Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 27, 2015

Robust domestic demand drives solid UK economic growth in third quarter

The latest official data showed that the UK economy continued to grow at a reasonably strong pace in the autumn, with increasingly robust domestic demand from businesses and consumers offsetting weak trade as key export markets remained in the doldrums and the strong pound hit competitiveness.

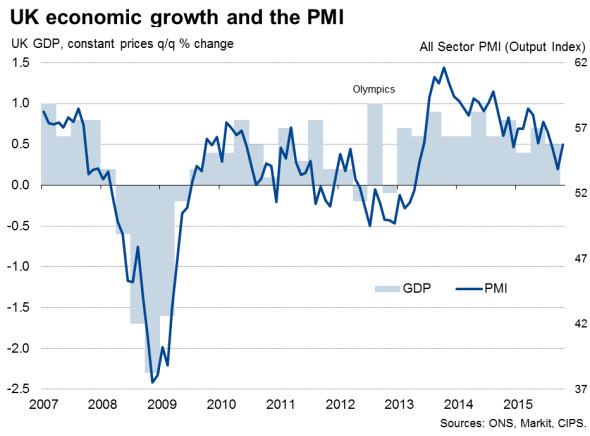

The UK economy grew 0.5% in the third quarter, according the latest official GDP estimates from the ONS, confirming the initial estimate.

Growth slowed from 0.7% in the second quarter as international trade exerted the strongest drag on record, suggesting the UK is being hurt by weakened global demand and the strength of sterling.

Trade took a huge 1.5 percentage points off GDP growth. However, we treat the trade data with caution, as the numbers are both volatile and prone to revision. Note that trade had boosted GDP by 1.4 percentage points in the second quarter. Eventually, we'd therefore expect third quarter GDP to be adjusted up to 0.6% as the trade data get revised.

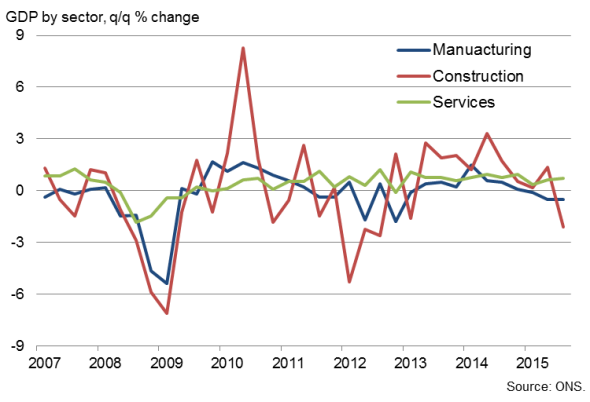

Another area of doubt is construction, where the official data suggest output fell 2.2% in the three months to September, which contrasts with stronger business survey data, again suggesting there's a likelihood of the official data being revised higher.

Industrial production meanwhile rose, up 0.2%, though this masked a 0.4% decline in manufacturing output, the latter presumably hit by the decline in exports.

The main driver of growth was therefore once again the service sector, where output rose 0.7%, accelerating from the 0.6% increase seen in the second quarter. Both business- and consumer-oriented services grew strongly, pointing to increasingly robust domestic demand.

Service sector driving growth

Solid growth continues into Q4

The slowing of the GDP growth rate confirms the signal sent by the PMI surveys in the third quarter. Importantly, looking ahead, further growth of 0.6% is signalled for the economy in the fourth quarter according to Markit's PMI survey data, which would mean the economy grew by a respectable 2.4% in 2015 as a whole.

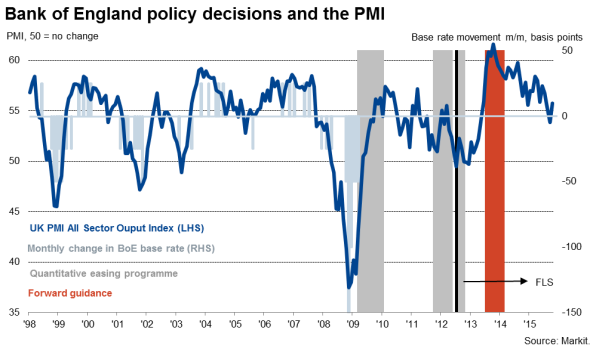

The sustained strong growth suggests that the economy is capable of withstanding higher interest rates, but clearly the Bank of England remains worried by the lack of inflation and the uncertain external environment, meaning there's little chance of any imminent interest rate hike. However, if the economy continues to show such robust growth in early-2016, there's a good chance of rates starting to rise in the spring. The caveats are that wage growth and the strength of sterling will of course also remain important to the timing and pace of any rate hikes.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112015-economics-robust-domestic-demand-drives-solid-uk-economic-growth-in-third-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112015-economics-robust-domestic-demand-drives-solid-uk-economic-growth-in-third-quarter.html&text=Robust+domestic+demand+drives+solid+UK+economic+growth+in+third+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112015-economics-robust-domestic-demand-drives-solid-uk-economic-growth-in-third-quarter.html","enabled":true},{"name":"email","url":"?subject=Robust domestic demand drives solid UK economic growth in third quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112015-economics-robust-domestic-demand-drives-solid-uk-economic-growth-in-third-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Robust+domestic+demand+drives+solid+UK+economic+growth+in+third+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112015-economics-robust-domestic-demand-drives-solid-uk-economic-growth-in-third-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}