Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 29, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Canadian banks are key focus of short sellers this week as they face increased loss provisions

- Four of the five European firms with more than 3% of shares shorted have seen covering in the last month

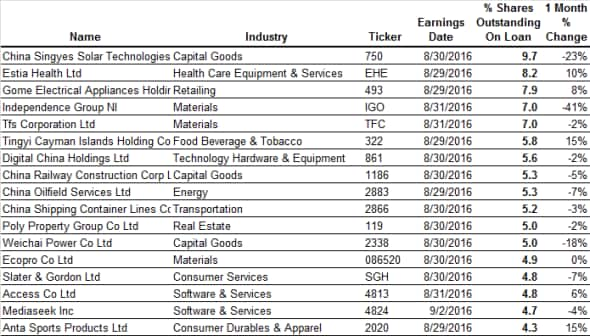

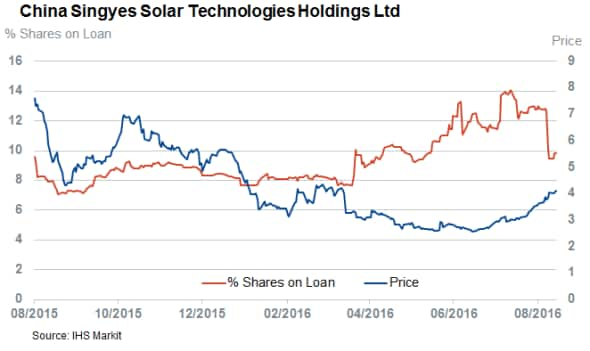

- China Singyes Solar is the most shorted company announcing earnings in Asia this week

North America

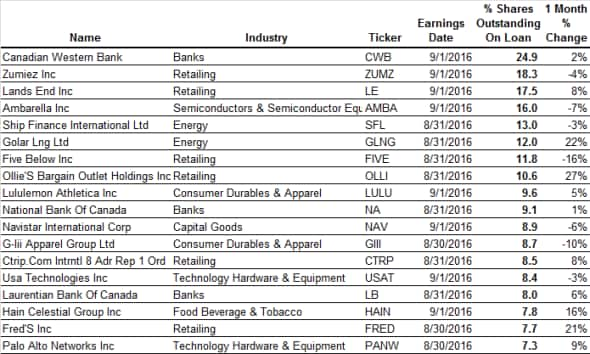

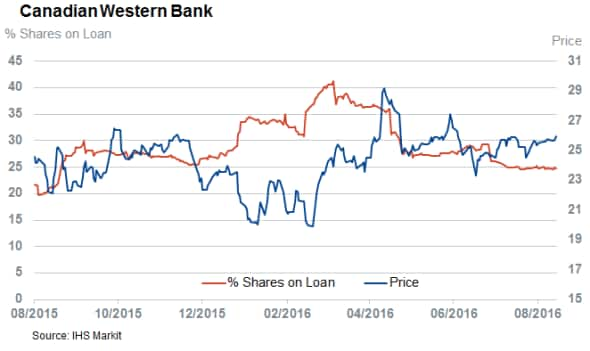

The big trade for North American short sellers this week is in Canadian banks with three of the country's banks making the list of heavily shorted companies ahead of earnings, as investors look to play a softening in Canadian real estate.

Experiencing the largest bearish sentiment out of the three is Canadian Western Bank which has just under a quarter of its shares now out on loan to short sellers. Short sellers have been circling around the firm due to its exposure to energy loans which have soured in the wake of the collapse in oil prices, prompting Canadian Western to increase its provision for bad loans by five fold in its latest quarterly earnings. This move looks to have placated some short sellers as Canadian Western's current short interest is a third lower than the highs set earlier in the year, but there still remain plenty of doubters to convince.

The other two high conviction trades in the sector are National Bank of Canada which has 9% of its shares shorted and Laurentian Bank which has 8%.

Canadian apparel maker Lululemon Athletica also makes the heavily shorted list as 9.6% of its shares are on loan to short sellers. The firm is a long time short target, but demand to sell its shares short has nearly halved in the last year as its shares doubled after a string of better than expected results.

Further south, US retailers continue to feature heavily among the most shorted companies with six companies featuring among this week's heavily shorted companies. The high conviction plays this week are Zumies and Lands End which have 18% and 17% of shares shorted respectively.

Video chip maker Ambarella, which has 16% of its shares shorted, rounds out the top most shorted firms. Ambarella's short interest stems from its close links to its largest customer GoPro, but the company has been able to diversify away its customer base in recent months which has led to a breakdown in the correlation between the two companies' shares. Short sellers have covered half their Ambarella short positions in the wake of this dislocation while GoPro continues to see short interest hover near its all-time high.

Europe

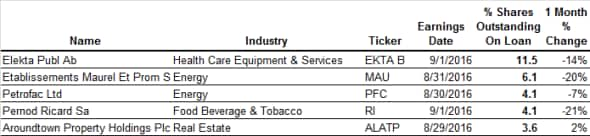

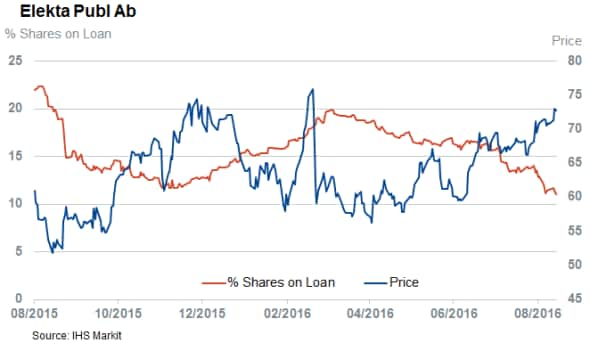

Europe sees relatively few companies announcing earning this week and only five firms out of that lot see any meaningful short interest. Short sellers' appetite in this week's most shorted is relatively lacklustre, and it's worth noting that short interest has fallen in four of the five shorted companies in the last month.

Short favourite Elekta is the most shorted of the lot, but covering of the firm has seen in the last month means that its short interest now stands at a three year low.

Petrofac has seen the most severe short covering with short interest falling 21% in the month leading up to earnings.

Apac

The 17 Asian high conviction trades this week are led by Chines solar company Chine Singyes which has just under 10% of its shares shorted. The firm has proved to be highly profitable for short sellers in recent months, but the company's shares have rebounded in recent weeks prompting shorts to cover a quarter of their positions in the last month.

Simon Colvin, Research Analyst at IHS Markit

Posted 29 August 2016

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29082016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29082016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29082016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29082016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29082016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}