Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 27, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in companies due to announce results in the coming week.

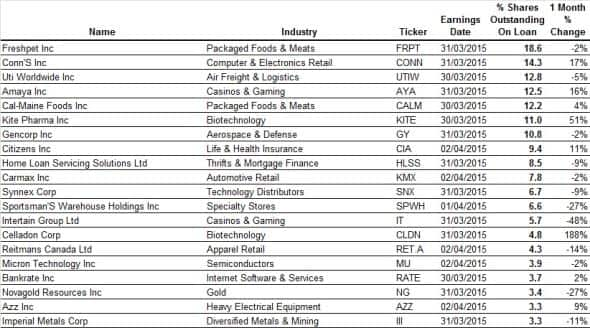

- Retailers dominate the list of the most shorted companies in North America

- Asos is most shorted stock in Europe despite its shares having bounced by 48%

- Short sellers are targeting residential real estate developers in China ahead of earnings

North America

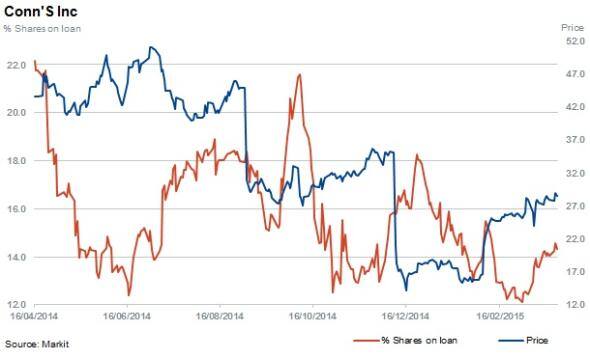

North American retailers represent a fifth of the most shorted companies about to release earnings. Leading the pack is furniture retailer Conn's with 14% of its shares outstanding on loan, although this is down from the highs of 22% seen in 2014.

Conn's share price has recovered in this year after collapsing by more than two thirds in 2014, which was a tumultuous year for the company. Last September, rising bad debts caused the company to cut profit guidance and prompting the shares to collapse. Then the shares slumped further after the firm adopted a poison pill takeover defence strategy.

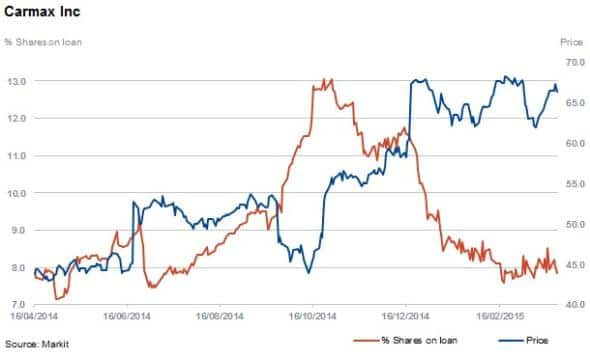

Second hand car retailer Carmax has sent short sellers covering in 2015. Sales for the year ending February 2015 are forecast by analysts to be higher while operating profit is expected to almost double.

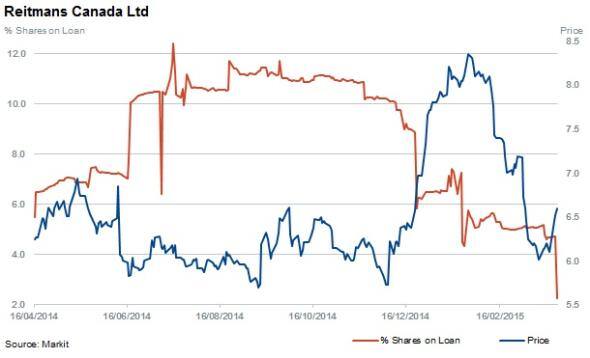

In the last five years, Canadian fashion retailer Reitmans' sales have flat lined and earnings have collapsed. This has in part been due to competition from cheap chic names such as H&M and Zara amid allegations of complacency among industry incumbents. The stock price has declined by 60% in the last four years but has rallied recently.

This rise looks to have squeezed out some short sellers as the number of shares out on loan has decreased by 65%.

Two US biotech stocks also make the list after having seen a significant increase in short interest in the last month ahead of earnings. Short sellers have increased positions in Kite Pharma and Celladon Corp by 55% and 183% to 11% and 4.8% of shares outstanding respectively.

Western Europe

Across the Atlantic, retailers are also high on the list of short targets with UK based internet retailer Asos the most shorted stock ahead of earnings. Shares outstanding on loan have climbed from 1.2% to 11.2% in the last 12 months as short sellers continued to build out positions.

