Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 28, 2015

US flash PMI data point to upturn in economic growth at start of third quarter

Signs of faster growth in the service sector at the start of the third quarter add to the likelihood of the FOMC moving closer to hiking interest rates for the first time in over six years.

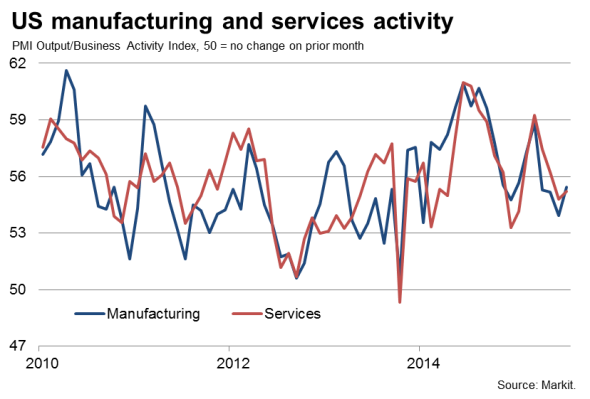

Having indicated a worrying slowdown in June, the flash PMI surveys showed both the services and manufacturing sectors enjoying modestly stronger growth in July.

The Business Activity Index from the services PMI rose from a five-month low of 54.8 in June to 55.2 and the manufacturing survey's Output Index jumped from a 17-month low of 53.9 to 55.4. The weighted average of the two surveys edged up from 54.6 to 55.2 as a result.

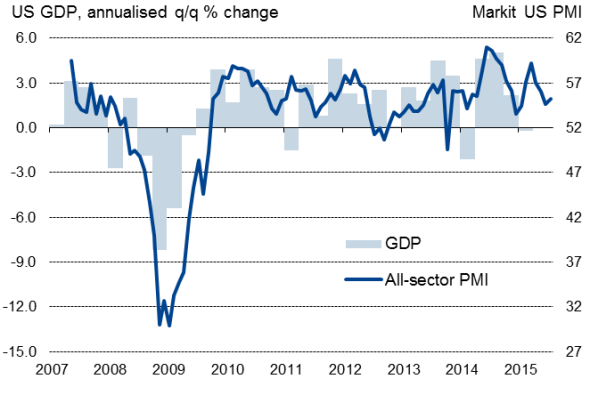

However, this is by no means runaway growth. The current 'all sector' reading of 55.2 is below the second quarter average of 55.9 and well below the recent peak of 59.2 seen back in March. However, nor is growth collapsing. The latest data point to a reasonably robust 2.0% annualised GDP growth rate at the start of the third quarter, down from the 2.75% rate signalled by the surveys over the second quarter as a whole but still a solid rate of expansion.

Economic growth & the PMI

Better start to the year

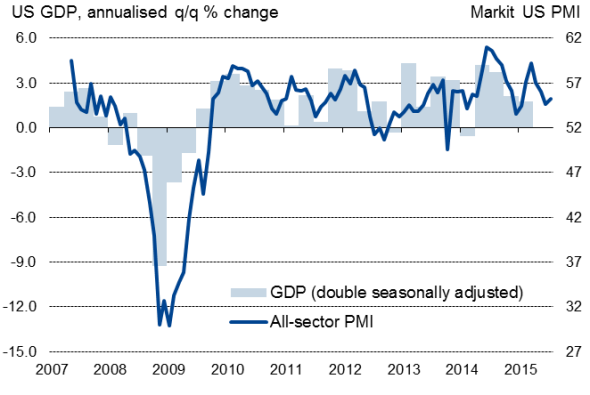

The PMIs also suggest that first quarter GDP growth will be revised to show a stronger start to the year than previously thought, adding to the upbeat tone of the economy's performance so far this year. This is supported by the San Francisco Fed's recent research on the official data, which indicate that the currently published series contains some residual seasonality. Double seasonal adjustment gets rid of this seasonality, has a higher correlation with the PMI and leaves a GDP series which registered 1.8% growth in the first quarter rather than a 0.2% decline.

