Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 30, 2015

Corporate risk flat after QE

The ECB's QE actions appear to have benefitted the European corporate bond market, but a closer inspection reveals that most of the recent tightening can be attributed to shifts in the sovereign bond market.

- Euro denominated investment grade bonds trade with roughly the same spread as six months ago

- Peripheral sovereigns such as Spain have seen spreads compress

- Much of the yield tightening can be attributed to sovereign yield compression

With the ECB's QE programme well underway, the European sovereign bond market has seen yields fall to record lows. This trend shows no signs of letting up, with Italy selling €2.5bn of ten year notes at a record low yield of 1.34%. On the corporate side, issuance and demand have both seen a strong start to the year.

Corporate spreads

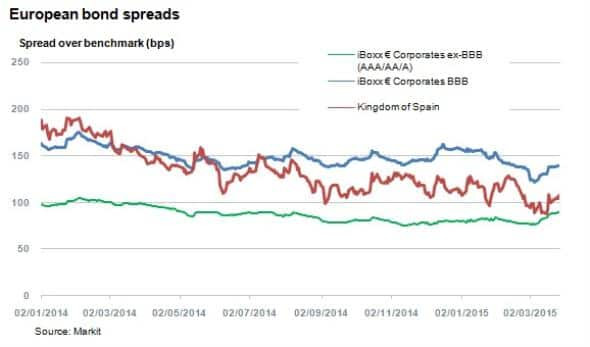

The impact of QE on the European bond market can be dissected to reveal the effects on specific areas of the market. Sovereign bonds have seen credit risk slowly eroding as yields have fallen, but the same cannot be said about euro denominated corporate bonds. Investment grade spreads (over government) have remained relatively flat since the start of 2014, well before any talk of sovereign QE from the ECB. The iBoxx € Corporates ex-BBB index, which incorporates bonds at the higher end of investment grade rating spectrum, has seen its spreads compress only 10bps over this period. At the lower end of investment grade, the iBoxx € Corporates BBB has tightened 24bps.

Sovereign Spanish bonds have seen much more tightening, as their ten year bonds have seen spreads over similarly dated German bunds fall by 81bps since the start of 2014.

Sovereign risk

Taking a broader view highlights the extent to which recent spread compression in Europe can be attributed to sovereign bonds. Yields on the iBoxx € Corporates index have fallen from 2.5% to just over 1% since the start of 2014, but spreads have remained relatively flat over benchmark sovereigns. In fact, the basis between corporates and sovereigns (as represented by the iBoxx € Sovereigns index) has only widened to 33bps since the start of 2014 as European bond yields have fallen around 2% in the same period.

This dynamic implies that much of the credit risk (which makes up a large chunk of the spread over benchmark) associated with corporate bonds still holds, with little impact from QE. Most of the de-risking has funnelled into sovereign bonds. Corporates in Europe still see high demand and issuance is booming; a trend that can largely be attributed to QE rather than improving issuer credits, liquidity or macro-economic conditions.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30032015-Credit-Corporate-risk-flat-after-QE.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30032015-Credit-Corporate-risk-flat-after-QE.html&text=Corporate+risk+flat+after+QE","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30032015-Credit-Corporate-risk-flat-after-QE.html","enabled":true},{"name":"email","url":"?subject=Corporate risk flat after QE&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30032015-Credit-Corporate-risk-flat-after-QE.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Corporate+risk+flat+after+QE http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30032015-Credit-Corporate-risk-flat-after-QE.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}