Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 27, 2014

Week Ahead Economic Overview

Worldwide manufacturing and services PMI releases plus an update on the US labour market are highlights of the week. Other standouts are the UK Autumn Statement alongside Bank of England and European Central Bank policy decisions.

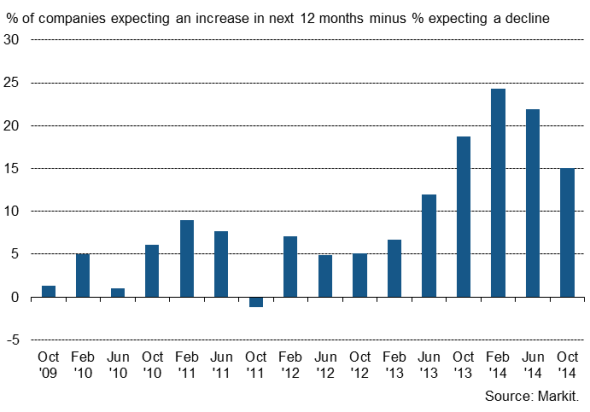

The Bank of England announces its latest monetary policy decision for the UK on Thursday. The UK economy expanded by 0.7% in the three months to September, continuing a strong spell of economic growth that has made two of the nine MPC members vote to raise interest rates at the last four meetings, but other policymakers are clearly worried about the economic outlook and the extent to which inflation could undershoot the Bank's 2% target if growth disappoints. With growth slowing, the economic outlook darkening (Markit's UK Business Outlook showed optimism about the year ahead ebbing to lowest since mid-2013) and wage growth remaining weak, the doves are expected to continue to outnumber hawks.

UK Business Outlook

The Chancellor of the Exchequer George Osborne will give his annual Autumn Statement to Parliament on Wednesday, in which he will provide updates on the government's tax and spending plans.

The Bank of England policy decision and the UK Chancellor's statement are preceded by an update on how the UK economy is performing in November via construction, manufacturing and services PMI releases. October's PMI data showed UK economic growth slowing at the start of the fourth quarter, with the pace of expansion the lowest for almost one-and-a-half years. The surveys currently point to a further moderation in the pace of economic growth as we move towards the end of the year, down to possibly 0.5% in the fourth quarter.

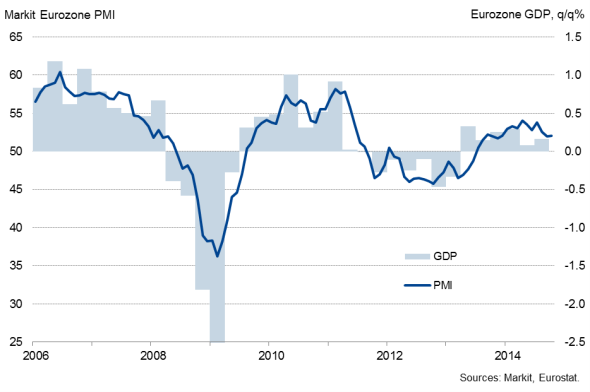

Final PMI data for the euro area will give insights into the currency union's performance in November and include more national detail. 'Flash' data signalled a slowing in the pace of economic growth to the weakest in 16 months, raising the risk of the region slipping back into a renewed downturn in the fourth quarter. France remains a key concern, with activity falling for a seventh month running, while growth in Germany has slowed to the weakest since the summer of last year.

Eurostat meanwhile release updated third quarter GDP numbers for the currency union, after an initial estimate showed the region's economy expanding by 0.2%, driven by growth in Greece, Spain and France, while Germany expended only marginally and Italy contracted.

Eurozone GDP and the PMI

No change is meanwhile expected at the European Central Bank meeting. The ECB has recently taken further steps to bolster the faltering eurozone economic recovery, including the commencement of a new asset purchase scheme in October.