Double seasonally-adjusted economic growth & the PMI

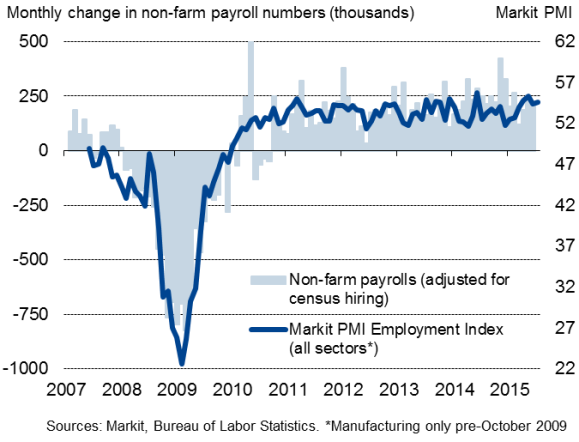

Another bumper payroll count

This sustained strength of economic growth is continuing to feed through to the labour market. The surveys' hiring gauges point to another bumper month of impressive employment growth in July, with non-farm payrolls set to rise by around 225,000, according to historical comparisons of the survey data against official numbers.

Employment

Rate hikes on the table

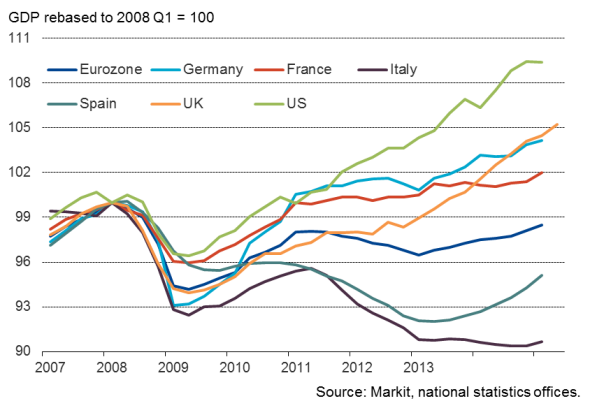

The upturn in the survey data will help to reassure policymakers that the economy is continuing along a moderate growth path which will continue to erode spare capacity. With the economy some 8.6% larger than its pre-crisis peak in the first quarter and a jobless rate of 5.3% indicative of full employment by some measures, the robust survey data will add to suspicions the Fed will step up its rhetoric in terms of interest rates starting to rise later this year, upping the odds of a September hike.

Rate hikes are by no means assured, however, as price pressures remain stubbornly low and the strong dollar is clearly hurting the economy. With the survey also showing business confidence sliding to a three-year low in July, many FOMC policymakers will want to see more signs of the economy's resilience in the face of the dollar's strength and the uncertain outlook for the wider global economy before risking higher interest rates. However, if the data flow continues to behave itself along the lines of the numbers seen in July, the FOMC may soon run out of excuses not to hike rates.

% change in GDP v pre-crisis peaks

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072015-economics-us-flash-pmi-data-point-to-upturn-in-economic-growth-at-start-of-third-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072015-economics-us-flash-pmi-data-point-to-upturn-in-economic-growth-at-start-of-third-quarter.html&text=US+flash+PMI+data+point+to+upturn+in+economic+growth+at+start+of+third+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072015-economics-us-flash-pmi-data-point-to-upturn-in-economic-growth-at-start-of-third-quarter.html","enabled":true},{"name":"email","url":"?subject=US flash PMI data point to upturn in economic growth at start of third quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072015-economics-us-flash-pmi-data-point-to-upturn-in-economic-growth-at-start-of-third-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+flash+PMI+data+point+to+upturn+in+economic+growth+at+start+of+third+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072015-economics-us-flash-pmi-data-point-to-upturn-in-economic-growth-at-start-of-third-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}