Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 28, 2015

Week Ahead Economic Overview

Worldwide manufacturing and services PMI releases, plus a labour market update and factory orders numbers in the US, are data highlights of the week. Interest rate decisions at the Bank of England and the European Central Bank are the policy highlights.

Composite PMI Output Index

The Bank of England is expected to leave interest rates unchanged when it announces its latest monetary policy decision on Thursday. As confirmed by the ONS's second estimate, economic growth in the UKstuttered to a two-year low in the first quarter, highlighting major concerns that linger over the health of the economy. While the service sector expanded further, construction and manufacturing acted as drags on stronger GDP growth. Despite a rebound in retail sales in April, it remains unlikely that the Bank will start raising rates until at least the end of the year and possibly not until early next year.

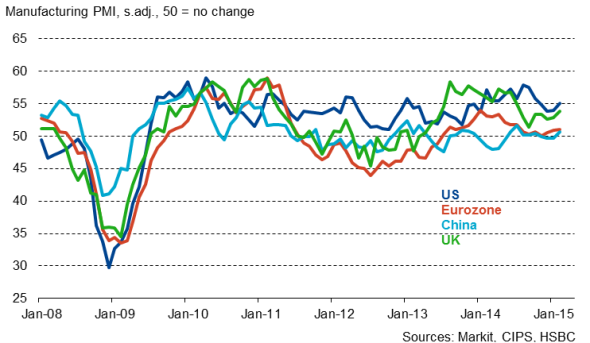

Manufacturing, construction and services PMI data for May will meanwhile give first insights into the UK's economic performance heading towards the middle of the year. April's survey data signalled that the economic upturn in the UK has become increasingly reliant on the service sector and consumer spending, which raises concerns about the sustainability of the expansion and a lack of rebalancing towards manufacturing.

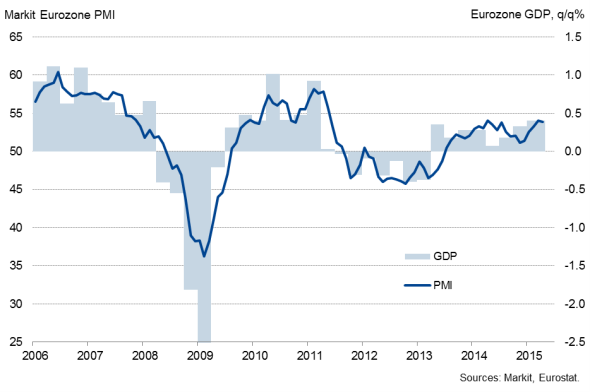

No change is also expected at the European Central Bank's latest monetary policy meeting. With the ECB's policy of quantitative easing under way, the eurozone's economy has been seeing some signs of improvement. However, latest flash PMI results painted a mixed picture on the region's health as economic activity slowed but job creation hit a four-year high. The main focus will therefore be on final PMI numbers for the manufacturing and service sectors released throughout the week. The results will include more national detail.

Revised first quarter GDP results are also issued for the currency bloc after the first estimate showed the region's economy expanding by 0.4%. Other important releases include flash inflation numbers for May plus retail sales and unemployment data.

Eurozone GDP and the PMI

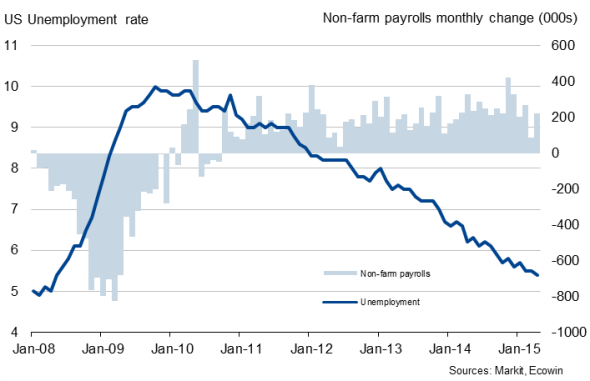

In the US, the data highlights include PMI and factory orders numbers, but perhaps most eagerly awaited will be the labour market update.

The all-important non-farm payroll numbers are released on Friday and are viewed for signs that the labour market remains in good health. Non-farm payroll growth rebounded in April and the unemployment rate dropped to a seven-year low of 5.4%. Flash PMI results signalled one of the best months of job creation seen since the recession, pointing to another month of non-farm payroll gains in excess of 200,000 in May.

US labour market

Recent survey data and employment numbers have therefore painted a brighter picture of the US economy than the latest official GDP numbers, which showed alarming weakness at the start of the year. However, policymakers will be eager to see if the encouraging employment trend and robust survey evidence persisted into May before considering any hike in interest rates. With policymakers worried about the impact of the strong dollar on goods exports, factory orders data will also be keenly eyed. Orders rose 2.1% in March, but survey data signalled a slowing in new business growth in April, with export orders falling for the first time since November.

Policymakers in China will meanwhile be hoping to see renewed signs of life in the country's economy. May's flash manufacturing PMI results showed output contracting at the strongest rate in just over a year, after official data showed that economic growth slowed to the weakest in six years in the opening three months of the year. If confirmed by final data, more stimulus measures look likely to be unveiled by the central bank in coming months.

Monday 1 June

Worldwide manufacturing PMI data for May are released by Markit.

In Australia, building permit numbers are out.

Inflation figures are issued in Germany, while the UK sees the publication of Halifax house price data.

Meanwhile, trade balance numbers are updated in Brazil.

Personal spending data are issued by the US Bureau of Economic Analysis.

Tuesday 2 June

Current account numbers are updated in Australia. Moreover, the Reserve Bank of Australia and the Reserve Bank of India announce their latest interest rate decisions.

In the UK, latest construction PMI data and consumer credit information are released.

Flash inflation data for May are issued by Eurostat for the currency union.

Meanwhile, Germany sees the publication of unemployment numbers.

In Brazil, industrial output figures are updated.

Factory orders data are issued in the US.

Wednesday 3 June

Worldwide services PMI data for May are released by Markit.

First quarter GDP numbers are meanwhile issued in Australia.

In South Africa, business confidence data are out.

The European Central Bank announces its latest interest rate decision, while retail sales and unemployment figures are also updated in the eurozone.

Unemployment numbers are updated in Italy.

Canada and the US release trade balance data, with the latter also seeing the publication of ADP employment survey results.

Thursday 4 June

A number of PMI releases, including the Eurozone Retail PMI are issued by Markit.

Retail sales numbers and trade balance data are meanwhile issued in Australia.

Unemployment figures are out in Greece and France.

The Bank of England announces its latest monetary policy decision, while Brazil's central bank also meets.

Initial jobless claims numbers and labour cost data are issued in the US.

Friday 5 June

Global sector PMI data are released by Markit.

The AIG Construction Index is updated in Australia.

In Japan, the Leading Indicator for April is issued.

Factory orders figures are published in Germany, while Spain sees the release of industrial production data.

Revised first quarter GDP numbers are meanwhile issued for the eurozone.

France sees the release of trade balance data.

Labour market data are updated in Canada and the US.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28052015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28052015-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28052015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28052015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28052015-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}