Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 29, 2015

European equities continue to entice investors

European equity ETFs continue to enjoy strong domestic flows despite the recent crisis, but investors' behaviour is shifting.

- Eurozone equity ETFs have gathered $5.8bn of assets in June; largest inflow of Q2

- Country focused products more popular in Q2; German and French products favoured

- Inflows into overseas listed Eurozone funds have dried up amid Greek crisis

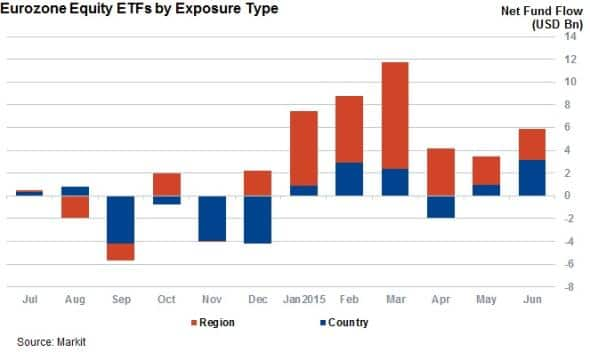

Despite ongoing concerns over a prospective Grexit, there appears to be no shortage of investors looking to gain exposure to eurozone equities. ETFs benchmarked to the currency union's equity market have continued to see inflows over the last three months. In fact, June has marked the best performing month in terms of inflows in second quarter.

The 292 such funds have seen over $5.8bn of new inflows, taking the quarterly total past the $10bn mark for the second quarter in a row. While eurozone equity ETFs have not been able to match the record breaking $27.9bn of inflows seen in the opening quarter of the year, the fact that investors have continued to add to their exposure demonstrates that fears over Greek-influenced instability are not a significant force in the ETF market.

Country specific exposure most popular

The inflows seen in June also differ somewhat from those seen at the start of the year due to the fact that investors have been favouring country focused exposure. Over half of all inflows came from the 161 country focused funds, which together saw over $3.16bn of new assets. This marks the largest inflow for these types of products, with investors choosing to favour a more granular investment exposure over the broad based regional focused exposure that proved so popular in the first quarter.

Core country focus proven to be the most popular strategy recently, as nine of the five funds which have seen the largest inflows in the last four weeks track French and German markets.

On the other side of the scale, the funds seeing the largest outflows are bearish products benchmarked to the same two markets; a further sign of confidence in the countries' equity markets.

Interestingly, the sole non-core product which managed to crack the top ten inflow table is Global X FTSE Greece 20 ETF, which saw investors add over $60m of new assets in the last four weeks. These continuing inflows are reminiscent of other highly volatile situations such as the recent oil slump, but are complicated by the fact that Greek markets are currently shut due to a state mandated bank holiday.

International investors less present

Domestic investors have proffered a much larger portion of the recent inflows than in the opening months of the year, when overseas investors were eagerly adding to their European exposure.

The current month's inflows into overseas listed eurozone equity ETFs are running at a quarter of the run rate seen in March. This trend may be driven by the recent market volatility and political uncertainty as non-European investors think twice about investing in eurozone equities

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29062015-equities-european-equities-continue-to-entice-investors.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29062015-equities-european-equities-continue-to-entice-investors.html&text=European+equities+continue+to+entice+investors","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29062015-equities-european-equities-continue-to-entice-investors.html","enabled":true},{"name":"email","url":"?subject=European equities continue to entice investors&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29062015-equities-european-equities-continue-to-entice-investors.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+equities+continue+to+entice+investors http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29062015-equities-european-equities-continue-to-entice-investors.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}