Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 27, 2014

US flash PMI surveys signal weakest economic growth for six months

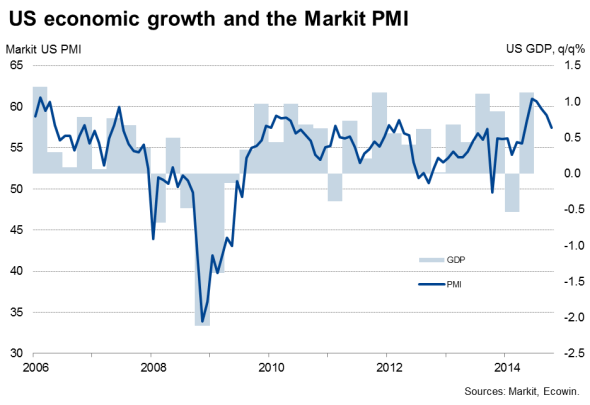

PMI survey data showed the pace of economic growth eased for a fourth consecutive month in October, and suggest that output growth and hiring could slow further in coming months. The pace of expansion remains robust, however, having merely eased from the very strong rates in prior months, which should alleviate recent worries about a sudden deterioration in the economy's health.

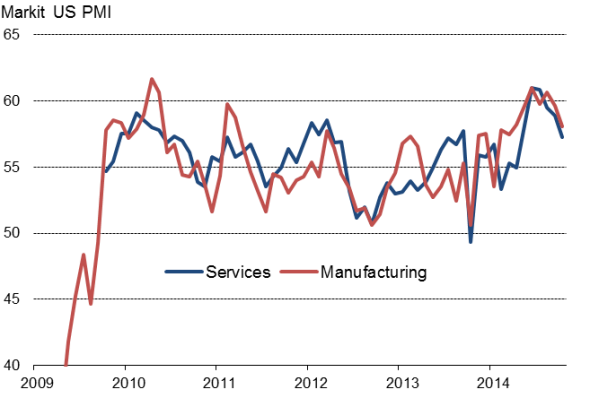

Economic growth slowed to a six-month low in October, according to Markit's flash PMI surveys. In a broad-based easing, service sector business activity grew at the slowest pace for six months while manufacturing output showed the smallest rise for seven months.

The composite PMI, which weights together the output indices from the manufacturing and services PMI surveys, fell from 59.0 in September to 57.4 in October, according to the flash data (based on around 85% of usual monthly replies). This represented an easing for a fourth successive month to the weakest since April.

Fourth quarter slowdown?

The October flash PMI data therefore suggest that the pace of economic growth looks set to moderate in the fourth quarter, perhaps even more than the 2.5% annualised rate signalled by October's flash data if the PMI falls further in coming months.

Markit's PMIs indicated that the economy grew at an annualised rate of approximately 3.5% in the third quarter. That compares with a 4.6% annualised pace of expansion in the second quarter; a reading which was in part flattered by a rebound from the first quarter, when the economy was affected by extreme weather.

A further slowing in fact appears to be on the cards for November. Inflows of new business showed the smallest increase for six months, slipping to a three-month low in services and a nine-month low in the goods-producing sector.

In an additional sign that service providers are bracing themselves for further weakness ahead, business expectations about the year ahead fell sharply, down to the second-lowest since November 2012. The level of optimism was one of the weakest seen since the financial crisis.

Buoyant recruitment, for now

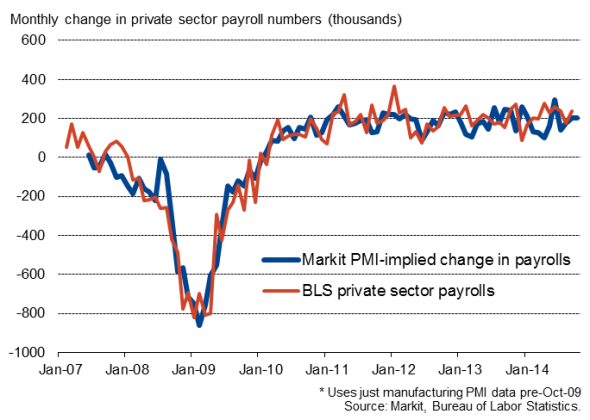

Some comfort can be gleaned from a sustained strong rate of job creation. Employment measured across both sectors rose solidly, the rate of job creation unchanged on September and running at a level broadly consistent with private sector non-farm payrolls rising by 200,000.

However, employment tends to be a lagging indicator, and the downturn in order book inflows suggests companies will take a less enthusiastic view to hiring in coming months, if sustained.

Non-farm payrolls (private sector)

Darker outlook

Companies responding to the services survey in October reported that they had become less upbeat about the outlook due to signs that sales growth had slowed in recent months, as well as worries about the future buoyancy of the domestic and global economies.

There are clearly many concerns, ranging from worries about the impact of Ebola, the Ukraine crisis, the ongoing plight of the eurozone economy, signs of further weakness in China and other emerging markets, the potential impact of the Fed starting to tighten policy and even the cost of Obamacare.

Policymaker caution

After data such as September's fall in retail sales led to financial market panic about the underlying health of the US economy, the PMI surveys provide some reassurance that the pace of expansion appears to be easing only moderately.

However, given the slowdown signalled by the survey and the long list of concerns facing businesses, as well as the recent easing in inflation, Fed policymakers will generally be minded to avoid fuelling additional concerns about the possibility of any tightening of policy being rushed.

Output growth by sector

Source: Markit.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102014-economics-us-flash-pmi-surveys-signal-weakest-economic-growth-for-six-months.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102014-economics-us-flash-pmi-surveys-signal-weakest-economic-growth-for-six-months.html&text=US+flash+PMI+surveys+signal+weakest+economic+growth+for+six+months","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102014-economics-us-flash-pmi-surveys-signal-weakest-economic-growth-for-six-months.html","enabled":true},{"name":"email","url":"?subject=US flash PMI surveys signal weakest economic growth for six months&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102014-economics-us-flash-pmi-surveys-signal-weakest-economic-growth-for-six-months.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+flash+PMI+surveys+signal+weakest+economic+growth+for+six+months http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27102014-economics-us-flash-pmi-surveys-signal-weakest-economic-growth-for-six-months.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}