Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 27, 2015

Robust US flash PMI data for April point to buoyant economy

The US service sector enjoyed strong growth at the start of the second quarter, adding to evidence that the economy remains in good health.

Although the pace of expansion slowed compared to March, the flash PMI™ survey data for April showed the second-largest rise in business activity for seven months.

Alongside a solid rise in output signalled by the sister manufacturing PMI survey, the robust growth indicated by the services survey points to the economy as a whole picking up speed again after a temporary soft patch at the start of the year.

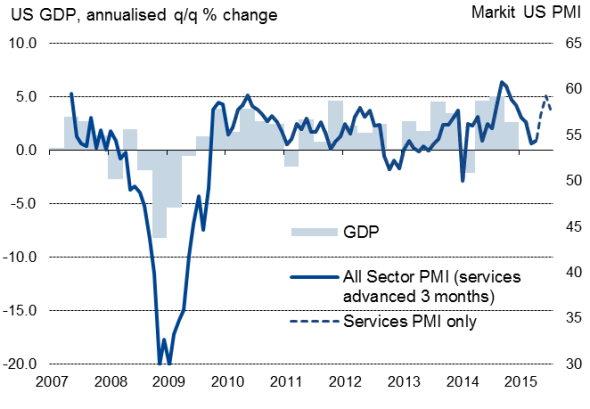

The Markit US Composite PMI, which weights together the output indices from the manufacturing and services surveys, hit a seven-month high of 59.2 in March and remained elevated at 57.4 in April, according to the flash readings. As such, while the PMI data indicate that GDP looks to have risen at a mere 1.0% annualised rate in the first quarter, the surveys are pointing to growth accelerating to around 3% in the second quarter[1].

US PMI surveys and economic growth

Domestic demand offsets export fall

Although the manufacturing survey showed signs of exporters struggling in the face of the dollar’s appreciation, the resilient strength of domestic demand reflected in the services survey will help reassure policymakers that the economy remains buoyant.

The flash manufacturing PMI survey showed new export orders falling in April for the first time since November 2014, but overall goods orders continued to rise at a solid pace. Incoming new business in the service sector meanwhile showed the second-largest gain since last October.

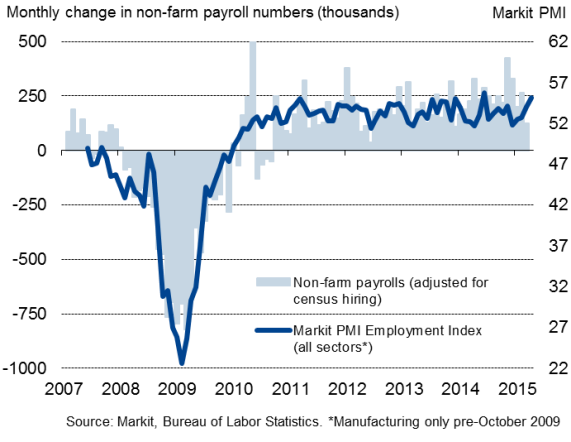

US PMI surveys and employment

Rate rise pressures mount

The surveys also indicated that inflationary pressures are reviving, with charges for goods and services rising in April at the fastest rate since last September.

Meanwhile, having slowed sharply in earlier surveys, the rate of job creation has also improved, reaching a ten-month high in April, led by faster service sector hiring and robust factory payroll gains. The data therefore suggest that the downturn in non-farm payroll growth in March will prove to be only a temporary slowdown.

The improvement in second quarter economic growth, rising price pressures and strong job creation signalled by the PMI surveys adds to pressure on the FOMC to consider starting the process of normalising monetary policy sooner rather than later at its meeting later this week.

Given the recent data flow, it’s clear that the first quarter advance GDP estimate, due on 29 April, is likely to disappoint and dissuade policymakers from hiking rates in June (there is no May meeting). The FOMC will most likely choose instead to await evidence of a stronger economy.

With the PMI suggesting that the second quarter GDP release, due on July 30, will provide encouraging news of faster economic growth, the FOMC therefore looks likely to hike interest rates at the following meeting, in mid-September. That is, of course, assuming the data continue to signal robust economic growth in the coming months, and most importantly the labour market data continue to impress.

[1] The best fit of the monthly PMI data with quarterly GDP numbers is in fact achieved by taking a weighted average of the two manufacturing and service sector PMI output indexes, but for the latter to be advanced to compensate for what appears to be an inherent lag in the official data (see chart).

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042015-economics-robust-us-flash-pmi-data-for-april-point-to-buoyant-economy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042015-economics-robust-us-flash-pmi-data-for-april-point-to-buoyant-economy.html&text=Robust+US+flash+PMI+data+for+April+point+to+buoyant+economy","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042015-economics-robust-us-flash-pmi-data-for-april-point-to-buoyant-economy.html","enabled":true},{"name":"email","url":"?subject=Robust US flash PMI data for April point to buoyant economy&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042015-economics-robust-us-flash-pmi-data-for-april-point-to-buoyant-economy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Robust+US+flash+PMI+data+for+April+point+to+buoyant+economy http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042015-economics-robust-us-flash-pmi-data-for-april-point-to-buoyant-economy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}