Asos reported sales growth and margins that were below expectations during 2014 after a robust 2013 period in which shares rallied strongly. After experiencing lagging international sales and industry headwinds in 2014, investor sentiment has turned sour. The shares have bounced back 48% this year to date and short sellers have covered positions by 17%.

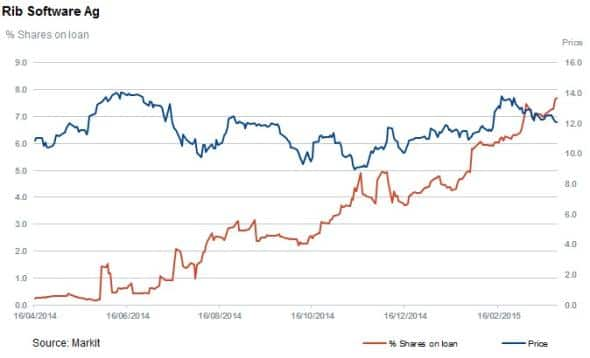

Rib Software provides solutions to the construction industry and is the second most shorted stock in Europe ahead of earnings. Shares outstanding on loan have increased by 22% in the last month reaching 7.7%. Shares in Rib delivered stellar returns in 2014, outperforming the DAX by 49%. However consensus forecasts now expect 2015 earnings to fall, despite higher sales forecast.

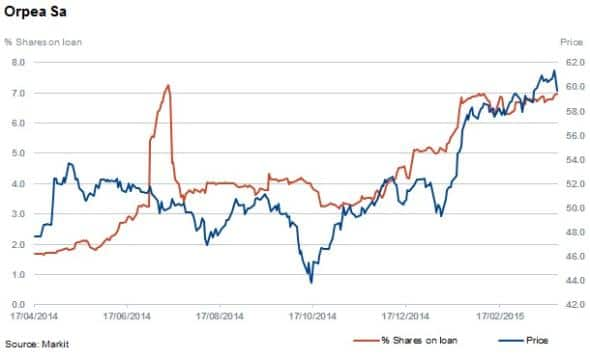

The third most shorted company in Europe is French based health centre provider Orpea. Orpea's shares have risen 25% in the last 12 months with increased sales and earnings reported. Short sellers do not seem to be convinced as demand to borrow has increased three fold to 7% of shares outstanding on loan.

Asia Pacific

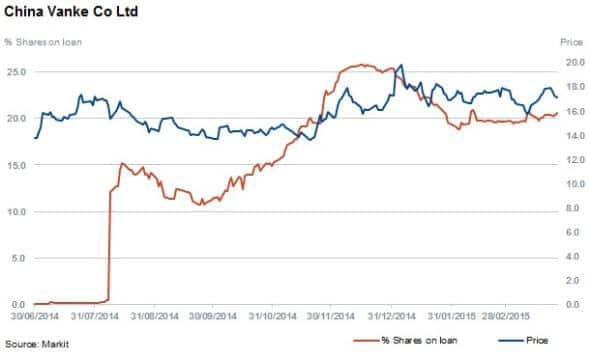

The most shorted stock in Asia this week is newly listed China Vanke, the largest real estate developer in China by market value. Short interest in the company currently stands at 20% of shares out on loan.

Property sales, selling prices and accordingly volumes have been weaker in China since early 2014 and developers have been heavily discounting to offload stock, adding to concerns of a continued slowdown in the Chinese housing market.

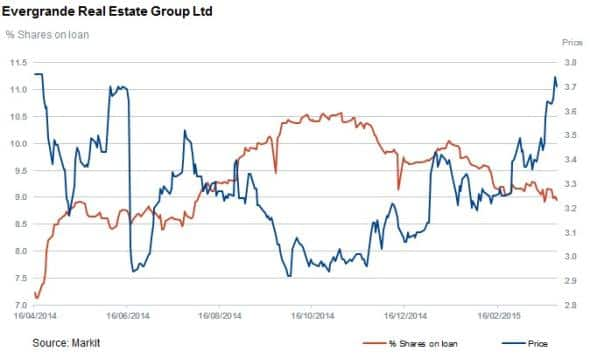

The second most shorted stock in the Apac region the second largest real estate developer in China, Evergrande Real Estate Group. The amount of shares out on loan has decreased by 15% since October 2014 while the share price has climbed by 22%

Markit's dividend forecasting team expects a lower final cash dividend for Evergrande of CNY 0.24 as concerns mount on the company's ability to maintain a high payout ratio given the weak market environment.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032015-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032015-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}