Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 29, 2016

Week Ahead Economic Overview

It could be an historic week, as expectations have risen that the Bank of England will announce more monetary stimulus. The Fed will meanwhile closely watch the latest non-farm payrolls and factory orders numbers. Moreover, PMI results will provide analysts and data watchers with the first available information on global economic trends, including any potential 'Brexit' impact, at the start of the third quarter.

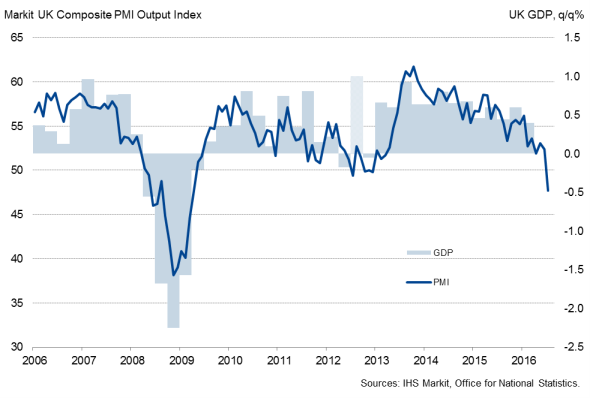

It has been over a month since the UK voted to leave the EU and although MPC members such as Martin Weale had wanted to wait for "firmer evidence" before cutting rates at the July meeting, the policy stance has changed after PMI data signalled the steepest drop in UK output since 2009. Although it remains to be seen if the weak data for July are just a reflection of the immediate shock following the Brexit vote or if it's the start of a downturn, it is widely expected that the Bank of England will announce more stimulus to provide a boost to business and consumer confidence.

UK PMI and GDP

Important data releases in the UK include final PMI results (including construction) for July, Halifax house price data and latest recruitment industry trends from the REC.

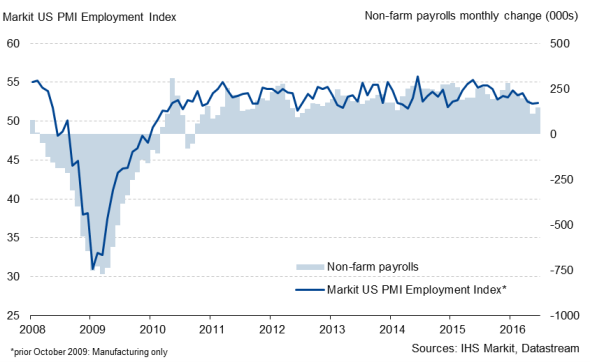

While the Bank of England is likely to cut rates, the US Fed keeps its door open to raise interest rates at some point this year, and following its latest policy announcement, the Fed stated that "near-term risks to the economic outlook have diminished". The release of factory orders, non-farm payrolls and final PMI numbers are likely to add to the policy debate in Washington.

Non-farm payroll numbers have risen by a monthly average of 172k so far this year and markets expect some payback from the solid figures in June when the US economy added 287k jobs. Recent PMI results also point to further robust hiring, but signal a more stable pace of growth than the often volatile official numbers. The US Department of Labor publishes labour market data for July on Friday.

US non-farm payrolls and the PMI

Worldwide PMI results are meanwhile released throughout the week after June's data signalled that the global economy saw its weakest quarter since 2012 with the eurozone economy struggling to gather pace and emerging markets remaining in an overall state of stagnation. Results for China will be especially interesting, after the National Bureau of Statistics reported second-quarter GDP growth of 6.7%. However, the latest Caixin PMI results pointed to a renewed downturn in manufacturing in June and the IHS Markit forecast for China's GDP currently stands at just 6.5% for 2016.

Final PMI results are also released in the eurozone and will include more national detail. A flash estimate showed the region's growth falling to a one-and-a-half year low. However, the data still signal annualised growth of around 1.5% so far this year. More information on household spending patterns are meanwhile provided by Markit's Retail PMI and official retail sales numbers from Eurostat.

Monday 1 August

Manufacturing PMI results for July are released worldwide.

The AiG Manufacturing Index and new home sales data are issued in Australia.

In Italy, industrial output numbers are published.

Trade figures are meanwhile released in Brazil.

Construction spending data are out in the US.

Tuesday 2 August

A number of manufacturing PMI results and the Markit/CIPS UK Construction PMI are released.

The Reserve Bank of Australia announces its latest monetary policy decision.

Consumer confidence data are updated in Japan.

Producer price numbers are meanwhile out in the eurozone.

In Brazil, industrial output figures are released.

Personal income data are issued in the US.

Wednesday 3 August

Services PMI results are issued worldwide.

In Australia, the latest AIG Services Index is released.

India sees the publication of M3 money supply information.

Retail sales numbers are out in the euro area.

Meanwhile, mortgage data and ADP national employment figures are issued in the US.

Thursday 4 August

Consumer price figures are updated in Russia.

The Eurozone Retail PMI is published by IHS Markit.

The Bank of England announces its latest monetary policy decision.

In the US, initial jobless claims and factory orders numbers are out.

Friday 5 August

Sector PMI results are published.

AiG publishes its Construction Index in Australia.

In Germany, Destatis releases factory orders numbers, while industrial output figures are out in Spain.

Halifax house prices and the latest REC UK & English Regions Report on Jobs are issued in the UK.

Labour market and trade data are updated in Canada.

Non-farm payroll numbers are updated in the US.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29072016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29072016-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29072016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29072016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29072016-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}