Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 27, 2016

Week Ahead Economic Overview

In a busy week for economic data watchers, worldwide PMI results will provide more information on the health of the global economy midway through the second quarter. Meanwhile, non-farm payroll numbers are released in the US, while inflation and unemployment numbers are out in the eurozone.

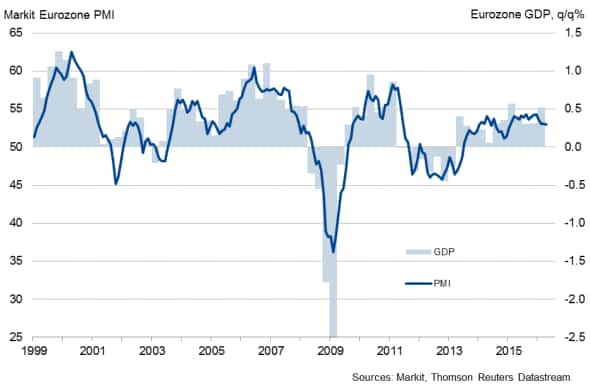

The search for clues to whether the Fed will raise US interest rates at its June meeting is set to intensify during the week, with PMI results, factory orders figures and non-farm payroll data all published.

In April, the US economy added just 160k jobs, which was well below expectations and the weakest for seven months. The weaker-than-anticipated increase in employment was exactly in line with signals sent by Markit's PMI data, which also point to a further waning of the hiring trend to show a rise of just 128k in May.

US non-farm payrolls and the PMI

Although Fed policy makers have become more bullish about the US economy after retail sales surprised on the upside and inflation is starting to pick up, Markit's flash PMI results for May paint a bleaker picture. If non-farm payrolls surprise on the downside and final PMI results, including ISM data, confirm the weak flash PMIs, expectations will rise that the next rate hike will be postponed until later in the year.

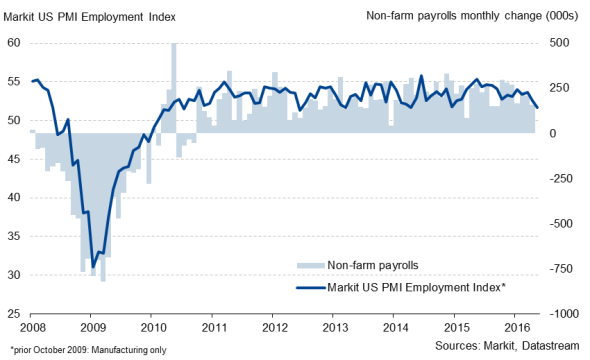

The European Central Bank will announce its latest monetary policy decision on Thursday, and it is likely that policy makers will take no further measures to boost growth after GDP rose at the fastest pace in a year during the first quarter. However, business survey data signal that the ECB's major stimulus initiative announced in March is so far showing little effect. The surveys instead point to the eurozone economy being stuck in a low-growth phase. Final PMI results are released on Wednesday for manufacturing and on Friday for services and will add some more colour on the region's economic performance, and may affect expectations of whether the ECB will decide to add more stimulus later in the year.

Eurozone GDP and the PMI

A couple of days before the ECB decision, inflation and unemployment numbers are released by Eurostat. The jobless rate fell to 10.2% in March and analysts will be hoping for it to fall below the 10.0% mark in coming months. Unemployment has been consistently above 10% since April 2011. Meanwhile, inflation is expected to remain low for longer, with the European Commission downgrading its inflation forecast for the region to just 0.2% for 2016 (down from 0.5% in February).

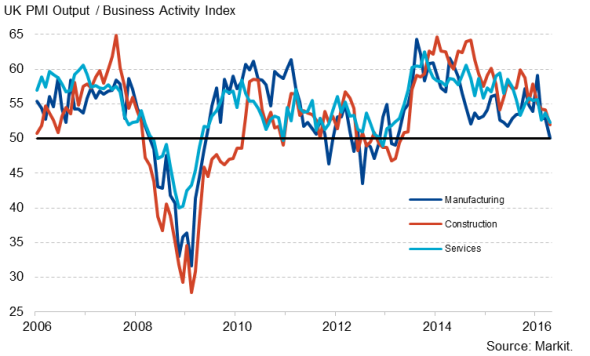

PMI results will be eagerly awaited by UK policy makers to give better insight into the extent to which Brexit uncertainty might be hitting the economy. GDP growth has already slowed to just 0.4% in the opening quarter of 2016, with business investment, construction, manufacturing and exports all in decline. The business survey data signalled a further slowing of the UK economy at the start of the second quarter, with some survey participants attributing the economic slowdown partly to Brexit uncertainty.

UK PMI Output Indices

Analysts in Asia will also keep a close eye on PMI results after the survey data pointed to a stagnation of the region as a whole in April. Moreover, a flash estimate of the Nikkei PMI showed a steepening export-led downturn in Japan in May, while official GDP data confirmed weak PMI numbers in Hong Kong.

Monday 30 May

Business inventory and new home sales numbers are released in Australia.

Japan sees the publication of retail sales figures.

The European Commission releases latest economic sentiment data for the currency union.

In Germany, retail sales, import prices and inflation figures are updated.

Meanwhile, revised first quarter GDP and consumer spending data are published in France.

Producer price information are out in Canada and Italy, while consumer price numbers are released in Spain.

Greece publishes provisional first quarter GDP results.

The latest Bank Austria Manufacturing PMI is released.

Tuesday 31 May

Australia sees the publication of building permit and current account data.

In Japan, industrial production and housing starts numbers are issued alongside latest household spending and unemployment figures.

GDP data are updated in Canada and India.

M3 money supply information are issued in South Africa alongside trade and budget balance numbers.

Consumer price, unemployment and M3 money supply data are released in the eurozone.

Spain sees the publication of current account figures, while retail sales numbers are out in Greece.

In Brazil, budget balance, producer price and unemployment data are issued.

Consumer confidence and personal income figures are released in the US alongside Case-Shiller home price information.

Wednesday 1 June

Manufacturing PMI results are published worldwide.

First quarter GDP figures and the AIG Manufacturing Index are issued in Australia.

In India, current account numbers are updated.

Nationwide house price data are published in the UK. Moreover, the Bank of England releases mortgage approval and M4 money supply figures.

Brazil sees the publication of first quarter GDP numbers.

ADP national employment, construction spending and mortgage data are updated in the US.

Thursday 2 June

Latest trade balance and retail sales numbers are out in Australia.

Consumer confidence figures are published by the Cabinet Office in Japan.

Eurostat releases producer price data for the currency bloc. Moreover, the European Central Bank announces its latest monetary policy decision.

The latest Markit/CIPS UK Construction PMI results are published.

Meanwhile, industrial output figures are out in Brazil.

In the US, initial jobless claims numbers are out.

Friday 3 June

Worldwide services and whole economy PMI results are released.

The AIG Services Index is published in Australia.

Retail sales numbers for the euro area are updated by Eurostat.

Canada sees the release of trade balance and labour productivity data.

The US sees the release of non-farm payroll and factory orders figures.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27052016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27052016-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27052016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27052016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27052016-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}