Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 28, 2016

Dividend ETFs come back in vogue in 2016

Last year investors shunned dividend ETFs as the strategy underperformed the market, but their popularity has surged in 2016 with record inflows in Q3

- Dividend ETFs saw a record $9.3bn of inflows in Q3, raising the 2016 haul above the 2013 record

- Dividend strategies are now back on a level peg with conventional equities' performance

- Dividend maximizing funds most popular YTD

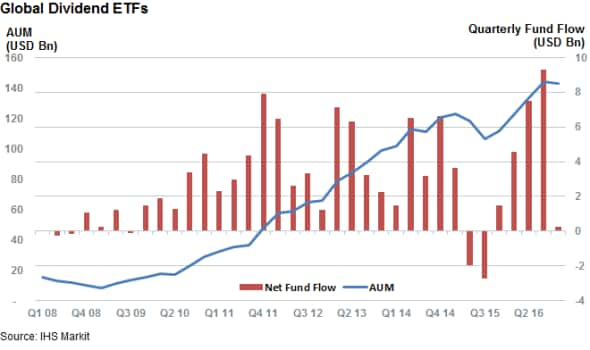

Dividend investing is the hot ETF strategy of the year so far. The asset class has just experienced its largest quarterly inflow haul on record in Q3, when investors ploughed over $9bn into the 268 globally listed funds tracked by the Markit ETP analytics database. This bumper result adds to the strong tally gathered by dividend ETFs in the opening half of the year; taking the net fund flows to $21.6bn, nearly $3bn more than the previous yearly record set back in 2013.

Dividend strategy ETFs account for almost a quarter of all equity ETF inflows for 2016 to date. This is more than double the level over the previous five years, when the average proportion has been 10%. Equally positive is the fact that inflows in have grown across each global region. Inflows into US, Apac and European listed dividend funds have each represented 19% of the AUM registered at the end of the last year, showing that investors have been equally eager to chase yield globally.

This strong global appetite for the asset class marks a fantastic reversal of fortune as dividend ETFs were largely out of favour last year. These funds registered their two largest outflows over Q2 and Q3 of last year as the commodities slump caught out many popular dividend maximising strategies due to their relative overweight exposure towards the oil and materials sector.

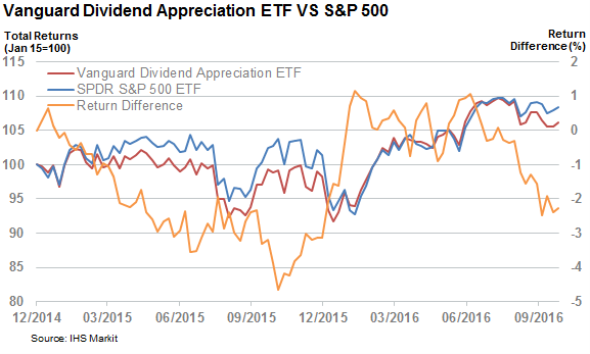

This large exposure to many of the names which bore the brunt of last year's market volatility meant that the largest dividend ETF, the Vanguard Dividend Appreciation ETF (VIG), was trailing the SPRD S&P 500 ETF by over 4.5% at one point in November last year. While the ETF recovered some of its lost ground over the closing months of last year it still ended over 3% behind its benchmark peer on a total return basis.

However, the commodities rebound seen since mid-February combined with the lack of interest rate hikes from the Fed has made for much more fertile ground for dividend strategies. As a result, the VIG has outperformed the market to regain the ground it lost over 2015.

Investors chasing yield

The Vanguard Dividend Appreciation ETF is still the most popular dividend ETF, but its place at the top of the rankings is threatened as investors pick products that invest in stocks that offer a high yield over those that that have a track record of growing payments. This strong appetite for yield has seen the Vanguard High Dividend Yield ETF gather $3.1nn of inflows. The high dividend yield offerings from Powershares and iShares have also proved popular with both finds outpacing their larger peer's $1.39bn year to date inflow performance.

Resurgence with risks

A growing demand for low cost smart-beta products and the current low yield environment makes it easy to see the appeal of these products to investors. But these "smart" strategies can only be as good as inputs that go into them. Since all of the existing products rely on a mechanised analysis of trailing dividend payouts, rather than future dividend prospects, the problem arises when companies change policy and cut or simply freeze dividends. With an interest rate rise in the US looming and Brexit turmoil in Europe, investors would be well advised to take future performance into account.

Simon Colvin, Research Analyst at IHS Markit

Posted 28 October 2016

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28102016-equities-dividend-etfs-come-back-in-vogue-in-2016.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28102016-equities-dividend-etfs-come-back-in-vogue-in-2016.html&text=Dividend+ETFs+come+back+in+vogue+in+2016","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28102016-equities-dividend-etfs-come-back-in-vogue-in-2016.html","enabled":true},{"name":"email","url":"?subject=Dividend ETFs come back in vogue in 2016&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28102016-equities-dividend-etfs-come-back-in-vogue-in-2016.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Dividend+ETFs+come+back+in+vogue+in+2016 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28102016-equities-dividend-etfs-come-back-in-vogue-in-2016.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}