http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102014-equities-esma-the-tip-of-the-shorting-iceberg.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}