Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Aug 28, 2015

Ukraine bonds rejoice, US GDP steepens curve

A deal between Ukraine and its creditors has pushed its default risk to 2015 lows, while encouraging US GDP figures have raised September hike expectations.

- Ukraine's five year eurodollar bond is now yielding 15.92% after debt deal, a new 2015 low

- Portugal telecom's Brazilian exposure has doubled it's 5-yr CDS spread over three months

- 10-yr US treasuries have bounced 20bps this week, as volatile market keeps investors guessing

Respite for Ukraine

Bond markets reacted positively as Ukraine reached a deal with creditors over the re-structuring of its $18bn debt load. The agreement delays payments for four years and includes a 20% haircut on principal. The country continues to be marred by conflict with Russia which has sent the economy on a downward spiral ever since it erupted in April 2014.

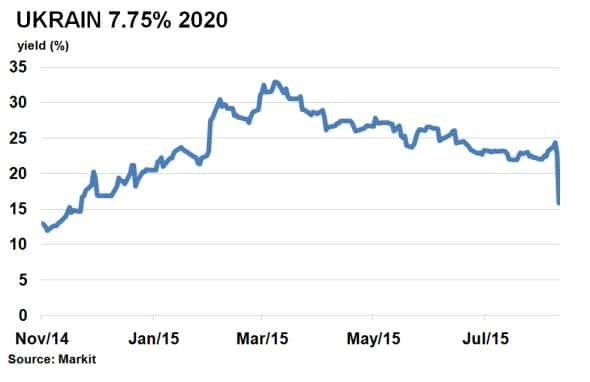

The announcement sent the price of Ukraine's $1.5bn eurodollar bond due 2020 up 17pts (cash basis to par). The equivalent on a yield basis is now 15.92%, the lowest level in 2015 according to Markit's bond pricing service. The yield represents less than half the level seen at the height of Ukraine's debt crisis in March, when falling oil prices swelled the counties economic woes. Similarly, in the credit derivatives market, Ukraine's CDS level is at a new 2015 low with latest indications showing levels similar to that of October 2014, and even below that of Greece.

Not all creditors reacted buoyantly. The main protagonist, Russia, is supposedly far from satisfied, but for now a default has been avoided.

Brazil dents Portugal telecom

The biggest single name credit deterioration in Europe over the past week was Portugal Telecom. Portugal's economy has fared well over the last few years but Portugal telecoms fortunes offer sharp contrast. The beleaguered telecoms giant has seen its 5-yr CDS spread widen 254bps in August, a 41% jump. Its spread reached 917bps on August 24th,a record high, before market volatility soothed spread levels; tightening to 873bps. The recent negative sentiment around Portugal Telecom has led to Markit Research Signals to issue a risk indicator alert, with further credit deterioration to be expected.

The mainstay of its problems lie in it's complicated operating structure, which includes a 27% stake in Oi, a Latin American telecoms organisation with considerable exposure to Brazil. A buyout from French firm Altice Group last year saw Portugal Telecom lose further control of its operations while still holding onto its sizeable debt obligations.

Fed lift off

Too much surprise, revised Q2 US GDP grew 3.7%, up from analyst expectation of 3.2%. The number comes as a welcome relief for hawkish members of the FOMC, after a week of extreme volatility in the stock market.

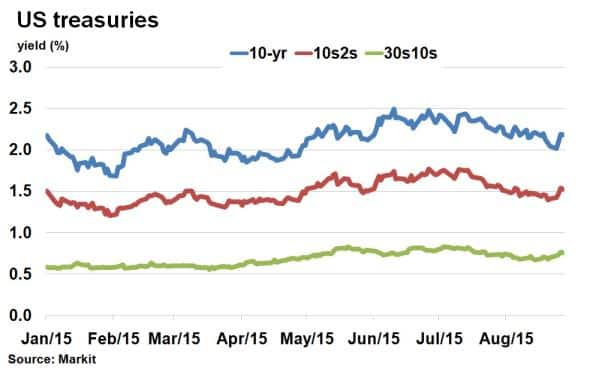

The wild ride this week was exemplified by the swing in US 10-yr treasuries. Yields fell below 2% on an intraday basis for the first time since April 28th before spiking 20bps higher towards the latter end of this week. 10-yr treasury yields, the most commonly used interest rate level and an important signal of investor confidence, had been falling since mid-June as deflationary pressures and market volatility pushed investors towards safe havens.

Calmer waters and the latest positive GDP figure steepened the short end (10s vs 2s) of the treasury curve by 12bps, suggesting the probability of a September hike had increased. A positive jobs report in early September may tip the scale further. The longer end remains flatter however; more dependent on inflation expectations 30s vs 10s are only 6bps wider this week.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28082015-Credit-Ukraine-bonds-rejoice-US-GDP-steepens-curve.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28082015-Credit-Ukraine-bonds-rejoice-US-GDP-steepens-curve.html&text=Ukraine+bonds+rejoice%2c+US+GDP+steepens+curve","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28082015-Credit-Ukraine-bonds-rejoice-US-GDP-steepens-curve.html","enabled":true},{"name":"email","url":"?subject=Ukraine bonds rejoice, US GDP steepens curve&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28082015-Credit-Ukraine-bonds-rejoice-US-GDP-steepens-curve.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Ukraine+bonds+rejoice%2c+US+GDP+steepens+curve http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28082015-Credit-Ukraine-bonds-rejoice-US-GDP-steepens-curve.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}