Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 29, 2015

Japanese industrial production on course for second quarter downturn

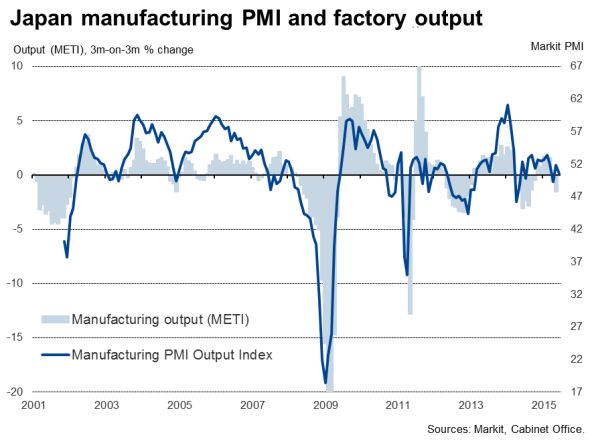

Having risen a buoyant 1.2% in April, some payback in May was always likely, but the 2.2% drop in Japan's industrial production seen last month was far larger than consensus expectation of a 0.8% decline. The disappointing data call into question Japan's ability to sustain its rebound from last year's brief recession, corroborating the bout of renewed weakness seen in the country's manufacturing PMI survey.

The official data mean that, having risen 1.6% in the first quarter, industrial production is currently on course to drop by 1.6% in the second quarter, wiping out all the gains from the positive start to the year. Even a strong number in June will do little to improve the second quarter performance. The government's survey indicates that manufacturers expect to increase production by 1.5% in June, but that will merely take the overall quarterly decline to 1.5%.

The official data follow the flash manufacturing PMI, which fell below 50 to finish off the worst quarter for two years in June.

The data flow in recent months is therefore suggesting that the pace of economic growth slowed signifcantly in the second quarter compared to the surprisingly strong 3.9% annualised expansion recorded in the first three months of the year. Consumer spending has continued to be hit by last year's sales tax rise and exporters are struggling in the face of sluggish demand in overseas markets.

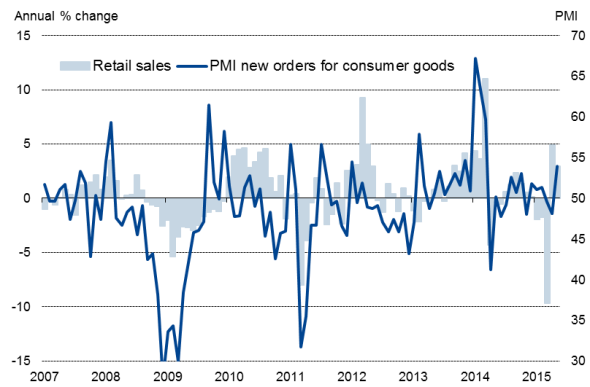

However, rays of hope were provided by a stronger than expected 1.7% rise in retail sales during May (taking sales 3.0% higher than a year ago). A similar upturn was seen in the PMI survey's measure of orders for consumer goods, which hit a 14-month high in May. The services PMI - which is more domestically-influenced than the export-led manufacturing PMI - has also been signalling modest growth in April and May. More will become known about the strength of demand and economic growth momentum heading into the third quarter with the publication of final PMI data for manufacturing and services this week.

Retail sales

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29062015-Economics-Japanese-industrial-production-on-course-for-second-quarter-downturn.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29062015-Economics-Japanese-industrial-production-on-course-for-second-quarter-downturn.html&text=Japanese+industrial+production+on+course+for+second+quarter+downturn","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29062015-Economics-Japanese-industrial-production-on-course-for-second-quarter-downturn.html","enabled":true},{"name":"email","url":"?subject=Japanese industrial production on course for second quarter downturn&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29062015-Economics-Japanese-industrial-production-on-course-for-second-quarter-downturn.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japanese+industrial+production+on+course+for+second+quarter+downturn http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29062015-Economics-Japanese-industrial-production-on-course-for-second-quarter-downturn.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}