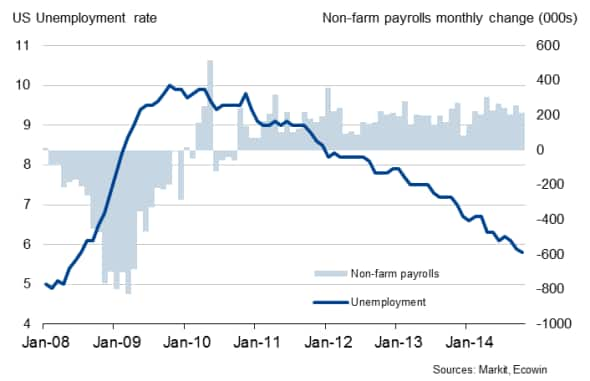

Early indications of how the US is performing in November are meanwhile provided by the final manufacturing and services PMI releases and the monthly employment report, which includes non-farm payroll numbers. In October, unemployment fell to a six-year low of 5.8% and non-farm payrolls rose by 214,000. However, lacklustre wage growth has taken some of the shine off the recent improvement in the employment situation, and also acts as a bar to raising interest rates. November's 'flash' PMI data meanwhile signalled the slowest rise in US business activity since April, suggesting that economic growth in the US is likely to moderate in the fourth quarter.

US labour market

The release of PMI data for China will indicate whether growth continued to slow at the start of the fourth quarter. Any positive signals from the survey data would represent welcome news to the Chinese authorities, after 'flash' PMI data suggested that manufacturing stagnated in November. Companies were found to have been struggling in the face of relatively weak domestic demand and lacklustre exports.

The PMI data for Japan will also be eagerly awaited by policymakers for signs that the economy is regaining momentum after Japan slid back into recession, with GDP down 0.4% in the third quarter. November's 'flash' data signalled ongoing expansion as exports helped lift the manufacturing sector.

Monday 1 December

Manufacturing PMI data for November are released worldwide by Markit.

Trade data are issued in Brazil and India, with the latter also seeing the release of current account numbers.

The Bank of England publishes latest data on consumer credit.

In Italy, ISTAT release final third quarter GDP figures.

Car sales numbers are out in South Africa.

Tuesday 2 December

Building permit and current account data are published in Australia, while the Reserve Bank of Australia holds an interest rate meeting.

India's central bank announces its latest interest rate decision.

The UK Construction PMI is released by Markit and CIPS.

Producer price numbers are issued for the eurozone.

In Brazil, industrial output figures are out.

Construction spending data and the IBD/TIPP Economic Optimism Index are released in the US.

The OECD publish a statistics release on consumer price indices.

Wednesday 3 December

Services PMI results are released worldwide by Markit.

The Australian Bureau of Statistics issues third quarter GDP numbers.

Business confidence data are meanwhile released in South Africa.

Retail sales numbers for the euro area are published by Eurostat.

The Chancellor of the Exchequer George Osborne will give his annual Autumn Statement to Parliament, while Halifax house price data are also out in the UK.

The Bank of Canada announces its latest interest rate decision.

In the US, the latest ADP Employment Report is out.

Thursday 4 December

In Australia, retail sales numbers and trade balance data are released.

Inflation figures are meanwhile out in Russia.

The Bank of England, the European Central Bank and the Banco Central do Brasil announce their latest interest decisions.

France sees an update on its ILO unemployment rate.

A number of whole economy and retail PMI results are published by Markit.

Initial jobless claims are out in the US.

Friday 5 December

The UK & English Report on Jobs is released by Markit and KPMG/REC.

In Australia, the AIG Construction Index is issued.

The leading indicator for October is published by the Cabinet Office in Japan.

Factory orders numbers are out in Germany, while Spain sees the release of industrial production data.

Eurostat releases an update on third quarter GDP for the currency union.

Trade data and an update on its labour market are issued in Canada.

In the US, factory orders numbers, trade data and a labour market update are published.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112014-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112014-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112014-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112014-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112014-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}