Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 29, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Biotech stocks feature among the most shorted stocks in North America

- Shorts cover positions in UK retailer Sainsbury's as shares surge 15% higher

- Noble second most shorted in Apac despite covering of a third of positions as oil prices rally

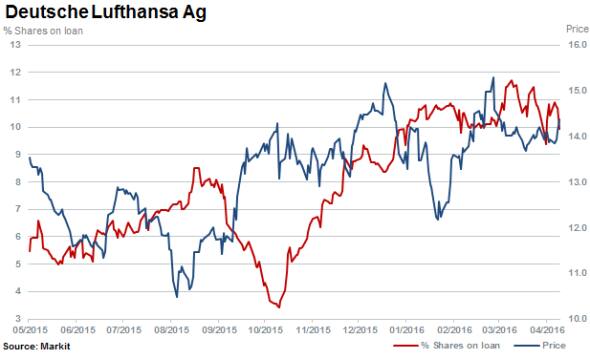

North America

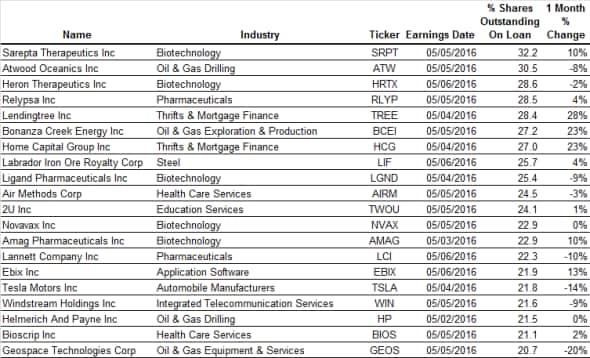

Most shorted ahead of earnings in North America this week is Sarepta Therapeutics with just under a third of its shares outstanding on loan.

Short interest in the medical research and drug therapies firm has surged recently with shares spiking higher this week in reaction to reports the firm may secure approval for a muscular dystrophy treatment. Short sellers' demand however remains high with the cost to borrow increasing fourfold in the last few weeks.

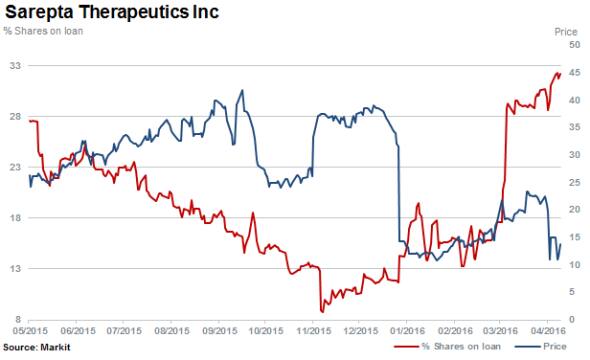

Second most shorted ahead of earnings is Atwood Oceanics with 30% of its shares sold short. Shares in the offshore driller have plummeted 68% in the last 12 months but have in fact rallied 60% from lows reached earlier this year on the back of stronger oil prices. Short sellers, though, have only reduced their positions marginally.

Lendingtree makes it into the top five most shorted stocks in North America this week after short interest has continued to aggressively climb higher in 2016.

Shares in the online lender have rallied 90% since February 2016 but have lost 15% in the past few weeks. Shares outstanding on loan have surged higher reaching 28.4% currently.

Europe

Most shorted ahead of earnings in Europe this week is Rec Silicon, a producer of silicon materials destined for renewable industries. The stock currently has 14.9% of shares outstanding on loan and gauging by the cost to borrow stock, short sellers' demand has steadily increased - in line with the recent rise in share price.

Second most shorted ahead of earnings and no stranger to being a short target is UK retailer Sainsbury's. The firm has seen shorts drastically cut positions in the past few months with shares outstanding on loan declining by more than two thirds since February 22nd. The stock has rallied 25% reaching a 12 month high and 14.8% of shares outstanding on loan currently.

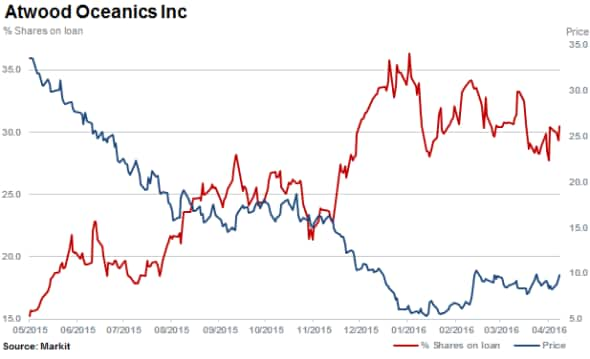

Short interest continues to remain high in German airline Deutsche Lufthansa. 9.9% of shares are outstanding on loan as the airline continues to face competition from low cost airlines, Middle East carriers and faces legacy labour issues and structural costs.

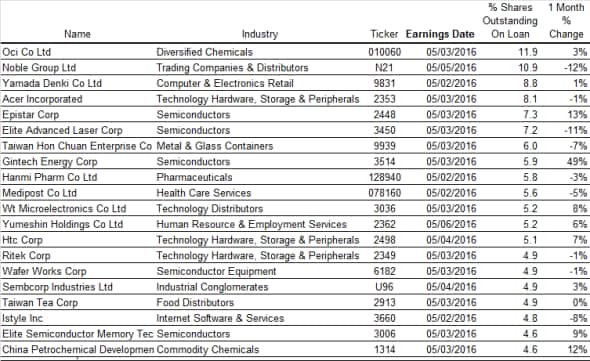

Apac

Most shorted ahead of earnings in Apac is Oci Co with 11.9% of shares outstanding on loan. Shares in the South Korean chemicals company have surged higher by two thirds in the past month with short interest levels increasing by a third to 1139% of shares outstanding on loan.

Short sellers have covered 27% positions in Noble Group as shares rally almost 50% on the back of rising oil prices. Inclusive of the recent rise, the commodities trader has seen shares lose half their value in the last 12 months as well as being a focused target of short activist Iceberg Research.

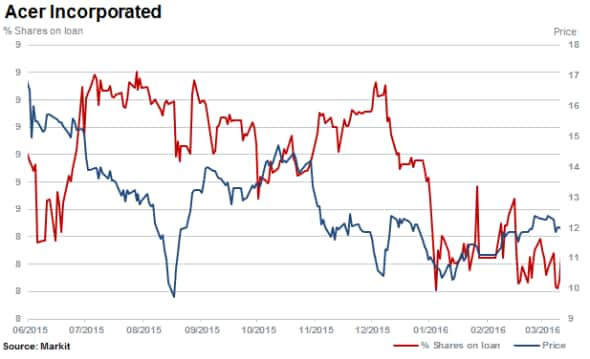

While shares in computer and hardware manufacturer Acer have plummeted over 40% over the past 12 months, short sellers have only marginally covered positions with short interest still hovering above 8% currently.

Relte Stephen Schutte, Analyst at Markit

Posted 29 April 2016

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}