Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Nov 25, 2024

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

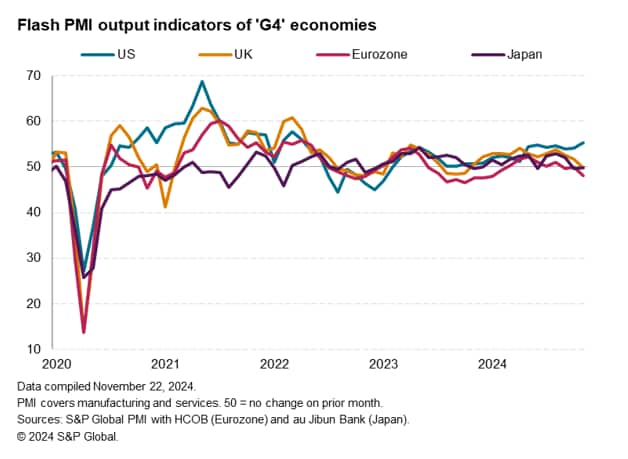

Inflation data for the US and Eurozone will be key themes to watch amid speculation on rate cuts in December, as survey data hint at a widening growth divergence between the two economies.

Flash PMI survey data for the US showed business activity growing at a strong and accelerating pace in November, with output rising amid strengthening demand. US business confidence about prospects for the year ahead has also surged higher in November as uncertainty from the Presidential Election lifted and prospects of a more business-friendly administration buoyed spirits, assisted also by hopes of further cuts to interest rates. To round off the good news, price pressures cooled further. In fact, average prices charged for US goods and services barely rose, registering the smallest monthly increase seen by the S&P Global PMI this side of the pandemic. All of this bodes well as we look ahead to the release of US GDP data and inflation numbers in the form of PCE prices in the coming week.

Also look out for the minutes from the last FOMC meeting, where clues will be sought as to the likelihood of another rate cut in December. Canadian central bank policy will meanwhile be guided by third quarter GDP.

It was a very different story in Europe, however, where the flash PMIs pointed to renewed downturns of business activity in the Eurozone and, to a lesser degree, the United Kingdom. The worrying message from Europe is that economic weakness seems to be spreading from the beleaguered manufacturing sector to the larger services economy. Sentiment is being hit by structural and protectionist worries alongside more domestic-focused concerns, especially relating to politics. On the plus side, the flash PMI surveys continued to register modest price growth by recent standards in both the eurozone and UK, adding to scope for potential rate cuts to help offset downturns. Fresh business confidence and eurozone inflation data will be available in the week ahead to add to the policy debate.

In Asia, GDP for India and Singapore are released while policy decisions are awaited in South Korea and New Zealand. The weekend will also see the release of NBS PMI data for mainland China, which will be eyed for impacts on business conditions from recent stimulus and tariff worries.

Monday 25 Nov

China (Mainland) PBoC 1-Year MLF

Singapore GDP (Q3, final)

Germany Ifo Business Climate (Nov)

United States Chicago Fed National Activity Index (Oct)

Tuesday 26 Nov

South Korea Consumer Confidence (Nov)

Singapore Industrial Production (Oct)

Hong Kong SAR Balance of Trade (Oct)

United States S&P/Case-Shiller Home Price (Sep)

United States CB Consumer Confidence (Nov)

United States Richmond Fed Manufacturing Index (Nov)

United States Dallas Fed Manufacturing Index (Nov)

Wednesday 27 Nov

Australia Monthly CPI Indicator (Oct)

New Zealand RBNZ Interest Rate Decision

China (Mainland) Industrial Profits (Oct)

Germany GfK Consumer Confidence (Dec)

France Consumer Confidence (Nov)

United States Core PCE Price Index (Oct)

United States Durable Goods Orders (Oct)

United States GDP (Q3, 2nd est.)

United States Personal Income and Spending (Oct)

United States Initial Jobless Claims

United States Wholesale Inventories (Oct)

United States Pending Home Sales (Oct)

United States Fed FOMC Minutes (Nov)

Thursday 28 Nov

United States Market Holiday

South Korea BoK Interest Rate Decision

Eurozone ECB General Council Meeting

Spain Inflation (Nov, prelim)

Eurozone Economic Sentiment (Nov)

Germany Inflation (Nov, prelim)

Friday 29 Nov

United States Market Holiday

South Korea Industrial Production (Oct)

Japan Unemployment (Oct)

Japan Industrial Production (Oct, prelim)

Japan Consumer Confidence (Nov)

Japan Housing Starts (Oct)

Germany Retail Sales (Oct)

Turkey GDP (Q3)

France Inflation (Nov, prelim) and GDP (Q3, final)

United Kingdom Mortgage Lending and Approvals (Oct)

Eurozone Inflation (Nov, flash)

Italy Inflation (Nov, prelim)

Germany Unemployment Rate (Nov)

Brazil Unemployment (Oct)

India GDP (Q3)

Canada GDP (Q3)

Saturday 30 Nov

China (Mainland) NBS PMI (Nov)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

Americas: Fed minutes, US Q3 GDP, core PCE, home prices, personal income and spending, Canada Q3 GDP

Minutes from the November FOMC meeting will be parsed for further clues on the Fed's thoughts regarding the outlook for interest rates especially with a more "gradual" view towards rate adjustment having been adopted in the post-election meeting. This is amidst uncertainty over whether interest rates will be further lowered in the December meeting, with a rate cut only partially priced in at present according to the CME FedWatch tool. A marked cooling of price pressures in the latest S&P Global Flash US PMI helps open the door for a further lowering of interest rates, though an acceleration of growth calls into question the immediate need to loosen policy.

Additional key data releases to watch include Q3 GDP from the US and Canada. October's US core PCE prices, personal income and spending figures will also be due.

EMEA: Eurozone inflation, France GDP, Germany Ifo Business Climate, pan-European confidence data

Following the release of the HCOB Flash Eurozone PMI, which showed that the rate of selling price inflation inched up in November but remained consistent with the ECB's target, official preliminary November consumer inflation data from the eurozone will be awaited to confirm the trend. Economic sentiment figures will also be due after the latest PMI Future Activity Index revealed that business optimism across the eurozone fell to the lowest since September 2023.

Separately, France updates final Q3 GDP figures while Germany's confidence data will be highlights in the week.

APAC: RBNZ, BoK meetings, China NBS PMI, Australia monthly CPI, India, Singapore, Taiwan GDP, Japan industrial production, unemployment data

Central bankers in New Zealand and South Korea convene in the new week with the market expecting rate cuts to unfold at the monetary policy meetings. Meanwhile key data releases in the region include mainland China's PMI from the National Bureau of Statistics (NBS) ahead of worldwide November PMI due at the start of December.

Additionally, GDP from India, Singapore and Taiwan will be updated through the week. More up-to-date November HSBC Flash India PMI data indicated that India's business activity expansion remained robust in the penultimate month of the year, signalling above-average growth in the fourth quarter based on the first two months' data. Japan's industrial production and unemployment data will also be in the spotlight, with the former in particular focus after the latest au Jibun Bank Flash Japan PMI showed a further reduction in manufacturing output in November.

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location

Products & Offerings